Allied Motion Technologies: Growth Is Coming But Not At The Cost Of Quality

Summary

- Allied Motion Technologies Inc. offers a good entry point for exposure to the industrial sector, despite trading above sector valuation metrics, due to its fast growth and diversified revenue streams.

- The company's backlog sits at $308 million, a 7% YoY increase, and recent earnings highlighted strong demand, a 27% revenue growth, and margin expansion, with gross margins now above the sector's average.

- Risks include the company's growing debt, which has nearly doubled since 2022, and the net debt/EBITDA ratio is above the preferred threshold, indicating potential risks with paying debt.

gorodenkoff

Investment Rundown

For exposure to the industrial sector with a company growing at a fast rate, I think that today Allied Motion Technologies Inc (NASDAQ:AMOT) offers a very good entry point despite trading above valuation metrics for the sector. The company offers customers a line of precision and specialty-controlled motion components. Several end markets which serve the diversified set of revenue streams help hedge against major downturns.

Solid margin expansion to the start of 2023 makes me very positive about the future potential of AMOT right now. I think that sometimes you have to bite the bullet and get in at valuations that perhaps are a little above what you are comfortable with to benefit in the long run. A p/e of 24 is still fine by me to pay here when growth seems to be over 15% yearly in the coming 5 years at least. Rating AMOT a buy.

Company Segments

AMOT serves many different end markets which aid them in maintaining consistent growth rather than growing but with a lot of volatility in terms of both the top and bottom line.

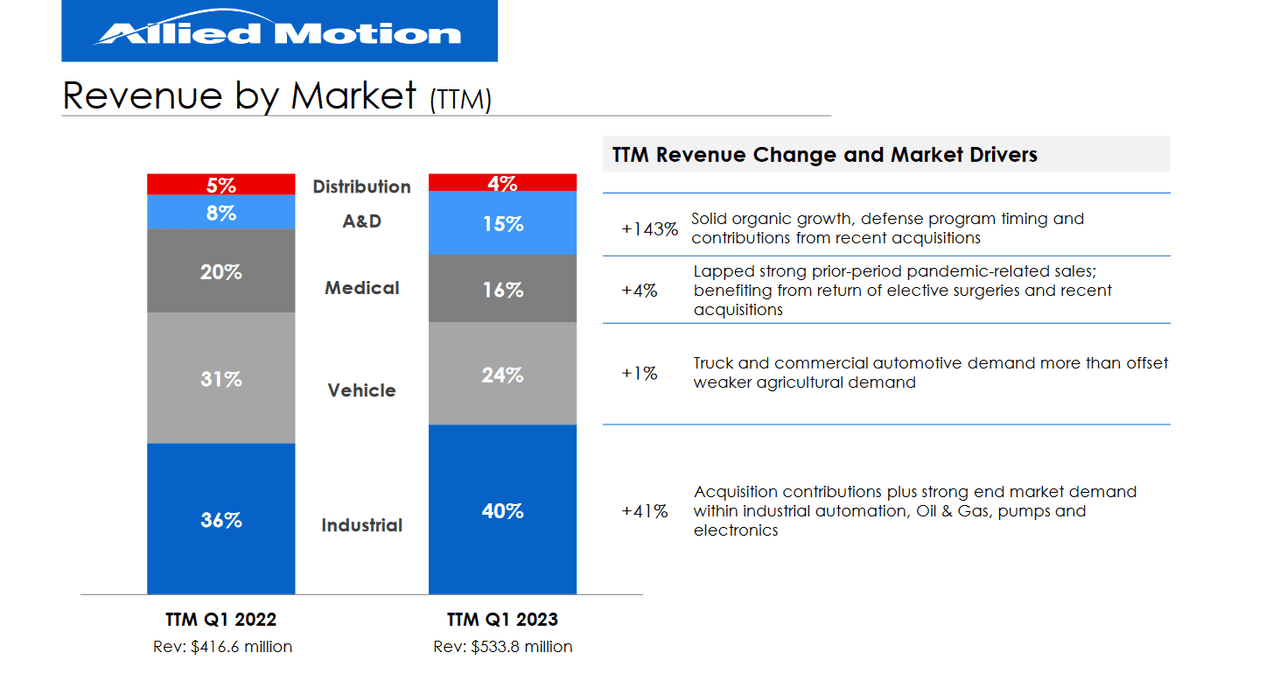

Revenue Streams (Earnings Presentation)

The primary market that AMOT has exposure to is industrial. The oil and gas industry is placing demand here as both of the energy sources remain in very high demand. Energy needs remain strong and we might even be facing challenges in achieving and meeting the needs of the market. This makes expansion and capital deployment appealing to these companies, which of course benefits AMOT as they supply many of the necessary products.

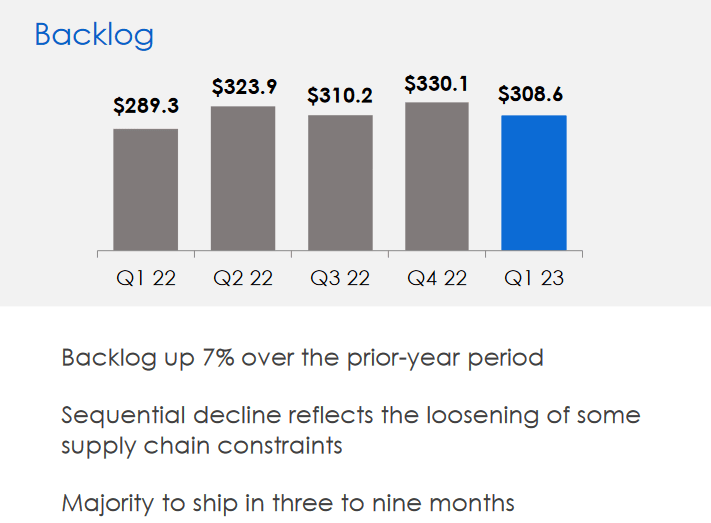

Backlog Growth (Earnings Presentation)

Seeing demand like this across many of the key markets is helping build up the backlog for the business. It now sits at $308 million, a 7% increase YoY but the loosening of supply chain issues has eased which did deter some of the incentives for companies to be early with making orders. Now there seems to be more "spontaneity" with the orders, but I don't fear that this will harm AMOT's revenues at all.

