Will Earnings Be Good Enough To Keep The Market Moving Higher?

Summary

- Earnings season is here, and given the recent stock rally, it seems expectations for earnings are high.

- Companies will need to deliver better than expected results to keep the recent rally moving.

- However, given the current market valuation, guidance will need to be significantly better.

- Looking for a helping hand in the market? Members of Reading The Markets get exclusive ideas and guidance to navigate any climate. Learn More »

naphtalina/iStock via Getty Images

It seems pretty hard to believe four months ago, the S&P 500 was trading below 3,900, and expectations broadly among investors were that first quarter earnings would be really bad. It set a low bar for investors, and as earnings rolled in better than feared, most stocks were able to rally.

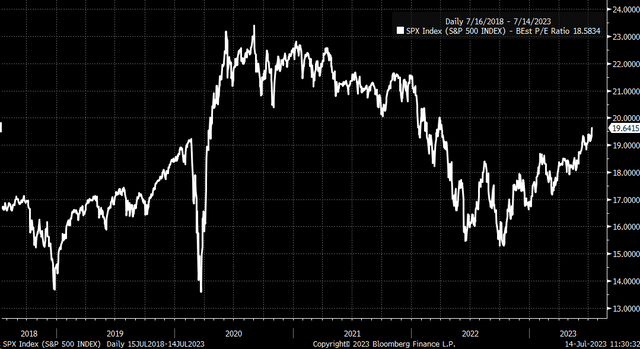

This quarter we find ourselves in a different position. The S&P 500 has rallied by almost 19% since the March 13 low and has seen its PE ratio swell to 19.6 from 17.1. Given the rapid rise in the index over such a short period of time, it seems the second quarter theme should be if earnings will be good enough.

Bloomberg

Earnings Will Need To Be Stellar

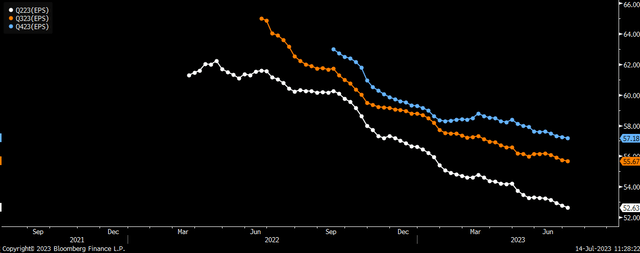

S&P 500 earnings estimates for the second quarter are very low, with analysts seeing earnings dropping by 8.9% versus last year to $52.6 per share. Of course, with stocks up so much and the PE multiple so high, the market already appears to have front run second quarter results and expects results to be much better than expected.

Bloomberg

Additionally, the second quarter is, at least for now, expected to be the trough in earnings. Earnings are expected to fall just 1.1% in the third quarter to $55.7 and then rise by 6.4% in the fourth quarter to $57.2. That probably means that companies will need to provide better than feared third quarter guidance to keep stock prices moving so that earnings can catch up to the PE multiple expansion seen since mid-March.

It isn't so much any longer if earnings will come in better than expected clearly given the movement in the market and, more notably, in some stocks, they need to come in not only better than expected, but these companies need to provide guidance that's much better than expected, to get those lower trending earnings estimates for the third and fourth quarter to reverse and trend higher.

If they can start trending higher and catching up with the recent rally in the stock market, then the PE ratio and the valuation for the stock market will begin to fall, making shares at least initially less overvalued. But if guidance isn't much better than expected, and earnings estimates for the third and fourth quarters do not start to turn higher, one must wonder what right stocks have trading at current valuations.

Relatively Not Cheap

Additionally, with bond yields so high, at some point, one needs to wonder when investors flip away from stocks and turn to yields. The inverse of the PE ratio is the earnings yield; a PE ratio of 19.6 equates to an earnings yield of 5.1%. Investors use earnings yield to help them determine how cheap or expensive stocks are relative to bonds. Currently, with the 10-Year nominal rate at 3.8%, the spread is just 1.3%. That's the narrowest the spread has been since 2007. A spread that has consistently been between roughly 3 to 3.5% since 2013. Stocks seem less attractive today, relatively speaking.

Bloomberg

Given the recent market moves, it appears that expectations are for companies to deliver better-than-expected results and more favorable guidance. Therefore, earnings will not only need to come in better, but they also will need to be significantly better than expected to justify the re-rating that has taken place since mid-March. Additionally, guidance must be good enough to turn earnings estimates from trending lower to higher.

If not, the recent rally will likely have been nothing more than a head fake.

Join Reading The Markets Risk-Free With A Two-Week Trial!

(*The Free Trial offer is not available in the App store)

Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, and looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

This article was written by

I am Michael Kramer, the founder of Mott Capital Management and creator of Reading The Markets, an SA Marketplace service. I focus on long-only macro themes and trends, look for long-term thematic growth investments, and use options data to find unusual activity.

I use my over 25 years of experience as a buy-side trader, analyst, and portfolio manager, to explain the twists and turns of the stock market and where it may be heading next. Additionally, I use data from top vendors to formulate my analysis, including sell-side analyst estimates and research, newsfeeds, in-depth options data, and gamma levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.