Cemig: Great Business But Uncertain Future

Summary

- Brazilian power company Cemig has seen a significant recovery since 2019, with operational expenses and losses now within regulatory limits, and future investment plans focusing on its distribution segment.

- Cemig's financial results show positive growth, with a recurring EBITDA of R$ 2.1 billion, an 8% increase compared to the previous year, and a profit of over R$ 1.3 billion.

- The potential privatization of Cemig is under discussion, but the process is complex and unpredictable, making it an uncertain factor for investors to consider.

- If privatized, Cemig will have the advantage of fully renewing concessions that are extremely important to the company's cash generation.

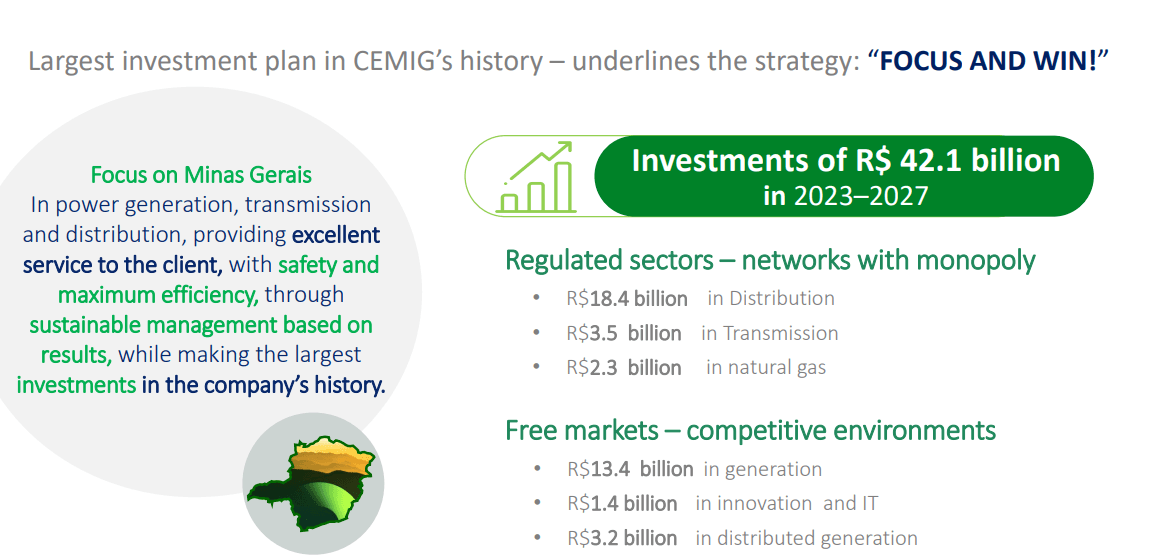

- Cemig has a total portfolio of investments amounting to R$ 42.1 billion for the period of 2023-2027, which might translate into increased returns for investors who stick to the shares.

pidjoe

Investment Thesis

Companhia Energética de Minas Gerais (NYSE:CIG), or simply Cemig, has experienced a remarkable recovery since 2019, achieving a suitable leverage level, bringing operational expenses and loss levels within regulatory limits, and demonstrating efficiency gains. Considering the uncertain scenario for privatization and the company's investment plans, my approach is for investors to hold onto Cemig stocks for the time being and closely monitor its performance.

Moreover, the company shifted investments towards the distribution segment, resulting in higher capital expenditures compared to the previous cycle. These initiatives have led to positive outcomes and strengthened Cemig's financial position.

A potential privatization of Cemig is under discussion, but the process is more complex compared to other similar cases, like Companhia Paranaense de Energia's (ELP). While a privatization could be beneficial for Cemig's investment program and strategy, I wouldn’t rely on it as the sole purpose to buy or keep the company’s shares, since the whole process is proving to be quite unpredictable.

Looking ahead, Cemig is expected to continue focusing its investments on the distribution division, with a planned annual investment of approximately R$ 3.7 billion during the 2023-2027 cycle. Furthermore, Cemig holds a portfolio of generation projects with a potential capacity of over 11.2 GW, which could be realized in the coming years.