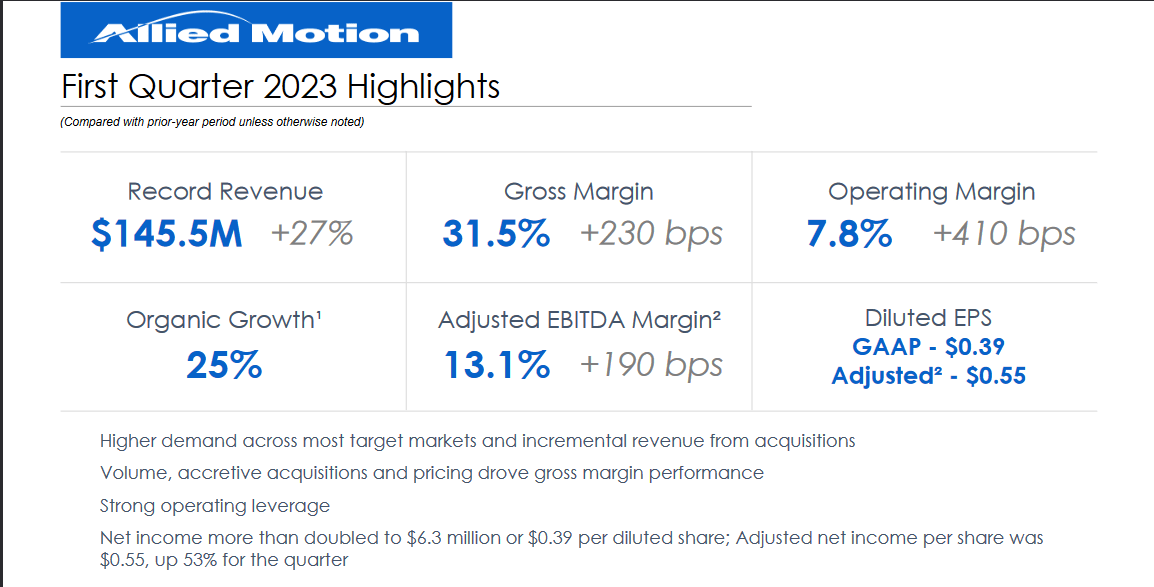

Earnings Highlights

The last report from AMOT highlighted the fact that demand is still strong and alive for many of the markets they have exposure to. Revenues grew by 27% and reached a record $145 million for the company. The key markets that drove this growth can be contributed to Industrial Aerospace & Defense.

Q1 Highlights (Q1 Earnings Report)

But it wasn't just revenue growth that was a key highlight, margin expansion also happened and the gross margins now sit at 31.5%. This is both above the sector's average gross margins of 29% and the historical gross margins for AMOT. I view this as a tailwind for the share price and support that the current valuation will stay and AMOT can trade at a higher multiple, despite having a smaller market cap than many of its peers like Regal Rexnord Corporation (RRX).

Besides the solid earnings results, AMOT also announced they are raising the dividend by 20% on the back of improving margins, leaving more capital available for distribution. This increase shouldn't be meant to show off AMOT as a value or dividend play. The payout ratio is still quite low at under 8%. The value for investors exists more with the potential EPS growth that AMOT can have and how that would lead to a share price increase. Looking at the earnings estimate they have AMOT in 2025 achieving a $2.27 EPS. With a 22x p/e, it nets AMOT a price target of $49. Leaves an upside potential of 29% from today's levels.

Risks

What I think is starting to look like a risk now with AMOT has to do with the debt to the company that is consistently taking over the years. It has grown to $227 million, nearly doubling since 2022. The cash position, however, hasn't seen such growth still at $25 million. The taking of debt seems to be necessary to fuel growth but at what time does it become more of a risk than a way to expand? Well the net debt/EBITDA does sit at 3.5 which is above the preferred threshold of 3. Anything over that does bring risk into the equation and for coming quarters I will be watching the development of debt. Between 2020 and 2022 the long-term debt grew by 85%. The revenues however grew by 37% during that time. My hope with coming quarters is the see the revenue outpace the rate that debt is being added onto the balance sheet.

Industry Comparison

Comparing AMOT to a peer like Powell Industries Inc (POWL) I think that AMOT still comes out ahead. The p/e for POWL sits at 28x on a forward basis. The yield for POWL is higher however at 1.72%. But margins are far worse for POWL with gross margins at just 17%, below the sector and AMOT. When choosing a growth company I find it important to go with the one with already established margins. It leaves less downside risk and the possibility of a negative bottom line seems less likely. Over the last 12 months though, POWL has provided investors with far more returns as the share price is up 172% during that period, compared to AMOT with 62%. A pullback back to sector multiples seems likely in the short term for POWL and that adds to the downside risk I see with the company currently.

Final Words

With demand coming from many directions AMOT has been able to grow at a rapid pace in terms of revenues but it has also resulted in margin expansion. The outlook seems strong and the current valuation for the company is a multiple I am happy to pay given the growth prospects. Rating AMOT a buy right now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.