Unpopular Opinion: The Bear Market Is Not Over

Summary

- I do not believe the bear market is over (and yes - my own signals and strategies are currently long equities).

- A bull market is ONLY known with hindsight when you’ve taken out the prior inflation-adjusted high and have officially ended a drawdown.

- Signals I track which historically get ahead of high volatility risk-off conditions are likely to turn soon.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Learn More »

DamianKuzdak

All truth passes through three stages. First, it is ridiculed. Second, it is violently opposed. Third, it is accepted as being self-evident. - Arthur Schopenhauer.

Before I get branded as a “perma-bear,” check the date on the below.

I received a lot of ugly comments from bears back then, with personal attacks continuously made as I loudly and aggressively argued a stock market melt-up was about to take place.

I was right.

And the same vitriol and sentiment I got from the bears in October is happening all over again from the bulls today.

Why?

Because I do not believe the bear market is over (and yes - my own signals and strategies are currently long equities).

Sounds crazy, right?

First – we should properly define what a bull and bear market is.

Twitter

A bull market is NOT about some arbitrary 20% rally off a low.

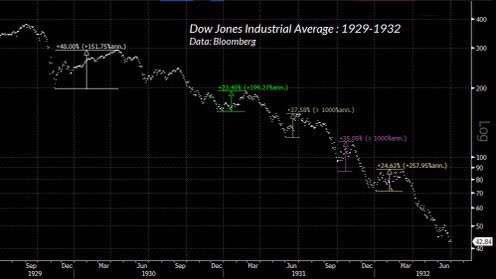

Credit to John Hussman on this, but we can clearly see that bear markets have enormous rallies that make people believe a “new bull market has begun.

John Hussman John Hussman John Hussman

Again – a bull market has NOTHING to do with how much something has gone up or down by.

A bull market is ONLY known with hindsight when you’ve taken out the prior inflation-adjusted high and have officially ended a drawdown. I can not stress this enough. Until you have actually made new highs after inflation, there is no way to know if a bull market actual began or not.

This isn’t about a market call, conditions, being a bull, or being a bear. This is simply about perspective.

I have consistently argued that 2023 would be a melt-up year given the pre-election dynamic, but that a credit event would take place likely later in the year. Nothing has changed. You can be both bullish and bearish at the same time depending on time frame, and the fact of the matter is that my risk-on/off signals outlined in The Lead-Lag Report correctly have been risk-on throughout the bulk of this year’s move in the S&P 500 (SP500).

Why am I so adamant about the bear market not being over?

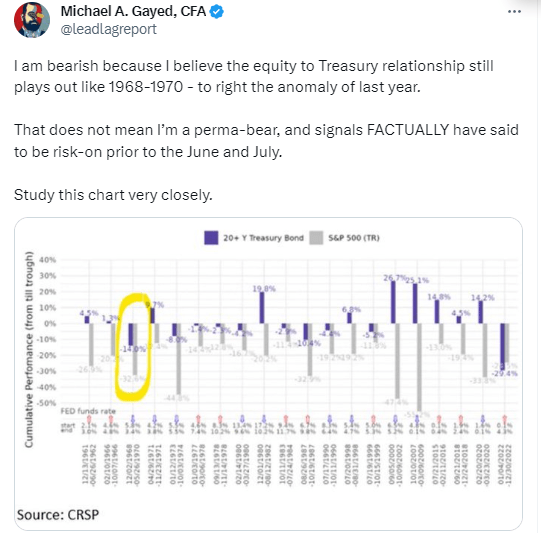

Twitter

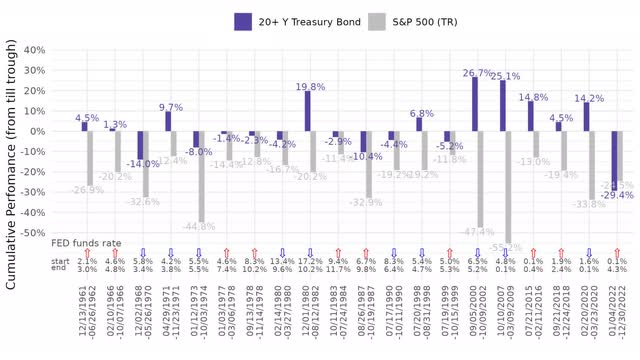

Everything goes back to what I called my “hell” last year, which was the failure of the flight to safety trade in Treasuries (NASDAQ:TLT). The chart above shows the top 20 peak-to-trough drawdowns for the S&P 500 (NYSEARCA:SPY) in gray, with long duration Treasuries (TLT) in purple. It is not my imagination. In 10 out of the 20 biggest declines for the stock market, long duration Treasuries made money (including in periods prior to the 40-year bond bull market). In 9 out of the 20 biggest declines for the stock market, long duration Treasuries fell (as you can see during the 1970s), but fell a lot less, which is fine from a portfolio management perspective.

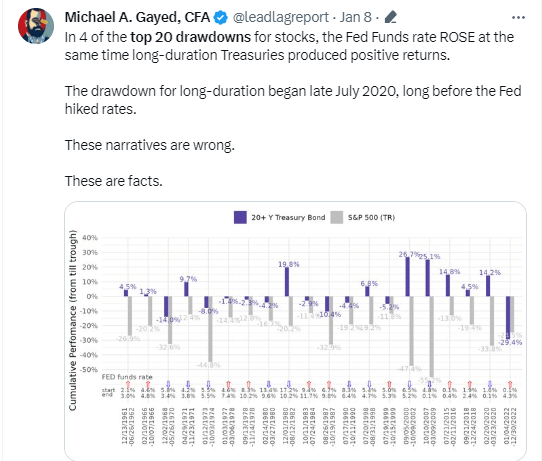

And before you go about saying all this was “obvious,” because the Fed hiked rates, you’re wrong.

Twitter

Last year was the only time in history, long duration Treasuries fell MORE than the broader stock market in a top 20 drawdown for stocks. “One of these is not like the other.” This is precisely why my own rules-based strategies suffered so much last year. But at the same time, maybe Treasuries, in the fullness of the equity drawdown assuming it isn’t over yet, haven’t failed.

Look to 1968-1970 in the chart. Third from the left.

What if the bear market is NOT over, and I’m right that a credit event is still out there? It could very easily play out like 1968-1970, where long duration Treasuries (TLT) were down 14% and the S&P 500 ended its drawdown down 32.6%. The implication on the far right of the chart would be that the S&P 500 breaks the lows of October last year (even slightly), making the gray bar more negative, as Treasuries in purple perhaps this time rally as the move lower is occurring this time (making the purple less negative with hindsight).

Could I be wrong? Of course! I continuously say on Twitter and Threads (which I’m enjoying) that “path matters more than prediction.” Signals I track which historically get ahead of high volatility risk-off conditions are likely to turn soon. Whether an accident happens this time around is only going to be known after the fact. All I know for a fact is that no one can predict the future, and that the bulls are as overconfident today as the bears were overconfident in October last year.

The stock market humbles us all, just not all at once.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (21)

What does that tell me? Should I hide under my bed clutching cash? And why are the author's strategies still long equities while advocating the bear market hypothesis?

TLT being hit more than stocks last year is what happens when inflation puts an end to the Great Moderation and a 40 year fixed income bull market..

As to a credit event, yes, that and hurricanes, earthquakes, asteroids hitting the earth, Putin going nuclear, Bad Moon rising, all that is possible. So what? Actionable conclusion?

Also, please spare us Hussmann's references lol. 23 YEARS of continuous bearishness lol. That's Hussmann, PHD!