O'Reilly Automotive: Margin And Inventory Concerns

Summary

- O'Reilly Automotive, a leading provider of auto parts, tools and accessories, has seen a decrease in gross, operating and net margins, despite impressive growth and significant stock buyback programs.

- The company's inventory has risen to $4.5 billion, a billion more than 2020, and its Free Cash Flow has been stagnating since Q4 2020.

- Despite these concerns, O'Reilly's stock is currently overvalued with a P/E ratio of over 27, well above its historical multiple of 20.

- All this leads to an unfavorable risk-reward ratio. Accordingly, I rate the stock only with a "hold".

mladenbalinovac/E+ via Getty Images

O'Reilly Automotive (NASDAQ:ORLY) has an outstanding growth engine. The company is one of the largest suppliers of automotive spare parts, tools, and accessories. Its customers include both professional and private customers. ORLY generates almost half of its $14.4 billion turnover with its own brands. In addition to impressive growth figures, the company shines with massive share buyback programs. For example, the number of outstanding shares fell from 142 million in 2010 to 62.4 million most recently. In 1Q 2023 alone, the company bought 1.4 million shares worth over $1 billion. ORLY is thus a shareholder's dream. Sure, ORLY is always an expensively valued company with earnings multiples of 20 and higher, but the company's success likely backs this up.

At the moment, however, the company has reached a point where even a benevolent view would show an unfavorable risk/reward ratio for buying the shares.

Margin is decreasing

First of all, the gross margin in 2022 has decreased from 50.27 percent in 2021 to 48.84 percent. The negative trend has continued in 1Q 2023 with a margin of 51 percent, a decline of 84 basis points compared to 1Q 2022.

At least management had already predicted this development. And on closer inspection, one reason was that the business with professional customers performed better than expected and generated proportionately higher revenues. Given that ORLY's professional business is traditionally the lower-margin part of ORLY's overall business, the negative impact on the margin is understandable. However, the negative development could continue in Q2, as the professional business is growing faster than the business with private customers. In addition, the management assumes that inflation will continue to put pressure on supply chain partners and that the costs in the supply chains will, therefore, not decrease:

While we are pleased with our results so far this year we remain cautious regarding the cost outlook for the remainder of 2023, including the prospect for incremental reductions to acquisition costs. Our supply chain partners continue to face anticipated broad inflationary pressures, and we expect to see a relatively stable cost environment with potential for puts and takes in both directions.

Overall, ORLY expects to achieve a gross margin for FY 2023 of 50.8 percent. This would mean that the company would have achieved the turnaround and would even be higher than the gross margin of 50.27 from 2021.

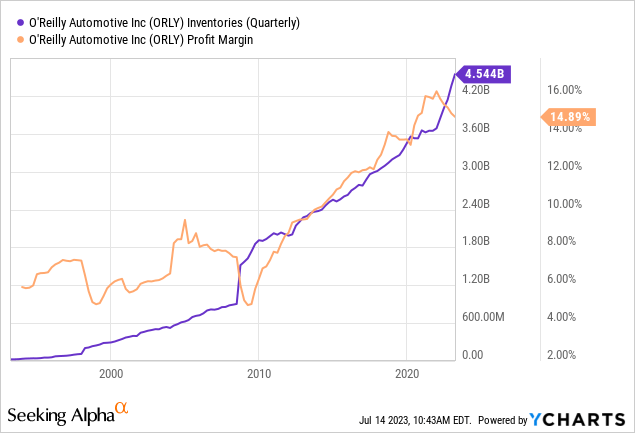

Likewise, the operating margin and net margin have declined over the past years. In the year 2021, the operating margin was 21.98 percent and the net margin 16.24 percent. In 2022, these came down to 20.56 percent and 15.08 percent respectively, and in Q1 2023, we saw an operating margin and net margin of 20.25 percent and 14.89 percent. Compared to 2021, this is a decline of more than one percentage point. However, this development had less impact on earnings per share due to the simultaneous strong increase in sales. EPS rose from $31.10 in 2021 to $33.44. In 1Q 2023, EPS rose again from $7.24 to $8.36, corresponding to a growth of 15 percent.

Nevertheless, the negative development is not to be welcomed in my view and investors should keep an eye on whether ORLY manages to increase margins again in the coming quarters.

Inventory is high

Another reason that worries me a bit is inventory. Many companies have accumulated huge amounts of inventory in the 2020/2021 boom that is now sitting in their warehouses and shops. This causes massive storage and administration costs that squeeze margins. In addition, companies often have to offer discounts to empty their own warehouses. A sad example of this is Stanley Black & Decker (SWK). But is ORLY also such a dramatic case?

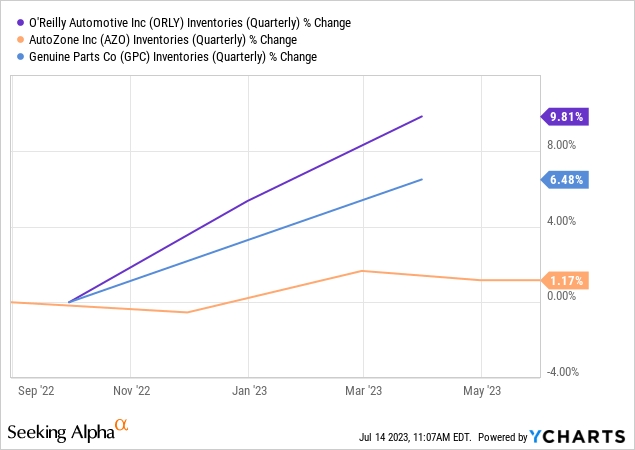

Well, ORLY currently has $4.5 billion in inventory. That is $1 billion over 2020, which means that ORLY's inventory has grown faster than AutoZone (AZO) or Genuine Parts (GPC) in the past 12 months.

