Universal Insurance Holdings: Growing Despite Headwinds

Summary

- Universal Insurance Holdings is a solid investment opportunity due to its strong underwriting business, high dividend yield, and potential for growth and expansion.

- Despite challenges from natural disasters like hurricanes, UVE has demonstrated resilience and strength, with a robust cash position of over $300 million and a growing operating margin.

- UVE offers a 4.2% dividend yield and frequently conducts buybacks, making it an appealing investment option; it is currently undervalued compared to its historical price-to-earnings and price-to-book ratios.

Wasan Tita

Introduction

Universal Insurance Holdings, Inc. (NYSE:UVE) doesn’t get a lot of attention on here it seems, which I think is a bit unfair as the business remains extremely solid and right now at a point where fair value seems to have been reached. Starting a position in UVE right now offers investors the chance to be in a company that has grown its underwriting business extremely well and yields high premiums from it.

Apart from that, the management is prone to buying back shares and the cash position is very strong right now to support a dividend yield of the current magnitude, around 4%. I find there to be a decent likelihood of raising the dividend consistently over the coming years as ROE is rising. I think this will translate to a stronger position for UVE to operate in and ultimately result in a higher valuation multiple being applied.

Company Structure

Universal Insurance Holdings focuses primarily on operating as an insurance holding company in the United States. Operations span through 19 states currently and have yielded UVE a 5-year average ROE of 7%. But in Q1 2023 the adjusted ROE was 23.9%, which brings into question that perhaps UVE still has a lot of room left to expand and grow its averages.

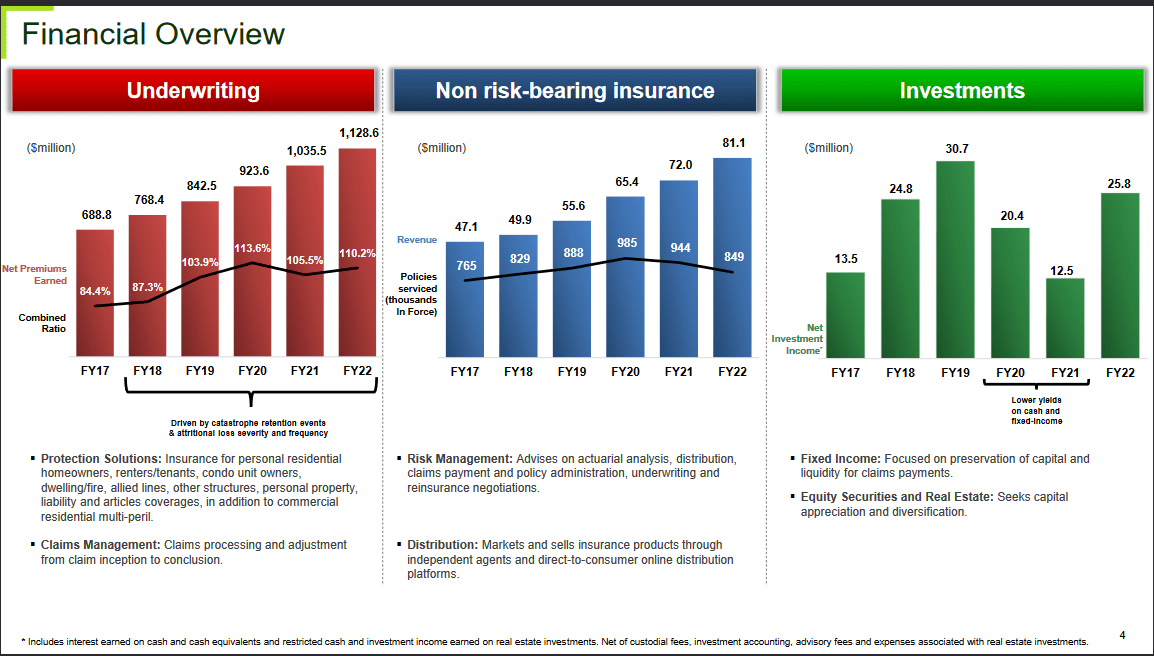

Financial Overview (Investor Presentation)

It engages in underwriting and offers protection solutions for residential homeowners but also to renters and tenants. Apart from that, the underwriting part of UVE provides clients with claims management.