A brief description of Cemig

Companhia Energética de Minas Gerais is a Brazilian electric power company founded in 1952 and headquartered in Belo Horizonte, Minas Gerais. It is one of the largest power companies in Brazil and operates in the generation, transmission, and distribution of electricity.

Generation: Cemig's generation portfolio (Cemig GT) includes a mix of hydroelectric, thermal, and wind power plants. They have a substantial number of hydroelectric plants, which benefit from Brazil's abundant water resources. Cemig also has thermal power plants that use various fuels such as natural gas, coal, and oil. Additionally, they have been investing in renewable energy sources, including wind and solar power (Cemig SIM).

Transmission: Cemig owns and operates an extensive network of transmission lines (Cemig GT), which are responsible for transporting electricity from power plants to distribution networks. These transmission lines play a crucial role in ensuring a reliable and stable supply of electricity across different regions.

Distribution: Cemig's distribution segment (Cemig D) involves the delivery of electricity to end consumers. The company operates a vast distribution network that covers a significant portion of Minas Gerais and serves millions of customers, including residential, commercial, and industrial users.

International Operations: Cemig has expanded its operations beyond Brazil and has investments in other countries. They have participated in power projects in countries such as Chile, Colombia, and Brazil's neighboring countries.

Sustainability Initiatives: Cemig is committed to sustainability and has implemented various initiatives to reduce its environmental impact. They aim to increase the share of renewable energy in their generation portfolio, promote energy efficiency, and engage in responsible practices in their operations.

Cemig is a publicly traded company listed on the São Paulo Stock Exchange (Ibovespa: CMIG3) and the New York Stock Exchange (CIG). As I write this article, Cemig has a market cap of $6.90 billion, an annual revenue (TTM) of $6.9 billion, $796 million in net income (TTM), and a 5-year average dividend yield of 2.80%.

A quick snapshot of the latest results

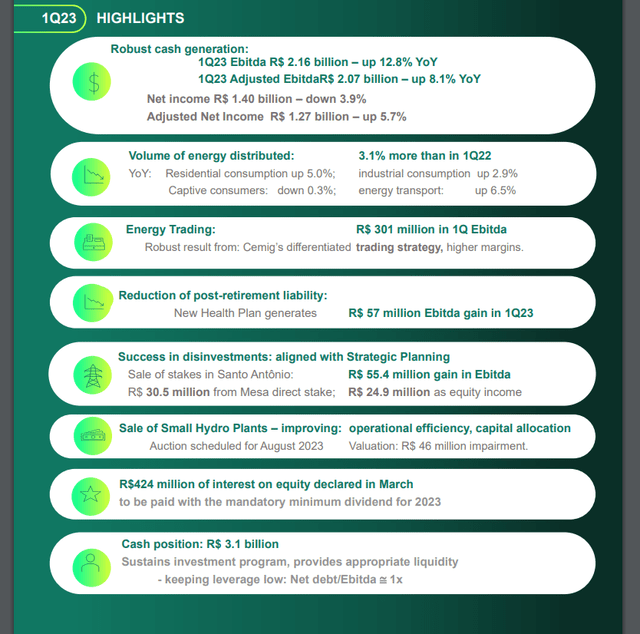

Cemig achieved good financial results in the first quarter, with a recurring EBITDA of R$ 2.1 billion, an 8% increase compared to the previous year. According to the earnings call, the company expressed optimism about the results for the rest of 2023. Due to Cemig’s vast business diversification, especially in the areas of distribution, generation, and trading, it has managed to generate strong cash flows and positive results, with over R$ 1.3 billion in profit, a 5.7% increase compared to the previous year.

The company mentioned the divestment of minority shareholders, specifically the sale of assets such as Santo Antonio, Retiro Baixo, and Baguari. These divestments are expected to be concluded in the second or third quarters of 2023, pending necessary approvals. On the other hand, Cemig had a significant investment program, with a plan to invest R$ 5.4 billion in 2023. The company highlighted the importance of these investments, particularly in Cemig SIM and generation, which are expected to be completed in the second half of the year and generate value for shareholders.

