Avid Technology: Supply Chain Delays Continue

Summary

- The ARRs continue to develop quite well, but EBITDA is being hit by issues on integrated solutions, which is seeing delivery delays.

- When supply chain bottlenecks there loosen, we'll see more hardware maintenance revenue too and some operating leverage, although the integrated solutions GM is weaker now.

- Enterprise conversions and wins are driving up per seat revenues, which is helpful, and there are iterations and additions to the Pro Tools product that help drive engagement.

- Some operating leverage benefit from integrated solutions pick up will help, and ARR grows. They're also restructuring, and there's something to be said about Avid's brands with lower long-term rate expectations.

- Still, it's a little on the expensive side for us.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Just_Super

Avid Technology (NASDAQ:AVID) holds a set of great brands that makes it entrenched in the digital music production space. They are pulling an Adobe (ADBE) and getting past perpetual licenses and maintenance into a more recurring subscription revenue model. That's all well and good, since it allows repricing and re-tapping old leads. Their deltas lately are from the integrated systems side of things, where things have been slowed down and margin eroded due to supply chain issues. The benefits from that loosening are getting deferred, but that's fine. Things should look better in the coming quarters, also as they plan on doing some more cost cutting and their ARPUs are coming up. However, despite some positives, the stock appears expensive also because of potential sale possibilities.

Looking at Q1

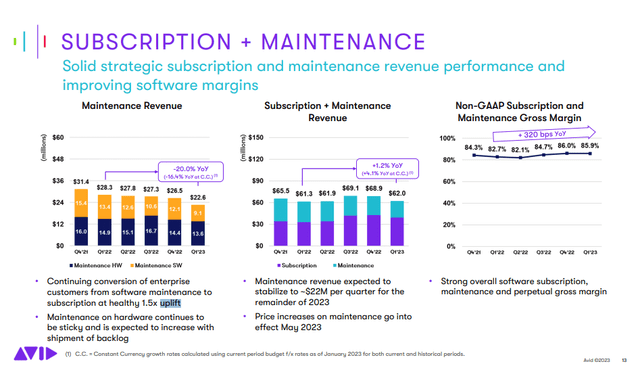

The Q1 is a story where ARRs from the conversion of customers from perpetual license and software maintenance is going quite well. The big changes is that there is quite a lot of activity on the enterprise side and that's allowing for a 150% uplift and to reactivate old users and leads. Maintenance on the software side is coming down, and the weakness in delivering hardware as part of integrated solutions is an issue for the hardware maintenance revenues which are here to stay after the transition.

Subscription + Maintenance (Q1 2023 Pres)

As the uplift kicks in and as ARR effects come to fruition in annualised revenues, the outlook is that revenues should come up almost 10% which is great net of the losses in perpetual license and maintenance revenue, as per the transition. The reason it's not higher in the outlook is primarily because of integrated solutions where the delays from a while ago continue.

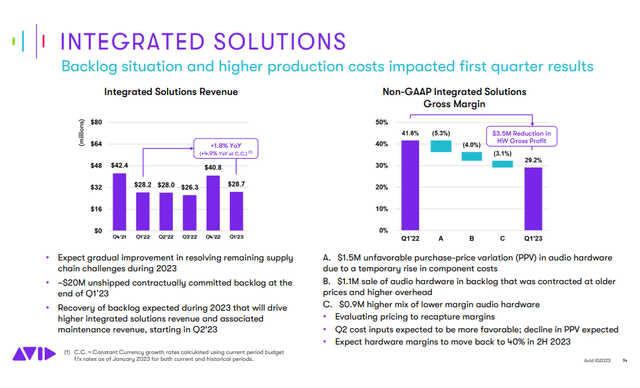

Backlog is building in the integrated solutions business and activity is good in the end-markets. However, the supply chain issues are slowing down revenues as well as eroding gross margins due to inflated hardware prices. This is also capping performance in the hardware maintenance business, which is mainly for clients that have bought integrated solutions. The issue is that even the revenue that is coming through is hitting margins pretty meaningfully due to the loss in segment profitability. When more liquidates mix effects will be worse, even though the segment is still profitable. The hit overall from the underwhelming integrated solutions performance is around $3.5 million, which is a lot against the $12.7 million in adjusted EBITDA this quarter.

Integrated Solutions (Q1 2023)

The company is also planning restructuring and early retirement initiatives which together should save $15 million annually, but these things rarely fully pan out.

Bottom Line

There have been discussions that Avid is considering selling itself with a push likely from activist investors Impact Capital. The question is whether someone will pick up AVID which currently trades at a ~$1.5 billion EV. The strengths are a powerful platform of brands that have important share in the music and content creation industry, as well as a business model being proven out that demonstrates recurring revenue and good retention throughout the transition. There will be a milestone coming up where we'll see how enterprise customer churn. This will be important to assess in the next two quarters, as performance in the enterprise segment would signal good retention.

A possible acquirer to speculate on might be something like Adobe. While Adobe Audition isn't bad, it's less of an industry standard and not a major element of the Adobe Suite, where After Effects and of course Photoshop are the go-to elements. Pro Tools is much more of an industry standard and a more capable programme, and much better positioned for integrated solutions since hardware can be dedicated to Pro Tools. Pro Tools is arguably more competent and versatile of a workstation as well. There are other things in Avid's portfolio that may be interesting enough like Sibelius to warrant a look from Adobe, and gives some integration across the chain of activities in music composition and creation.

At around a 15x EV/EBITDA it would be on the steeper side considering M&A markets. But if M&A markets were to inflect on the recent CPI news for example, it is a possibility if there is a strategic buyer out there like Adobe or others that may be able to afford the premium. On that basis, there is some speculative merit to Avid, but it is a little expensive for us considering the current rate of growth and the troubles in profitability that rest on cost cutting and restructuring measures.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.