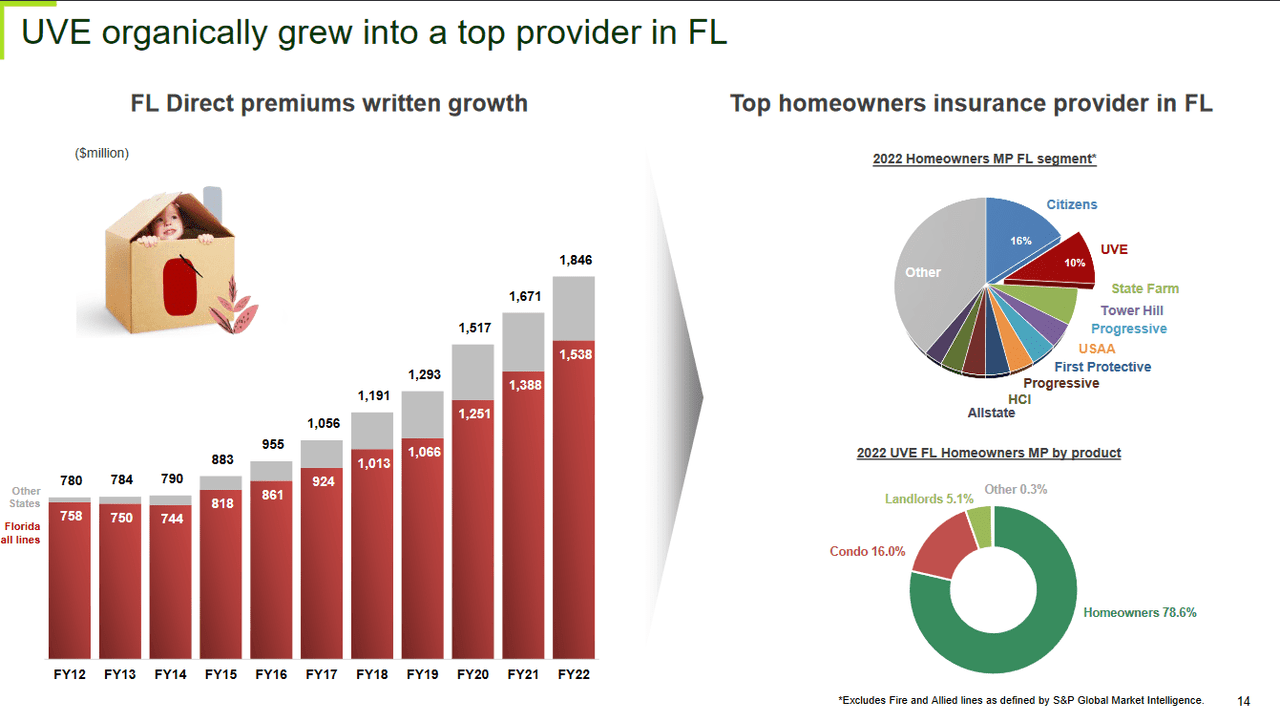

Florida Market (Investor Presentation)

Founded in 1990, UVE has been doing business the longest in Florida and this is also where a lot of the revenues and earnings are generated from. Here UVE has grown into one of the top providers and now boasts a leading position compared to peers. The state primarily works with homeowners, 78.6% to be exact.

Hurricane Ian was a hard task for the P&C insurance market to handle in Florida as insurance claims rose. But UVE has proven to be resilient in times like this nonetheless and the operating margin has still been growing on a YoY basis, reaching 10.9% in Q1 FY2023.

Dividend Support By A Strong Cash Position

Looking at the dividend yield right now it's sitting at a FWD yield of 4.22%. This makes UVE perhaps not as strong of a dividend addition as some other banks out there yielding over 10%. But what I think that UVE has above others is strong EPS growth still, which will translate into the share price growing rather than decreasing over longer periods.

The cash position for UVE sits at over $300 million and in 2022 the dividends that were paid out reached $23.8 million. That in my opinion makes it likely we will continue to see a dividend of this magnitude without any cuts to it.

Earnings Transcript

On April 28, 2023, UVE posted its Q1 2023 results and in the earnings call, some comments stuck with me.

Additionally, as we sit here today, we already have our core all states property catastrophe reinsurance tower for the 2023-2024 period, fully supported and secured, with no material changes to our historical reinsurance partners or our terms and conditions, while the costs are well within our budget parameters.

This shows that even though the hurricane in Florida created a difficult market environment for insurance companies as claims rose and expenses increased, UVE made it out very well. They seem well on their way to posting strong numbers in the coming quarters in my view.

Underwriting Growth (Investor Presentation)

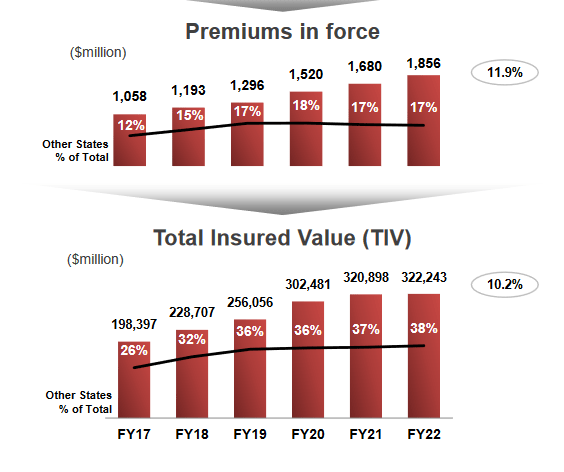

The underwriting part of UVE is still growing steadily, posting a 10.2% CAGR between 2017 and 2022, and premiums in force are outgrowing that as well. In the coming report, I think we are likely to see more buybacks announced as the company is consolidating results and translating that into investor value.

