Titan Machinery: No Long-Term Alpha In This Cyclical Acquirer

Summary

- Titan Machinery Inc., a founder-led company that acquires agricultural and construction equipment stores, has acquired over 55 businesses since 2003, operating 86 stores in the US and 35 in Europe.

- Despite being a mature business, Titan has never paid a dividend or bought back shares, instead growing through acquisition.

- Titan is not considered a long-term growth play due to the cyclical nature of its industry and the resulting volatility.

William Reagan/iStock via Getty Images

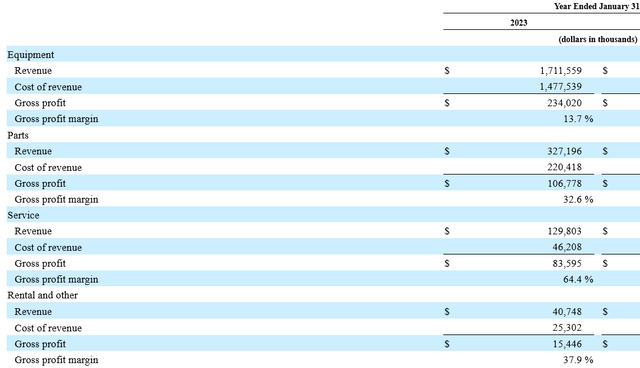

Titan Machinery Inc. (NASDAQ:TITN) is a founder led, serial acquirer of full service, agricultural and construction equipment stores. They operate 86 stores in the US and 35 in Europe. They’ve made over 55 acquisitions since 2003. Here is how their revenue breaks down:

Titan is only focused on the retailing of their equipment, not the manufacturing, so many of its publicly traded peers will have margins that reflect the manufacturing blended with distributing.

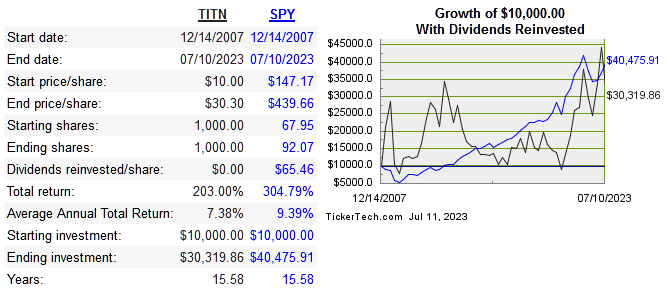

Below is the share performance since IPO:

dividend channel

In May they did beat EPS by $0.17, but missed revenue by $25.8 million. Shares dropped 27% in the days following that particular earnings announcement, but recovered a bit and is now up 21% since that point. This kind of movement is no surprise; TITN stock has a beta of 1.68 and it absolutely qualifies as being highly volatile and cyclical.

Next are the return metrics versus peers:

Company | Rev 10-Year CAGR | Median 10-Year ROE | Median 10-Year ROIC | EPS 10-Year CAGR | FCF/Share 10-Year CAGR |

TITN | 0% | 2.9% | 1.2% | 8.4% | n/a |

| -3.3% | 14% | 2% | 9.2% | n/a | |

| 2.4% | 10.1% | 7.2% | 8.4% | 3.3% | |

5.2% | 7.8% | 6.3% | 8.2% | n/a |

Capital Allocation

Despite being a mature business simply in terms of years(founded in 1980), they’ve never paid a dividend or bought back shares. They grow by acquisition.

They never stray far from their roots when it comes to the acquisitions, its always in agricultural or constructions equipment. Sometimes they buy assets off of other companies, and other times they acquire the entire business, usually a local dealership.

Their M&A strategy stays most around the Midwest, as these states are agriculturally more active than many other coastal states. Some examples are Larsen Implement in 2021 which had locations in Minnesota and Iowa, or the assets bought from Pioneer Farm Equipment in Iowa.

Below we see how capital was allocated:

Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

EBIT | 92 | 47 | 1 | -23 | -2 | 1 | 27 | 21 | 37 | 90 |

FCF | -187 | -106 | 23 | 223 | 129 | 70 | 35 | -24 | 153 | 121 |

Capex | 72 | 24 | 18 | 8 | 12 | 26 | 12 | 25 | 20 | 38 |

Acquisitions | 4 | 15 | 14 | 7 | 34 | |||||

Debt Repayment | 146 | 134 | 141 | 117 | 63 | 66 | 26 | 50 | 16 | 9 |

SBC | 2 | 2 | 2 | 2 | 2 | 3 | 3 | 3 | 3 | 3 |

Risk

There’s no doubt that they are a consolidator, but can top notch M&A skills outfight an inherently cyclical industry? There are things to like in this company, like the fact that they can employ a roll-up strategy with minimal debt load and also never dilute anymore.

Revenue peaked in 2014, which isn’t something you’d like to hear from a business built on acquiring others, but the asset base is now lower, therefore raising the capital intensity ratio and ROIC, which are higher now than in 2014. These two ratios along with operating and net margins were at record highs last year.

There is certainly an extra potential to the portion of the businesses located in Ukraine due to the current conflict. They have $27.4 million in assets located in Ukraine as of January 2023. I certainly don’t have unique insights into the probability of these international operations being affected by the conflict. All I can say is that they seemed to have maintained things fairly well in spite of the conditions. There’ve been no material damage or loss to inventories so far. Had they exited operations in Ukraine swiftly, it would be different but right now they have no plans to cease operations there.

