ThredUp: Growth Levers In Place

Summary

- ThredUp is well-positioned to capture growth in the US soft lines resale market, which is expected to grow at a CAGR of approximately 30% by 2027.

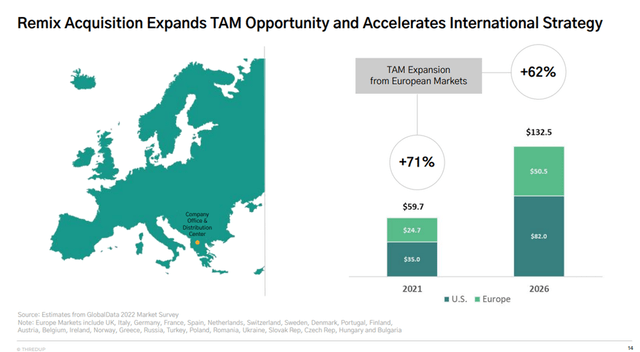

- The acquisition of Remix has expanded ThredUp's total addressable market and provides access to the $24.7 billion European secondhand and resale market.

- The Company's Retail-as-a-Service Strategy provides another revenue stream, with the potential to boost consignment sales in the long term as brands switch their RaaS business to a consignment model.

- I view TDUP stock as a buy and have an end-of-year price target of $3.5 on the stock.

Iryna Imago/iStock via Getty Images

Thesis

I have a positive outlook on ThredUp Inc. (NASDAQ:TDUP) because I believe the company has ample opportunities for growth and possesses a scalable business model that offers competitive advantages and the potential for sustained high-profit margins in the long run. The US softlines resale market will continue to grow at a high double-digit pace, with factors like inflation and a socially conscious Gen Z expected to drive demand. Moreover, the acquisition of Remix has expanded TDUP's total addressable market (TAM) and the company is well-positioned to capture market share as the resale market expands. I view the stock as a buy and have an end-of-year price target of $3.5 on the stock.

Growing resale market amidst a weaking economy

TDUP operates in a relatively small industry, but there is a long runway for industry growth, particularly in the resale sector, which I believe will be the next disruptive force in retail, following e-commerce and off-price retail. This industry aligns with three key macro themes: sustainability, value, and the shift to e-commerce. TDUP expects the US softlines resale market to grow at a CAGR of approximately 30%, reaching $70 billion by 2027, offering upside potential to the company's growth projections. With the acquisition of Remix, the company's TAM has expanded further.

Moreover, increased pressure on consumers due to inflation and a less promotional retail environment in 2023 may strengthen ThredUp's appeal toward value-oriented consumers, in my view. In March, consumer sentiment fell for the first time in four months. Though inventory levels remain elevated, as brands work to clear levels and promotions slow, ThredUp is well positioned to capture share from price-sensitive consumers as the resale market grows. Remix, its European business, may get a boost from the weakening economy in the region.

Remix Offers a Gateway to Europe

ThredUp's expansion into Europe through the acquisition of Remix in 2021 boosted its total addressable market, providing access to the $24.7 billion European secondhand and resale market, which GlobalData suggests could reach $50.5 billion by 2026. Though resale has a greater hold in the US today, $35 billion vs. Europe's $24.7 billion, both markets are estimated to more than double as shoppers worldwide increasingly seek affordable and sustainable options. In 2020, Remix generated $33.9 million in revenue, and this may grow as resale gains popularity in Europe. Leveraging ThredUp's existing marketing, infrastructure, logistics and data science, coupled with shifting Remix to a consignment model that mirrors the US, may improve its gross margin, which has been dilutive since the acquisition.

