EastGroup Properties: Solid Core Holding At Less Of A Bargain

Summary

- EastGroup Properties, a Sunbelt-focused industrial real estate investment trust, specializes in properties ideal for last-mile distribution for e-commerce and business-to-business uses.

- After a 25% stock price rally YTD, EGP's price to FFO of 24.6x does not indicate a bargain, but the REIT has shown strong, consistent growth over the last decade.

- EGP faces challenges from high borrowing costs and the need to refinance maturing debt at higher interest rates, but its strong balance sheet mitigates this headwind.

- Looking for a helping hand in the market? Members of High Yield Landlord get exclusive ideas and guidance to navigate any climate. Learn More »

MediaProduction

EastGroup Properties (NYSE:EGP) is a Sunbelt-focused industrial real estate investment trust ("REIT") with an excellent track record and crack management team. The REIT specializes in multi-tenant, multi-building, shallow bay, infill property parks primarily used for distribution and logistics purposes. These properties are ideal for last-mile distribution both for e-commerce and business-to-business uses.

What distinguishes EGP from some other industrial REITs that own very large (>120K square feet) buildings outside of urban, supply-constrained areas is the mantra repeated again and again in the real estate industry:

- Location, location, location

Business users need to be in these last-mile industrial locations in order to operate their businesses. This is true both for e-commerce players, who are competing to deliver goods to customers faster and faster, and B2B players who want to be located near their business customers. Whereas newly constructed industrial supply tends to be on the periphery of cities where land is more abundant, EGP's properties face much less direct competition from new infill space.

As such, EGP's tenants compete for this space based on location, not price, which means that rent growth is generally higher. EGP's properties are mission-critical for tenants, whereas the typical exurban industrial building is more of a commodity product subject to price sensitivity.

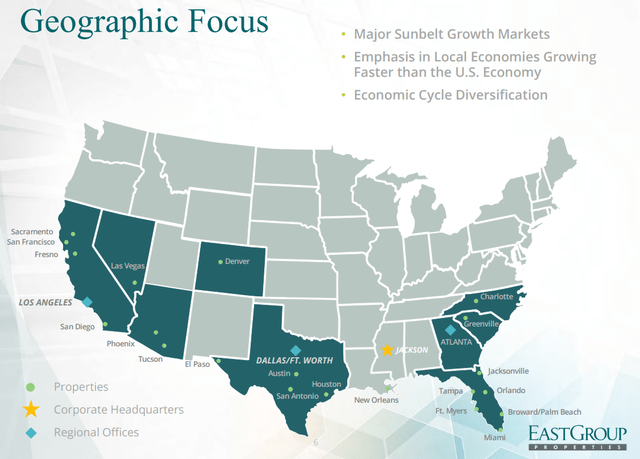

On top of that, EGP's properties are located in fast-growing markets in some of the fastest growing states of the US:

And on top of that, EGP has an active development arm. Just shy of half (49%) of its portfolio was developed in-house.

That said, after an over 25% stock price rally YTD, EGP's price to estimated 2023 FFO of 24.6x does not scream "bargain" like it did when EGP traded under $160 (low 20x FFO range).

Some might object that even a low 20x FFO multiple sounds pricey for a REIT. But I would argue that any REIT capable of consistently growing at a high single-digit or double-digit rate deserves a >20x multiple. And EGP is indeed capable of doing so. By my calculations, EGP's adjusted FFO per share growth over the last decade has averaged 17-18% per year.

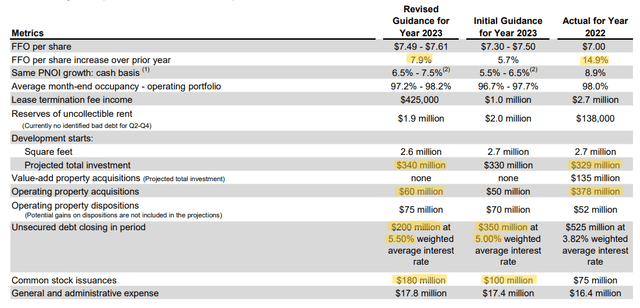

Last year, EGP turned in ~15% FFO per share growth, and this year, amid high interest rates, EGP still expects to achieve ~8% growth.

Notice a few other points about the above image.

First, EGP continues investing in its development pipeline, expecting to invest $340 million this year compared to ~$330 million last year. However, external acquisitions will slow dramatically this year, from $378 million last year to $60 million expected for this year. That is due to high borrowing costs, wherein realistic interest rates on new debt are almost as high as cap rates for EGP's target properties.

Also, most of the ~8% FFO growth expected for this year appears to be coming from same-property NOI ("SPNOI") growth. After a guidance boost, cash SPNOI growth is now expected to come in between 6.5% and 7.5% in 2023, down only slightly from 2022's 8.9%.

