3 Dividend Stocks Poised To Outperform The Rest Of 2023

Summary

- The S&P 500 and Nasdaq saw a significant rally in the first half of 2023, led by technology companies, with the top three performing sectors being Information Technology, Communication Services, and Consumer Discretionary.

- Given the top heavy rally in the first half, we go value hunting in today's piece and look at three quality dividend stocks primed to outperform in the second half.

- There is a lot of uncertainty in the back half of the year, which could have investors switch from risk-on assets to more defensive sectors.

- I do much more than just articles at iREIT on Alpha: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

SvetaZi

The S&P 500 and Nasdaq saw a huge rally in the first half of 2023, but when you dive deeper, you see that the rally was very top heavy.

Here is a look at the first half performance for the 11 sectors within the S&P 500:

- Information Technology: +42%

- Communication Services: +35%

- Consumer Discretionary: +32%

- Industrials: +9%

- Materials: +7%

- Real Estate: +2%

- Consumer Staples: FLAT

- Financials: -1.5%

- Health Care: -2%

- Utilities: -7%

- Energy: -7%

The top three performing sectors were largely lead by technology companies. Information technology is self-explanatory, but Communication Services was led by Meta Platforms (META), and Consumer Discretionary was led by Tesla (TSLA).

What will happen moving forward is anyone's guess, as the top sectors have bucked the trend of a "slowdown" for the first six months already, but many of those high flying stocks trade at extreme valuations and seem likely to take a breather.

As such, I am value hunting for stocks that can outperform during the second half. In today's piece, I will discuss 3 Dividend Stocks I have researched the past few weeks that I believe will outperform the second half of 2023.

3 Dividend Stocks To Outperform In The Second Half

Dividend Stock #1 - Enterprise Products Partners L.P. (EPD)

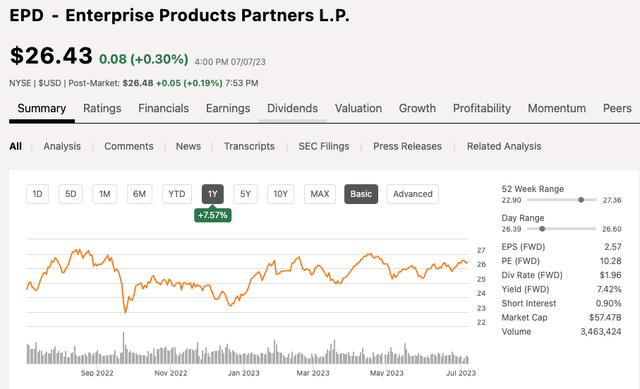

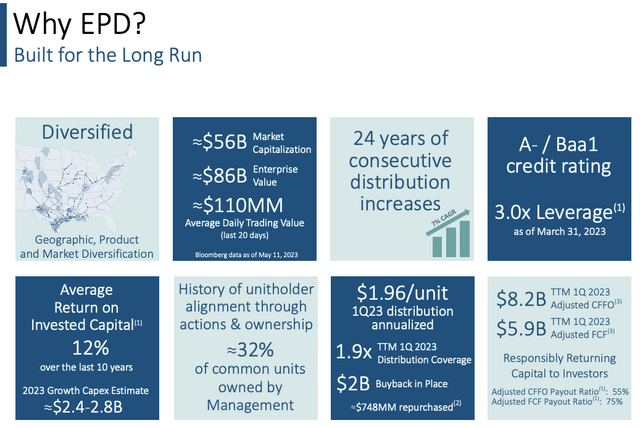

EPD operates as a Limited Partnership within the Energy sector, which as we saw above is one of the lagging sectors through the first half of 2023. EPD has a market cap of $57 billion and over the past 12-months, shares of EPD are up 7%.

As such, EPD has held their own in 2023 in a year when Energy has really struggled, after being the top performing sector in 2022.

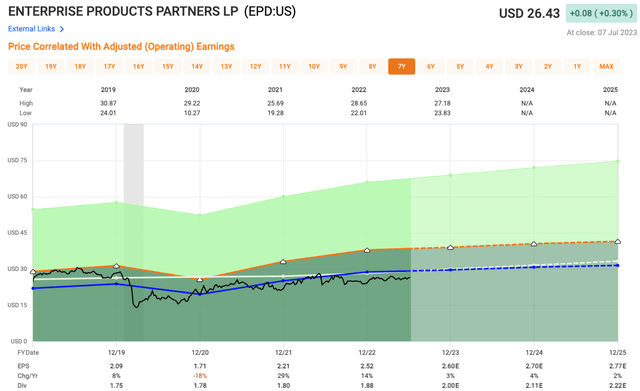

However, over the past decade, the stock has not done anything, actually down nearly 20% over that period, and down 5% over the past 5 years.