An increased inventory is not always bad. In the case of high demand, it is even good to have full stocks. Likewise, an increased inventory can be explained by the fact that there are simply more shops. ORLY grows by opening new shops. For example, ORLY opened 60 new shops in 1Q 2023. This brings the company to more than 6000 shops. However, the inventory per store was $754,000 in 1Q 2023, which was a 14 percent increase from Q1 2022. Actually, ORLY wants to increase the inventory by only 2 percent in 2023 which is far less than the current increase. This is another point investors should keep in mind. Thus, in the strong build-up of inventory, the profit margin could fall even further as it last did in the late 1990s and in the wake of the Great Recession of 2008/2009.

FCF is decreasing

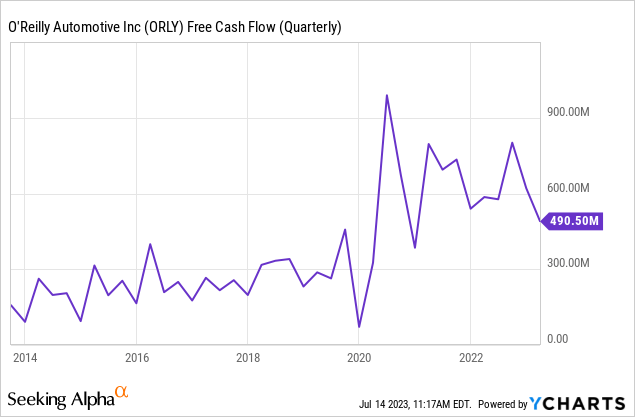

I am also negative about the development of the FCF. On a multi-year basis, FCF has stagnated around $2.5 billion per year since Q4 2020. In Q1, FCF was $486 million, more than 90 million below Q1 2022.

I also don't like ORLY's way of approaching the adjusted debt-to-EBITDA ratio of 2.5 in times of rising interest rates and falling FCF, while at the same time buying its own shares with historically high multiples.

High valuation limits upside potential

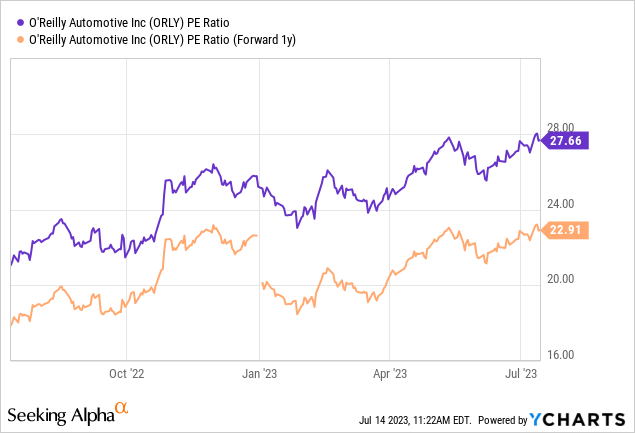

This brings me to my last point. ORLY is an expensive stock, and investors are currently paying an above-average premium. The current PE ratio of over 27 is far above the historical multiple of 20. Even with a forward PE ratio of almost 23, the ORLY share is still overvalued.

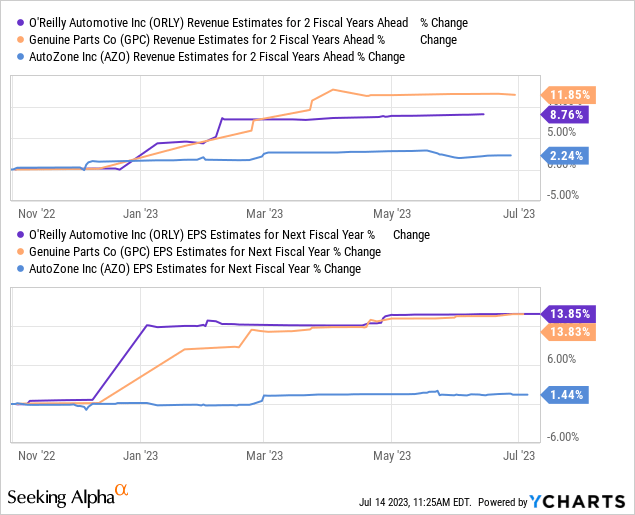

The peer group is also valued more cheaply. Genuine Parts, for example, has a PE ratio of only 19. AutoZone has a multiple of 20.3. The question is whether ORLY really deserves this premium. If we look at the growth prospects, it is not as if ORLY is running away from the competition. For example, analysts expect revenue growth for the next two years at ORLY to be just under 8 percent. Even ORLY expects revenue growth of only 4 percent to 6 percent in FY 2023.

Conclusion

In my view, the risk/reward ratio of ORLY does not justify an investment at the moment. At the current valuation level, I would like to see an improvement in margins and inventory. Furthermore, the slowing growth momentum is in my view a warning sign and risk for a downside. Accordingly, I rate the stock only with a "hold".

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.