Ford Motor Has A Target On Its Back As Contentious Auto Labor Talks Unfold In Detroit

Summary

- The United Auto Workers (UAW) union has begun labor negotiations with the Detroit Three automakers, including Ford, which could be the strike target.

- Ford's labor costs are reportedly $1 billion higher annually than General Motors and Stellantis, due to differences such as the number of vehicles imported from overseas plants.

- The UAW's negotiating strategy could include increasing the number of union jobs at GM and Stellantis, rather than allowing Ford to reduce its cost disadvantage.

Mustang Mach E Shown Nation"s Capital Alex Wong/Getty Images News

Labor negotiations among the Detroit Three automakers and the United Auto Workers union are never easy. This year's talks, which just began inauspiciously toward a mid-September expiration of a four-year contract, look especially perilous - with a strong possibility that Ford Motor Co. (NYSE:F) could find itself the worst off.

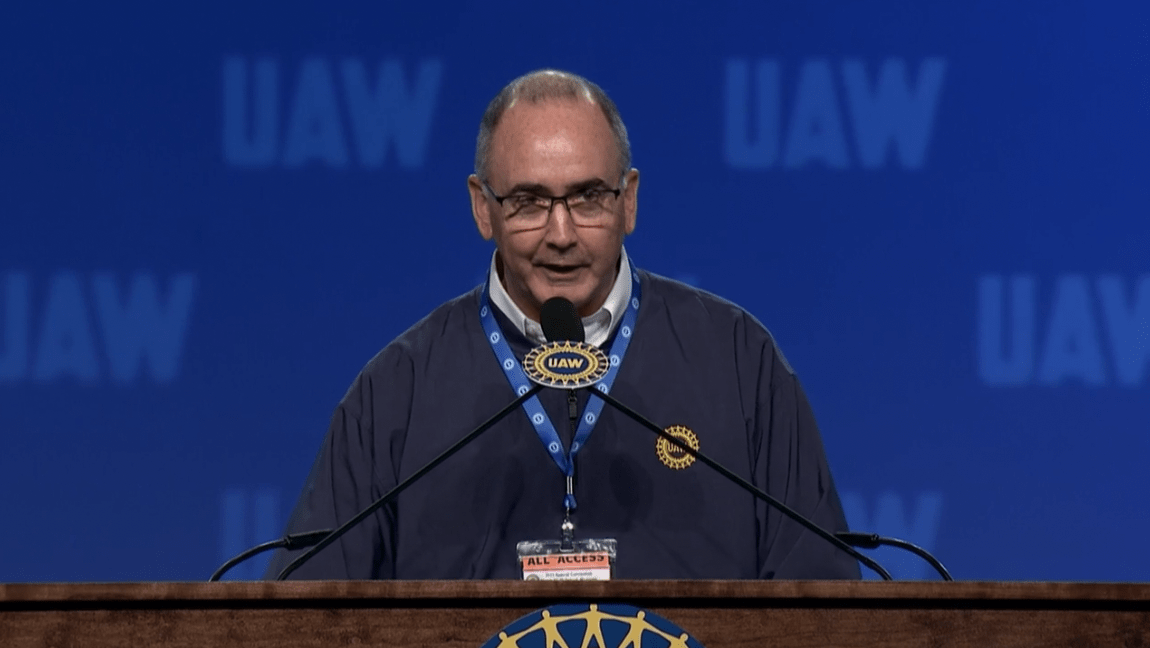

Newly-elected UAW president Sean Fain in March said "we're here to come together to ready ourselves for the war against the one and only true enemy: Multi-billion dollar corporations and employers who refuse to give our members their fair share," Fain said to members. "It's a new day in the UAW."

Shawn Fain, UAW President (UAW)

While it's true that labor talks normally feature hyperbolic rhetoric from the union, designed to fire up members who might be asked to walk off their jobs, the bitterness this year prompted Bill Ford Jr. to respond publicly. Ford took particular umbrage at a statement from a UAW vice president disputing that Ford's workforce constituted a "family."

"I disagree"

"That's just wrong," Ford was quoted in Automotive News, speaking at the sidelines of an event announcing a disaster relief fund. "I was just at (Ford's) Kentucky Truck Plant and met with a whole room of multi-generational employees. We are a family company, despite what anybody says."

"The day that our employees are considered my enemy is the day I'll retire," Ford said. "The head of the UAW may consider us his enemy, but I'll never consider our employees our enemy."

The already-bitter atmosphere turned more nasty when the UAW declined to participate in the traditional ceremonial handshake between company and union officials that marks the beginning of negotiations, which began Wednesday.

In the past, the UAW has traditionally selected one from among Ford, General Motors Co. (GM) and Stellantis N.V. (STLA) (now including Chrysler), as its negotiating or "strike target." Once an agreement is reached, it becomes the basis for similar agreements with the remaining two automakers.

Wasted capital

In 2019, the UAW rejected a proposed contract from GM and launched a 40-day strike that cost the automaker upwards of $3 billion. When the strike was settled, the UAW accepted a contract that was largely identical to the one it first rejected.

