Market Cycles And Why The Bull Isn't Dead

Summary

- Valuations remain high by historical standards. Valuations in a bear market cycle should mean-revert and forward-return expectations.

- While prices can seem to defy the law of gravity in the short term, the subsequent reversion from extremes has repeatedly led to catastrophic losses for investors who disregard the risk.

- Making money in the first half of a full-market cycle is easy. Keeping it during the second half is the hard part.

TheaDesign

There is much debate as of late on the current market cycle. Is it a bear market? Maybe. But what if this is just a correction within a 40-year-long secular bull market cycle? It is a question posed by Jacques Cesar previously.

“The cyclical bull started in late March of 2020, after the market plunge sparked by the initial outbreak of Covid-19. The secular bull began way back in 1982, as equities shook off a vicious 14-year slump that more than halved the S&P 500 index when adjusted for inflation. There have been some notable cyclical bears amid the current secular bull, including the 1987 crash, the internet bust, and the global financial crisis.”

Before you dismiss the notion entirely, his claim has some credence.

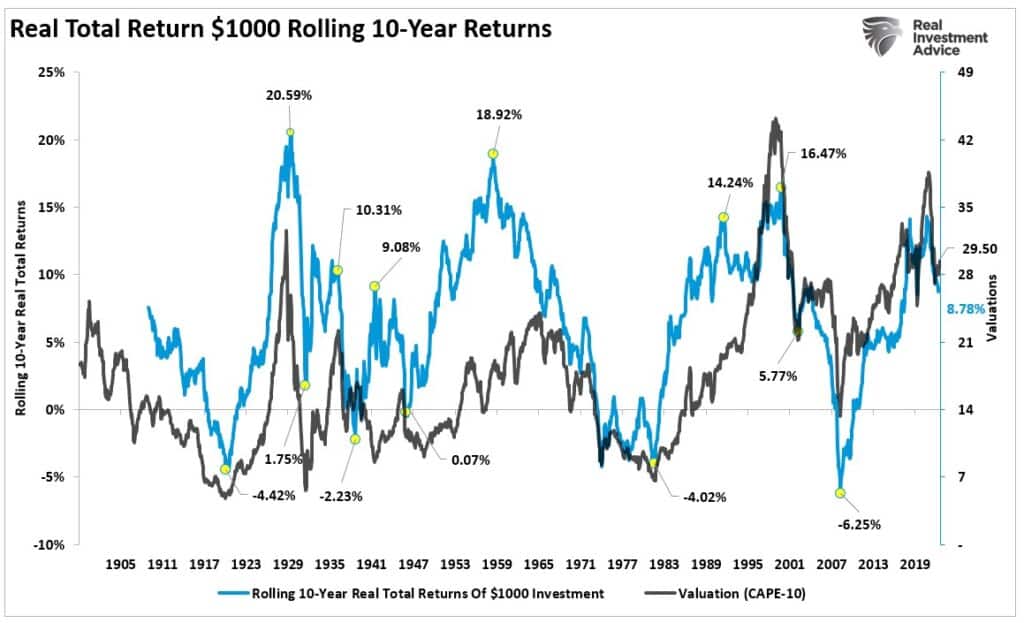

For example, as shown, valuations remain high by historical standards. Valuations in a bear market cycle should mean-revert and forward-return expectations.

