IBM: Still Looks Interesting Before Earnings

Summary

- Upcoming earnings for IBM are expected to show flat revenue and a decline in adjusted EPS from $2.31 to $1.98.

- Despite the expected decline in EPS, the stock is considered to be attractively valued and offers a solid forward dividend yield.

- The earnings release, scheduled for next week, could provide actionable insights for investors and reiterates a bullish thesis for IBM.

JHVEPhoto

Investment thesis

As my initial coverage of IBM (NYSE:IBM) explained, the stock is attractively valued and offers a solid forward dividend yield. Today, I want to reiterate my bullish thesis from the upcoming earnings perspective. The company's upcoming quarter's earnings release is planned for the next week; therefore, I think this call would be helpful and maybe even actionable for readers. I expect earnings to be at least in line with consensus estimates. The major reason for my optimism is the new acquisition since I believe during the upcoming earnings call management will emphasize the increasing reach of the company's offerings.

Earnings preview

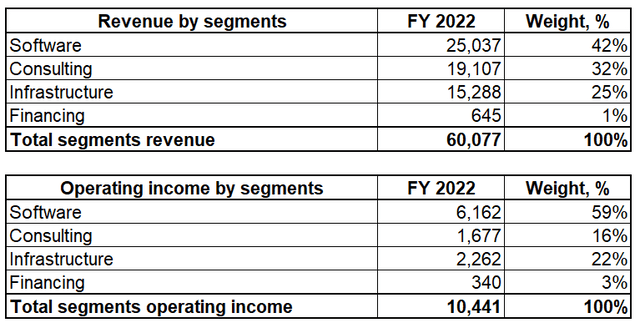

The upcoming earnings report is planned for release on July 19. Revenue is expected to be flat from the topline perspective, which looks decent in a harsh environment. On the other hand, adjusted EPS is expected to decline from $2.31 to $1.98. To get into deeper details about upcoming earnings, let me remind you of the structure of the company's revenue and operating profits by-segment weight.

Author's calculations

As we see, segment software is the one that affects the bottom line the most, since its operating profit represented about 60% of the total in full fiscal year 2022. I expect this segment to demonstrate growth based on the CIO survey conducted by Morgan Stanley analysts after the Q2 end; the application development and engineering, and application maintenance are expected to grow at solid double digits. Therefore, I'm looking optimistically at the company's largest segment and expect growth here.

The company's second-largest segment, Consulting, also is critical to understand. To try to predict the quarterly financial dynamic for the segment, I would like to look at the company's current job postings because usually payroll is the major cost in consulting. The company currently is seeking more than 1,000 professionals, according to LinkedIn, and mainly they're related to the consulting business. Therefore, I expect this segment to demonstrate resilience during the current environment. That said, the segment's activities are increasing in scale, otherwise the company did not need an additional workforce.

The segment which is likely to suffer a weak YoY dynamic is infrastructure. This line of business related to hardware is in a secular decline, and I think that expecting any growth here would be too optimistic.

The company was very active during the quarter from the acquisitions perspective. The latest acquisition announcement of Q2 was the software company Apptio for $4.6 billion cash. The company manages financial and operational IT management and optimization software solutions. Apptio has a diversified portfolio of clients, including tech behemoths like Amazon (AMZN), Microsoft (MSFT), and Google (GOOG). The deal is expected to be closed during the second half of the current fiscal year. The company expects this acquisition to improve its application management, optimization, and observability offerings. The acquisition aligns with the expansion strategy into AI and automation software. The deal is unlikely to affect this year’s guidance, but management might share their preliminary estimates of the extent of synergetic effects expected.

Another acquisition announced earlier in June is aimed at expanding hybrid cloud consulting capability. The company named Agyla SAS is a leading French cloud professional services firm. According to the IBM Newsroom, with the acquisition of Agyla SAS, IBM Consulting can better provide the end-to-end services French clients need to build, deploy and run large-scale digital transformations on a hybrid cloud.