Where do things go from here?

Well, there are some things to be excited about for potential shareholders, one being the high dividend yield which we will touch on in a second.

For those unaware, EPD is not an oil driller or producer, instead the company is a midstream energy service in which producers of oil, natural gas and natural gas liquids use to move and store their products. This means that EPD depends less on the actual underlying commodity prices, so it can be much less volatile.

The company has over 50,000 miles of pipeline in the US and has 29 Natural Gas processing plants.

The company does have large capital expenditure budgets, which have eaten into profits, but they are required to maintain the growth of the business. However, the company has done a fine job at increasing its Cash Flow on an annual basis, which helps support their high dividend yield and they sport a high credit rating of A-.

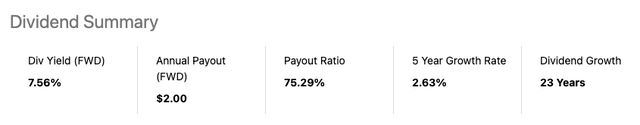

Speaking of the dividend, EPD is on the verge of becoming a Dividend Aristocrat in 2023. The company currently pays an annual dividend of $2.00 per share after recently increasing the dividend by 2%. The stock yields a high dividend yield of 7.6%. The strong and growing FCF more than covers the high dividend.

In terms of valuation, analysts expect 2023 EPS of $2.60 which equates to a P/E of 10.1x. Over the past 5 years, shares have traded at an average P/E multiple of 11.5x, over the past decade closer to 14.5x.

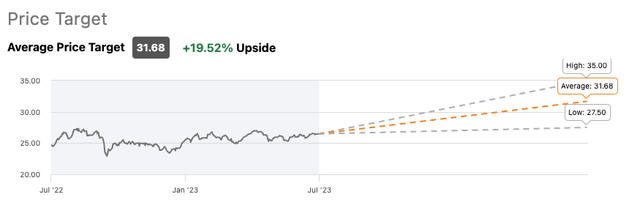

Analysts rate the stock a strong buy with a 12-mo Price Target of $31.68, implying 20% upside from current levels.

Dividend Stock #2 - Bristol-Myers Squibb (BMY)

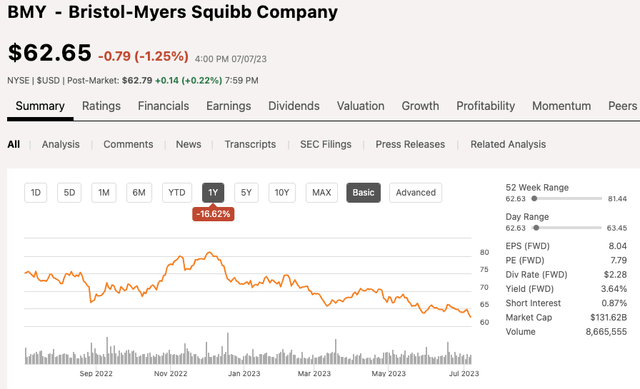

Bristol-Myers Squibb is one of the largest pharmaceutical companies in the US today. The company has a market cap of $132 billion and the stock has fallen 17% over the past year.

Like we saw with EPD and the energy sector, BMY and the health care sector were also an underperforming sector through the first half of the year. However, I expect healthcare to regain some legs in the second half. Now I don't expect huge gains, but the sector has been beaten down pretty badly as investors have largely been focused on "risk-on" assets.

If the economy does slowdown in the second half and we dip into a recession by years end, we could see some defensive posturing from investors, which includes health care stocks like BMY.

Pharmaceutical companies are required to invest heavily in R&D in order to manufacture the next blockbuster drug or else get left in the dust when patents expire. All pharmaceutical companies go through this cycle. Right now, we are seeing the likes of AbbVie (ABBV) go through this with the loss of their patent on Humira at the start of the year.

