LendingTree: May Be Undervalued

Summary

- Catalyst remains minimal in the near term, but potential recovery in FY 2025 onwards means that the stock could be undervalued today.

- Home and consumer segments may continue to see downtrend into FY 2023.

- Given the ongoing tough macro situation, TREE's focus on right-sizing its business and improving profitability and cash flows is the preferred approach.

cunfek

LendingTree (NASDAQ:TREE) is an online lending marketplace that connects borrowers with multiple lenders, allowing them to compare and choose the best loan offers for their specific needs. It was founded in 1996 and is headquartered in the United States. The platform covers various types of loans, including mortgages, personal loans, auto loans, student loans, and small business loans.

TREE went public in 2008 and traded at around ~$9 on the opening day. Since then, the stock has been through ups and downs, though overall it has trended up and gained ~170%. This year, TREE reached a YTD-high of ~$46 before declining to ~$26 per share today.

I rate TREE a buy. Despite the temporary macro weakness, my 5-year target price model that assumes a recovery sometime in FY 2025 suggests that TREE may be undervalued today.

Risk

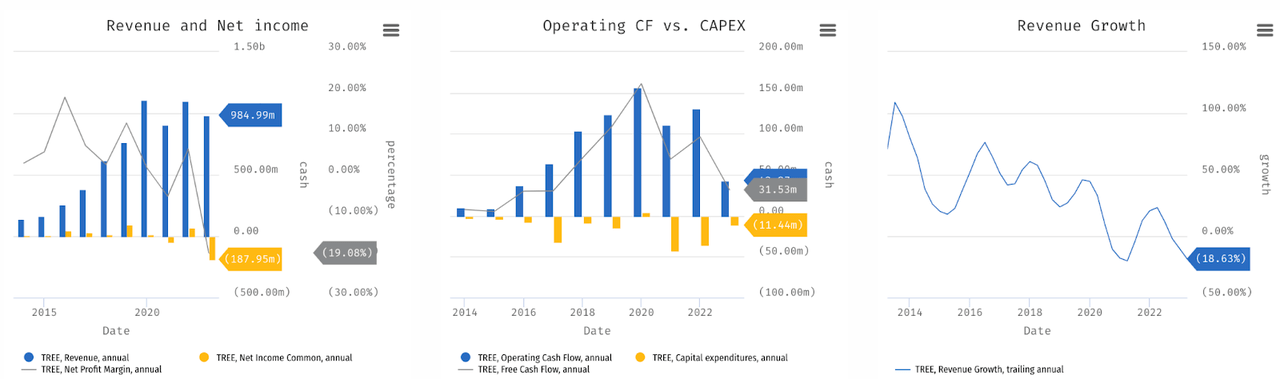

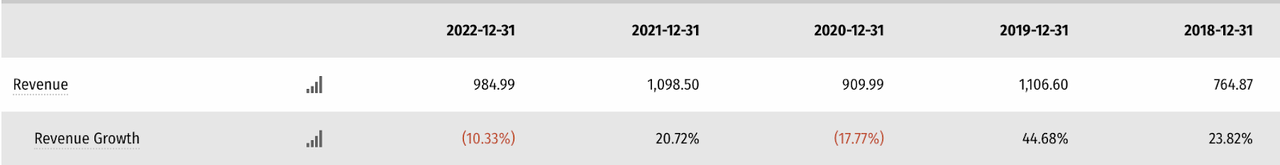

The downside risk remains high. I expect TREE to continue facing significant challenges this year, given the high-interest rate environment. TREE’s fundamentals have weakened since 2021, when TREE saw a 25% growth in revenue. However, growth continued to decelerate, and in Q1, revenue declined ~29% YoY.

stockrow

Likewise, operating cash flow / OCF has been on a downward trend since 2019. OCF margin was between 14% - 16% up until 2019 but has gradually contracted to 11% - 12% during the COVID-19 year of 2020 and the year after. As macro weakness intensified in 2022 onwards, the OCF margin has dropped to low-single digits, including in Q1.

