AT&T: Waiting For The Dead Cat Bounce To Sell My Entire Stake

Summary

- AT&T has been in my retirement portfolio for many years. Accordingly, I have experienced a lot of drama as a shareholder.

- While I was bullish on the stock for a long time and published bullish articles several times, my patience has run out.

- Investors who do not expect price increases but are looking for a high-dividend investment that currently has little downside potential might be happy with AT&T.

- But I will sell my shares if they recover again. Until then, I will use the cash flow for other investments.

- It is still sad because, at the end of the day, who would have thought such a development of the former dividend aristocrat possible five to ten years ago?

RiverNorthPhotography

The AT&T (NYSE:T) share has been in my pension portfolio for many years. Accordingly, I have experienced a lot as a shareholder, be it the 5G auctions, the TimeWarner acquisition, the building of an advertising platform, or the absurd turnaround with the spinoff of Warner Bros (WBD) and the return to the traditional mobile and telecommunications business.

I was bullish on the stock for a long time and published bullish articles several times. However, my patience has run out. This has little to do with the disastrous share price performance, but with the realization that my money is simply in the wrong hands with AT&T.

Therefore, I would not recommend any investor to go on a bottom fishing tour at the moment, but rather to keep their hands off AT&T. Existing shareholders should ask themselves their original strategy. My strategy is dividend cash flow. Here I continue to take along the still secure and predictable distributions. However, if the share price recovers, I will sell the shares and invest elsewhere.

Reasons why the AT&T stock is dead

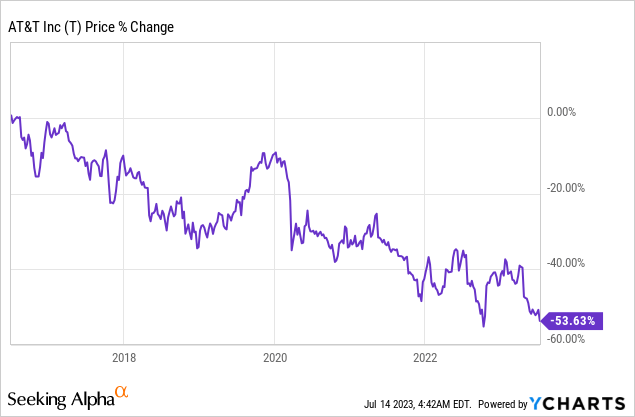

The AT&T share has lost more than 50 percent of its value since its high in 2016. The performance YTD is also at a disastrous level with minus 17 percent. Overall, the stock has continuously declined for more than five years.

There are several reasons why the share was and is so dead despite a boom cycle.

The fairy tale of the 5G Revolution

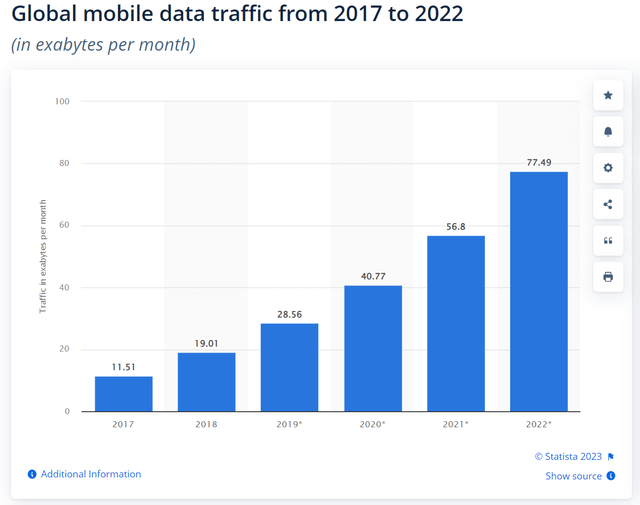

In recent years, I have also pointed to the roll-out of the new telecommunications standard, 5G. 5G will massively increase the exchange of data and, thus, the volume of data.

According to Statista, the global mobile data traffic amounted to 19.01 exabytes per month in 2018. By 2022, however, mobile data traffic was expected to reach 77.5 exabytes per month worldwide at a compound annual growth rate of 46 percent.

Global mobile data traffic (Statista)

Data traffic and data volume are also expected to increase massively in the future. According to Ericcson,

- In 2027, all mobile data traffic growth will come from 5G, as 4G traffic declines.

