DIVO: Enhanced Yield In A Prudent Manner

Summary

- The Amplify CWP Enhanced Dividend Income ETF tracks 20-30 large-cap, high dividend stocks and uses a covered call strategy to aim for solid total returns.

- DIVO correlates strongly with the S&P 500, but tends to lag behind in strong upward markets and better resists drops, due to its different stock selection process and covered call strategy.

- DIVO offers a 4.3% monthly dividend yield, making it attractive for investors seeking exposure to market risk and reward characteristics with improved dividend yield and some downside protection.

bpawesome

The Amplify CWP Enhanced Dividend Income ETF (NYSEARCA:DIVO) is an actively managed ETF, which tracks the performance of 20 to 30 large-cap and high dividend paying stocks with an aim to produce solid levels of total return on a risk-adjusted basis. An important nuance, which DIVO incorporates in its asset allocation policy is the covered call strategy, which is devised on a tactical basis.

We can think of DIVO as an investment which strongly correlates to the S&P 500 provided that there are no major volatility spikes in the market.

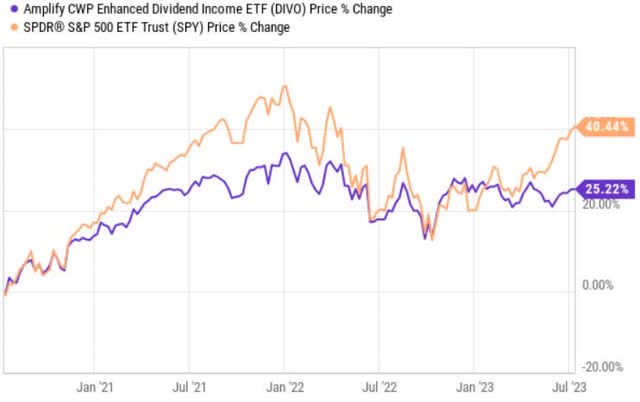

The chart above depicting the 3-year historical performance of the S&P 500 and DIVO captures the essence perfectly. Whenever the market exhibited a strong upward momentum, DIVO lagged behind by providing relatively lower returns. At the same time, when the market started to drop, DIVO resisted and stood flat (e.g., from January to July in 2022).

Currently, we are seeing a very similar pattern, where since the beginning of 2023, the market has been ticking higher in a notable fashion, while DIVO has traded sideways.

There are two main reasons for this divergence.

First is the difference between how the S&P 500 selects, weighs and tracks the performance of its underlying constituents, and how DIVO approaches the overall stock selection process. Although DIVO picks the same large-cap stocks, which are included in the S&P 500, the fact that there are only 20-30 stocks creates inherent deviations both from the sector and stock specific allocation perspective.

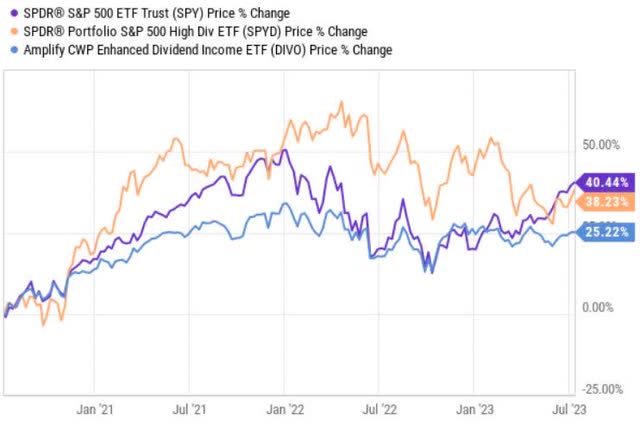

However, as it can be seen in the chart above, DIVO's skew towards more higher yielding S&P 500 stocks does not really explain the difference between the performance of DIVO and S&P 500. In fact, the SPDR Portfolio S&P 500 High Dividend ETF (SPYD), which also carries a more pronounced exposure to relatively high yielding stocks, has moved in tandem with the classical S&P 500, but in a higher beta manner.