My take on all of this is that in general, online lending companies like TREE are highly macro-sensitive. As we have seen with the abrupt shock in 2020 and then in 2022 onwards, the business appears to be highly dependent on favorable demand as well as interest rate environments. However, the macro situation today continues to be challenging and it remains difficult to forecast a recovery.

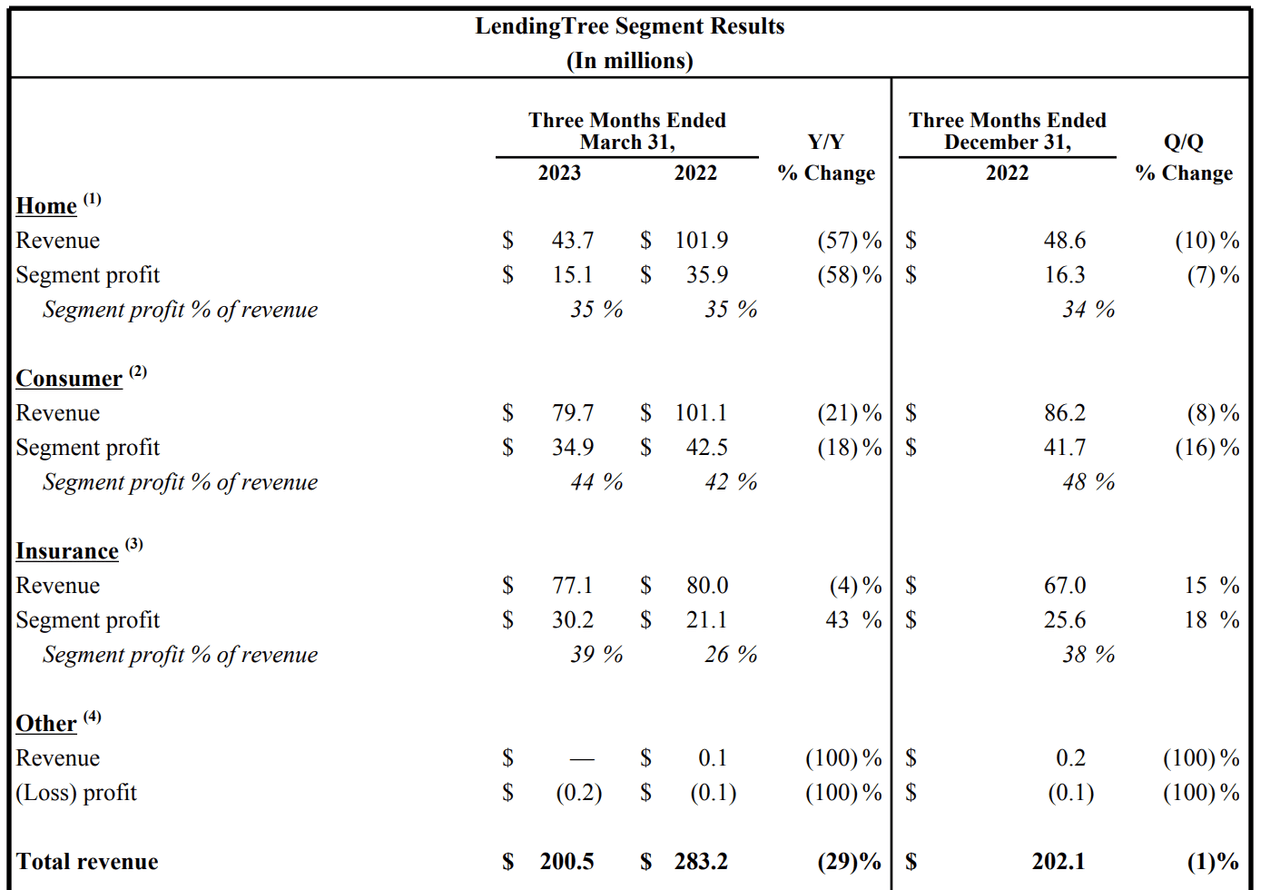

TREE's press release

The macro weakness has significantly impacted all of TREE’s businesses. In particular, the home segment, which includes mortgage-related activities and is historically TREE’s largest business, declined by 57% YoY in Q1. The same thing happened with the consumer segment, which saw a 21% decline in Q1, despite already being diversified across product lines such as credit cards, personal loans, and SMB loans.