Cemig's 1Q 2023 highlights (Investor Relations)

Concerning ESG commitment, Cemig emphasized its commitment to sustainability, operating with a 100% renewable matrix. The company is involved in relevant sustainability indexes and has a social tariff program benefiting 1.3 million families. The company mentioned the positive effects of reducing post-retirement liabilities, transferring third-party contracts, and focusing on liability management and debt renegotiation. It also highlighted the growth in Cemig D's energy market and efforts to reduce losses and delinquency rates. The company reported operating efficiency within regulatory limits and strong cash generation.

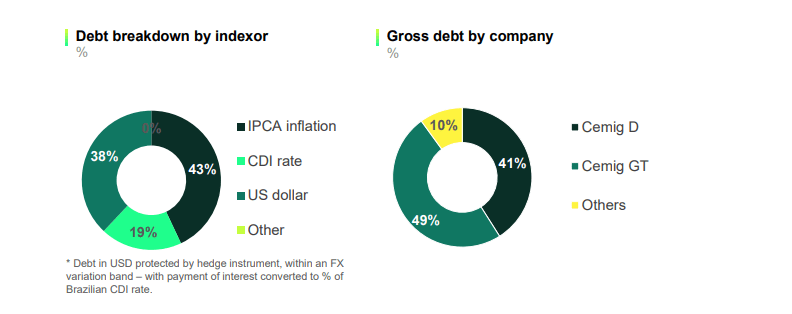

When it comes to leverage levels, Cemig discussed its debt profile and mentioned efforts to manage liabilities, particularly related to Eurobond. The company's leverage remained below 1x, supporting its investment program. In addition to that, there was a reduction in EBITDA and net profit for Cemig GT, mainly due to the migration of trading activity to Cemig H. However, when considering the displacement of EBITDA, the company highlighted an EBITDA of R$ 1.032 billion for Cemig GT in the first quarter. Overall, the earnings call highlighted positive financial results, divestments, investments, sustainability efforts, and operational achievements for Cemig.

Cemigs's debt breakdown (Investor Relations)

Cemig’s recent and relevant developments until now

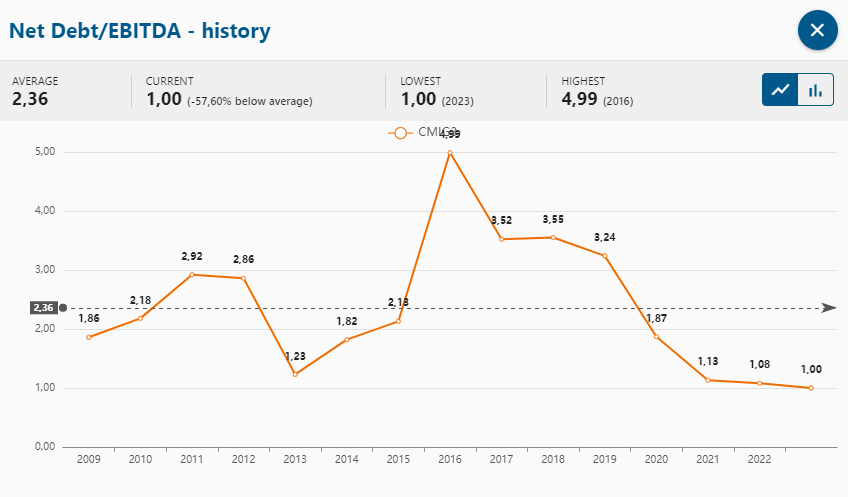

To be honest, I’m quite surprised by the speed of Cemig's recovery during the cycle that began in 2019. Since then, the company has achieved a suitable leverage level (Net Debt/EBITDA ratio dropped from 5x to 1x), as well as brought operational expenses and loss levels within their respective regulatory limits, consolidating gains with efficiency.

