Adapting To Change: Lamar Advertising's Growth Potential In The Digital Era

Summary

- Lamar Advertising has a strong track record of revenue and free cash flow growth, with an average ROE of 26.51% over the past 10 years, significantly higher than the sector median.

- Despite increasing competition from digital advertising, Lamar is investing in digital advertising technologies and expanding its digital billboard network to adapt to the changing landscape.

- Based on a discounted cash flow analysis, Lamar is currently undervalued, offering a potential gain of 25.5% compared to its current market price, making it an attractive investment option.

mura/E+ via Getty Images

Intro

Lamar Advertising (NASDAQ:LAMR), founded in 1902, is a prominent outdoor advertising company operating across North America. With an extensive network of over 350,000 displays in the United States and Canada, Lamar provides a wide range of advertising formats, including billboards, interstate logos, transit, and airport advertising. Notably, the company boasts the largest digital billboard network in the United States, comprising approximately 3,800 displays, offering advertisers enhanced visibility and flexibility.

The objective of this article is to provide a thorough examination of LAMR's financial performance and growth potential. We will explore the company's revenue patterns, profitability measures, and its capacity to generate free cash flow. Furthermore, we will assess LAMR's strategic position and future prospects. By analyzing these critical factors, investors can acquire valuable insights into the company's possibilities and assess its appeal as an investment opportunity in the present market conditions.

Track Record

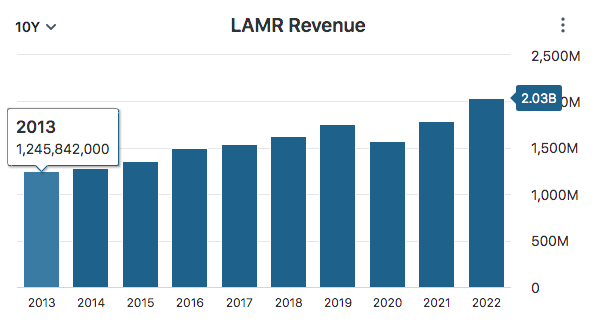

Value investors look for companies that are trading for less than their intrinsic value. Intrinsic value is the value of a company based on its underlying assets, cash flow, and earnings potential. One way to estimate intrinsic value is to look at a company's financial track record over an extended period of time. This gives investors a sense of the company's profitability, growth potential, and financial strength. Over the years LAMR has established a strong track record of financial performance, let's take a look beginning with the company's revenue growth over the last decade. Below is a chart of LAMR's full year revenue over the past decade.

Data by Stock Analysis

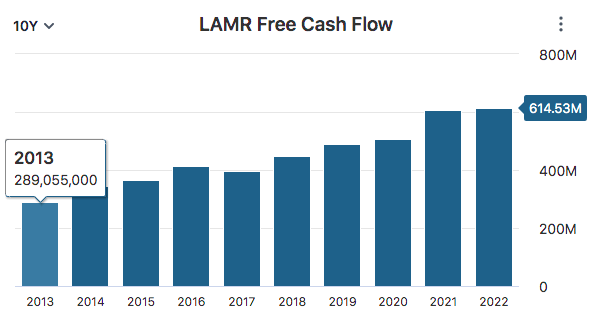

Revenue and Free Cash Flow Growth: Lamar Advertising has a strong track record of revenue and free cash flow growth. Revenue has grown by 5.01% compounded annually over the past 10 years, and free cash flow has grown by 7.83% compounded annually over the past 10 years. This growth is due to the company's strong position in the outdoor advertising industry, as well as its focus on acquiring new properties. Over the years LAMR has established a vast network of billboards across the United States. This gives businesses the opportunity to reach a large audience with their advertising campaigns which have powered the company's growth over the last decade. Below is a chart of LAMR's full year free cash flow over the past decade.

Data by Stock Analysis

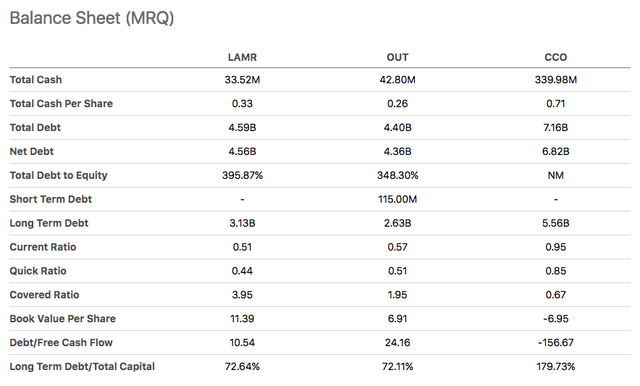

Balance Sheet: Lamar Advertising's balance sheet is not as strong as its revenue and free cash flow growth would suggest. The company has a high debt-to-equity ratio of 3.82, and its current ratio is only 0.5. This means that the company may have difficulty meeting its financial obligations if its revenue or free cash flow growth slows down.