- The monthly global average usage per smartphone is expected to exceed 20 gb at the end of 2023.

- In 2028, 5G shares of mobile data traffic is forecast to growth to 66 percent.

Given this data, one would think that the mobile tariff providers operating in an oligopoly are in a gold rush, and the shares are rushing from one record high to the next. But far from it. The earnings multiples of AT&T and Verizon are currently 6 and 6.9, respectively, and the P/Sales ratio is 0.9 for AT&T and 1.1 for Verizon.

What is the reason for this counterintuitive historically low valuation?

AT&T is not up to the competition

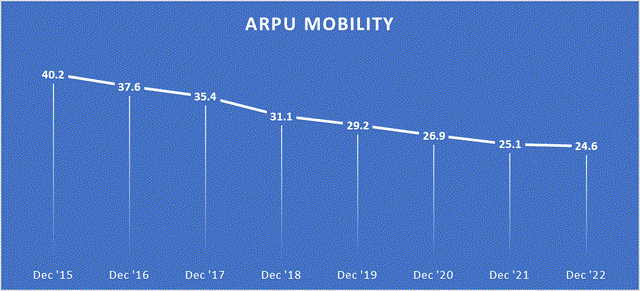

One factor I also misjudged is the enormous competition in the mobile market, the high investment costs, and, last but not least, the unwillingness of consumers to pay higher prices for their data traffic. This can easily be seen from the fact that the average revenue that AT&T generates with individual customers (ARPU) has fallen massively since 2015.

In 2015, ARPU was still $40.2, but it fell to $24.6 in the following years, almost half of what it was!

ARPU Mobility (Investor relations)

In the respective 10-K filings, as from 2021, one finds the following explanation:

Average revenue per subscriber (ARPU) decreased in 2021 and reflects the impact of higher promotional discount amortization.

AT&T, therefore, dilutes its turnover through higher discounts to gain customers. Ultimately, we are left with the realization that you cannot achieve growth with data traffic alone, even if data traffic and data volume explode. Perhaps this also explains AT&T's desperate foray into the streaming and advertising business.

And then, of course, there is the elephant in the room with Amazon (AMZN). According to media reports, the online giant plans to enter the mobile phone market. Amazon wants to offer its Prime customers particularly low-cost or even free mobile phone tariffs. Amazon is said to be in talks with the network operators AT&T, T-Mobile US, and Verizon. I don't think much of the whispering that Amazon could disrupt every possible business model. Nevertheless, such a rumor is enough to plummet the telecom companies' shares. Indeed, a brand entry by Amazon could further intensify the price war within the industry. We have seen that AT&T cannot use the increased data volume to push through higher prices. What will happen when Amazon offers even lower prices? Amazon is known for its price advances and can cushion lower margins, if necessary, by cross-subsidies from more profitable business areas. In short: AT&T is already no match for the competition. A market entry by Amazon (as unclear as it is now) would massively exacerbate this problem.

Debts and capital expenditures

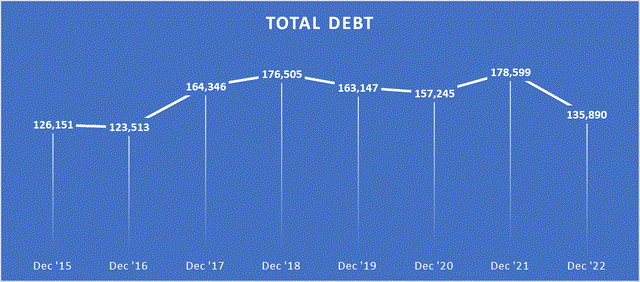

The second big problem is debt. At the end of the financial year 2022, AT&T carried $135 billion in debt. Net debt today is $3 billion higher than nine months ago.

Total Debt (Investor relations)

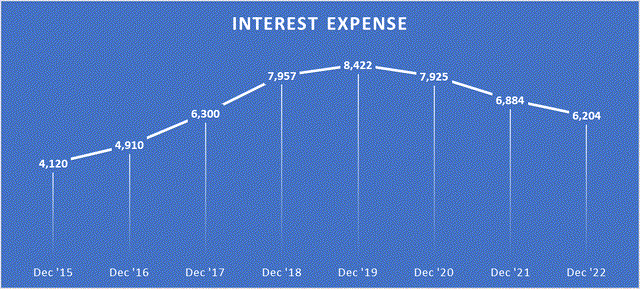

These debts have to be serviced, and interest is added. Recently, interest expenses have been falling annually. In 1Q 2023, however, they were again higher at $1.7 billion than in 1Q 2022 at $1.6 billion. We will have to see in Q2 whether this trend continues or whether the increase was just a one-off.