StatusInvest

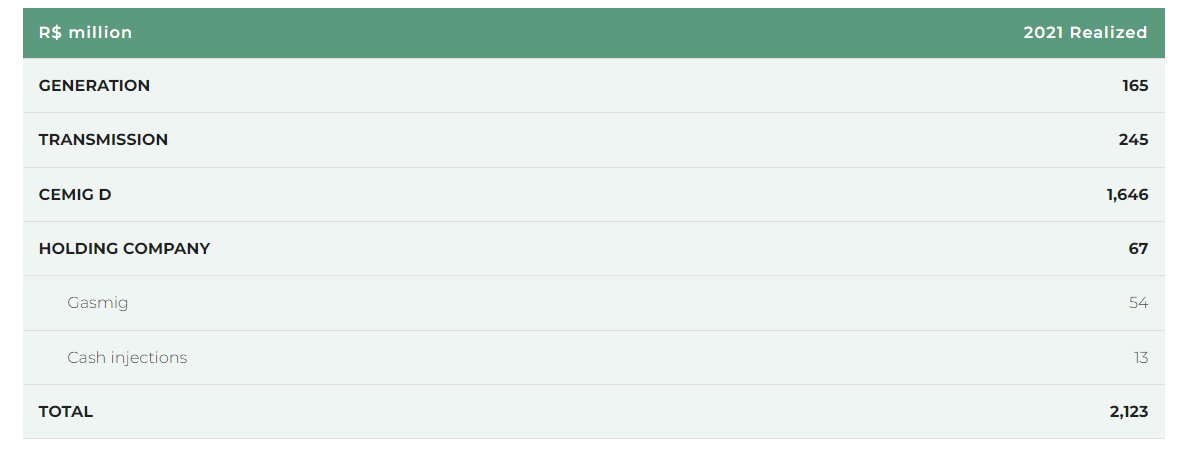

Among the initiatives that facilitated this transformation, I can highlight a greater focus on operations in Minas Gerais, reducing investments in minority holdings that the company doesn’t have proper control over the assets (a total of R$ 34 billion was invested in this manner between 2009 and 2018). Furthermore, investments started to focus on distribution (averaging R$ 2.8 billion per year between 2019 and 2022, 7 times higher than the 2009-2018 cycle). The graph below illustrates the composition of the company's Capex in 2021.

Cemig's Capex structure for 2021 (Investor Relations)

With the same focus, the company had a cash inflow of R$ 2.1 billion from sales of minority stakes and from outside Minas Gerais since 2019 (mainly from Light, Renova, Santo Antônio Energia, Ativas, and Axxiom). This avoided the need for investing R$ 1.9 billion in these businesses, in addition to an accumulation of R$ 1.1 billion in tax credits.

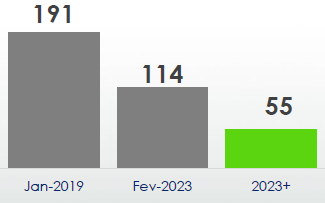

Cemig’s stake in companies after divestments (number of companies) (Investor Relations)

