Sell Li Auto Stock At Its Likely Peak

Summary

- Li Auto is a $37 billion market cap Chinese company that focuses on designing, developing, manufacturing, and selling new energy vehicles in China.

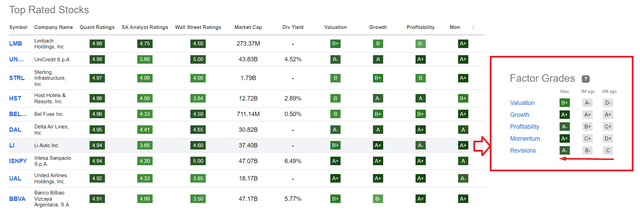

- In recent weeks, the company's stock has gained significant attention on Seeking Alpha's main page due to the exceptional performance of its Quant grades.

- Nevertheless, I respectfully disagree with SA's Quant system this time. I explain point-by-point why.

- Given a combination of high valuation, overly optimistic EPS expectations, and a high beta, Li Auto stock is likely to decline sharply once it reaches its "Selling Volume" which I showed in this article.

- I give LI stock a "Sell" rating and expect it to cool down shortly.

- Looking for a helping hand in the market? Members of Beyond the Wall Investing get exclusive ideas and guidance to navigate any climate. Learn More »

David Trood

In recent weeks, Li Auto Inc.'s (NASDAQ:LI) stock has gained significant attention on Seeking Alpha's main page due to the exceptional performance of its Quant grades, which improved dramatically over the past 6 months:

Seeking Alpha Premium, author's notes

Nevertheless, I respectfully disagree with SA's Quant system this time. In my assessment, I believe that Li Auto stock is nearing its peak price levels, indicating a potential sharp sell-off shortly.

Why Do I Think So?

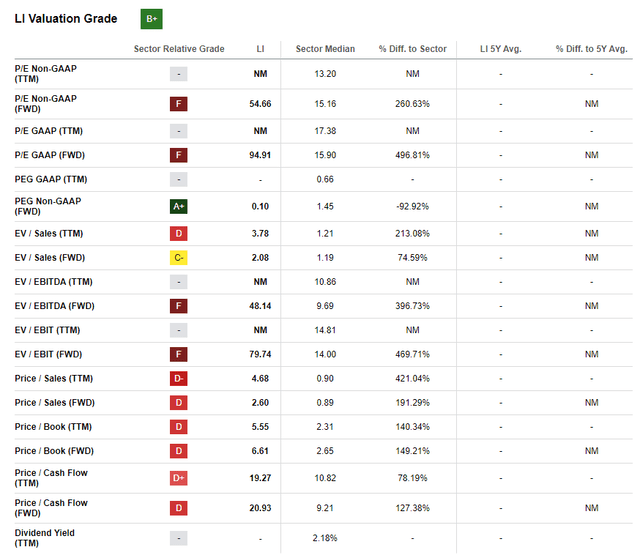

Let me first explain why I disagree with the quant system of Seeking Alpha this time. The idea of the whole system seems to me to be ingenious in its simplicity and efficiency - we look at 5 different characteristics of a single company and compare them with the median indicators of the sector to which this company belongs. The track record of this system is amazing, but as with any algorithm, there is a peculiarity. The way I see it, the quality of a single factor grade is evaluated based on the available indicators. Here is an example from Li Auto regarding its Valuation grade:

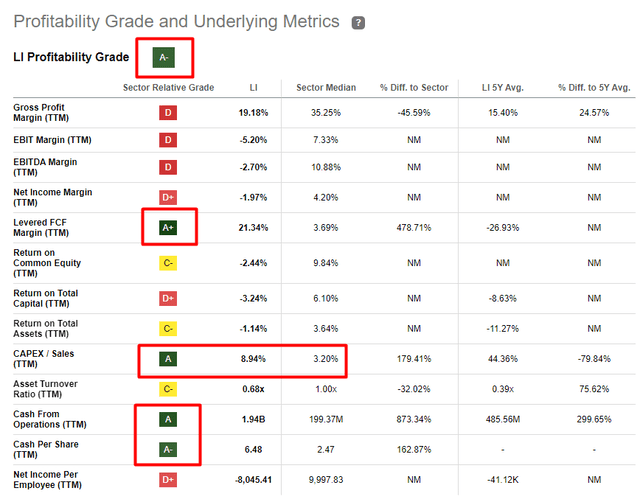

The strong "B+" grade seems to come solely from the low next-year PEG non-GAAP ratio - as you may see, most other indicators would give the stock a "D" rating. Roughly the same applies to Li's Profitability "A-" grade:

Seeking Alpha Premium, author's notes

Note that the high CAPEX/sales ratio above is considered an advantage over the sector. However, in the era of expensive capital we live in today, I would come to an opposite conclusion. Comparing the absolute figures for operating cash flow and the cash-per-share ratio without taking the share price into account also seems a bit wrong to me.

