Mesabi Trust: There's A Strong Headwind, But Also An Opportunity

Summary

- Mesabi Trust, a New York-based royal trust involved in the Minnesota iron ore mining business, has been given a "Hold" recommendation due to uncertainty surrounding the business outlook.

- The trust's royalty income has been negatively impacted by Cleveland-Cliffs' decision to close its Northshore taconite ore operation in May 2022 and by a downward trend in the price of iron ore.

- A dispute between Cleveland-Cliffs and Mesabi Trust over the payment of the royalties, a potential recession, and the suspension of dividends are all factors contributing to the "Hold" rating.

nikitos77

This Analysis Assigns a ‘Hold’ Rating to Mesabi Trust

This analysis gives shares of Mesabi Trust (NYSE:MSB) -- a New York-based royal trust involved in the Minnesota iron ore mining business -- a "Hold" recommendation rating due to uncertainty surrounding the outlook for this business.

About Mesabi Trust

Mesabi Trust earns revenue from royalties it claims for the mining of taconite from the Peter Mitchell Mine near Babbitt and Silver Bay, at the eastern end of the Mesabi Iron Range, in Minnesota.

Northshore Mining Corporation, a subsidiary of Cleveland, Ohio-based flat steel producer in the US, Cleveland-Cliffs Inc. (CLF), is the operator of the Peter Mitchell Mine.

Northshore Mining Corporation at the Peter Mitchell Mine near Babbitt mines taconite, which is then shipped by rail to Silver Bay, where the magnetite-rich natural resource undergoes a pelletizing [process] to produce a 62 - 65% iron concentrate. The material is used in the steel industry to manufacture steel products.

Mesabi Trust's royalty income depends on the taconite production of the Peter Mitchell mine and the price of the raw material (or the price of iron ore as a benchmark). The more taconite mined, the better it is for Mesabi's profit, and the higher the price of iron ore, the better it is for Mesabi's profit.

While the production of taconite depends on local factors, company policies, and demand and price factors, the price at which the raw material is sold depends on supply and demand factors, which are in turn influenced by the economic outlook as well as geopolitical factors.

How Mesabi Trust Performs

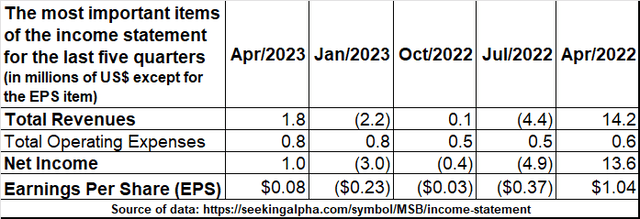

The most recent period of the last five quarters has not been one of the happiest for Mesabi Trust's royalty income, as shown in the table below, which is based on Seeking Alpha's data on the company's financials.

Royalty income has been confined to extremely low levels/negative areas due to: Cleveland-Cliffs' decision to close its Northshore taconite ore operation in May 2022 and a downward trend in the price of iron ore futures contracts over the last five quarterly reporting periods.

Northshore's suspended taconite ore operations impacted revenues from the July 2022 quarter through the January 2023 quarter as Northshore Mining was unable to reopen until early April 2023, albeit not at full capacity. While a significantly lower iron ore price combined with still some headwinds from the partially operating Northshore impacted operations in the April quarter of 2023.

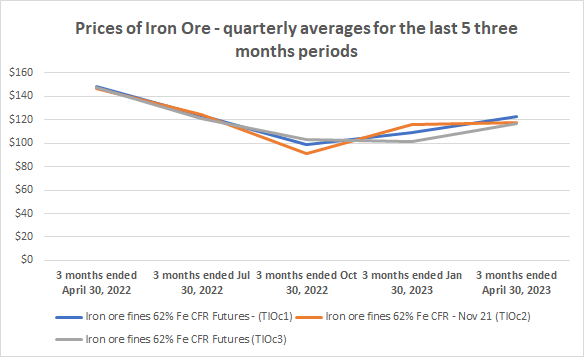

Compared to the April 2022 quarter, when Northshore's taconite ore operations were still operating at full capacity (before the May 2022 suspension), the average price of iron ore in the April 2023 quarter was 19.2% lower.

Source of data: Seeking Alpha

Or based on the slopes of the curve lines showing price trends for Iron Ore Fines 62% Fe CFR Futures - (TIOc1), Iron Ore 62% CFR - Nov 21 (TIOc2), and Iron Ore Fines 62% Fe CFR Futures (TIOc3) from the April 2022 quarter to the April 2023 quarter, prices fell by approximately 6.7% to 8.2% on a quarterly basis.

Operations at the taconite ore mine were shut down because Cleveland-Cliffs stockpiled more than enough taconite ore at other locations while demand for steel products was weak, according to Cleveland-Cliffs' facts and reported in this Star Tribune article. But that doesn't seem to be the only problem currently facing the Peter Mitchell Mine, the Mesabi Trust's source of income. In fact, according to the Star Tribune article, there is a dispute between Cleveland-Cliffs and the Mesabi Trust over royalties to be paid to the Trust for a Babbitt production that Cleveland-Cliffs CEO Lourenco Goncalves called "absurdly high".

And this is a major concern for Mesabi Trust's investors because pending the resolution of the dispute, Northshore's operations could be scaled back in the future to meet Cleveland-Cliffs' specific operational needs, impacting Mesabi's net income. In fact, Cleveland-Cliffs Inc. has also disclosed that it intends to continue operating the Babbitt mines at a reduced capacity, which may vary based on the company’s operational needs.