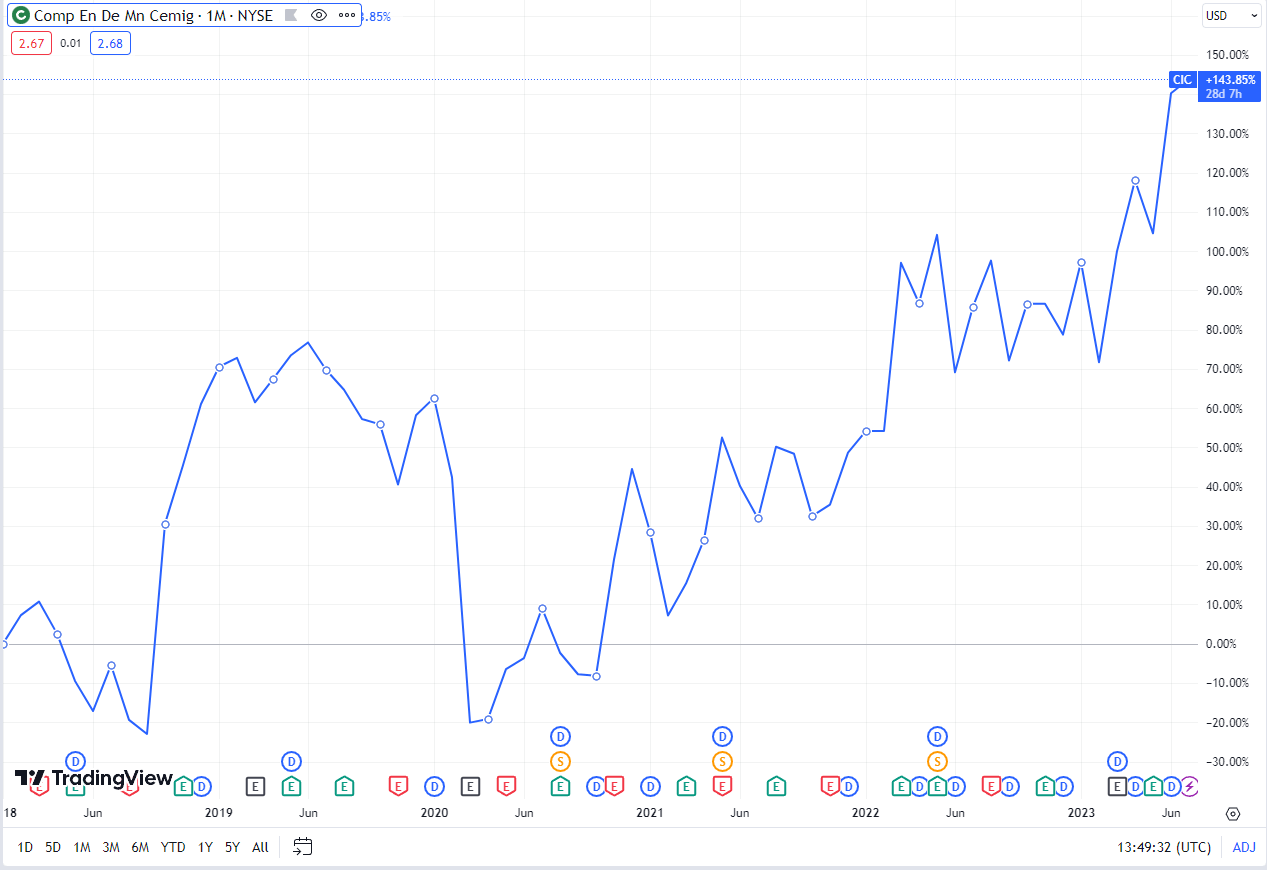

The result achieved by the shareholder was a total return (considering appreciation and dividends) of 253% in BRL and 143% in USD between 2018 and 2022. It is worth noting that, in the long run, returns tend to be in line with positive transformations in companies, especially when they become so evident through the evolution of results and risk mitigation.

Cemig's total return since 2018 (TradingView)

Potential privatization is under discussion

In Minas Gerais, the privatization of state-controlled assets needs to go through a referendum. In order to change this requirement, which would greatly complicate the process, the government needs the approval of a relevant two-thirds majority of state deputies (48 out of 77).

The situation, despite the government's good intentions and management at the moment, is much more complex than that of Copel’s in Paraná, where there is no requirement for a referendum. In Copel’s scenario, a broad government base ensured the comfortable approval of the bill that was voted on, which strengthened the case for probable privatization to ensure the full renewal of important power plants. This situation is quite similar to Cemig’s, who is also experiencing expiring contracts. The problem is that Cemig is facing more obstacles in the process, so it might not be able to heap the benefits in time.

Having said that, a privatization would be very positive for the consolidation of Cemig's current investment program and strategy (will talk about it in the next section). Nevertheless, the company is still surrounded by a high degree of unpredictability that I do not advise investors gambling on, so it’s best if we stick to issues that we can analyze with more precision.

What we can expect from the company in the near future

I have a strong belief that the company will continue to focus its investments on the distribution division, since it has a planned annual investment of approximately R$ 3.7 billion in this segment alone during the 2023-2027 cycle. Investments in the range of R$ 1.2 billion have already been contracted for generation and transmission departments, where the company wishes to invest an average of R$ 3.3 billion and R$ 700 million per year within the cycle, respectively. This includes R$ 900 million for the construction of 170 MWp of solar power and R$ 308 million for transmission reinforcement and improvement works, which will incrementally increase the Receita Anual Permitida (RAP, or Annual Allowed Revenue).