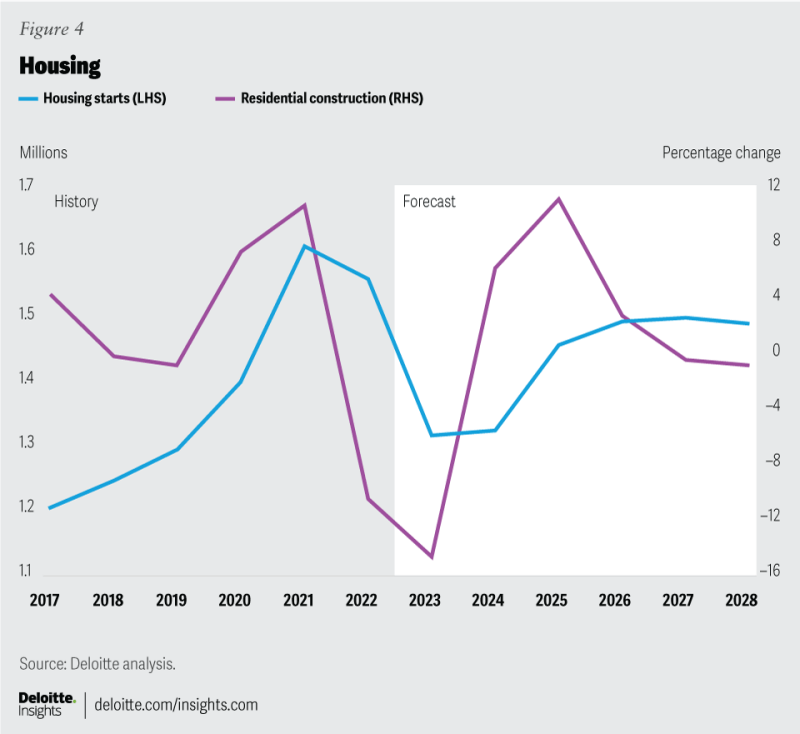

delloite

It is possible that the downturn in the mortgage-related business will not only continue into the rest of FY 2023 but also the following FY. As suggested by the forecast by Deloitte, housing demand, which drives the mortgage business, would probably not see a recovery until 2025.

I think that the same situation may apply to TREE’s other businesses since all of them are driven by the interest rate environment, which is uncertain at the moment. Based on the most recent info, it seems likely that the Fed will do more rate hikes to keep inflation under control.

Catalyst

The near-term catalyst remains minimal for TREE at present. Given the temporary headwind, TREE has been right-sizing its business and optimizing for profitability and cash flows. In Q1 things seemed to go well across those two fronts as both OCF and net margins saw significant expansions. To me, it seems that it is in TREE’s best interest to continue maintaining steady margins while it is challenging to deliver predictable growth given the tough macro situation.

stockrow

Nonetheless, it is noteworthy that while TREE guided a decline in revenue growth in FY 2023, TREE remains one of the more well-known players in the online lending space. Therefore, as the overall demand comes back, it is in a good position to capture a lot of those, as it has proven in FY 2021. After seeing a rather steep ~17% decline in revenue in 2020 due to COVID, TREE bounced back rather swiftly and saw a ~20% growth in FY 2021.