The company also is striving to improve its presence in open source, and that's the reason why IBM acquired Ahana in April 2023. This purchase give IBM a managed SaaS and AW marketplace version of the popular open-source Presto database. Apart from acquisitions, during Q2 the company launched its own generative AI platform named Watsonx. I like the management's rapid response to the increasing population and demand for generative AI.

I like the company's commitment to growth and innovation, especially in the current evolving environment where technologies can rapidly become obsolete. On the other hand, I do not expect these acquisitions to have an immediate effect on the P&L, but during the upcoming earnings call management might give hints on how these acquisitions will affect the company's earnings in the nearest fiscal years. I believe that changes in guidance would be a much bigger catalyst for the stock price over the short term, rather than meeting or not meeting consensus earnings estimates.

Valuation update

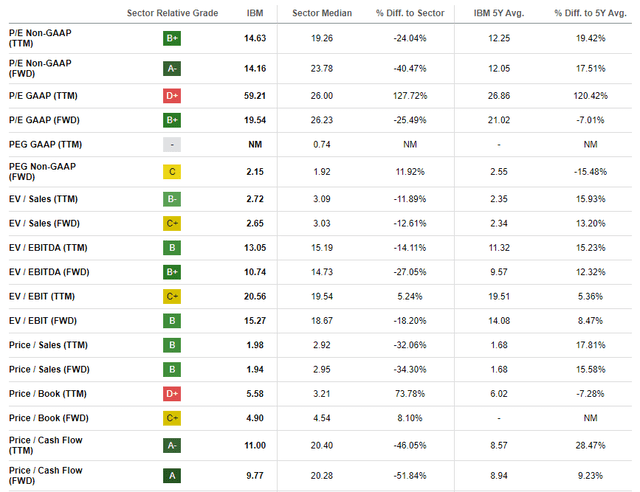

IBM stock underperformed the broad market year-to-date with about 5% share price decline. Seeking Alpha Quant assigns the stock a relatively high "B" rating, meaning the stock is attractively valued. Indeed, current valuation ratios are mostly lower than the sector median. On the other hand, current multiples are higher that the five-year averages almost across the whole board.

Seeking Alpha

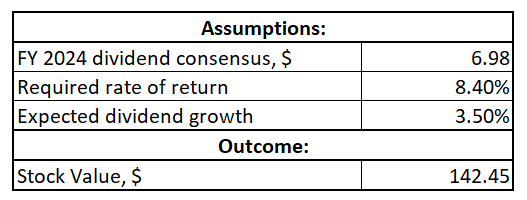

Consensus estimates slightly decreased the FY 2024 expected dividend, so I should recalculate my discounted dividend model [DDM] formula. I also want to use a more moderate 3.5% dividend growth rate instead of 4% I used last time. The WACC remains the same at 8.4%.

Author's calculations

The stock's fair price is about $142, approximately 6% higher than the current level. I used a more conservative dividend growth because of the challenging environment the company is facing. Moreover, we should not forget that the payout ratio is high, above 70%, meaning there is not so much room for dividend growth.

Overall, I believe the upside potential is attractive if we also consider a forward dividend yield of almost 5%.

Risks to consider

I think that the current harsh environment poses significant risks for IBM. While inflation is on the way to return to normal, the recession is still not off the table. And some analysts predict a recession in the U.S. starting in early 2024 - for example, Standard Chartered or Stifel. The recession will inevitably lead to a cut in IT spending, meaning that revenue growth will be under pressure for IBM.

Another significant risk that I see comes from frequent acquisitions. The company bought new companies during a single quarter. While acquisitions might unlock vast potential, it also brings significant risks. First of all, there's always a substantial risk that the acquired entity will never pay off the initial investment. Second, the integration processes during the merger might go worse than expected and can mean failing to achieve synergetic effects from M&A.

Bottom line

Overall, I reiterate a "Buy" rating for IBM stock. I like the valuation and the forward dividend yield, which looks like a present at the current level. The management is apparently striving to adapt to the constantly evolving technological landscape via strategic acquisitions. I like the commitment to innovate and think that acquisitions are likely to unlock new growth drivers for the company.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)