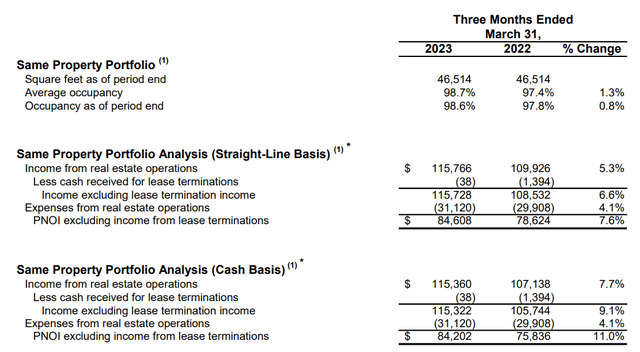

In Q1 2023, EGP got off to a strong start on this front, turning in 11% cash SPNOI growth. That is obviously expected to cool over the course of the year, but EGP's strength here is notable.

Likewise, as a result of higher interest rates, EGP has pulled back its expectation of unsecured debt issuance this year from $350 million at a 5% interest rate to $200 million at a 5.5% interest rate. Partially filling the capital needs will be additional equity issuance: from an expected $100 million to $180 million now.

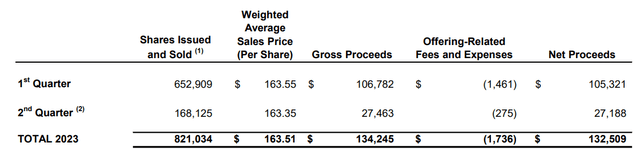

The stock price rally is excellent news for EGP's planned equity issuance this year.

Why? In the first quarter and part of the second quarter, EGP issued shares at an average price of $163.51, or a 4.6% FFO yield.

Today, at a stock price of $185.50, EGP now trades at an FFO yield of ~4.1%, while property cap rates still appear to be rising and construction costs are cooling. That should widen the critical investment spread between EGP's weighted average cost of capital and property cap rates / development property stabilized yields.

A higher stock price could mean even more equity issuance than planned, if management find attractive investment opportunities. This should then result in a decline in the debt-to-EBITDA ratio, which currently sits just under 4x.

| Adjusted Debt To Pro Forma EBITDA | |

| 2019 | 3.92x |

| 2020 | 4.43x |

| 2021 | 3.83x |

| 2022 | 4.48x |

| Q1 2023 | 3.95x |

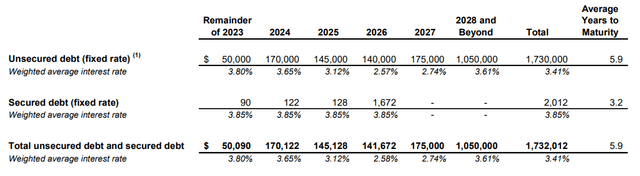

Despite EGP's very strong, low-leveraged balance sheet, the REIT does face a headwind from the need to refinance some maturing debt at higher interest rates.

In 2023, 2.9% of total debt matures. Next year, thought, 9.8% of total debt is maturing.

Management expects to refinance this debt at around 5.5% interest rates, compared to 3.8% weighted average rates for 2023 and 3.65% for 2024.

The benefit of SPNOI growth and new development properties coming online definitely outweighs the detriment of higher interest expenses, but it is a headwind nonetheless.

Bottom Line

EGP is one of my largest and favorite REIT holdings because of its strong track record, swift dividend growth, fortress balance sheet, and superlative property locations in infill Sunbelt markets. I wish I owned more of it.

That said, at $185 a share, EGP is not as compelling to me as it was at $160 a share. More of its future growth is priced in today than it was months ago.

Given my unwavering focus on dividend growth investing, additional future growth is required to make a 2.7% dividend yield equally attractive as a 3% or 3.25% yield. If you can't build in enough future growth to make the lower yield equally attractive, then the stock is simply less of a value at that lower yield than it was at the higher yield.

I think that's the case for EGP. I love the REIT and want to own more of it, but (especially with a potentially looming recession) I'd much prefer to buy it around a 3% (or higher) yield than a 2.7% yield.

This is especially true given management's guidance forecasting a slowdown in rent and FFO growth over the course of this year. EGP's rising stock price and valuation pertain more to the expectation of lower future interest rates than an acceleration of organic growth, which is determined more by supply and demand.

When Q2 results are reported later this month, don't be surprised to see the SPNOI and FFO growth rate slip a bit from Q1's numbers. But I also wouldn't be surprised to see a bit more strength than management's latest guidance suggests.

If you want access to our entire Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the largest real estate investment community on Seeking Alpha with over 2,000 members on board and a perfect 5/5 rating from 400+ reviews:

For a Limited Time - You can join us at a deeply reduced rate!

This article was written by

I write about high-quality dividend growth stocks with the goal of generating the safest, largest, and fastest growing passive income stream possible. My style might be called "Quality at a Reasonable Price" (QARP) in service to the larger strategy of low-risk, low-maintenance, low-turnover dividend growth investing. Since my ideal holding period is "lifelong," my focus is on portfolio income growth rather than total returns.

My background and previous work experience is in commercial real estate, which is why I tend to heavily focus on real estate investment trusts ("REITs"). Currently, I write for the investing group, High Yield Landlord.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EGP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.