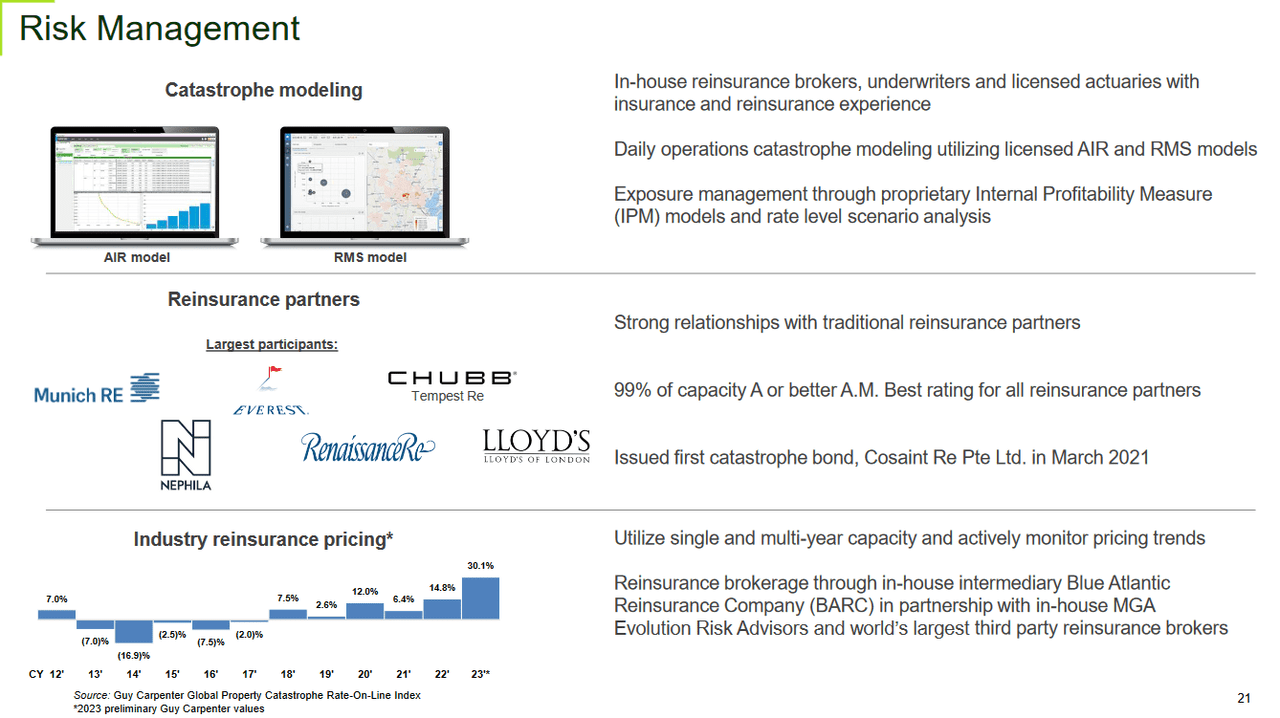

Risk Associated

Despite the challenges posed by natural disasters, such as hurricanes, which can be difficult to predict and prepare for, UVE has demonstrated its resilience and strength in navigating these circumstances. The company has implemented robust strategies to manage the expenses associated with natural disasters, including ensuring adequate reserves and adjusting pricing models to reflect the risks involved.

Risk Management (Investor Presentation)

However, it's important to acknowledge that even with these preparations, insurers face ongoing obstacles. Inflationary pressures can drive up the cost of claims, while the prevalence of roofing scams adds a layer of complexity to the insurance landscape. These factors contribute to the increased expenses that insurers like UVE must manage.

All in all, though, UVE remains resilient and proof that even though quarters might sometimes show inconsistent growth or face obstacles, the long-term remains positive. UVE is still growing and consolidating its position in key markets and the underwriting industry is facing constraints, which makes it difficult for competitors to operate, a tailwind for UVE in the end.

Investor Takeaway

For investors seeking an insurance company that has proved its worth in terms of resilience and the face of challenges like natural disasters, UVE looks like a solid addition. The company also brings a 4.2% dividend yield to the table and buybacks are happening frequently. Most recently a $20 million plan was announced, with today's market cap, that would bring down the outstanding shares by 4.3%. UVE is also trading below its historical p/e and historical p/b which makes starting a position right now even more appealing. Rating UVE a buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

Ian was a near miss, and not a 1/100 freak event, and there are clear expectations that the trends of increased hurricane and flood activity in the region (and the world) will continue.

The assurances around the placement of the reinsurance programme should not be taken at face value, I would recommend looking into the details around how much risk is taken by UVE vs transferred to reinsurers year on year, and what the cost of this in % of premiums year on year to see the impact is on forward profitability. Also, note that the reinsurance payments get topped up via “reinstatement premiums” as they cover is used.After years of easy reinsurance conditions, that past of the industry has just had th most dramatic cycle change in decades - changing the historical risk/return profile for insurers. UVE will be no exception.Not encouraging to see the insured values increase by 10% and the premiums only by 11% - their costs are going to be up more than this.All in all - its important to look into the details before making investment decisions on insurers. If you want to look at a 4% dividend yells for insurers, I would look more closely at one of the global reinsurers, better dividends, better pricing power and much more diversification of risk available there.

Just my honest opinion…..be careful out there and GLTA