According to the Cemig's capital expenditure section on its official website, the total portfolio of investments amounts to R$ 42.1 billion for the period of 2023-2027. In my opinion, this is quite doable and realistic, considering that the company generates a relatively high EBITDA, which will be enough to fund these expansions while maintaining a healthy leverage level. To give you a reference, let's run a quick calculation:

The company's EBITDA for the year 2022 was R$ 6.9 billion, so if we estimate a conservative increase of 15% per year, the results would sum up to a figure of around R$ 44.4 billion by 2027, which is higher than the investment plan. It's important to note that this total does not account for the current cash balance. All in all, the investment plan looks sound and I believe it's going to generate great returns to the shareholders.

| 2023 | 2024 | 2025 | 2026 | 2027 | |

| EBITDA (R$) | 7.93B | 9.12B | 10.49B | 12.06B | 13.87B |

Cemig's investment plan (Investor Relations)

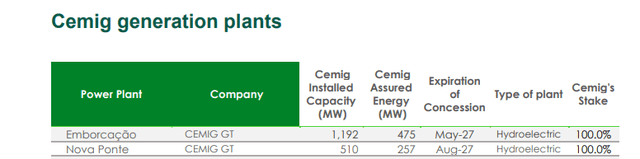

The company is still expected to compete for approximately R$ 50 billion in transmission investments to be auctioned between 2023 and 2024. Additionally, it holds a portfolio of over 11.2 GW in generation projects that may be achieved in the coming years. I don’t have to mention that this pipeline is quite important, as Cemig has around 31% of its installed capacity (1.7 GW) expiring due to concession contracts that end in 2027 (Emborcação and Nova Ponte power plants).

If privatized, Cemig will have the advantage of fully renewing the contracts upon payment of a bonus. Otherwise, it will only be able to renew the concessions upon accepting to sell assets, handing over approximately half of the capacity and also paying proportional fees.

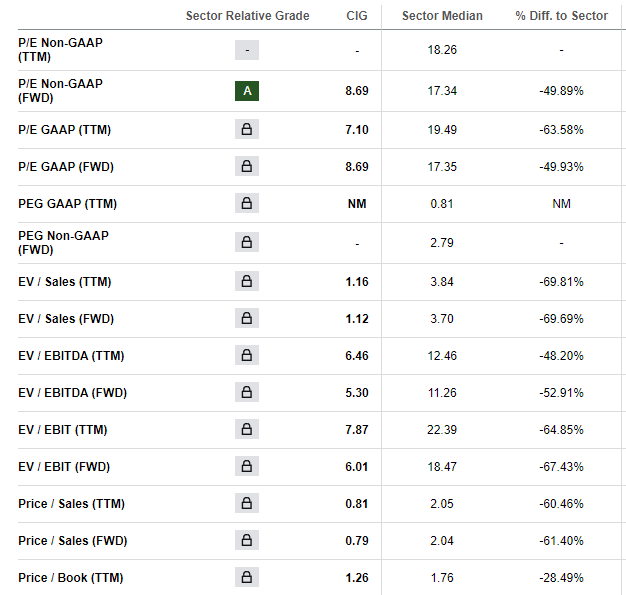

Low price multiples and a look on past returns

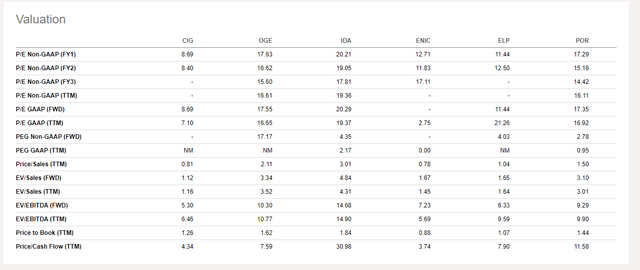

In addition to the company's and my forecasts in the previous section, it's also important to point out that Cemig is currently "cheaper" than its peers when using price multiples comparison. As we can see from the table below (first image), there is not one single price metric that is above the sector median, showing that Cemig might be indeed the underpriced choice for now. Another interesting fact is that this price difference is definitely not a mild one, with most of them being -60% lower than the sector's average, indicating a solid margin of safety for the company.

