I Predicted The S&P 500 Would Break Above 4500 By July 15, So What's Next?

Summary

- In my July 2nd article, I said we would reach for 4600. We have a very good shot at getting above 4550+.

- This is because interest rates are likely to continue to fall this week even as we raise another .25%. This is because of the great inflation news of last week.

- The only possible spoiler is that PCE is once again before us. Luckily for our purposes, it is to be revealed the following week.

- So what happens? Well, this week, unless there is some new news that hasn’t popped up yet, the rally should continue, with perhaps a little profit-taking on Friday. I would not be at all surprised if we make it past 4550. What could rain on that parade? Read on.

- This idea was discussed in more depth with members of my private investing community, Group Mind Investing. Learn More »

Mlenny/E+ via Getty Images

First, let’s get this out of the way

This article was published July 2nd I freely talk about getting to 4500, and then on to 4600. This is a full week before the great Thom Lee made the same prediction. Not to take away from him, he has been bullish all this year, when my faith was challenged here and there. There have been plenty of times that I had to explain why I make predictions before the start of the week. When they go against me on Monday, I just don’t stand there, I constantly measure the market action to my prediction. Usually before the end of the first day of trading a take down my hedges if a market sell-off doesn’t happen. What do I do when the market goes my way, do I pile in with all my cash? Not if I am in control of my emotions. This week I came into it with approximately 15% cash and I ended it with 15% cash. In between I did a lot of fast money trading. If a trade went against me, I didn’t just give it time, if the reason why I went short or long didn’t materialize I was out lick-itty-split. More on that in the “My Trades section.

Here’s what could rain on the parade…

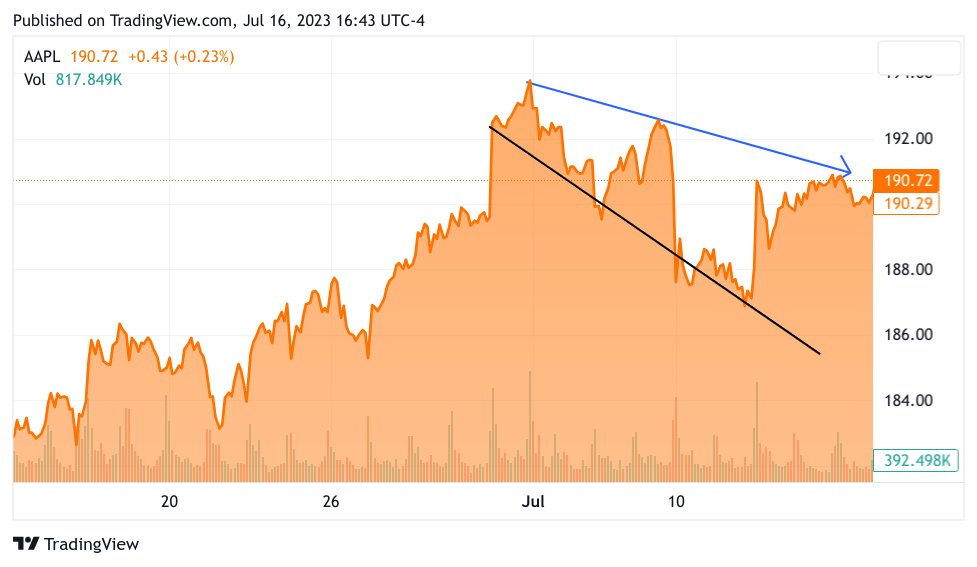

I said that the likely direction of interest rates will be lower. What happens if they only go lower but crash down to earth? Remember not too long ago interest rates were well lower than they are now. Back in May, the 10-Y was at 3.3% which is 50 basis points lower than today. May may seem long ago but it was just 6-weeks ago. In my bullets, I said lower rates would be a good thing powering the indexes higher. This is all about the delta, a graceful slide would be welcome, and a sharp dive would be fodder for the bears to spook market participants. They would be once again calling for the dreaded recession that still hasn’t come but is “right around the corner” say many pundits. Even if the 2-Y and 10-Y stay where they are or vacillate like 10bps either way the market will continue to move higher. Of course, if interest rates move quickly in the other direction the same result should be expected. The other thing that could stop the market in its tracks and start a retreat is a bunch of lousy earnings. Perhaps not from small regional banks, or a bunch of the consumer non-durables. But if housing-related names disappoint, our new auto sales aren't so profitable. Or small business sales stats, that could really spook the market. Especially next week when a .25% rate rise is all but done and dusted. It likely starts gradually with a bunch of unrelated earnings reports that disappoint, especially with crumbling margins. I want to say that we are still at the very beginning of earnings, perhaps with small margin misses, maybe just meeting expectations. If that is the case and I think that it is highly likely this week should give us higher indexes. As a reminder, I am only reviewing the bear case here. Right now we are relying on the other 493 S&P stocks. I believe the “Magnificent 7” are treading water. Apple (AAPL) has faltered 2 weeks in a row, and it looks like it is headed lower. Don’t believe me?