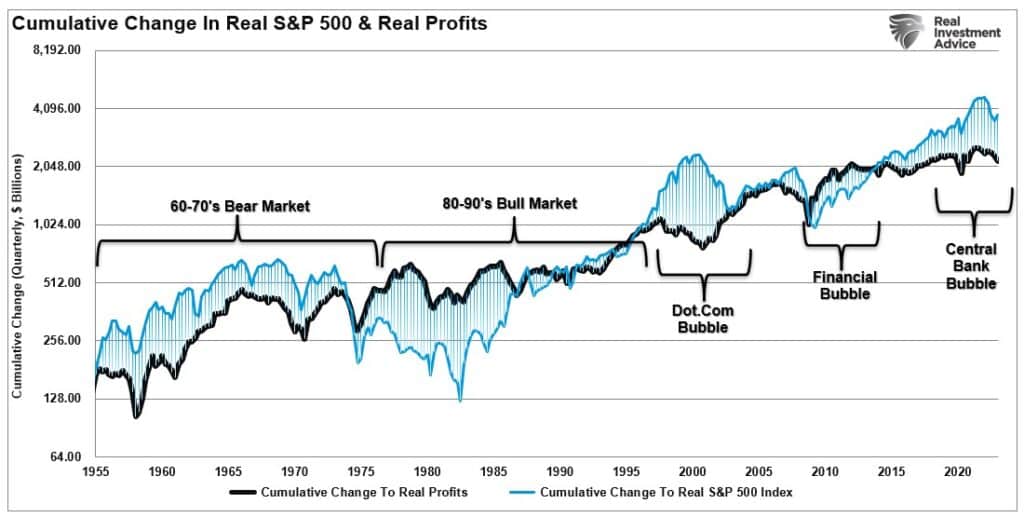

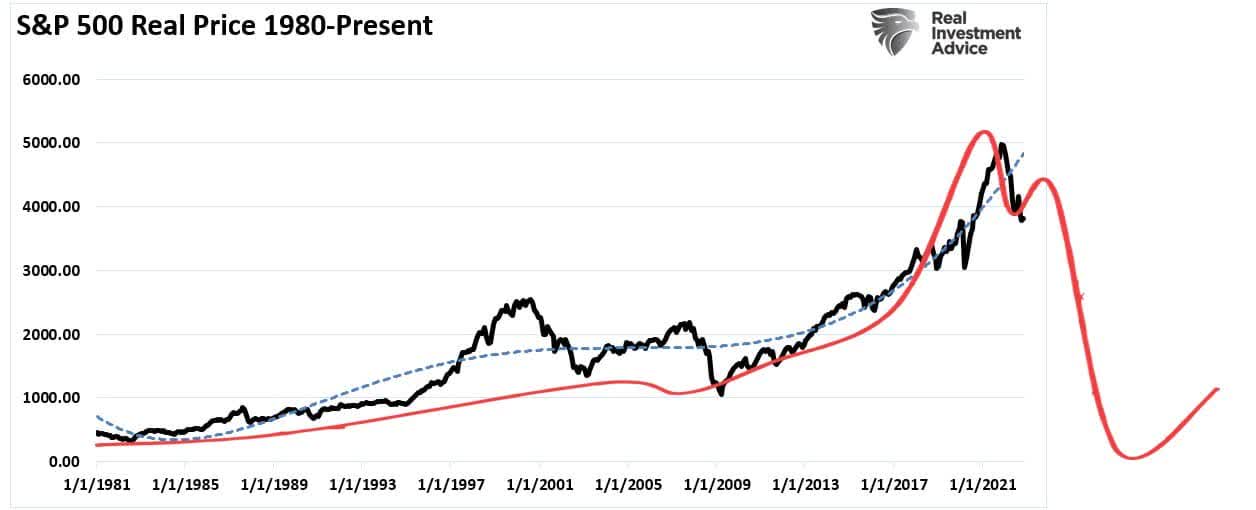

Furthermore, the detachment of the stock market from underlying profitability has been a constant companion since 1980. The lack of a mean reversion in profits is a concern.

“Profit margins are probably the most mean-reverting series in finance, and if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system, and it is not functioning properly.” – Jeremy Grantham

The lack of these mean reversions, which are needed, is mainly due to the “animal spirits,” which were awakened by consecutive rounds of financial stimulus on a global scale. Despite the market decline in 2022, investors remain focused on a Fed “pivot” to eliminate the risk of a market cycle completion.

That “faith” has been carefully cultivated by the Federal Reserve over the last decade to keep the psychological cycle from completing. The Fed is aware of the economic havoc unleashed if they lose control of the financial narrative. Such is why Jerome Powell recently clarified that they would act if needed.

“If we overtighten, we can support economic activity.”

