Annexon: Mixed Results, Overly Strong Market Reaction

Summary

- ANNX produced mixed results from its GA program.

- While the primary endpoint was not met, an important functional endpoint saw success.

- However, the market reaction was drastic, and perhaps too drastic.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

Maglara

I covered Annexon (NASDAQ:ANNX) in mid-April and I liked it for its lead candidate ANX005 targeting Guillain-Barré Syndrome (GBS), however, the stock got crushed because a secondary candidate called ANX007 failed a phase 2 trial for geographic atrophy. Is this a buying opportunity, or a signal to run for cover?

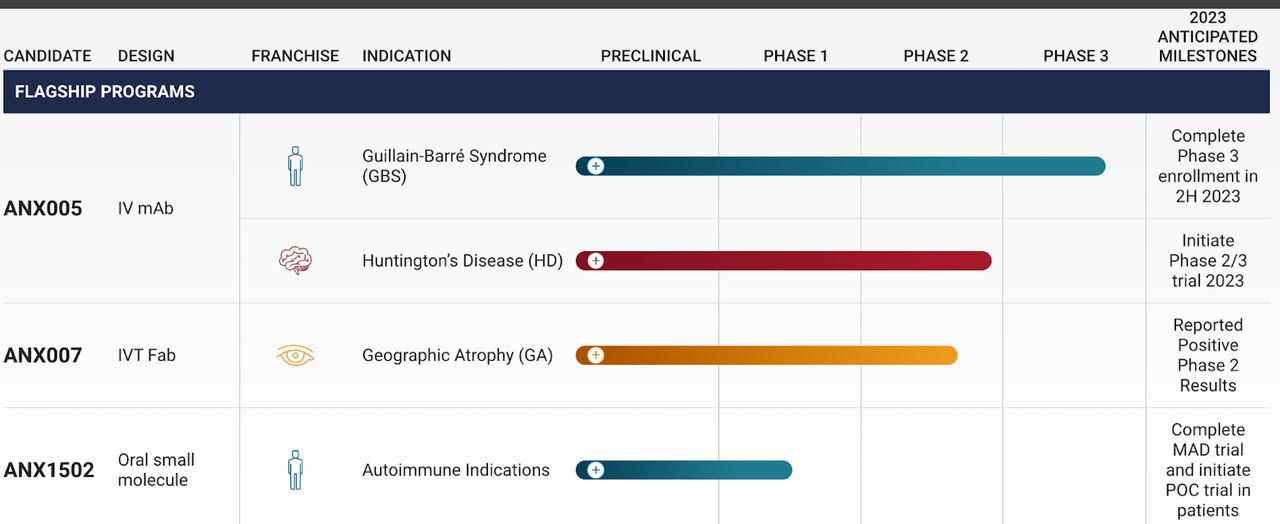

First, this is the pipeline of this microcap company:

ANNX pipeline (ANNX website) ANNX pipeline (ANNX website)

Lead candidate is ANX005, which has a phase 3 pivotal trial in GBD and a second phase 2 trial in Huntington's Disease. ANX007 is the second candidate, and this one has a phase 2 trial in GA, which, despite what they claim as a positive trial, failed to achieve its primary endpoint, mean rate of change (slope) in GA lesion area compared to placebo at 12 months, which did not achieve statistical significance. Key data from this trial:

A 6.2% reduction in lesion growth was observed in the monthly treatment group while a 1.3% reduction was seen in those given the medicine every other month.

Annexon noted that patients dosed monthly showed a 72% reduction in risk of 15-letter loss, while patients in the every-other-month group demonstrated a 48% reduction.

The molecule was also the first complement-mediated drug that was able to preserve visual acuity, and provided "statistically significant protection against vision loss in both foveal and non-foveal patients through 12 months."

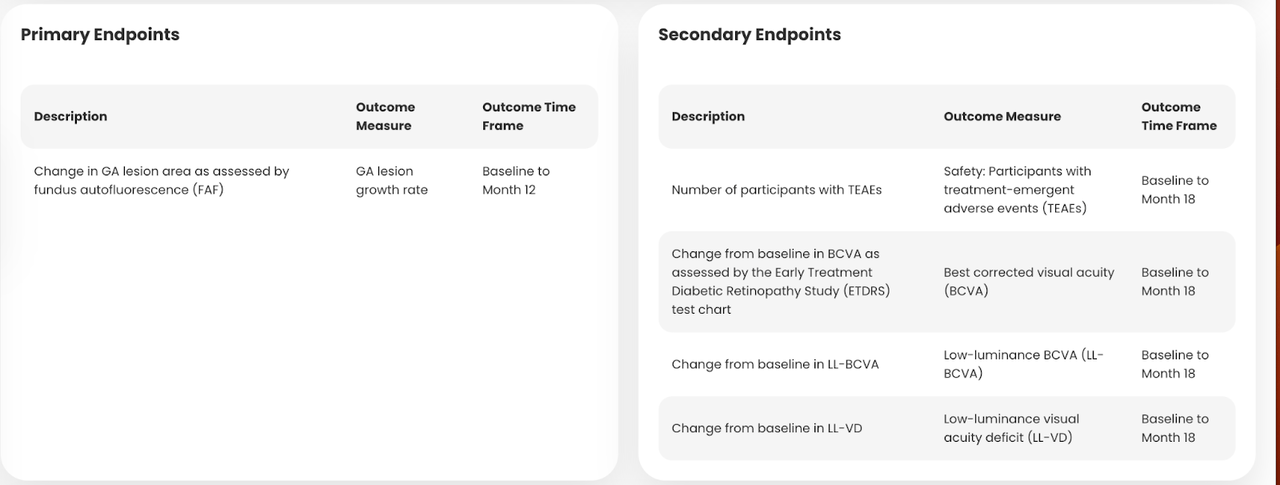

Below is the list of endpoints of this trial, as seen on TickerBay:

