SIGNA Sports United: Near-Term Performance Is Going To Pressure The Stock (Rating Downgrade)

Summary

- I recommend a hold rating for SSU due to expected negative performance in the near term, which will likely limit stock price movements.

- Despite SSU's successful transformation into an online sports retail specialist, macroeconomic headwinds in Europe and intense margin pressure from competitors have negatively impacted the company.

- I suggest investors stay on the sidelines until there is evidence of positive recovery, despite potential long-term upside if SSU meets targets.

FreshSplash/E+ via Getty Images

Summary

This is an update to my previous coverage for Signa Sports United (NYSE:SSU). Previously, I recommended buy rating because of my positive view on transformation journey into an industry powerhouse - an online sports retail specialist.

For this update, I recommend a hold rating for SSU as I expect it to see negative performance in the near term, which will put a lid on stock price movements.

Business description

SSU group has become one of the most successful online sports retailers thanks to its specialized web stores for popular sports like cycling, tennis, outdoor activities, team sports, and even athleisure. Signa Sports United is taking advantage of the booming e-commerce market by offering its wares on a number of different webstores accessible to consumers all over the world. SSU's presence in strategic locations, including Europe, Norway, the United Kingdom, and the United States, has increased the number of countries that can take advantage of its services. Bikes are Signa's bread and butter in the global online market, with Tennis, Outdoor, Team Sports, and Athleisure coming in close seconds.

Industry

SSU main market, the global bicycle market size is valued at $64 billion in 2022, based on Grand View Research, which is expected to grow at 9.7% CAGR from 2023 to 2030. I believe this is part of the "athleisure" trend where people are exercising with "leisure" in mind, and bicycle fits well to this trend as one can travel while exercising.

As for the Athleisure Market in general, Modor Intelligence projects a 6.09% CAGR for the Athleisure Market between 2023 and 2028, with total market size increasing from USD294 billion in 2023 to USD395 billion by 2028. I attribute the growth to people's growing interest in health and fitness as well as their desire to lead more active lives and present themselves as healthy and attractive. Consumers are getting more active and healthier as a result of these influences. A shift in market dynamics has resulted from this increased participation, driving up demand for athleisure goods.

Modor Intelligence

SSU seems also well positioned in the key markets that have larger market size relative to other countries globally.

Some of the more well-known players are Adidas, Nike, Under Armour, Puma, Lululemon, etc.

Thesis updates

Although I had high hopes for the SSU's transformation efforts, their failure to produce tangible results has, in my opinion, significantly weighed on the stock. As a result of macroeconomic headwinds in Europe, consumer spending on discretionary items fell 23% on a pro forma basis in the 2Q23. Demand will likely remain subdued for the foreseeable future due to the macro headwinds. SSU also felt intense margin pressure as a result of competitors' promotions aimed at clearing inventory. This has forced SSU to follow through with similar actions in order to clear their inventories. I would add that inventories are likely to be higher than usual as retailers stockpiled in anticipation of post-pandemic demand. As a result, I anticipate continued margin pressure in the near future.

Given the current macro and industry environment, I do not anticipate a rapid turnaround in the stock price anytime soon. I think investors will need to see evidence of an improving trend before the stock sees a meaningful recovery.

As such, I think it will be a wiser move to stay on the side-lines until we see evidence of that recovery.

Financial analysis

2Q23 revenue declined 23% on a pro forma basis, as European macro headwinds (exacerbated by Ukraine conflict) have pressured consumer appetite for discretionary goods. Gross margin of 22.5% and adj. EBITDA of (€59M) came in below our estimates of 30.9% and (€40M), respectively. Management noted the softer-than-expected financial performance was primarily driven by a combination of macro headwinds and oversupply in the market.

I believe SSU revenue is likely to remain under pressure in the near term as long as the European macroeconomic environment remains weak and volatile. Given Europe's high inflationary environment, I don't believe anyone can predict when the turmoil will end; therefore, I advise forecasters to be cautious.