Cemig's price multiples against peers in the sector (Seeking Alpha)

The sector median we are talking about here is the Utilities sector, so this comparison is including companies like OGE Energy Corp. (OGE), IDACORP, Inc. (IDA), Enel Chile S.A. (ENIC), Companhia Paranaense de Energia (ELP), Portland General Electric Company (POR) and others. Below is a table comparing Cemig's key price multiples against the peers I've just mentioned.

Cemig's price multiples against peers in the sector (Seeking Alpha)

Regarding the company's returns for the past 5 years, we can see that they were quite generous to shareholders, amounting to a total of +95.11%. Running a quick CAGR calculation, this figure implies a annual return rate of +14.30%, not a bagger but also far from a modest one. I believe the next years will also reward holders that have the patience to stick to the share as the company implements its investment plan. When it comes to energy companies, especially in Brazil, we have to understand that things go slower than with companies in other sectors, that's why you rarely find a bagger or explosive returns in short timeframes. "Slow but steady" is the motto here.

Cemig's total returns over the past 5 years (Seeking Alpha)

Potential risks

Although I believe Cemig is a great hold case for now, investors should be aware that there are potential risks involved as you stick to the shares. In my view, two are of utmost relevancy and should be made aware of so investors know what they are dealing with.

The first one is related to Cemig's partial installed capacity of 31% (1,702 MW) which is relying on concession contracts expiring in 2027. So, we can't deny that this figure is quite important to the company's revenue generation, and to know that it's relying on concession renewals is definitely an aspect to pay attention to. When it comes to concessions, nothing is certain, and we'll have to just sit, wait, and hope for good news concerning this topic.

Emborcação and Nova Ponte power plants (Investor Relations)

The other major risk I'd like to point out is inherent to Cemig's profile. As a state-owned company, we know that sometimes the government's interests are not always aligned with the shareholders', and some might consider the current populist 4-year mandate of President Lula a red flag. As a native Brazilian myself, I know that Brazil does not have a great history when it comes to business interference. So, owning a state-owned company like Cemig is knowing that you are exposed to the State of Minas Gerais using the company's resources for whatever it deems fit, which might not necessarily be beneficial to the shareholder.

This government-related risk is also directly connected to the sector's risk. The utility sector in Brazil, especially the energy one, is heavily regulated and overseen by the government, posing great business limitations to the companies that operate in this industry. In addition to that, energy tariff variations are always unpredictable, and since the company's revenues rely on that, we can expect at least mild volatility in this business segment.

In summary, investors should take the risks mentioned above with caution and understand that they might affect the forecast presented in this thesis, but even so, I am on the optimistic side and I believe Cemig now has more ups than downs, thus a hold case for it but not optimistic enough for a buy.

Conclusion

Undoubtedly, the recent history is surprising not only due to the capabilities of Cemig's current management, but also because we can see the soundness of the electric companies' business models. On several occasions, major companies in the sector have gone through periods of value destruction that, if had occurred in other industries, would certainly result in permanent capital loss. But, they managed to undergo agile restructuring when the interests of managers and shareholders were aligned.

Cemig's planning for the 2023-2027 cycle is very sound, considering the challenges that it faces. The company can expand with greater predictability by investing in its distribution network to reap the benefits of tariff revisions in the future, instead of focusing on transmission auctions that may continue to offer unattractive returns due to high levels of competition.

It's important to point out that Cemig faces significant risks related to its concession contracts expiring in 2027, which make up a substantial portion of its current installed capacity. The uncertainty surrounding the renewal of these concessions is a key aspect to monitor. Additionally, being a state-owned company exposes shareholders to the potential interference and conflicting interests of the government, particularly in light of the current political climate. The heavily regulated nature of the Brazilian utility sector and the unpredictability of energy tariffs also contribute to potential revenue volatility.

Considering all factors, especially the uncertain scenario for privatization, I believe that the best option at the moment is to hold onto the stock for a while longer and watch it closely.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.