MasterBrand: Good Execution And End Markets Bottoming Make It A Buy

Summary

- MasterBrand is expected to benefit from a potential housing market recovery next year as well as strong market position and favorable long-term tailwinds.

- The company's margin is expected to benefit from proactive pricing strategies and cost-reduction initiatives.

- The company is executing well with its "Align to Grow" initiatives.

JHVEPhoto

Investment Thesis

While MasterBrand (NYSE:MBC) is expected to face some headwinds in the near term due to a decline in volume driven by the weak residential housing market, we are likely near the bottom of the housing cycle and the company should see a recovery from the next year onwards. The company is also poised to benefit from favorable long-term tailwinds, including the aging homes in the U.S., a significant rise in home equity, a significant underbuild of new homes since the great recession, and its strong market position, which should contribute to market share gains and benefit its R&R and new construction business in the long run.

Additionally, the company's margin is expected to benefit from the proactive execution of pricing strategies and cost-reduction initiatives. Furthermore, investments in higher-margin areas of the business are anticipated to support margin expansion in the coming years. The valuation is also attractive making it a good buy.

Revenue Analysis and Outlook

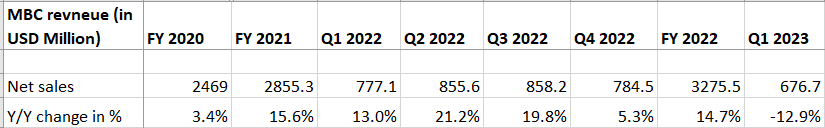

After a strong last couple of years, MasterBrand has now started seeing a decline in its revenue growth due to a slowdown in the housing market caused by high interest rates. In the first quarter of 2023, the company recorded a year-over-year revenue decline of 12.9% to $676.7 million. This decline can be attributed to volume declines during the quarter, as anticipated, due to the prevailing uncertainty in the company's end market caused by the weak residential housing market. The impact of higher net Average Selling Price (ASP) resulting from recently implemented prices was overshadowed by these volume declines.

MasterBrand Revenue Growth (Company data, GS Analytics Research)

Looking ahead, while the company's revenue should face continued pressure due to the ongoing slowdown in the housing market, there are some green shoots that indicate we are likely near the bottom of the housing cycle. The housing starts data in May was better than expected and showed Y/Y as well as sequential improvements in the housing units started. We are also likely to see interest rates peak over the next couple of months and the potential cuts over the coming years which should aid housing recovery.

In addition to the housing market recovering, the company is also poised to benefit from its "Align to Grow '' initiative which includes focusing on the best growth area. This initiative has helped the company grow market share in recent quarters as it shifted its focus to target production builders (with less personalization options) and moved away from custom homebuilders. Due to challenging cost environments custom homebuilders (which are more expensive) are seeing a sharper slowdown in demand compared to production builders and a focus on targeting production builders helped MBC gain share. I expect this trend to continue and help MBC outperform end markets.

Further, as a part of this initiative, the company has received its bath portfolio and identified products that can enhance its vanity offering. This should allow it to gain market share from importers similar to the success of the company's Mantra brand against kitchen imports. The Mantra brand, launched a few years back to compete with importers, has grown into a $150 million business as its product category continues to outpace the market. These initiatives should continue to drive market share gains in the highly fragmented market, ultimately benefiting the company's revenue in the coming years.

Furthermore, the long-term outlook for the housing market is also promising. The long-term secular growth trends, including the aging housing stock in the U.S., rising home equity, and undersupply of homes resulting from a decade of under-construction, are expected to support the company's R&R (Repair and Remodel) and new construction businesses. These factors will further drive the company's revenue in the long term.

Overall, I believe we are close to the bottom of the housing cycle and revenue should bottom sometime this year. The medium to long-term outlook remains favorable due to the company's various initiatives, long-term secular tailwinds, and strong competitive position with the company holding approximately a 1/4th share in the growing U.S. Residential Cabinet Market.

Margin Analysis and Outlook

Despite the decline in revenue, the company achieved a healthy 160 basis points improvement in its adjusted EBITDA margin to 12% in the first quarter of 2023. This margin growth was primarily driven by a lower fixed cost structure resulting from cost reduction actions at the factory level and supply chain improvements.

Looking ahead, while the company's margin is expected to face pressure due to volume deleveraging, the cost savings from restructuring actions, combined with a focus on the proactive execution of pricing strategies and supply chain improvement, should offset it to a good extent. Usually, the company faces decremental margins in the 20%- 25% range but thanks to good execution and cost reduction initiatives, management is expecting decremental margins to be less than 15%. Further, once the housing market bottoms and the company starts seeing revenue recovery from the next year, margins should also post a swift improvement. The company continues to make progress on its "Lead through Lean and Tech Enabled" strategic initiatives, which should contribute to long-term cost reduction. Additionally, the company remains committed to investing in business areas with high returns as its top priority, further driving margin growth in the years to come.

Valuation and Conclusion

MBC Stock is trading at 9.87x FY23 consensus EPS estimates and 9.07x FY24 consensus EPS estimates. With the company executing well, and the housing market poised to bottom this year, MBC can post good earnings growth over the next few years. I also see a potential for upward revision in the earnings estimates as housing recovery takes hold, So, I am optimistic about the company's prospects and believe the stock is a good buy at the current levels.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Vedang S.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.