Chewy: Margin Upside Can Drive Stock Higher

Summary

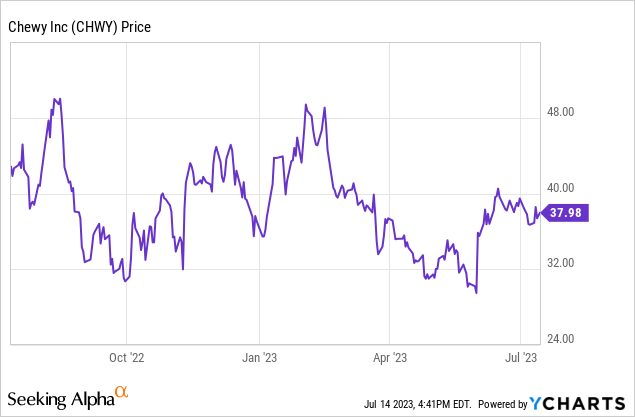

- Chewy, Inc. has demonstrated strong fundamental progress on margins and profitability, despite the stock only being up ~7% year to date.

- The company is also planning on opening its first international market in Canada later this year.

- Gross margins are seeing tailwinds from lower promotional activity, though this has not hampered sales growth.

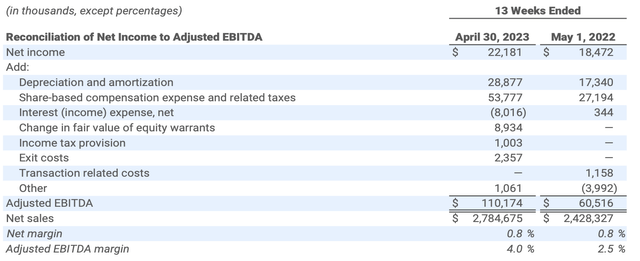

- As a result, Chewy, Inc. adjusted EBITDA is nearly doubling y/y.

Justin Paget/DigitalVision via Getty Images

With markets hovering at year-to-date highs on hopes that lower inflation will mean an end to Fed rate hikes, a common question investors ask is: is it too late to get into the rally? In my view, there's still plenty of upside left if we deploy careful stock-picking.

Chewy, Inc. (NYSE:CHWY), in particular, is a stock I'm banking on for further upside through year-end. The leading pet e-commerce vendor is up only ~7% year to date, despite strong fundamental progress particularly on margins and profitability.

The Chewy bull case sits on top of an attractive valuation

I view Chewy as a non-cyclical e-tailer that is just on the cusp of realizing the economies of scale needed to produce substantial profitability. I remain bullish on Chewy and am holding onto the stock in my portfolio. I'm especially encouraged by the company's ability to pass price increases onto customers and rely much less on promotional activity to drive sales growth.

For investors who are newer to Chewy, here is my full long-term bull case on the company:

- Pet ownership is taking off. The trend of "pandemic pets" is still driving increased pet ownership in the U.S., and a lot of those new pet parents skew young and are highly disposed toward convenient online services like Chewy.

- Beloved consumer brand. Chewy has built up quite a lot of brand equity around being a very customer service-oriented company. This has helped the company build up a base of more than 20 million active customers; and Chewy continues to expect customer growth in 2023.

- International expansion. Chewy plans to open its first international market in Canada later in 2023.

- Margin expansion driven by expanding product categories. Chewy's push to grow its own brand (Tylee's), plus focus more on selling higher-margin hardgoods, has proven very effective at producing margin expansion. Gross margins have recently expanded to ~29%, vs. low-20s at the onset of the pandemic. In addition, Chewy's success at passing on price increases to its customers has allowed it to preserve this gross margin progress even in the current inflationary environment.

- Constant product innovation. More to the point above, the company recently also launched its own pet wellness brand "Vibeful," which gives it access to a pet health and wellness TAM that it sizes at $2.4 billion alone.

- Nascent opportunities in pet telehealth and pet insurance. The craze in telehealth and doctor consultations via your mobile device is spilling over into the pet world, too. The company's "Chewy Health" offering has built out a "Connect With A Vet" service, and it also has rolled out a pet pharmacy as well. In August, the company rolled out its "CarePlus" pet insurance plan, which was recently bolstered through a new partnership with Lemonade's (LMND) pet insurance vertical. This is a broad, new opportunity for Chewy that can both accelerate its growth and grow its margins.

From a valuation perspective, I think Chewy still has plenty of room to run. At current share prices near $38, Chewy trades at a market cap of $16.24 billion. After we net off the $803.2 million of cash on Chewy's most recent balance sheet, the company's resulting enterprise value is $15.44 billion.

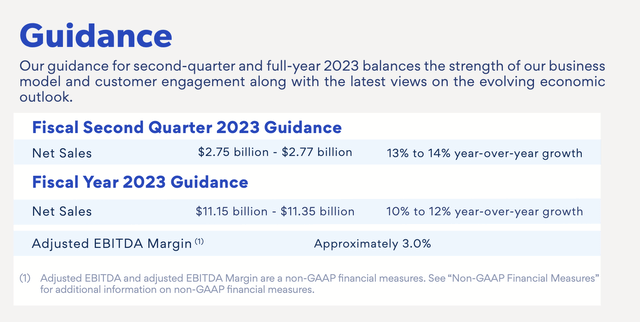

Meanwhile, for the current fiscal year, Chewy has guided to $11.15-$11.35 billion in revenue (+10-12% y/y growth), at a 3% adjusted EBITDA margin implying $337.5 million in adjusted EBITDA at the midpoint.