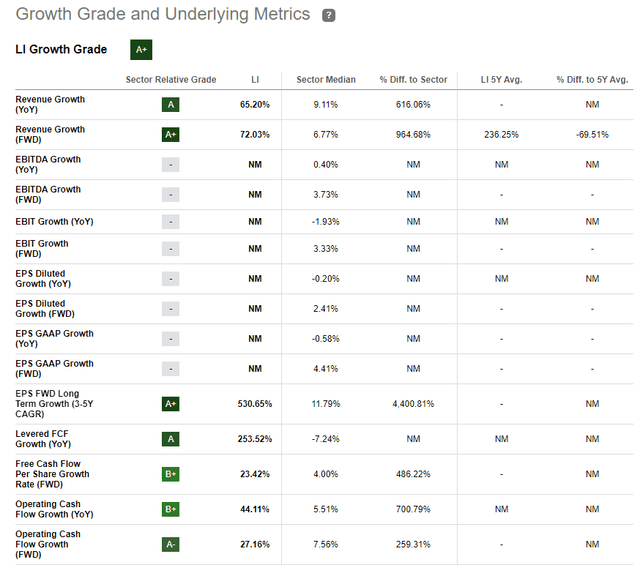

As for the Growth grade, I have no questions - LI really increases the operational capacity by leaps and bounds. I believe that's why investors are willing to pay so much for it.

But here we have to keep in mind that LI's next-year EV/EBITDA ratio is at >48x. That means there is a small base effect that explains the triple-digit growth rate of FCF.

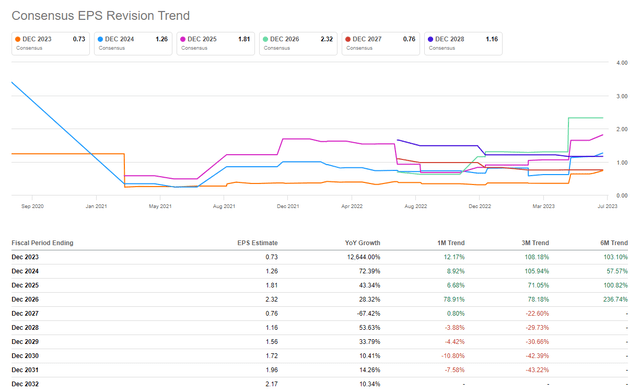

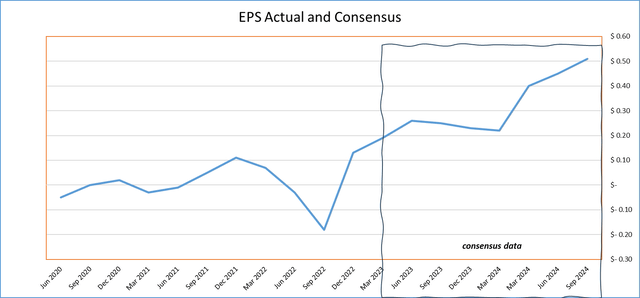

Positive earnings Revisions are another factor I'd like to point to. In fact, Li Auto has seen 9 out of 9 revisions on the positive side in the last 3 months. But again, this shows the effect of a low base - compared to what analysts gave the company 3 years ago, the current forecasts look like a mockery. The overall momentum is indeed positive relative to the past year, but today's share price has reached roughly the same level as 3 years ago, against a backdrop of priced-in EPS that were many times lower than then.

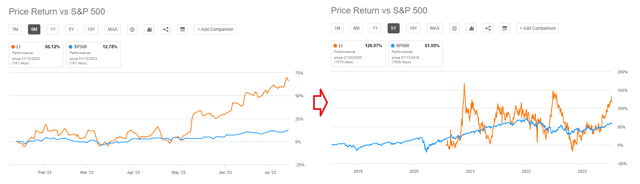

The strong Momentum is perhaps the only true grade of why LI is rated so high based on the Quant System - indeed, the stock gained >66% over the past 6 months amid S&P 500 Index's (SPX) (SPY) (SP500) rising by just 12.76% over the same time. However, in the longer term, it can be seen that the volatility of the LI stock is many times higher than that of the SPX and that if we weight the return of the stock by its risk, the abnormal return of 53.36% (66.12% - 12.76%) was not worth the bellyache of investors.