However, it is important to give context to the industry when evaluating a company with a poor balance sheet. The outdoor advertising industry is capital-intensive, and companies in this industry typically have high debt-to-equity ratios. When comparing LAMR to its industry rivals, OUTFRONT Media Inc. (OUT) and Clear Channel Outdoor Holdings, Inc. (CCO), we see that LAMR's balance sheet is not out of the ordinary. Below is a table comparing popular balance sheet metrics from each company's most recent quarter (MRQ).

Overall, LAMR's balance sheet is not a major red flag for investors. However, it is important to keep an eye on the company's debt levels and its ability to generate free cash flow. If these metrics start to decline, then investors may need to reconsider their investment in LAMR.

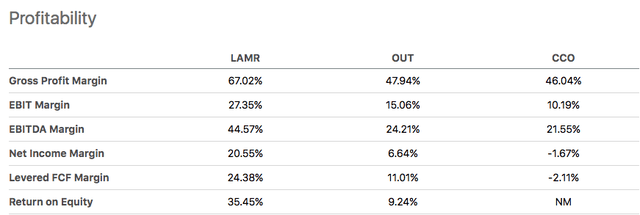

Profitability: Lamar Advertising is a profitable company, with an average ROE of 26.51% over the past 10 years. This is significantly higher than the sector median ROE of 4.62%. The company's profitability is due to its high margins and its efficient use of capital. Below is a table of LAMR, OUT, and CCO's TTM profitability metrics. As seen in the chart below LAMR scores better than its industry rivals in many profitability metrics in addition to ROE including gross profit margin, EBIT margin, EBITDA margin, net income margin, and levered free cash flow margin.

Due to its large scale, LAMR has the advantage of achieving higher profit margins compared to its competitors. As one of the largest outdoor advertising companies in the United States, LAMR maintains a vast network of over 350,000 displays. This extensive reach grants the company significant economies of scale, enabling it to operate with improved efficiency and offer cost savings to its customers.

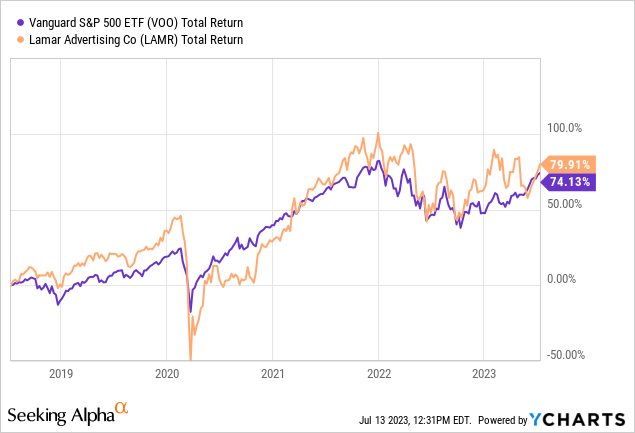

Total Return: Lamar Advertising has outperformed the S&P 500 over the past 5 years, with a total return of 79% but only by a mere 5%. The company's strong revenue and free cash flow growth, as well as its high profitability have left investors wanting bigger returns and wondering if the company can achieve these returns in the future.

2023 and Beyond

LAMR reported its 2023 Q1 earnings results on May 4, 2023. The company missed analyst expectations for earnings per share (EPS) by $0.07, but beat expectations for revenue by $5.33 million. The lower than expected earnings were driven by a notable interest expense increase of $14.7 million, reaching $41.4 million, up from $26.8 million during the same period in 2022. This marked rise can be attributed primarily to the higher interest rates.

Lamar Advertising has been struggling to beat its earnings estimates lately. Over the last 12 quarters, the company has missed revenue estimates 7 times. One of the headwinds driving this negative trend is the impact of digital advertising on LAMR's business.

Digital advertising is becoming increasingly popular, and poses a real risk to Lamar Advertising's business in the future. Digital advertising is seen as more effective than billboards due to its flexibility and reach. Billboards can only reach people who are driving or walking by, while digital ads can be seen on computers, smartphones, and other devices. This means that businesses can reach their target audience with digital ads more easily than with billboards.