Valuation / Pricing

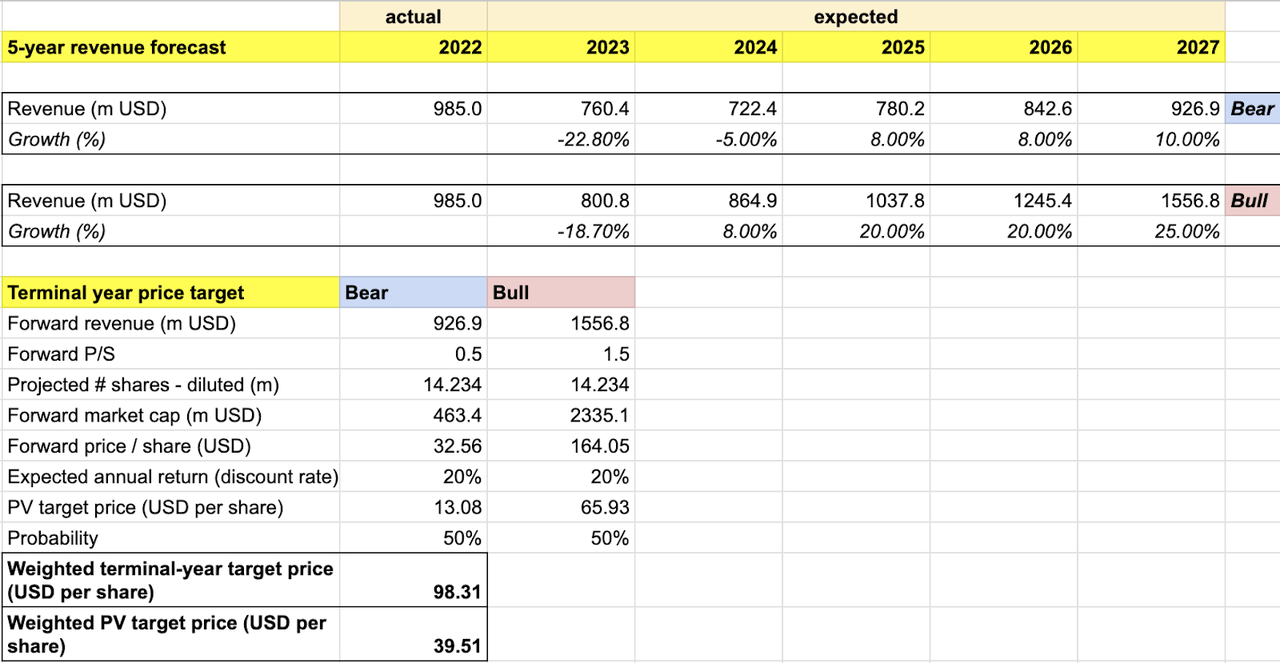

My target price for TREE is driven by the following assumptions for the bull vs bear scenarios of the FY 2027 target price model:

Bull scenario (50% probability) assumptions - TREE to finish FY 2023 at the highest end of its guidance with ~800 million of revenue, which is a 19% decline in growth. I expect temporary headwinds to subside in FY 2024, where growth will turn positive. FY 2025 onwards, I expect the macro situation to fully recover, where TREE will see 20% - 25% growth into FY 2027. I assign TREE a forward P/S of 1.5x, an expansion from where it is today given the accelerating revenue growth. This may also be a conservative assumption, since TREE saw a 1.5x P/S last time in March 2022, when the business already saw some impact from the weakening macro.

Bear scenario (50% probability) assumptions - TREE to finish FY 2023 at the lowest end of its guidance with ~760 million of revenue, a 23% decline in growth. I expect headwinds to prolong into FY 2024, where TREE will see a negative growth of -5%. TREE will see growth returning to positive in FY 2025, though at 8% - 10%, the growth will remain modest and below TREE’s historical growth average pre-COVID. I assign TREE a P/S of 0.5x, just a tad higher from where it is today.

author's own analysis

Consolidating all the information above into my model, I arrived at an FY 2027 weighted target price of ~$98 per share. Discounting that to the present day’s terms with a 20% discount rate, TREE’s fair value today would be around $39 per share.

In summary, $39 per share is the highest price point at which investors can purchase the stock to realize a projected 20% annual return if my FY 2027 target price of $98 is achieved. At ~$25 per share today, the stock trades at a ~56% discount to my target price, indicating that it is undervalued. I rate TREE a buy - even under some conservative assumptions and the 50-50 chance between the bull and bear scenario, TREE appears to provide an attractive enough upside for investors.

Conclusion

Despite current macro weaknesses, my 5-year target price model indicates that TREE may be undervalued, assuming a recovery by FY 2025. However, there is still a high downside risk, particularly due to the challenging high-interest rate environment. The company's focus on right-sizing its business and improving profitability and cash flows under the current tough macro situation seems to be the right and only approach. I rate TREE a buy at this time.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.