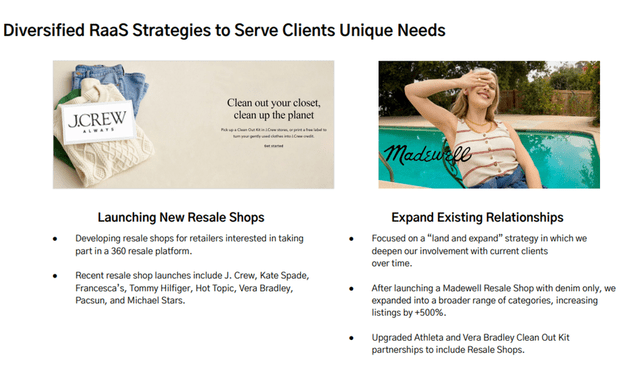

Retail-as-a-Service Strategy Brings Fresh Sales

Bringing resale to brand names through its Retail-as-a-Service Strategy (RaaS) offering provides another revenue stream to stretch ThredUp's reach, increase product availability on its platform and boost customer options. ThredUp had 42 brands on its RaaS platform by the end of 2022, after reaching 28 in 2021, including Walmart, Adidas and Reformation. In 1Q, it launched with Kate Spade and H&M and in 2022, it expanded its Madewell resale shop into 15 categories outside of denim, which saw listings grow by more than 500%. Brands can distribute ThredUp's cleanout kits and allow sellers to earn credit at the clothing line or use ThredUp's white-label resale shops, a more comprehensive approach where the company handles clothing intake, processing and fulfillment for a brand's own online-resale platform.

Widening ThredUp's RaaS client base, coupled with transforming existing partnerships from cleanout programs to branded online resale shops, can boost consignment sales in the long term as brands switch their RaaS business to a consignment model. ThredUp's European and RaaS businesses currently fall under product revenue but will soon shift toward the consignment model, which may boost such sales growth by double digits and aid margin. As more clients add resale shops to their e-commerce sites, ThredUp will also receive a percentage of those sales, vs. just receiving a one-time integration fee, service charges and usage-based pricing from brands that only have cleanout programs.

Gen Z to Drive Demand in Resale Market

As younger generations (Gen Y and Z) become a larger proportion of US consumers, there is an opportunity for secondhand-apparel retailers to gain a greater market share. These younger demographics tend to prioritize environmental consciousness, leading to increased adoption of purchasing used products. According to a GlobalData survey, 53% of millennials and Gen Z plan to spend more on secondhand purchases in the next five years. Millennials, who surpassed baby boomers in 2020 to become the largest adult group in America, have substantial spending power exceeding $600 billion, as reported by Accenture and BLS. Gen Z, comprising 20% of the US population and influencing $600 billion in family spending, is estimated to have buying power of $143 billion, according to Barkley.

Financial Outlook

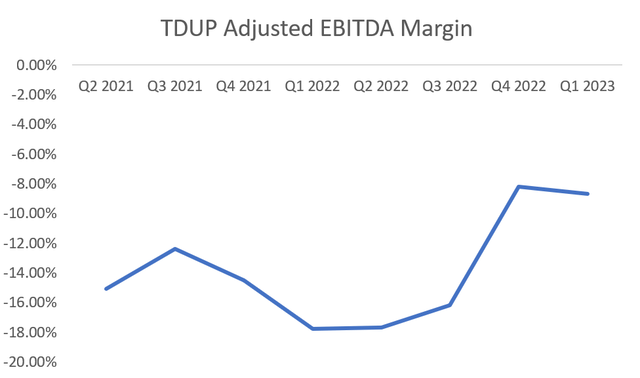

Like other newly public e-commerce companies that are currently not profitable, a crucial question is when TDUP will achieve profitability. The answer to this question primarily depends on number of orders, per-order profitability and the fixed costs associated with the business. TDUP anticipates significant improvements in per-order profitability, primarily driven by automation, and expects strong order growth to continue. Consequently, the management sees the possibility of achieving adjusted EBITDA profitability by FY24E, with an optimistic scenario suggesting breakeven in the second half of 2023. In the long term, the company aims for an adjusted EBITDA margin of 20-25%.

I believe ThredUp's sales may accelerate in 2Q after lingering 1Q promotional challenges, and there's potential to reach breakeven EBITDA in 3Q ahead of its 2H goal, given its ability to take share in a resale market it projects can grow much faster vs. broader apparel. It's clean-out kit fee, new distribution centers, growth in Resale as a Service, and consumer thrift may spur high-single-digit sales growth in 2023.

