Devon Energy: Capture It Before It Recovers Too Much

Summary

- Oil prices have recovered some recently, presenting a unique opportunity as stocks have yet to recover.

- The company is turning on all cylinders with a manageable financial position, continued production growth, and strong shareholder returns.

- We think the market is undervaluing the company as it can continue generating double-digit shareholder returns, making the company a valuable investment.

- The Retirement Forum members get exclusive access to our real-world portfolio. See all our investments here »

Gray Freeman/iStock Editorial via Getty Images

Devon Energy (NYSE:DVN) is a $30 billion energy company that has seen some share price weakness recently. The company's share price is down almost 40% from its 52-week high. However, with some recent strength in Brent crude prices, the company's impressive asset portfolio could enable increased shareholder returns.

Devon Energy Portfolio

Devon Energy has a relatively well distributed portfolio, however, the vast majority is in the Delaware Basin.

Devon Energy Investor Presentation

The company's production is more than 600 thousand barrels / day, and the company's acreage resides in major U.S. asset bases. The company has diversified production, and it has a lower natural gas focus risk than many other producers. The company has a 12-year inventory, slightly stronger than many other comparable producers, and we expect it to maintain its strength.

Devon Energy Shareholder Commitment

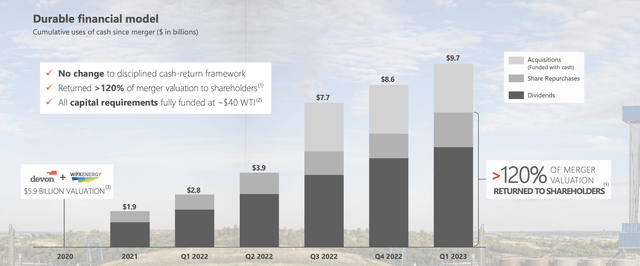

The company has focused, since the weakness of 2020, on cleaning up its portfolio and driving shareholder returns.

Devon Energy Investor Presentation

The company was one that we recommend previously in 2021, soon after its merger led to a valuation of just under $6 billion. The company has since managed to return $9.7 billion counting cash funded acquisitions, with >120% of the merger valuation returned directly to shareholders. The company was of course benefited by an incredibly strong 2022.

However, the basis worth noting is that the company is able to fully fund all of its capital requirements at $40 WTI. That's still well below current prices and is a level at which the company can drive substantial returns.

Devon Energy 2023 Plan

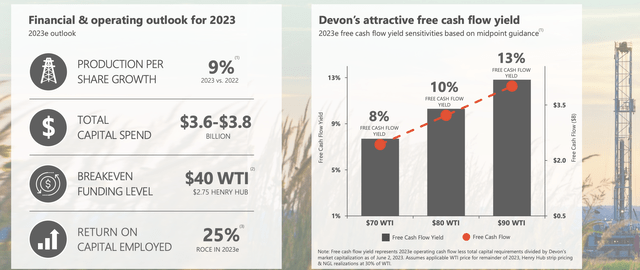

The company's 2023 plan, at its current positioning, will enable strong shareholder returns.

Devon Energy Investor Presentation

The first is that the company is focused on strong production growth with its capital spending. The company is targeting 9% production per share growth. That's of course partially supported by share buybacks, but it's still incredibly strong in terms of the company's valuation. That's all affordable for the company at $40 WTI, $2.75 HH with a 25% ROCE ($3.7 billion spend).

After that impressive capital spending and results, the company is still expecting a 9% FCF. The company has a minimal debt load, meaning that the vast majority of that FCF can be directed towards shareholder returns.

Devon Energy Shareholder Return Potential

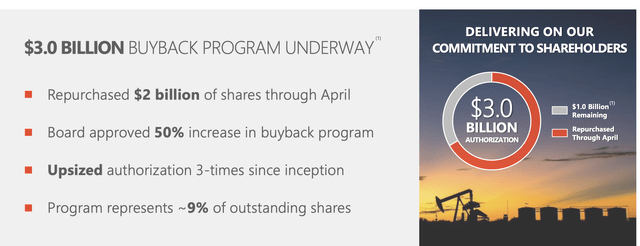

The shareholder return potential of that FCF is immense.

Devon Energy Investor Presentation

The company has a $3 billion buyback program and through April it already repurchased $2 billion. The program represents 9% of the company's outstanding shares, in line with the company's FCF, and it's a level that the company can comfortably afford. We expect that the company will be able to increase share repurchases even further increasing returns.

At the same time, the company's dividend framework provides a very strong baseline yield. At current WTI prices the company's dividend policy establishes a roughly 6% yield. That grows towards the double-digits past $100 WTI. That dividend program is incredibly strong, and combined with repurchases, and capital spending will enable strong double-digit returns.

Thesis Risk

The largest risk to our thesis is crude oil prices. The market has been in a bull market for a long time, with a brief COVID-19 blip that central banks solved with stimulus. Now that stimulus is over and interest rates are rising, the market is expecting a downturn. That's kept prices lower despite OPEC+ production cuts, which can continue to have a negative impact on prices.

Conclusion

Devon Energy has a strong portfolio. The company has an asset life of more than a decade, a well distributed portfolio of assets, and a strong oil and natural gas mixture. The company is continuing to invest massive capital into that portfolio, of almost $4 billion, and it expects to generate 9% production growth from that investment.

On top of that, the company expects to generate strong FCF even at today's lower prices. The company's capital spending breakeven is $40 / barrel WTI and at current WTI prices, the company has a 9% FCF yield. The company's dividend policy is a 6% yield and it expects to direct most of the rest towards share buybacks.

That continued investment makes the company a valuable investment. Let us know your thoughts in the comments below.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don't miss out because you didn't know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.

This article was written by

#1 ranked author by returns:

https://www.tipranks.com/experts/bloggers/the-value-portfolio

The Value Portfolio focuses on deep analysis of a variety of companies across a variety of sectors looking for alpha wherever it is to maximize reader returns.

Legal Disclaimer (please read before subscribing to any services):

Any related contributions to Seeking Alpha, or elsewhere on the web, are to be construed as personal opinion only and do NOT constitute investment advice. An investor should always conduct personal due diligence before initiating a position. Provided articles and comments should NEVER be construed as official business recommendations. In efforts to keep full transparency, related positions will be disclosed at the end of each article to the maximum extent practicable. The majority of trades are reported live on Twitter, but this cannot be guaranteed due to technical constraints.

My premium service is a research and opinion subscription. No personalized investment advice will ever be given. I am not registered as an investment adviser, nor do I have any plans to pursue this path. No statements should be construed as anything but opinion, and the liability of all investment decisions reside with the individual. Investors should always do their own due diligence and fact check all research prior to making any investment decisions. Any direct engagements with readers should always be viewed as hypothetical examples or simple exchanges of opinion as nothing is ever classified as “advice” in any sense of the word.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)