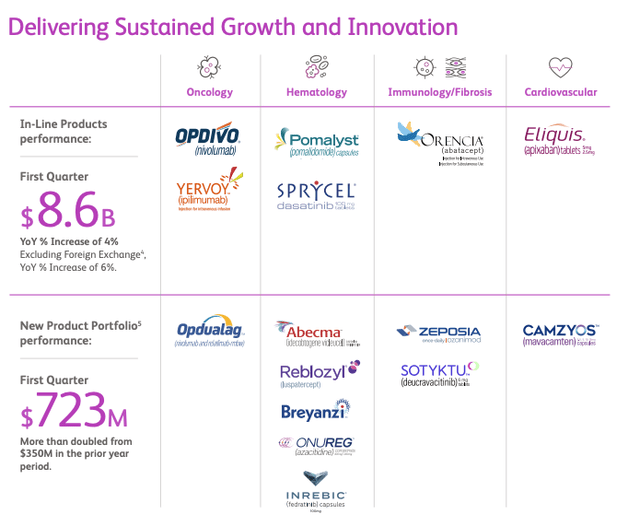

BMY has a loaded pipeline both from organic drugs, meaning they developed the products, but also products that were brought in via acquisition, Celgene being one of the largest acquisitions for BMY in recent years.

During the company’s Q1 results, BMY saw 4% revenue growth from their In-Line products, but it was the growth in new products that nearly doubled year over year. The total amount is still small but the trajectory is positive.

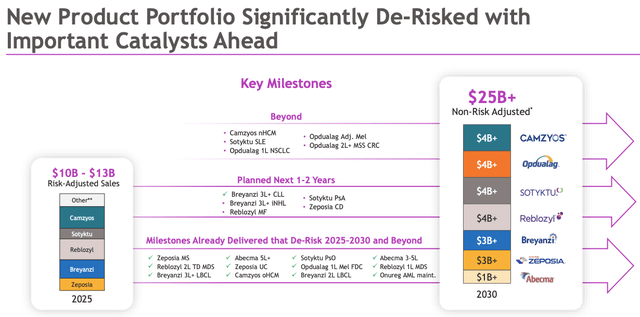

By the year 2030, management believes the New Product Portfolio will be generating more than $25 billion in annual sales.

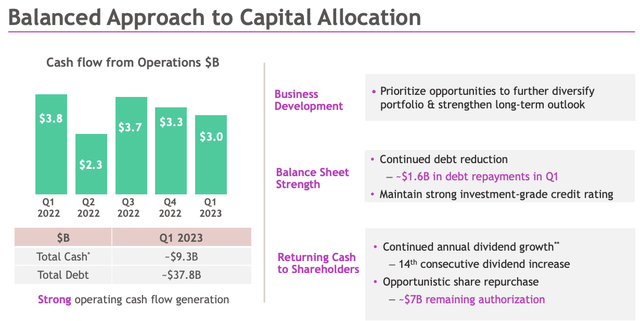

The Celgene acquisition certainly helped bolster the portfolio, but it also brought on a lot of debt, as it was a $90 billion deal. However, the company has generated strong FCF over the years which has been used to fund R&D, paydown debt (they paid $1.6B in Q1 alone), and fund a growing dividend as well as buyback stock.

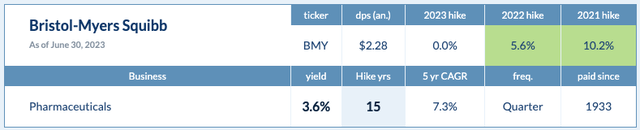

BMY currently pays an annual dividend of $2.28 per share which equates to a dividend yield of 3.6%. In addition, management has increased the dividend for 15 consecutive years and they have a 5-year DGR of 7.3%.

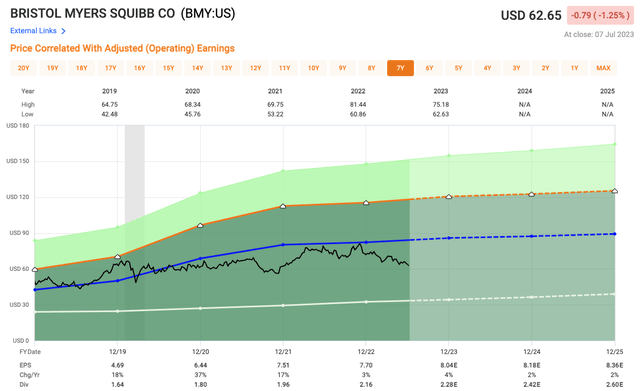

In terms of valuation, analysts are calling for 2023 adjusted EPS of $8.04, which equates to a P/E multiple of 7.8x, which I think is INCREDIBLY low. For comparable purposes, BMY has traded at an average multiple of 10.7x over the past 5 years and closer to 17x over the past decade.