TradingView

This is the one-month chart and the peak was June 30 on the dot. The last 2 weeks are showing a weak formation. Lower highs and way lower lows. This is nothing against AAPL, it’s just that the non-Magnificents are getting market participants' dollars. The same can’t be said for Amazon (AMZN) right now because the AWS investor events and interviews with Andy Jassy. Microsoft (MSFT) hasn’t gone anyway in a month having reached 351 on June 16. Tesla (TSLA) closed Friday at 281.38, great, right? However, July 3, the first trading day of the month reached 281.66, at a standstill. It reports this week so perhaps it regains momentum, perhaps not. The point I am trying to make here is that we broke 4500 without the bigshots, it was the Hoi Polloi that did it this time. I think that trend continues, are you still not satisfied I made my point? Probably NVIDIA (NVDA) will be the exception (that’s right I haven’t looked, this is all just me thinking out loud.) Hmmm, NVDA had a key reversal on Friday. I didn’t even realize that. Yes, NVDA has gone up in the last 2 weeks. Though a key reversal means it reached its 52WH and then fell below the previous day’s low. To be exact the 52WH was 480.88 and Friday it hit 480.40 so if you want to quibble and say it didn’t make a new high go ahead. I believe the majority will agree with me that this is close enough. It doesn’t always mean NVDA goes lower on Monday especially if the whole market goes higher. Though, if you believe in technical trading analysis the risk is to the downside. That said NVDA has been the hero of the group. Do I need to go through all 7 to satisfy you? Let’s do it then (I’m curious too)… Alphabet (GOOGL) June 15 GOOGL hit 125.11 and closed this Friday at 125.42, again nowhere. The point is any new money is going into the non-magnificent 493. I think that continues, and if it doesn’t it will be because TSLA and Netflix (NFLX) disappoint on their earnings reports this week or interest rates go haywire in either direction. I think the lower dollar will do a lot to buoy earnings, many S&P 500 stocks including TSLA and NFLX have international revenue. The fact that the spot market price for the dollar broke under 100 for the first time in several years won’t be a factor the dollar has been falling for a while now. In the past, the high dollar hurt revenue and profits now it should help. This is what is helping to buoy the hydrocarbons, a lower dollar makes Oil cheaper to the rest of the world, and in turn pushes up the price for us. This of course would stimulate more drilling because of the profit motive. No need for extra tax reductions or subsidies, just higher oil prices. Ok now for my trades which include APA Corporation (APA), when did they stop calling it Apache Oil? In any case, the lower dollar in my opinion will continue to fall and consumption will likely go up globally. I think this will be good for Call Options on APA. I got them a bit out of the money out to October, but they are on my new tighter standards. If they don’t move my way this week I will be out. Then why do I have such a long expiration date, it’s part of my rules for options trading. Normally I would give them 2 to 3 weeks, but I want to stay as liquid as possible as we are about to hit August, and Fall comes not too far away. The trade I really want to talk about was executed last Friday, Coinbase (COIN) jumped 25% by the end of the week. My thought was that COIN would surely give some back on Monday and I would close it out in the morning. By the time the market opened, it started to rise, the condition of the trade was that the stock would drop in the morning, at the open in fact. I gave it to 11:30 am and I managed to get out with a $15 per contract loss. I even announced to my members that the stock would likely fall later in the day but I didn’t want to chance it. Why all these strict rules about selling at a loss? I had an epiphany or maybe I read it somewhere that I don’t recall now, most options trades fail. When they work, they work very well. So the best mode of action is to cut unfavorable options trades as fast as justifiable. I have a simple options trading rules list that I share with members. On the other hand, I do have some very long-term options but I treat them differently. I am talking about fast money trades, which I plan on doing more especially when we have a new bull market. My next trades are again tied to the notion of falling interest rates, I think home builders who already have done splendidly, and recently had a little retreat will once again get back to old highs so I got back into Green Brick (GRBK) and KB Home (KBH), they are in the money calls and I will give them to Friday. I’ve already traded GRBK and also Taylor Morrison (TMHC) successfully last week so I do feel comfortable with them. I had several successful Call options trades with Zscaler (ZS) sold off due to the fact that MSFT was going to enter their market was silly and SZ bounced back nicely. I successfully traded Snowflake (SNOW), and Advanced Micro (AMD) just to buy the dip. Finally, I set up a trade concerning the MSFT merger with Activision Blizzard (ATVI), right at the close. So I want to give a chance for my Group Mind members to set up the trade before I give it away.

Okay, happy trading! I haven’t forgotten that I said I should add 2 weeks on to every prediction I make. However, this one is so tightly defined that I either got it or I didn’t. Hopefully, as some of you long-time readers have figured out, this is in a journal or memoir form. This is what I am thinking on Sunday afternoon in order to get ready for the trading week. If the week starts off differently than what I shared here, I don’t just sit around passively, I adjust. My hope is you might find these thoughts useful if you are actively managing your stocks.

Have you ever bought a stock that everyone's saying is great, only to find you bought near or at the all-time high that stock drops 20% immediately? What happened? By the time the average stock purchaser gets a stock idea, usually, it's already overbought.

If this sounds like you, join our community Group Mind Investing which adheres to a Cash Management Discipline. We watch the market for you and uncover fresh trading and investing ideas. We identify sectors, trends, and individual stocks. You learn how to target a stock, buy and sell. Try our 2-week trial

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KBH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I write this weekly analysis in memoir style. If I say you should buy a stock or option it is a typo. When I refer to you should buy, I really mean me. Nothing I write about should be taken as investment advice. I enjoy writing about the market, and I hope you enjoy reading about it. That is all this is.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

Thanks.

OPRA was a shocker last week

Lol