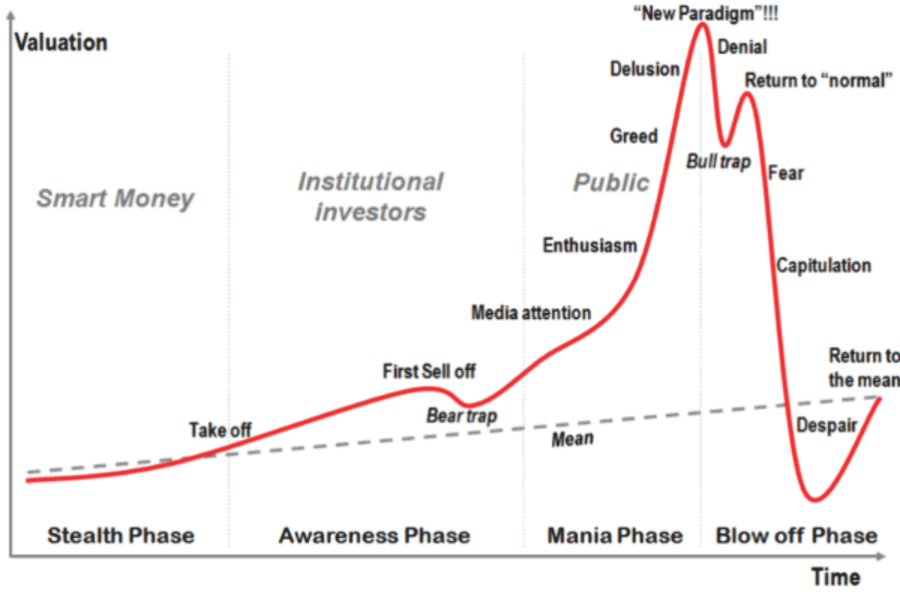

We will focus on the following psychological cycle related to the current secular market cycle, which has remained consistent throughout history.

The Importance Of Full-Market Cycles

I have often discussed the importance of full-market cycles.

However, you should note that when investing, what has separated long-term “investing success” stories is when those individuals started their journey.

- Warren Buffett started in 1942 and acquired Berkshire Hathaway in 1964.

- Paul Tudor Jones launched his hedge fund in 1980

- Peter Lynch managed the Fidelity Magellan Fund starting in 1977

- Jack Bogle launched Vanguard in 1975

The list goes on, but you get the idea. Much of these investing greats’ success came from catching the beginning of a bull cycle with low valuations and high forward returns.

“Here is the critical point. The MAJORITY of the returns from investing came in just 4 of the 8 major market cycles since 1871. Every other period yielded a return that actually lost out to inflation during that time frame.”

By looking at each full-cycle period as two parts, bull and bear, I missed the importance of the “psychology” driven by the entirety of the cycle. In other words, what if instead of there being eight cycles, we look at them as only four?