This year, the sides will contend over a number of issues including wages and the union's demand that cost of living allowances (COLA) be restored to worker paychecks. Earlier, the union agreed to accept profit-sharing bonuses in lieu of COLA. The industry also will try to resolve looming questions about pay and staffing for plants that build battery electrics (BEVs).

In principle, the three automakers should have roughly similar labor costs resulting from comparable contracts with the union. Because of differences such as the number of vehicles imported from overseas plants, labor costs can vary widely. This week, Automotive News reported that sources at Ford peg the company's labor cost disadvantage at about $1 billion annually, compared with GM and Stellantis.

Notes from Automotive News:

Ford employs roughly 57,000 union workers in the U.S., about 11,000 more than GM and 16,500 more than Stellantis. It has created or retained 14,000 UAW jobs - 5,600 more than it had committed to - since signing its current contract with the union in 2019.

Presumably, the union's negotiating strategy could include proposed contract provisions increasing the number of union jobs at GM and Stellantis - rather than creating parity by granting Ford flexibility to redress its cost disadvantage.

With Ford committing $50 billion in investments through 2026 toward "all in" status for BEVs - and Q1 2023 liquidity (net of debt) standing at $9 billion, compared with $16.1 billion at Q4 2021 - the automaker can ill afford to take a strike like the one GM suffered in 2019.

Fresh cash

In late June Ford announced a loan agreement with the U.S. Department of Energy for $9.2 billion as part of the Biden administration's push to accelerate production and sales of BEVs. Ford and its South Korean joint venture partner, SK ON, intend to use the money for the construction of three battery plants, two in Kentucky and one in Tennessee.

For the time being, Ford's BEV operations are producing losses, which isn't unexpected since the new technology hasn't yet been embraced by a broad swath of consumers. Concerns about price, battery range and charger availability have been hurdles to sales. Ford recently reached an agreement with Tesla Inc. (TSLA) that will allow Ford models to be charged at Tesla stations.

Meantime, disquieting reports indicate that unsold BEV models are beginning to pile up, posing another potential difficulty for Ford and other BEV producers facing pressure to cut prices. Axios, citing research from Cox Automotive:

Particulars: The nationwide supply of EVs in stock has grown nearly 350% this year, to more than 92,000 units.

- That's a 92-day supply - roughly three months' worth of EVs, and nearly twice the industry average.

- For comparison, dealers have a relatively low 54 days' worth of gas-powered vehicles in inventory as they rebound from pandemic-related supply chain interruptions.

- In normal times, there's usually a 70-day supply.

- Cox's inventory data doesn't include Tesla, which sells direct to consumers.

EV glut?

An analysis by Autoblog noted that Ford dealers are selling fewer Mustang Mach Es and Ford F150 Lightnings than they were a year ago and that inventories of those BEVs are larger than a year ago.

Per Autoblog: "Ford dealers were able to sell 86.4% of their Mach-E inventory within 30 days in the second quarter of 2022, but that figure - known as a turn rate - dropped to 27.7% in the same period of 2023 even as the automaker had over twice as much inventory on the market, according to data from analytics firm Cloud Theory."

Ford's EV sales during the second quarter fell 2.8%, to 14,843 vehicles, as supplies of the Mach-E were short amid an overhaul of the factory that makes the EV. Ford said it's revamping that plant to increase production of the Mach-E during the quarter, which should result in stronger sales.

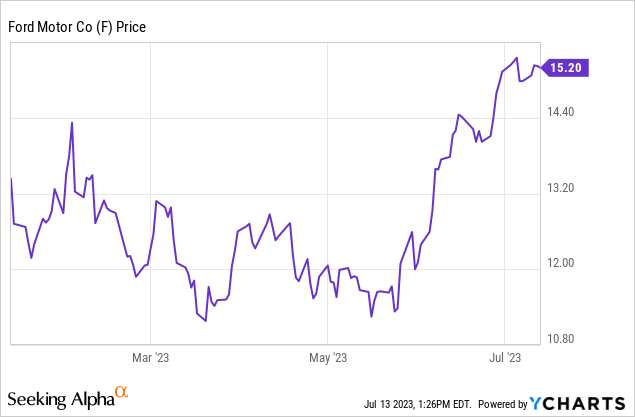

Since late May, Ford shares have made a sustained move higher outpacing the major indices. For short-term traders, any time between now and the middle of September, when the UAW contract, expires would present a good opportunity to take profit.

There's no telling who the UAW will pick as its strike target. Sometimes the UAW goes with the financially strongest of the three, using the logic that it can afford the richest contract, which then dictates to the others what they must pay. On the other hand, this time Ford may have sealed its fate by publicly contradicting the UAW's posturing.

With a bit of luck, the UAW rhetoric, in the end, will prove overblown, allowing the industry - and Ford specifically - to avoid a bruising labor stoppage that would simply burn capital to no one's obvious benefit. Hold Ford shares.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.