Trial endpoints (Tickerbay.com)

While GA lesion is a key endpoint, BCVA is also a key functional endpoint which can also be an independent measure of a GA trial, and here, ANX007 did well. Therefore, as Jeffrey S. Heier, M.D., Director of the Retina Service and Retina Research, Ophthalmic Consultants of Boston, and an investigator in ARCHER, said:

The ultimate goal for any physician is to preserve vision for our patients for as long as possible. The totality of the data on ANX007 from the ARCHER trial is promising, with the demonstrated preservation of functional vision in GA patients, regardless of their lesion location or size. I am encouraged with the overall profile of ANX007 and look forward to its continued development.

Here's what Evaluate says on this question:

Annexon claimed significance for these versus sham and quoted p values - but since this was a secondary endpoint in a study that missed its primary goal, these are statistically meaningless.

This finding also raises the question of how the antibody protected against vision deteriorating when it had no effect on the lesions that cause that deterioration.

I have, frankly, not encountered this new definition of the phrase "statistically meaningless" before, that if a trial that misses a primary endpoint shows benefit in a secondary one, that this latter is "meaningless." Need I remind my reader that there are major drugs that have been approved based on such "statistically meaningless" secondary endpoints - besides the dubitable approval of aduhelm, we also have Sanofi's NEXVIAZYME, approved for AT-GAA on FVC despite failing the primary endpoint of 6MWT, and Bayer's Larotrectinib (marketed as VITRAKVI), which failed the primary ORR endpoint but was approved based on a secondary endpoint of DOR. I can provide many more examples but will rest my case with a final one, this one from Novartis, Siponimod (marketed as MAYZENT), which failed the primary endpoint of 3-month CDP, but was approved based on success with a secondary endpoint of time to 6-month CDP. Let's also not forget that the only approved drug in GA, Apellis Pharmaceuticals' SYFOVRE, also does not have an exemplary record in lesion reduction, but has done well with reduction of vision loss.

As to the second issue raised by Evaluate, firstly, it is disingenuous to claim that the antibody had no effect on GA lesions. It did, and the effect size was numerically superior, although not statistically significant. That is the first issue. The second is that I can think of myriad ways this could have happened, the lack of stat sig in GA lesions despite numerically superior effect, coupled with stat sig in the functional BCVA endpoint. One way to look at this would be to hypothesize that the small effect on GA lesions translates to a much larger effect on BCVA, which brings out the difference between drug and placebo. It is like two packs of cards, and you hit each with a nudge, the difference in the powers of which are minimal, but there is a difference, which is then demonstrated by one pack of cards merely crumbling, while the other is blown all over your desk - a cascading effect from a small difference, if you want to be technical.

Another way to look at it would be to say, as the company did, that ANX007 targets an upstream effect, which does well with vision loss, but fails to improve lesion growth, which "is often targeted by clearing out debris in the cells behind the photoreceptors."

To sum it up, yes the failure in the primary endpoint has hurt the stock, and rightly so, but perhaps the quantum of punishment was too large. This is not the lead program as well.

The lead drug is ANX005, and here, too, the company presented confusing data earlier, in the second indication, Huntington's Disease. Here, too, there was some clinical improvement, but there was an issue with the increase in Nfl. In the lead program, where they have this phase 3 pivotal running, they have phase 1 data, which I discussed earlier. This data was early, more focused on safety and biomarkers, but it also showed early signs of GBS measures improvement.

Financials

ANNX has a market cap of $200mn and a cash balance of $228mn. R&D expenses were $32mn and G&A expenses were $8.9 million. At that rate, they have a cash runway of 4-5 quarters.

Risks

The trial failure(s), while containing mitigating circumstances I discuss, are still failures, and therefore a perpetual risk until ANNX can produce better data.

The company has a poor perception in the market, as evinced by their low enterprise value, and the fact that they are trading below cash.

Bottom Line

I find something wrong with the market reaction to this data. There are worse failures in our sector with better market reactions. The trial(s) had, in the worst case, mixed results, and the lead trial does not have too many surprises yet. They also have a good deal of cash. I think I will keep this one under observation for taking a small pilot position.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Important: My Hold rating only means "I will not Buy now." I am not telling *you* to hold, because I see some risks here. But I am also not telling you to *sell*, because, a) the risks are not insurmountable, and b) you may have bought at such a low price that your risk-benefit ratio is acceptable to you. Thus, my “Hold” is a bearish rating, but it is not as bearish as a “Sell” rating.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.