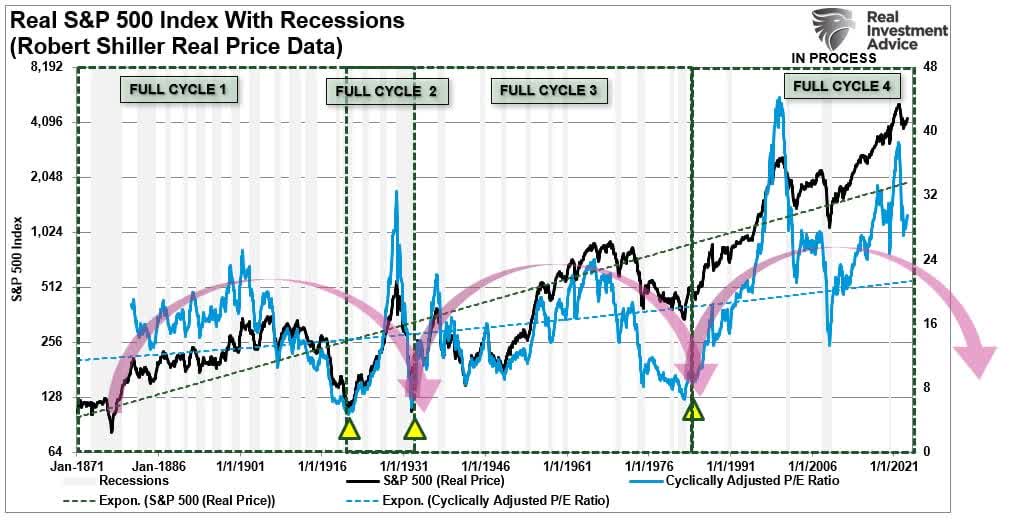

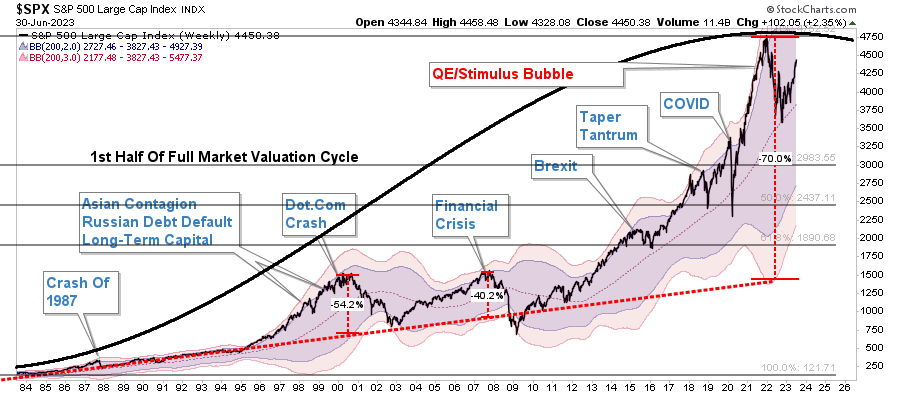

Viewing the market in complete cycles would suggest the bull market that began in 1980 is not yet complete.

Notice in the chart above, the CAPE (cyclically adjusted P/E ratio) reverted well below the long-term in both prior full-market cycles. While valuations did, very briefly, dip below the long-term trend in 2008-2009, they have not reverted to levels either low or long enough to form the fundamental and psychological underpinnings seen at the beginning of the last two full-market cycles.

Combining Psychological And Market Cycles

Reframing our analysis to combine psychological and full-market cycles provides a different view of where we are currently. The combination of the psychological cycle compresses the four primary secular market cycles into just three full-market cycles.

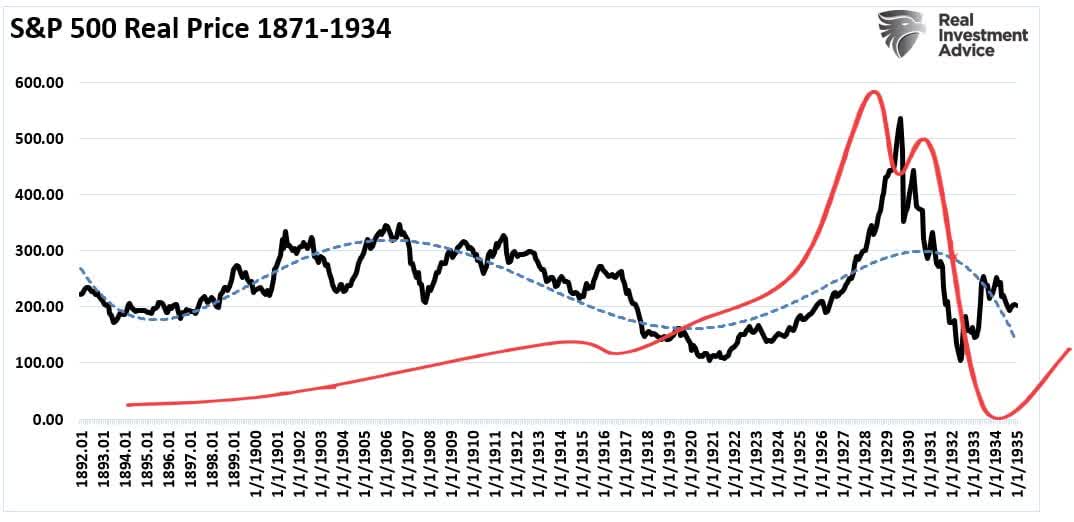

The first full-market cycle lasted 63 years, from 1871 through 1934. This period ended with the crash of 1929 and the beginning of the “Great Depression.”