Second, which is the key driver of the delta between DIVO and S&P 500, is the notion of a covered call strategy. DIVO writes covered calls on a tactical basis and only on selected stocks (i.e., not on an index basis). This means that the beta exposure is only partially capped by the short positions in the options, which, in turn, warrants higher upside potential via the capital appreciation component as well. At the same time, it implies that DIVO is structurally set to register lower volatility levels than the S&P 500, while providing enhanced yield from the pocketed call premiums.

However, as of now, DIVO has assumed covered calls on only 3 of its holdings accounting for ~ 11% of the total portfolio value. Here we can see the effects from active management, where currently it seems that the Management has decided to have a relatively high exposure to the overall market risk.

Investment case

DIVO offers ~ 4.3% in monthly dividends, which from the historical perspective can be deemed attractive.

Granted, if we compare the yield against the levels of current income that are offered by the U.S. T-bills or Treasuries, the story becomes not that attractive.

In my opinion, DIVO should be considered by investors, who seek to maintain an exposure towards the overall market risk and reward characteristics (i.e., the S&P 500), but with an improved dividend yield and some downside protection.

At the prevailing price levels of the S&P 500 and DIVO, there is a favorable spread in the dividend yield offered by the Fund - i.e., spread of ~ 280 basis points. The corresponding yield is underpinned by strong fundamentals as the underlying investments are of a blue-chip nature and spread across 10 different industries with no industry exceeding 17% exposure. Plus, a notable contribution to DIVO's yield stems from the pocketed call premiums, which per definition offer "riskless" (or very close to that) streams of income.

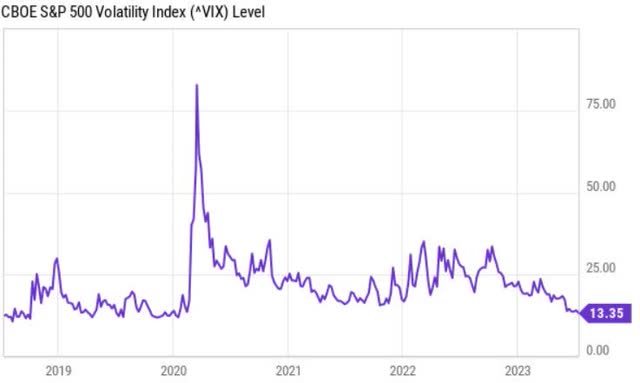

With that being said, we have to remember that the VIX is trading at rather depressed levels implying cheapness in the option premiums. Had the VIX been higher and the overall notional exposure towards the covered calls within DIVO's portfolio more pronounced, the premiums would have been more juicy resulting in a more attractive yield spread relative to the S&P 500.

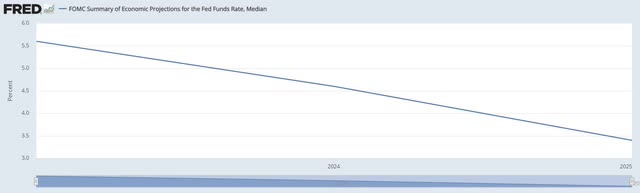

The current characteristics of DIVO's portfolio that are associated with the partial hedging, however, goes hand in hand with the increased potential to participate in the market rally that would be initiated by the normalization of the interest rates. For example, looking at the FOMC expectation on the future interest rates, it is clear that sooner or later there will be a convergence towards lower yield territory. This entails a considerable probability of experiencing a notable rally in the equity markets.

Furthermore, the fact that DIVO has assumed several covered call positions inherently provides certain downside protection in case the markets experience notable downside volatility (e.g., due to a further deterioration in the PMI data, spiking inflation etc.). Looking at the historical performance of DIVO, it is clear how the protection element has indeed introduced a resistance to the downside corrections.

Bottom line

DIVO is a solid investment for investors, who seek long exposure towards the market (i.e., beta factor) in a manner which offers less volatile returns and more higher yielding dividends that are underpinned by strong fundamentals (e.g., no external leverage).

DIVO, however, should not be viewed as an investment which could deliver alpha in the scenario of upwards trending markets. It should also not be viewed as a pure play protection mechanism during declining equity markets since the current covered call strategy does not encompass a significant part of the portfolio.

In essence, DIVO is an attractive bet for investors, who expect the S&P 500 to slowly but surely increase in value or trade sideways.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.