The Dividend Could Face More Headwinds

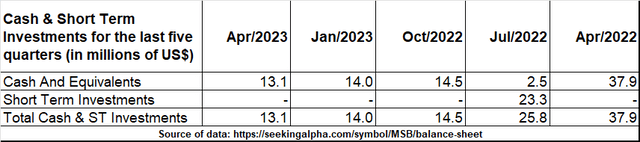

With growing uncertainty about the contribution of Babbitt's mining royalties, the likelihood to resume the dividend could come under pressure as available cash has also weakened to make up for about a year of mine closure.

There's no questioning Mesabi Trust's ability to continue to fund the payment of the dividend after Northshore reopens. By the time Trust resumes paying dividends, if it does, perhaps shares will have gotten even trading lower. However, the general conditions under which the company is currently operating are less flexible than before, also due to an unfavorable economic cycle for the steel industry.

Mesabi Trust paid dividends totaling $22.960 million in the April 2022 quarter, $13.645 million in the July 2022 quarter, and paid a total of $11.021 million in the October 2022 quarter. The trust did not pay dividends for either the January 2023 quarter or the April 2023 quarter. The stock is composed of about 13.12 million shares outstanding.

Iron Ore Outlook: Lack of Drivers in the Steel Industry

The near future is not very promising for iron ore demand and iron ore price. The primary target of the iron ore product is the steel-making industry, and when that industry falters, so do the iron ore producers, and with it the Mesabi Trust's royalties. As with many manufacturing activities currently slowing down, steel making in the US and Europe is likely to face sluggish demand right now as higher borrowing costs to combat core inflation, which remains resilient despite aggressive monetary policy, are causing problems for consumption and corporate investments. The health of manufacturing activities in the US and the Eurozone is deteriorating significantly.

The United States of America now tops the list of the world's largest buyers of steel products, but China is also an important consumer. The Asian country ranks second, but the current economic situation does not bode well for the steel industry, which could also have a negative impact on iron ore demand and iron ore prices.

China is struggling to fuel the economic recovery and there are also signs of deflation, raising doubts about the strength of the demand. The Asian country would also lack support from Western economies, whose systems are not in good shape and facing the risk of recession due to their central banks’ aggressive monetary policies. In fact, exports from China have fallen very sharply, marking a 12.4% year-on-year decline to $285.32 billion as of June 2023. This was the sharpest drop in more than two years as global demand eased. Sales of several commodities fell, including steel products (-0.6%), and among the Chinese country's main trading partners, US exports fell 23.7% yoy, while EU and ASEAN exports to China decreased by 12.9% and 16.9% respectively.

These macroeconomic trends are not helping to create positive expectations for future demand for iron ore, which is likely to have a negative impact on the price of the commodity. Analysts at Trading Economics expect iron ore prices to fall nearly 1% by the end of this quarter and 8.6% by June 2024.

The Stock Valuation

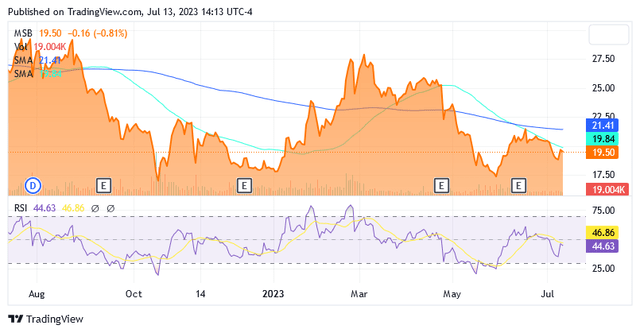

Shares of Mesabi Trust traded at $19.50 apiece as of this writing giving it a market cap of $257.94 million. Shares are trading below the middle point of $23.255 of the 52-week range of $16.56 to $29.95.

Shares are also trading slightly below the 50-day simple moving average of $19.84 and well below the 200-day simple moving average of $21.41.

That does not mean, however, that you are encouraged to improve your position because if you do that, you will then miss out on all the issues this company is currently facing, which, as highlighted in this analysis, are no small matter.

Mesabi Trust's future appears to be plagued with a great deal of uncertainty over the receipt of royalties that may no longer be regular as the asset from which they originate becomes a swing business for Cleveland-Cliffs. In addition, the market could need less taconite due to a slowdown in steel production over the next few months, which also looms over the specter of a recession. Conditions are too uncertain to predict when the company might resume dividend payments, and cash on hand has dwindled during Babbitt Mine's inactive quarters. For now, I would settle for a Hold rating and see what will happen with the dispute between the Mesabi Trust and Cleveland-Cliffs over royalty payments and whether the economy could go into recession.

Conclusion

Investors should consider a “Hold” rating on Mesabi Trust shares as they still have significant room to trade below current levels due to the following headwinds: the royalty income-generating asset in Minnesota is unlikely to be used as a regular ore mining operation, perhaps until the dispute over Cleveland Cliff's royalty payment to Mesabi has been resolved. The demand and price outlook for taconite ore (a magnetite-rich natural resource used to produce a 62-65% iron concentrate) does not bode well for the Mesabi Trust either, and a recession looks imminent.

Meanwhile, shares could fall further before the Trust resumes dividend payments. The investor should be patient and wait until everything becomes clearer in front of him.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.