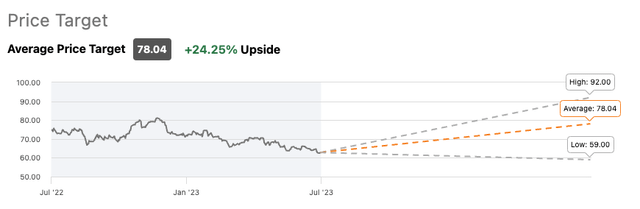

Analysts also believe shares of BMY have some nice upside from current levels as they have an average 12-mo price target of nearly $78 on the stock, implying 24% upside from current levels.

Dividend Stock #3 - Domino’s Pizza (DPZ)

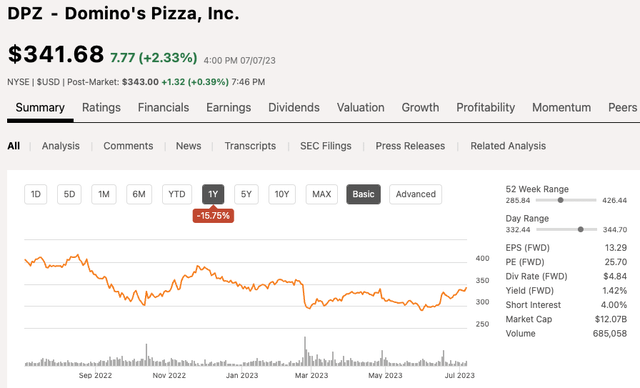

Domino’s is the largest quick serve pizza company on the market today with a $12 billion market cap. Shares of DPZ have fallen 16% over the past 12 months and have largely been flat year to date.

Domino’s operates its pizza business through three segments:

- US Stores

- International Franchise

- Supply Chain

The angle I took on DPZ is not only focused on fundamentals, but also on the likelihood of a slowdown in the economy in the second half. If you think about it, if the economy begins to slow and we start to see unemployment creep higher, what happens? Spending tightens, which means those cheap meal options start to look a little more intriguing.

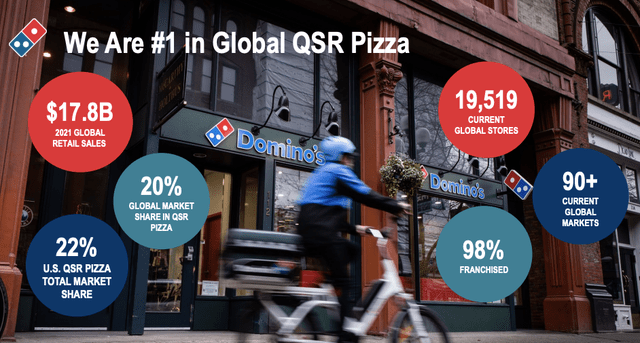

In terms of Quick Serve Pizza, Domino’s is #1 with 20% global market share and 22% US market share.

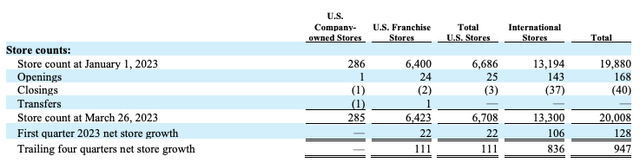

The company has a total of 20,000 stores across 90+ global markets and 99% of those stores are franchised as of the end of 2022.

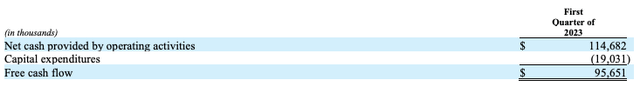

During the first quarter, DPZ generated $95.7 million in FCF, which easily covers the company’s dividend.

High inflation has put margin pressures on the business over the past 12_ months, but with inflation cooling and more favorable comps in the year ahead, things look appealing for Domino’s especially if consumers become more cost conscience in the second half.