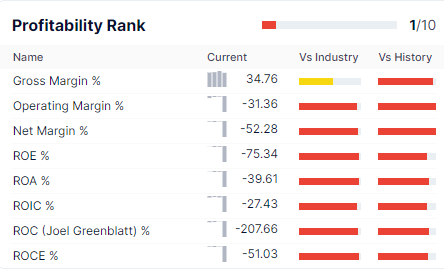

The company is also not making any meaningful profits, which I believe it will continue to be loss-making for the near term as revenue stays pressured, which is another reason why investors are avoiding the stock, as I don't see any appetite for low growth + profitless companies. Furthermore, SSU is similar to a turnaround/restructuring story with high execution risk. With the weak revenue outlook, I am also bearish on SSU's near-term EBIT performance.

Gurufocus

When we compare SSU to the industry, it seems that the company will not screen well for investors who are unfamiliar with the company's name.

SSU's saving grace is that it has no debt, which means it has more leeway in raising debt to get through this difficult period. However, the cash holding is insignificant, totaling only $38 million.

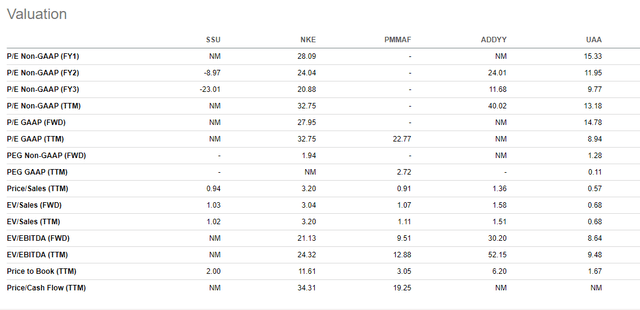

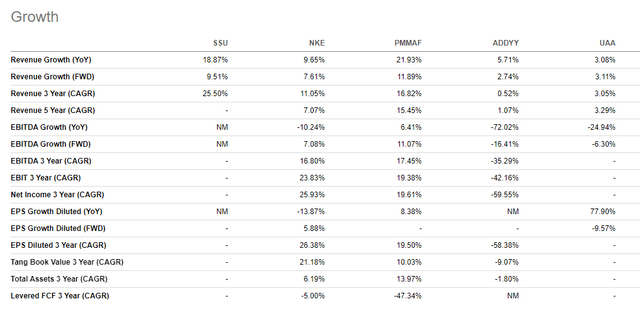

Valuation

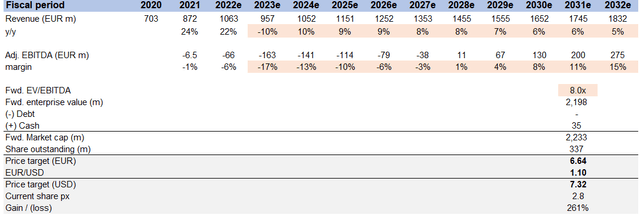

Author's model

I previously had a price target of $14 as I expected growth to be much stronger than what I modelled today at $7.32.

According to management guidance, I expect SSU revenue to decline in FY23, as I see no end to the macro situation in the near term. This will likely result in a significant decrease in margin. This short-term result, in my opinion, would cause the stock to remain at its current levels.

However, if we assume that SSU can meet management's long-term EBITDA margin target and my long-term growth target (5%), I believe the upside is still appealing. Take note that my 8x forward EV/EBITDA valuation is derived by comparing SSU to its peers. To be conservative, I assumed that SSU would trade at a slight discount to the group's lowest multiple.

However, I believe the market is not currently focused on the long-term narrative, so the stock is unlikely to reflect my price target.

Risk

The sports retail industry is highly competitive. In such a complex market, SSU's regional brands face tough competition, both online and offline. Similarly, international and local players affect their growth, profits, and market share as well. Also, other factors that impact the business's growth negatively are the new and strong growing independent players in the market who are expanding their reach in SSU's current and future geographies.

Conclusion

I recommend a hold rating for SSU due to weak near-term performance that will likely pressure the stock. Despite previous positive views on SSU's transformation journey, the lack of tangible results and macroeconomic headwinds in Europe have negatively impacted the company. Consumer spending on discretionary items has decreased, and intense margin pressure from competitors' promotions has affected SSU's margins. In the long term, if SSU can meet targets, the upside may be appealing, but the market's focus is currently on the short term. Given these factors, it is prudent to stay on the sidelines until positive evidence of recovery emerges.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.