Cloudflare Boosts Strong Network Positioning For Long-Term Growth

Summary

- Cloudflare is gaining market share from vendors offering point products and is positioned to deliver 30%-45% revenue growth over the next 3-5 years.

- The company's strong technology and shift towards advanced service functionalities and large enterprise adoption are driving new customer acquisitions and accelerated revenue growth.

- As Cloudflare continues to generate durable 30%-45% growth, I believe the company will see strong operating leverage.

- My end-of-year price target of $75 on the stock is based on 15x EV/CY24E Sales.

pixdeluxe

Thesis

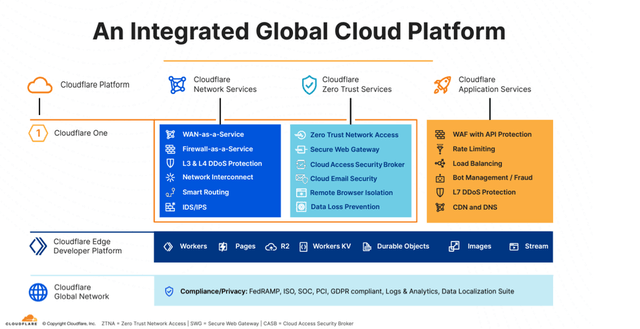

I believe Cloudflare, Inc. (NYSE:NET) is benefiting from the trend of consolidating security tools to reduce costs, and the company is gaining market share from vendors offering point products. Cloudflare possesses a competitive advantage with its strong technology that addresses critical issues and aligns with emerging technology trends. It is well positioned in areas such as Cloud Direct application adoption, Enterprise Digital Transformation, multi-cloud, and Edge Compute, benefiting from trends like 5G, IoT integration, and security. The company's shift in business model towards advanced service functionalities and large enterprise adoption has resulted in new customer acquisitions and accelerated revenue growth. I believe NET can deliver 30%-45% Revenue growth over the next 3-5 years and sustain Gross Margins in the mid-to-high 70% range while delivering operating leverage. I think NET should be a core holding in growth portfolios and have an end-of-year price target of $75 on the stock.

Critical Technology with a Competitive Advantage

Despite the recent decline in the stock, Cloudflare is in a favorable position due to its strong technology, which can address critical issues and support emerging technology trends. I believe the company is well positioned in areas such as Cloud Direct application adoption, Enterprise Digital Transformation, multi-cloud, and Edge Compute. The demand for Edge Compute is driven by significant trends like 5G adoption, integration of IoT and OT, and security, where Cloudflare can provide valuable assistance. Moreover, Cloudflare is undergoing a transition in its business model, shifting from investing in network infrastructure and acquiring freemium customers to developing advanced service functionalities and focusing more on large enterprise adoption. This shift has involved substantial operational expenses, but these investments are now paying off with new customer acquisitions and accelerated revenue growth.

Appealing Subscription Pricing Model

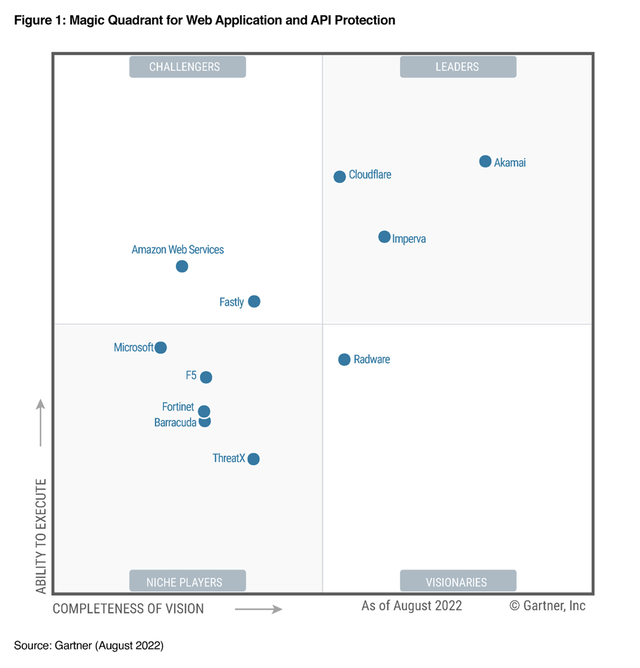

Cloudflare's subscription pricing is attractive to enterprise users as the growth in their internet traffic and large-scale cyberattacks may drive up costs under a usage-based model. The appeal of subscriptions became apparent at the start of the pandemic when Cloudflare gained customers from rivals after enterprises' bills spiked as employees shifted to working from home. I believe that Cloudflare's subscription-based pricing is rather unique among its content-delivery network peers, as Akamai Technologies, Inc. (AKAM), Fastly, Inc. (FSLY) and Limelight use pay-as-you-go pricing based on bandwidth consumption. Cloudflare generates more than 95% of its revenue from subscriptions. About 80% of subscription sales are from annual or multiyear contracts, which lends visibility to its revenue growth.