Path to Profitability

Unlike many popular consumer internet companies that have experienced a decline in growth and shrinking profit margins due to rising costs of production, labor, and other inputs, TDUP has consistently improved its unit economics in recent years. This has resulted in a record-high gross margin of 74.5% in the most recent quarter in the US market. Although the company has been shifting its focus towards Europe, which has temporarily affected the visibility of its cost-saving efforts, management is confident that these measures will drive profitability as buyer and revenue growth recover, especially in the US. Despite the progress made so far in improving the cost structure, I believe there is still room for further gross margin expansion, particularly as more of the business transitions to consignment, and the European market expands.

Moreover, ThredUp has been testing charging a standard $14.99 clean-out fee, which may help combat growing processing costs for used clothing. Though ThredUp has a history of experimenting with these fees, if it sticks with this level across its platform, the company could see positive EBITDA in 2H or early next year. Longer term, the additional fee, which flows straight to the bottom line, could make it easier for ThredUp to reach its targets for 75-78% gross margin and 20-25% adjusted EBITDA margin. In 2021, ThredUp processed more than 2 million Clean Out Kits and facilitated the resale of more than 1.7 million items through their resale-as-a-service model to date. This, along with lower headcount, R&D expenses, and capital spending, is aiding free cash flow growth.

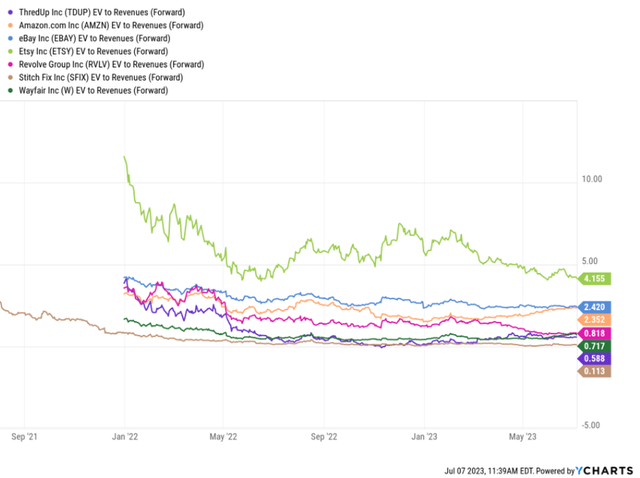

Valuation

For comparable company relative valuation purposes, I separate e-commerce marketplaces and apparel & retail e-commerce into two distinct buckets. The marketplaces are generally trading at a significant premium to retail e-comm on both forward revenue and GP. Some of this is structural, given the asset-light, low/no inventory risk, and generally more attractive margin profiles (as a % of revenue). There is also a component that reflects category exposure - more discretionary areas such as apparel have been particularly hard hit from a stock performance and multiple perspective, while marketplaces that have sufficient scale and/or serve a wider range of categories have held up better. Also embedded in these rev/GP multiples is some consideration for EBITDA/FCF profitability or the lack thereof, as most investors have been increasingly migrating towards more traditional valuation metrics such as FCF yield or EBITDA multiples. In the absence of operating or cash flow profitability, a lower revenue/GP multiple is probably warranted, in my view.

Because TDUP is not yet profitable, valuation is less straight-forward than it is for many other companies (i.e., traditional P/E and EV/EBITDA metrics are not applicable), thus, I think it is most appropriate to value TDUP using an EV/Sales multiple. My end-of-year price target of $3.5 is based on 1x FY24E revenue-roughly in line with marketplace peers.

Risks to Rating

There are several risks associated with investing in TDUP. Firstly, the company is currently unprofitable and needs to increase its profit margin in order to reach breakeven or become profitable. The management has laid out a path to profitability according to which the company is forecasted to achieve EBITDA profitability by FY24. However, any delays in the company's achievement of profitability would put pressure on the stock to the downside. Moreover, the company does face competition from other sellers, which could affect growth. While TDUP is currently the only managed marketplace for mass apparel, there are competitors operating a peer-to-peer model that could present competitive challenges for TDUP. This could negatively impact the company's growth if sellers and buyers choose these alternative platforms instead.

Conclusion

I believe TDUP is well-positioned to maintain its leadership in the online resale market for apparel due to its robust user base and a user-friendly experience with minimal obstacles. The acquisition of Remix has expanded TDUP's TAM, and the company is well-positioned to capture market share as the resale market expands. I view the stock as a buy and have an end-of-year price target of $3.5 on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.