Total expenses on interests (Investor relations)

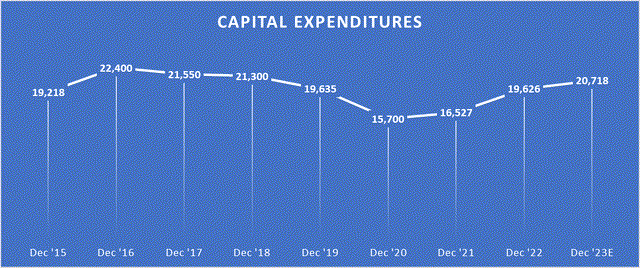

In addition, with its focus on the traditional core business, AT&T will continue to be massively dependent on capital to expand and maintain its infrastructure. Capital expenditures have risen steadily since 2020 to $19.6 billion. So I think managing debt in a rising interest rate environment and the necessary capital expenditures will remain a mammoth task in the coming quarters and years.

Capital Expenditures (Investor relations)

Reasons why I don't sell

My position is currently down by around 20 percent. After the dividend cut, I believe the dividend is safe for now, with a cash dividend payout ratio (TTM) of 60 percent.

In the event of a price recovery, however, I will ultimately sell my shares in AT&T. There is potential for a price recovery given the fundamental valuation because even assuming that earnings do not increase further, the share is more than favorably valued.

Analysts polled by FactSet Research do not expect AT&T to increase adjusted earnings per share from last year's $2.54. The analysts' expectations for the adjusted profit as published by FactSet are as follows for the following years:

- FY 2024: 22 analysts expect a range of $2.19 to $2.60.

- FY 2025: 18 analysts expect a range of $2.28 to $2.73.

- FY 2026: 5 analyst expects a range of $2.15 to $2.61.

On average and based on adjusted earnings, the market has valued AT&T at a fair P/E multiple of 13.3 over the past ten years. Based on average adjusted earnings per share of approximately $2.30 and $2.50 expected for 2025, the P/E ratio would be only slightly above 6, thus far below the historical average, suggesting a significant upside potential of at least 50 percent.

Even if we discount the fair multiple with regard to a potential market entrance by Amazon, AT&T's fundamental valuation is still quite attractive.

And, of course, there is still the option of AT&T showing moderate growth again and achieving an operational turnaround. And there are some positive signs as well. Postpaid phone ARPU grew by 2 percent in 1Q 2023. And also, in the promising fiber business, ARPU grew by $5 from $60.41 to $65.92. Sales even increased by 31 percent over the year. And after all, more than 95 percent of AT&T's debt is now fixed at an average rate of 4.1 percent. Plus, for 2023, analysts expect an increase to $20.7 billion. After all, however, in 1Q 2023, the expenditures were $230 million below those of 1Q 2022.

Conclusion

The circle of those who could be happy with an investment in AT&T has become smaller and smaller over the last few years. In my view, what remains are perhaps retirees who do not expect price increases but are looking for a high-dividend investment that currently has little downside potential. AT&T could be such an investment based on the current fundamental valuation. But even here, I would be cautious, as a possible market entry by Amazon could weigh on the share price like lead. Accordingly, despite the undervaluation, I still see the downside risk as moderate and not low.

I will sell my shares if they recover again. Until then, I will use the cash flow for other investments. If the share price continues to fall, AT&T will become one of my portfolio corpses. That is also part of investing. It is still sad because, at the end of the day, who would have thought such a development of the former dividend aristocrat possible five to ten years ago?

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (49)

I need to ask the following question before investing in individual equities going forward:

not "why not this company's stock?"

but "why this company's stock instead of all the others out there?"

so glad i dumped T. learned a valuable lesson believing some SA contributors. now what to do with this WBD junk i inherited from T. for now it sits in my portfolio in deep red if for no other reason than to warn me away from some of the authors here (and not bet on single stocks).

I'm one of that "many".