In addition, digital ads can be targeted to specific demographics and interests, which makes them even more effective. For example, a business that sells shoes could target its ads to people who have recently searched for "running shoes" online. This type of targeting is not possible with billboards, which means that businesses may not be able to reach their target audience as effectively with billboards alone.

As a result of these factors, Lamar Advertising is facing increasing competition from digital advertising. This is likely to continue in the future, which could put pressure on the company's earnings. However, Lamar Advertising is taking steps to adapt to the changing landscape. The company is investing in digital advertising and other new technologies. During the first quarter alone LAMR added 71 net digital billboards bringing the quarter-end total to 4536 large-format units and the company has a full year goal of 300 digital conversions.

Another challenge and risk for the business stems from the current economic downturn. The weakened economy has contributed to LAMR's recent earnings disappointments. With businesses adopting a more cautious approach to spending, there has been a reduction in advertising budgets. As a result, LAMR's revenue has been negatively impacted, affecting its overall financial performance.

In the face of these obstacles, LAMR is actively embracing change and taking measures to navigate the evolving landscape. The company exhibits a proactive stance towards expansion by pursuing strategic acquisitions. This forward-thinking approach reflects LAMR's commitment to adapting to industry shifts and positioning itself for continued growth. Although 2023 has seen a comparatively slower pace in mergers and acquisitions (M&A) for the company, CEO Sean Reilly shared insightful comments during the company's 2023 Q1 Earnings call regarding their plans for acquisitions in the remainder of the year.

On the M&A front, the year is off to a quiet start. We closed 11 deals for about $14 million in the first quarter. We have some additional transactions in the diligence and closing stages, but continue to anticipate that this will be a modest acquisition year for us with spend in the $100 million to $150 million range.

Despite increasing competition from digital advertising and a weakening economy, it is our opinion that LAMR will continue adapting and growing at a steady rate. With strategic investments in digital advertising and a commitment to expanding their digital billboard portfolio, LAMR is positioning itself for continued success. Additionally, the company's plans for future acquisitions, as mentioned by CEO Sean Reilly, demonstrate their proactive approach to fueling growth.

Of course, Acquisitions can be risky for businesses because they can be expensive, time-consuming, and difficult to integrate and there's always a chance LAMR's digital strategy doesn't pan out, but this is why we pay attention to strong track records to see how companies have dealt with and overcame adversity in the past to prove that they have experience and skills necessary to overcome difficult times ahead. We believe LAMR's resilience and commitment to staying ahead of industry trends make them well-equipped for sustained expansion.

Valuation

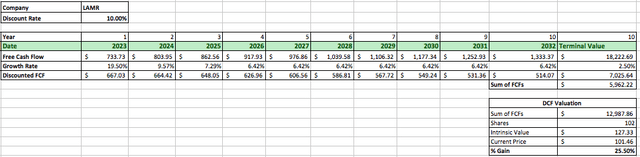

In order to determine the true worth of LAMR, we will employ the discounted cash flow (DCF) analysis, a reliable method for assessing a company's value. By calculating the present value of LAMR's projected future cash flows, we can derive its intrinsic value.

We will commence the analysis with LAMR's previous year's free cash flow of $614 million. Considering the average analyst earnings growth rate of 19.5% for 2023, followed by growth rates of 9.57% for 2024 and 7.29% for 2025, we establish LAMR's anticipated free cash flows for these years. Projecting free cash flows beyond the next three years presents challenges. Nonetheless, we will utilize a growth rate of 6.42% for the subsequent seven years, based on the average of the compounded annual revenue and free cash flow growth rates over the last decade.

To calculate the terminal value, we will apply a conservative perpetual growth rate of 2.5%. Utilizing a discount rate of 10%, which accounts for the long-term return rate of the S&P 500 with dividends reinvested, we determine LAMR's intrinsic value to be $127.33. This suggests that LAMR may currently be undervalued, potentially offering investors a potential gain of 25.5% compared to the company's current market price.

Takeaway

In conclusion, LAMR has demonstrated a strong track record of growth and profitability, making it an appealing investment opportunity. Despite facing increasing competition from digital advertising and dealing with a weakening economy, the company is taking proactive steps to adapt, investing in digital advertising technologies and expanding its digital billboard network.

Furthermore, LAMR's strategic acquisitions indicate a commitment to fueling future growth. Although the company has faced challenges in meeting earnings estimates recently, its solid financial performance, combined with its outlook for the future, suggests that LAMR has the potential for sustained expansion. The company is currently trading for a discount to intrinsic value based on a discounted cash flow analysis, investors may consider LAMR as an attractive investment option, offering a potential gain of 25.5% compared to its current market price.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.