Magic Quadrant for Web Application and API Protection

Financial Outlook

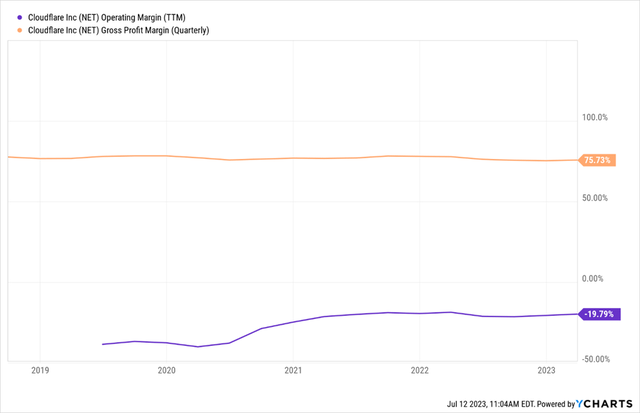

Cloudflare is targeting a long-term gross margin of 75-77%, which I view as conservative given positive trends in the business, including the launch of several profitable new products, a 25% price increase, and growth in enterprise accounts. Cloudflare has built its network with low-cost hardware, with all of the value centered in its growing software and services portfolio, which offers meaningful margin expansion as new products scale up over time.

Cloudflare has set a long-term operating margin goal of 20%, though I don't foresee it reaching this level within the next five years due to its heavy investment in new-product development. Its fixed network investment and ample capacity pave the way for both gross and operating margin accretion, though a focus on developing and launching new products suggests its investment in sales and R&D may remain elevated. Still, Cloudflare's non-GAAP operating margin turned modestly positive in 3Q21 and expanded to 5.9% on an adjusted basis in 4Q22 on a steady decline in its operating expense margin. The company has also instilled some cost discipline in recent quarters, given the turbulent economic environment, though its investment in new products may push out its ability to hit a 20% goal beyond 2027.

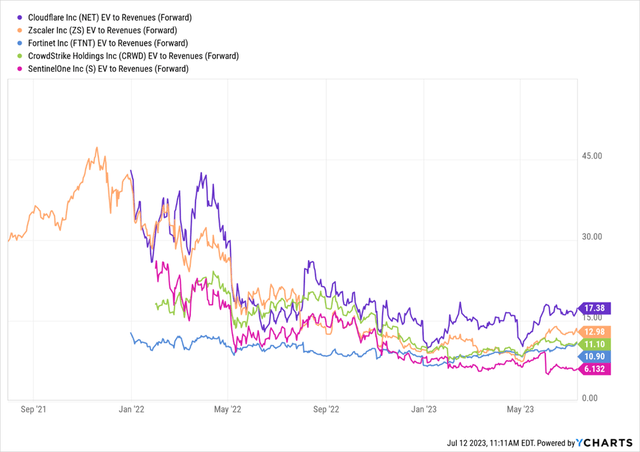

Valuation

Cloudflare's EV/Sales multiple has declined significantly since the start of 2022, pressured by a downward revision to revenue guidance that reflects a deceleration in growth for the first time since 2018. Still, the multiple is significantly above the average for a basket of its peers. Cloudflare has the richest valuation in the comp group, with its leadership likely linked to its ability to sustain relatively strong growth as the economy slows.

The move from Enterprise, on-premise and perpetual to cloud SaaS applications and IaaS is still in relatively early innings but has matured to the point where the scope of this transition is starting to alter the fabric of long-standing traffic patterns, security postures, programming/coding approaches and IT administrative roles. I believe Cloudflare is one of the most prominently positioned players to capitalize on all of these broader themes (and a few more) by fulfilling their audacious goal of helping to build a better Internet. I believe the rise of AI will only heighten the need for Cloudflare's services, driving additional Cloudflare adoption and product usage.

As Cloudflare continues to generate durable 30%-45% growth, I believe the company will see strong operating leverage. I view Cloudflare as a unique asset and one of the few companies that can power through a brief or prolonged inflationary environment, gradually bringing down its EV/S multiple over time. My end-of-year price target of $75 on the stock is based on 15x EV/CY24E Sales.

Key Downside Risks

Recent stock market activity has led to a decline in the value of high-growth companies that may take longer to become profitable. Stocks with high price-to-sales ratios have been particularly affected compared to those with lower valuations. However, I believe that these companies have the potential to grow into their higher valuations over the long term and still provide above-average returns. It's important to note that there may be occasional setbacks along the way, which could negatively impact investors holding shares of Cloudflare. Moreover, Cloudflare's growth and valuation could be at risk if the company faces challenges in scaling its Enterprise business. While the company has shown its ability to operate at a massive scale for millions of free customers and has experienced impressive growth in its Enterprise customer count, it will need to further expand its operations to reach and serve a larger number of large customers. Currently, the majority of Cloudflare's customers are either on free plans or small self-service plans, which offer limited avenues for growth and higher churn.

Conclusion

In the long term, I anticipate that Cloudflare's robust and strategically positioned network will enable the development of an innovative Cloud Direct architecture. Cloudflare's network is renowned for its speed, extensive global coverage, and advantageous features such as programmability, simplified connectivity, policy management, and high performance. The company is actively expanding this platform by introducing significant new product capabilities. Although Cloudflare's shares may not be cheap, I believe that investing in stock allows for participation in the company's long-term growth and the potential for substantial profitability. I view Cloudflare as a company with significant potential and anticipate that it will achieve multi-billion-dollar revenues and an operating margin of at least 25% over time. I view the stock as a buy and have an end-of-year price target of $75 on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)