Seeking Alpha data, author's notes

Based on the combination of the above arguments, I believe that SA Quant had a little glitch in its assessment of Li Auto stock this time, which is quite normal for any automated system. We - living humans - are responsible for keeping a close eye on such things and doing due diligence through our own "manual work" before making an investment decision.

One of the most obvious reasons for the rise of LI's stock in recent months has been the positive news about record deliveries. At the very beginning of July, LI reported impressive delivery figures: 32,575 vehicles were delivered in June 2023 (up 150.1% YoY). Q2 closed with 86,533 deliveries (up 201.6% YoY), exceeding the company's guidance. In 1H FY2023, Li Auto delivered 139,117 vehicles, surpassing the full-year 2022 deliveries. The company is targeting continuous growth, aiming for monthly deliveries of more than 10,000 for the Li L8 and Li L9 models and 15,000 for the Li L7 model in the 3rd quarter, Seeking Alpha News reported.

This is certainly good news, but the question is how justified the valuation of the company looks today. In my opinion, Li Auto has a limited upside to its possible operational capacity when it comes to what the market expects from it now.

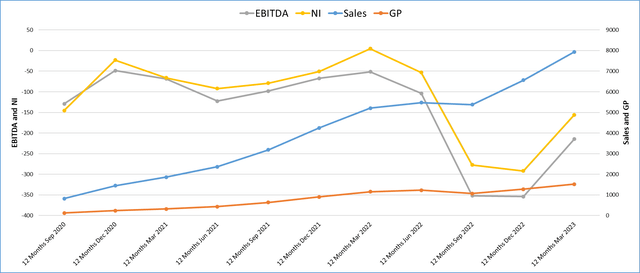

I have to commend LI - their break-even is indeed approaching rather quickly:

Seeking Alpha data, author's work

But further, the market seems to be overly optimistic given the macro complexity in China, increased competition among EV automakers, and a likely drop in demand for cars and consumer discretionary stuff in the coming months in China (I wrote about this in more detail in my Tesla (TSLA) article - here's the link).

Seeking Alpha data, author's work

The technical picture also looks very worrying - literally 7-10% higher, and investors are waiting for a strong resistance level, which saw LI falling like a stone previously:

From conversations with professional managers, I increasingly hear the opinion that the shares of fast-growing companies have risen too quickly in the past year:

The historical average annual return of the NASDAQ-100 index is 17%. So the 78% annual return for the first half of the year exceeds the average return by a factor of 4.6. Simply put, this indicates that it is time for this index to cool off. Cooling down usually occurs due to several factors. First, many investors have a desire to lock in their short-term gains. Second, those investors who have not participated in this growth would be more comfortable waiting for a correction before entering this asset. Therefore, after such strong and rapid growth, the most likely outcome is either volatile consolidation within a sideways range or some correction.

Source: From a proprietary note of a hedge fund manager, emphasis added by the author

The Verdict

Given a combination of high valuation, overly optimistic EPS expectations, and a high beta, Li Auto stock is likely to decline sharply once it reaches its "Selling Volume" which I approximated in the TrendSpider chart above.

But of course, I may be wrong in my prediction. No one knows the future, and perhaps automated systems like the Quant System from SA, which has proven itself over the long term, are right about the company's bright prospects. Or maybe the EPS forecasts are not as optimistic as I see them - in any case, the changes are down on an annual basis, and it is good for those who follow the principle of conservatism.

Author's work (SA data)![Author's work [SA data]](https://static.seekingalpha.com/uploads/2023/7/14/49513514-16893341434907556.png)

Given these risks, I still give LI stock a "Sell" rating and expect it to cool down after reaching resistance levels that seem to be just around the corner.

Thanks for reading!

Can't find the equity research you've been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!

This article was written by

The chief investment analyst in a small family office registered in Singapore, responsible for developing investment ideas in equities, setting parameters for investment portfolio allocation, and analyzing potential venture capital investments.

A generalist in nature, common sense investing approach. BS in Finance. The thesis description can be found in this article.

During the heyday of the IPO market, I developed an AI model [in the R statistical language] that returned an alpha of around 24% over the IPO market's return in 2021. Currently, I focus on medium-term investment ideas based on cycle analysis and fundamental analysis of individual companies and industries.

Get a free 7-day trial +25% off for up to 12 months on TrendSpider with the coupon code: DS25

**Disclaimer: Associated with Oakoff Investments, another Seeking Alpha Contributor

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.