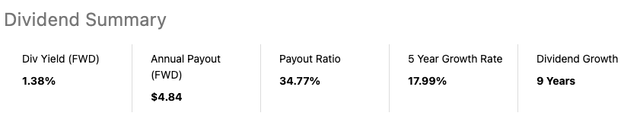

Dominos is known as a dividend growth stock as they have a 5-year DGR of 17.1% and they have been growing the dividend for 10 consecutive years. The company currently yields a low dividend of 1.4%, but as we mentioned, they are growing at a fast clip and buying back shares.

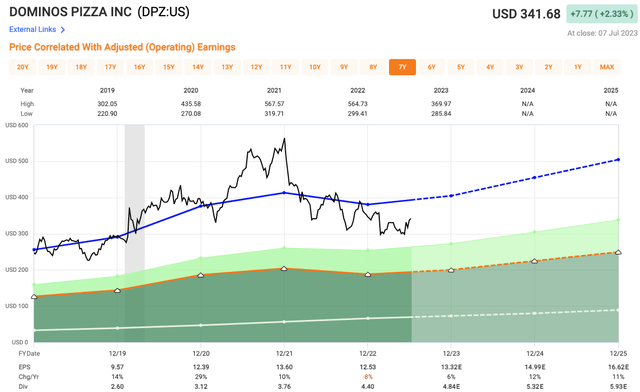

Now for valuation. Analysts are looking for EPS of $13.32 in 2023, which equates to a P/E multiple of 25.5x and over the past 5 years, shares of DPZ have traded at an average multiple of 30.3x and over the past decade closer to an average multiple of 31.5x.

The multiple is much higher than the others we looked at, but that is largely due to the much faster earnings growth the company has and will generate moving forward. When you look at the bottom of this fast graphs chart, you can see just how fast the company has been growing its EPS as well. Analysts are only calling for 6% EPS growth this year but in 2024 and 2025 they are looking for 12% and 11% growth, respectively.

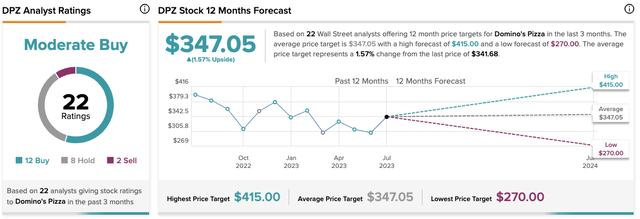

Analysts are more mixed in terms of price target with the average rating being a Moderate Buy but the avg 12-month price target is only $347, which is 1.5% higher than today’s close. One reason for that is what I believe to be the VERY low price target from one analyst who has a $270 PT, meaning they are expecting a more than 20% drop from current levels. If you pull out that rating, there is not another rating below $300, meaning the average PT would jump pretty substantially.

Investor Takeaway

As we saw, the first half performance was great and all, but many sectors did not participate, giving the rally the feel of being more top heavy. Technology companies lead the charge with the Nasdaq pulling out its best start to the first half of a year in four decades.

As such, that provides opportunities in other areas that are trading at great valuations. I believe these three dividend stocks pay safe and growing dividends, but they are also trading at very intriguing valuations setting them up to outperform in the second half of 2023.

In the comments section below, let me know which of these dividend stocks you think will outperform in the second half.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

No marketing to add

This article was written by

Mark Roussin is an active Certified Public Accountant (CPA) in the state of California. Mark has worked as a CPA, serving both public and private Real Estate corporations for over 10 years. Today, he provides his followers insights to both undervalued dividend stocks mixed with high-growth opportunities with a goal of them reaching financial freedom in the long-term. Mark tends to invest primarily in dividend stocks with a strong emphasis on Real Estate Investment Trusts (REITs).

Author of the weekly financial newsletter, "The Dividend Investor's Edge."

Mark has partnered with "iREIT on Alpha”, which is the premiere marketplace service that provides the best daily in-depth REIT research. The service boasts a community of like minded investors that also receive complete access to our various portfolios that you can track in real-time. Come check out all the exclusive content today!

-----------

DISCLAIMER: Mark is not a Registered Investment Advisor or Financial Planner. The Information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. He asks that you perform your own due diligence or seek the advice of a qualified professional. You are responsible for your own investment decisions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BMY, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.