Chewy outlook (Chewy Q1 earnings release)

This puts Chewy's valuation multiples at:

- 1.4x EV/FY23 revenue

- 46x EV/FY23 adjusted EBITDA.

Considering Chewy is growing its gross and adjusted EBITDA margins by 100-150bps y/y in its most recent quarter and is still on the cusp of achieving operating leverage, I think it's too early to judge Chewy on a profitability basis now. It's worth comping Chewy's revenue multiple, however, against Amazon (AMZN) which trades at a ~2x forward revenue multiple (acknowledging, of course, that roughly 20% of Amazon's revenue accrues to the high-margin AWS business).

In short here, I think there's tremendous opportunity for Chewy to advance higher as the company takes advantage of recent pricing and margin tailwinds to boost its profitability.

Q1 download

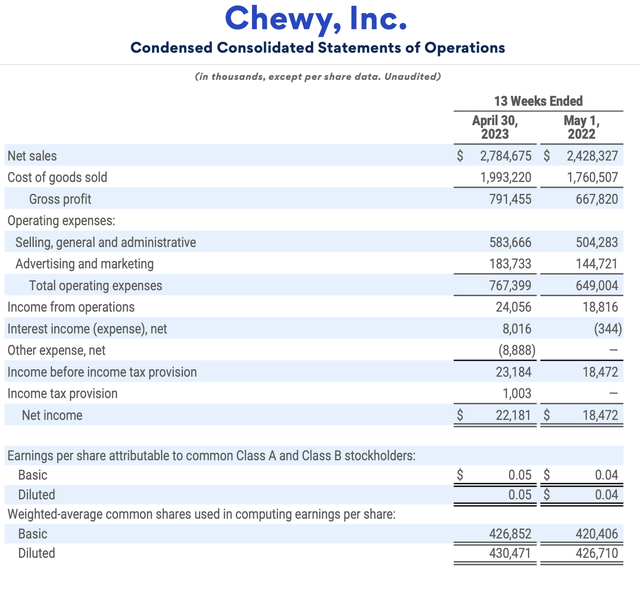

Chewy's recently-released Q1 results are a good demonstration of the company's recent momentum. Take a look at the Q1 earnings summary below:

Chewy Q1 results (Chewy Q1 earnings release)

Revenue grew 15% y/y $2.78 billion, beating Wall Street's expectations of $2.73 billion (+12% y/y) by a three-point margin. Revenue growth also accelerated versus 13% y/y growth in Q4. And autoship, the company's recurring-subscription program, continued to be a major driver of growth with 19% y/y revenue growth in the quarter and representing 75% of total sales.

It's important to note that Chewy has a major growth driver coming up in the third quarter this year: opening its first international market in Canada. Speaking on the Q1 earnings call on the company's decision to launch in Canada, CEO Sumit Singh noted as follows:

As we assessed which geography would be most suitable for our expansion plans, we honed in on Canada's large and growing market where we see a path to achieving market share and profitability akin to our U.S. business. Canada has a healthy and increasing e-commerce penetration where we can offer a differentiated value proposition relative to existing players in the market, and build the same level of trust with Canadian pet parents that those in the U.S. have come to associate with the Chewy brand. Our initial launch will focus on the Greater Toronto market, which represents the largest metropolitan area in Canada, from which we plan to take a gradual and responsible approach to expanding our footprint.

Our service delivery model will leverage our assets to create operational efficiency and attractive economics, while ensuring a high-bar customer experience. Specifically, we intend to support our Canada strategy with a scaled, local third-party fulfillment and logistics partner. Our U.S. supply chain affords us an additional asset, and we will leverage our U.S. network in situations where it is strategically or economically advantaged to do so.

Taken together, this approach allows us to launch in Canada with a focus on optimal customer experience and without any material commitment to CapEx spend, until the success and scale of the business supports an investment in this area. We do not anticipate this market requiring material CapEx investment through at least 2024. More broadly, on a company-wide level, we do not expect our investments in Canada to deviate us from our projected long-term profitability, cost or CapEx targets. We look forward to sharing our progress over the quarters to come."

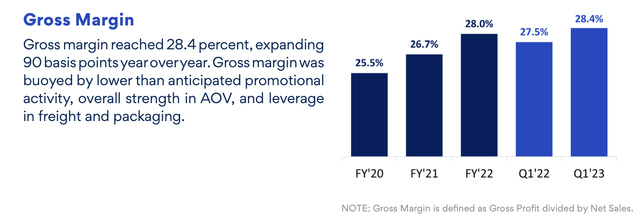

On the margin front, it's key to note as well that Chewy achieved revenue acceleration while simultaneously lowering promotional activity. In addition, the company opened a fourth distribution center in Nashville, Tennessee that is expected to be accretive to long-term margins.

Chewy gross margin trends (Chewy Q1 earnings release)

As a result, as shown in the chart above, gross margins rose 90bps y/y to 28.4%. The company also achieved 60bps of further operating expense reductions to net a 4.0% adjusted EBITDA margins, up 150bps y/y. Adjusted EBITDA nominally grew 82% y/y to $110.2 million: illustrating the notion that Chewy's profitability is still in its early stages with much more leverage to come in the quarters ahead.

Chewy adjusted EBITDA margins (Chewy Q1 earnings release)

Key takeaways

In my view, Chewy, Inc. is on the verge of achieving substantial profitability while also sustaining multiple growth drivers under its belt, including international expansion and category expansion to services like insurance. Stay long here.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CHWY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.