Public Storage: Performing Well In A Successful Sector

Summary

- Public Storage, the largest self-storage REIT, has expanded rapidly since 2019.

- Revenue from same-store properties increased by 9.8% YoY and NOI increased by 11.2%.

- Additionally, the self-storage market has seen a lot of success and will likely continue to grow in the future.

- I present my analysis, which leads me to a buy rating for Public Storage stock.

NoDerog

Today I would like to take a look at Public Storage (NYSE:PSA), which is a self-storage real estate investment trust, or REIT. As I outlined in one of my previous articles on one of the biggest self-storage REITs CubeSmart (CUBE), the sector has been getting a lot more customers because the average size of housing is shrinking. This then leads people to seek storage elsewhere. Additionally, self-storage benefits from urbanization, which makes many people move from a house to an apartment, which once again means less space and a need for extra storage.

Now for PSA itself. It is the largest self-storage REIT in the U.S. At least for now, as Life Storage (LSI) and Extra Space Storage (EXR) announced they are going to merge in the second half of 2023 which will then make Public Storage the second-biggest player. PSA is also listed as part of the S&P 500 (SP500).

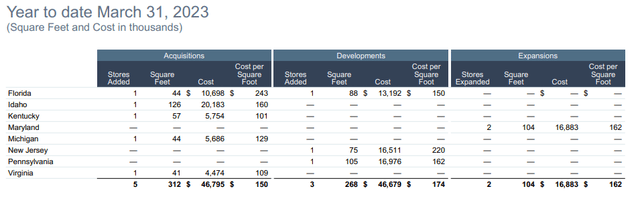

They own a total of 2,877 properties in 40 states, which comes up to 205 million square feet. The company is actively trying to expand and has invested $8.4 million in expansion since 2019, which resulted in a 27% portfolio increase. They are also the fastest expanding among other self-storage REITs. Just last year, they obtained 5 new acquisitions, started 3 developments and 2 expansions (see below).

The occupancy stands at 92.8% which is a 2.3% decrease YoY but still pretty high. The company has been performing well in general too. Their revenue on same-store properties has increased by 9.8% YoY and NOI increased by 11.2%. Their operating expenses by 8.2%. The guidance provided by the company suggests that growth will continue in the future as well. Revenue is expected to grow by 2.75-5% and NOI by 1.5-5.1%. However, expenses are also expected to grow and even more than the revenue by 4.75-6-75%. These are still good numbers and the company seems to be performing well on this end.

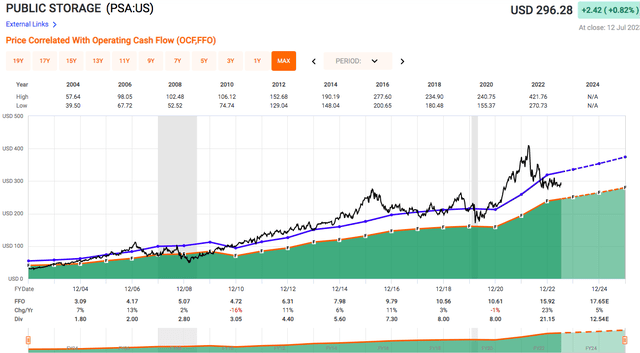

The funds from operations ("FFO") per share is currently $4.08 for Q1 2023. It went up quite a bit compared to Q1 2022 by 16.2%, and it is expected to grow even further in the remainder of the year by 2.6-7.8%. Which is also positive.

Now let's dive into the balance sheet. The company has an A rated balance sheet which makes it one of just seven REITs that have an A- rating or better. With $6.9 billion of outstanding debt. They have an extremely low weighted average interest rate of 2.2%. Moreover, they have $700 million in cash and $500 million available on a line of credit. They don't have any maturities this year, and a little over $1 billion maturing in the two years after that. With the cash and the credit they have on hand, this should be pretty easily manageable and leave the company without any major issues.

Investors can collect a nice 4.1% dividend, which was recently increased from $2 to $3 dollars per share per quarter and is still well covered by a 76% FFO payout ratio.

The P/FFO for the company is 17.79x trading just a little bit below the historical average of 20.05x. For comparison, peers trade at the following multiples: CUBE at 17.13x, EXR at 17.73x. While it seems like PSA is fairly valued towards peers, I think it deserves to trade at a little bit of a premium because their operational metrics and forward-looking outlook are really good.

So, with the company performing well and self-storage getting a lot more popular lately, Public Storage seems to have some great years ahead. I believe the sector will continue to grow in the future as well because people will still need to store their things somewhere. This leads me to a BUY rating for PSA here.

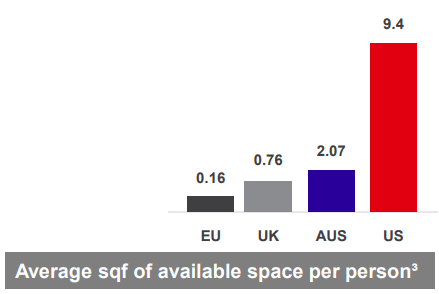

I would also like to mention some risks to consider. In a recession, people will more likely sell/throw out their things rather than get a self-storage unit to save some money. Another risk is the competition, which is pretty big in the U.S., so customers can choose to go elsewhere (see the graph below, which represents the self-storage space per capita). Moreover, the market is very saturated, which is not good for the long-term outlook.

Big Yellow Group

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.