They are heavily dependent on a single manufacturer, CNH Industrial. Also, even though TITN is founder led, insider ownership is only around 10%, which I would like to ideally see higher. These are all minor risks however, and I don't see any major risk with the business model or strategy.

They currently have $38.3 million in cash with $93.4 million in long term debt.

Valuation

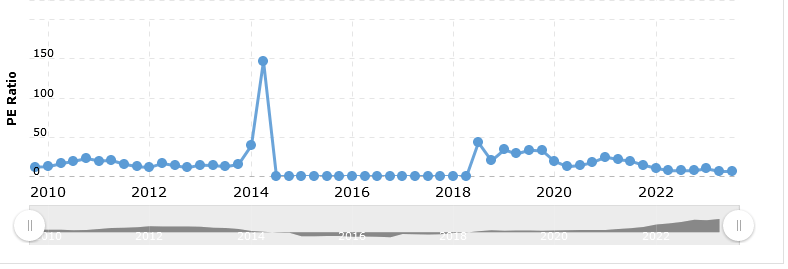

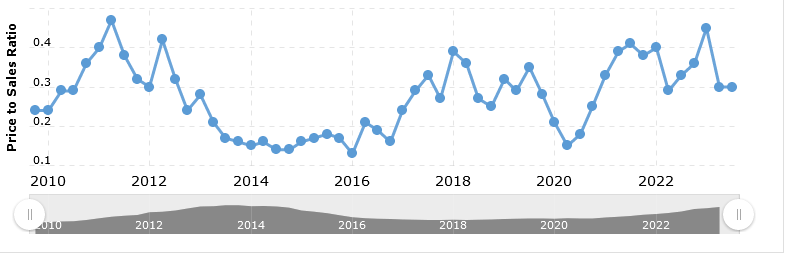

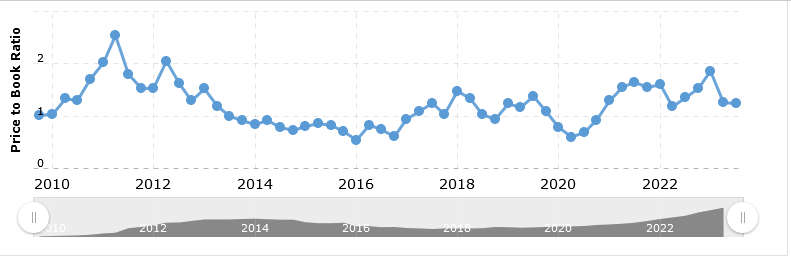

Let's first look at the multiples comp followed by historical multiples:

Company | EV/Sales | EV/EBITDA | EV/FCF | P/B | Div Yield |

TITN | 0.3 | 4.2 | -6.8 | 1.2 | n/a |

CNHI | 1.6 | 8 | -143.5 | 2.6 | 2.7% |

AGCO | 0.8 | 6.4 | 26.9 | 2.4 | 0.8% |

WKRCF | 0.7 | 6.2 | -21 | 1.1 | 4.3% |

Macrotrends

Macrotrends

Macrotrends

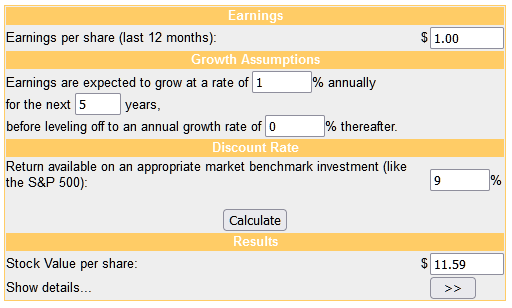

Next is the DCF model:

Moneychimp

Because of the cyclicality in general, I don't expect the current returns on capital or operating and net margins to remain at these levels much longer. So I put a more normalized EPS for the TTM. The result is that I don't see the stock undervalued at all. Even if there is a big price decline, this stock will basically only give profits in the short run. Even at a low, a long term strategy won't work here. This doesn't mean the business is poorly run, but it simply isn't the kind of compounder I'm ideally looking for, nor is it simply so dirt cheap that it can't be ignored.

Conclusion

I think there are some businesses that are both cyclical and also long term growth stories. If a company gets materially larger decade after decade, yet whose shares perform like a rodeo ride the entire time, I would consider it a growth company but not necessarily a growth stock. TITN would have to fall into the category , but I don’t want to diminish the quality of this business.

This is another company that makes me ask the question, why wouldn’t this company just be better off private? The minimal use of debt, equity issuance, and stock-based comp are signs that there is no major benefit to the company being publicly traded at all. I don’t have control over this, and I’m also not saying they are ripe or takeover from private equity because of it. Serial acquirers aren’t usually looking for an exit themselves. All I’m saying is that TITN is fundamentally not a long term growth play.

It is in the somewhat distinct position of being a serial acquirer in a cyclical industry. They deserve credit for being able to use the strategy without burying the company with debt or dilution, but industry itself is cyclical and capital intensive. I don't see this stock as undervalued, and I definitely don't see it compounding at any significant rate when held for years.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.