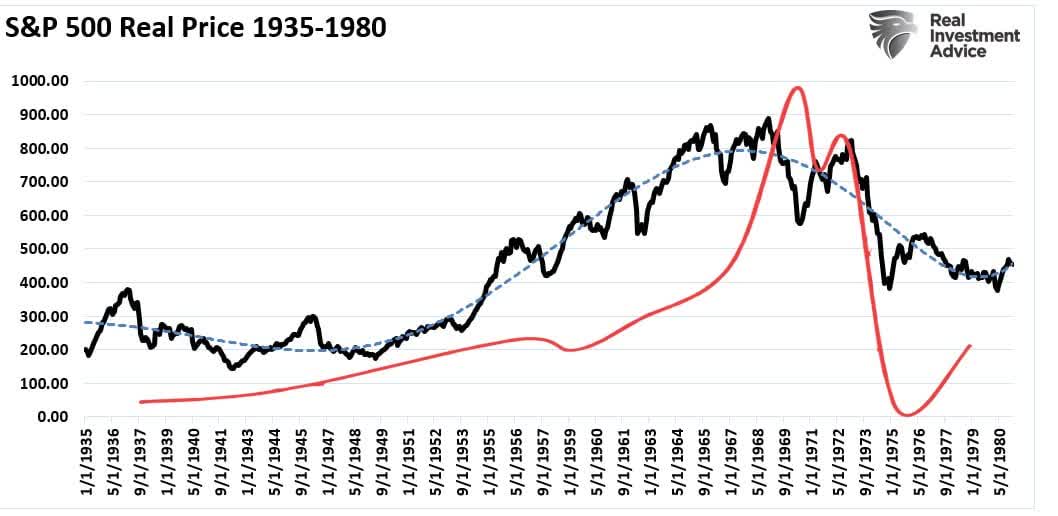

The second full-market cycle lasted 45 years, from 1935-1980. This cycle ended with the demise of the “Nifty-Fifty” stocks and the “Black Bear Market” of 1974. While not as economically devastating to the overall economy as the 1929 crash, it greatly impaired the investment psychology of those in the market.

The third (current) full-market cycle is only 42 years in the making. Given the still-elevated valuations, it is highly likely we have yet to complete the current market cycle.

The following chart supports the idea that the “bull market” began in 1980.

- The long-term bullish trend line remains.

- The cycle oscillator is only halfway through a long-term cycle.

- On a Fibonacci retracement basis, a 61.8% retracement would almost intersect with the long-term bullish trend line around 1500, suggesting a complete reversion could be nasty.

Again, I am not suggesting this is the case. This is a thought experiment about the potential outcome of the collision of weak economics, high debt levels, valuations, and “irrational exuberance.”

Understanding The Risk

This thought experiment aims to recognize that excesses exist currently that have historically never occurred.

As Vitaliy Katsenelson once wrote:

“Our goal is to win a war, and to do that we may need to lose a few battles in the interim. Yes, we want to make money, but it is even more important not to lose it.”

I agree with that statement, so we remain invested but hedged within our portfolios.

Unfortunately, most investors do not understand market dynamics and how prices are “ultimately bound by the laws of physics.” While prices can seem to defy the law of gravity in the short term, the subsequent reversion from extremes has repeatedly led to catastrophic losses for investors who disregard the risk.

Just remember, in the market, there is no such thing as “bulls” or “bears.”

There are only those who “succeed” in reaching their investing goals and those that “fail.”

Sure, this time could be different. However, as Ben Graham said in 1959:

“‘The more it changes, the more it’s the same thing.’ I have always thought this motto applied to the stock market better than anywhere else. Now the really important part of the proverb is the phrase, ‘the more it changes.’

The economic world has changed radically and will change even more. Most people think now that the essential nature of the stock market has been undergoing a corresponding change. But if my cliché is sound, then the stock market will continue to be essentially what it always was in the past, a place where a big bull market is inevitably followed by a big bear market.

In other words, a place where today’s free lunches are paid for doubly tomorrow. In the light of recent experience, I think the present level of the stock market is an extremely dangerous one.”

Remember, making money in the first half of a full-market cycle is easy. Keeping it during the second half is the hard part.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

After having been in the investing world for more than 25 years from private banking and investment management to private and venture capital; I have pretty much "been there and done that" at one point or another. I am currently a partner at RIA Advisors in Houston, Texas.

The majority of my time is spent analyzing, researching and writing commentary about investing, investor psychology and macro-views of the markets and the economy. My thoughts are not generally mainstream and are often contrarian in nature but I try an use a common sense approach, clear explanations and my “real world” experience in the process.

I am a managing partner of RIA Pro, a weekly subscriber based-newsletter that is distributed to individual and professional investors nationwide. The newsletter covers economic, political and market topics as they relate to your money and life.

I also write a daily blog which is read by thousands nationwide from individuals to professionals at www.realinvestmentadvice.com.