Unveiling Carvana's Surge (Rating Downgrade)

Summary

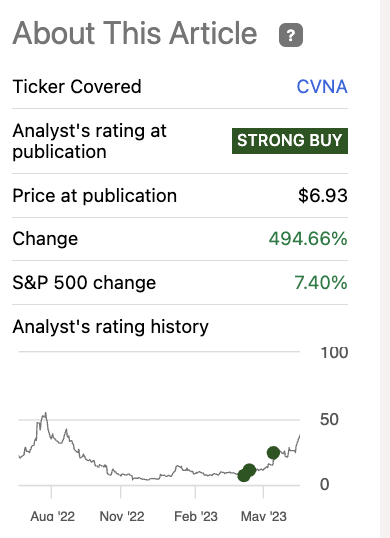

- Carvana's stock has surged by 500% since May 2023, with the company now boasting a market capitalization of $8 billion. Congratulations to all who joined the ride.

- While some media outlets attribute this surge to a short squeeze, we believe there are other significant factors at play.

- Furthermore, we will discuss what actions shareholders should take and what they should keep an eye on when the stock price reaches the desired target.

skynesher/E+ via Getty Images

Recap

Lately, our undivided attention has been fixated on Carvana (NYSE:CVNA), a company that has been the central focus of three of our recent articles within the past sixty days. It is a rare occurrence for us to shine such a bright spotlight on a single stock with such remarkable frequency. Nevertheless, Carvana's stock has experienced an astounding surge, soaring by a staggering 500% since our initial coverage on the first day of May 2023. This extraordinary leap compels us to provide a long-awaited update to our esteemed investors.

Seeking Alpha

Carvana, once a victim of bankruptcy, has now blossomed into a formidable entity, boasting an impressive market capitalization of $8 billion. To those skeptical individuals who might dismiss this as a mere short squeeze, we extend a warm welcome to the world of possibilities. However, we must clarify that our investment philosophy does not rely solely on market sentiment or the predictive behaviors of other investors. Even financials, which some deem paramount, are merely echoes of past performance from our perspective.

While our discussions may occasionally veer towards dissecting the business model, it is not the sole focus of our endeavors. We firmly believe that investment is a multifaceted tapestry woven from various threads—the consumer, the business model, and the management. It is a long and winding journey, and what investors perceive today is merely a fleeting moment along this path.

For us, among these three vital components, the consumer's perspective reigns supreme. Their thoughts, needs, and satisfaction hold true significance. Ultimately, they are the lifeblood of any business—the driving force behind its triumph or downfall. Therefore, let us keep our eyes on the road and our hands on the wheel as we navigate the intricate highways of investment, always considering the pulse of the consumer.

Consumer feedbacks matter the most

In the realm of investment, the voice of the consumer rings loudest.

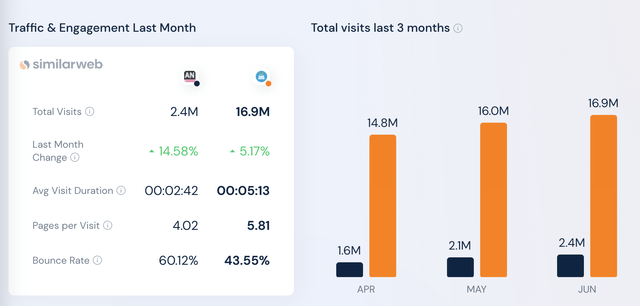

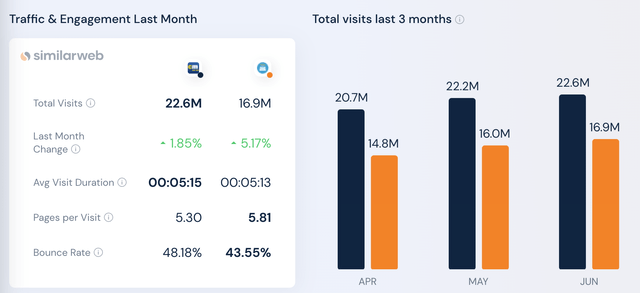

Carvana, a name that has stirred up a whirlwind of questions among investors, stands tall amidst the storm. A beacon in the vast digital sea, its website has carved out a significant place for itself. According to SimilarWeb, it's the seventh most visited site in the vehicle category in the United States, rubbing shoulders with the likes of Carmax.com.

SimiliarWeb

The numbers speak volumes. A staggering 16.9 million user visits. An engagement rate that overshadows Carmax.com, as evidenced by a lower bounce rate. A digital footprint that leaves even AutoNation (NYSE:AN), one of the largest used car dealerships, in the dust. These metrics are a testament to Carvana's appeal, shattering the misconception that it caters only to subprime consumers.

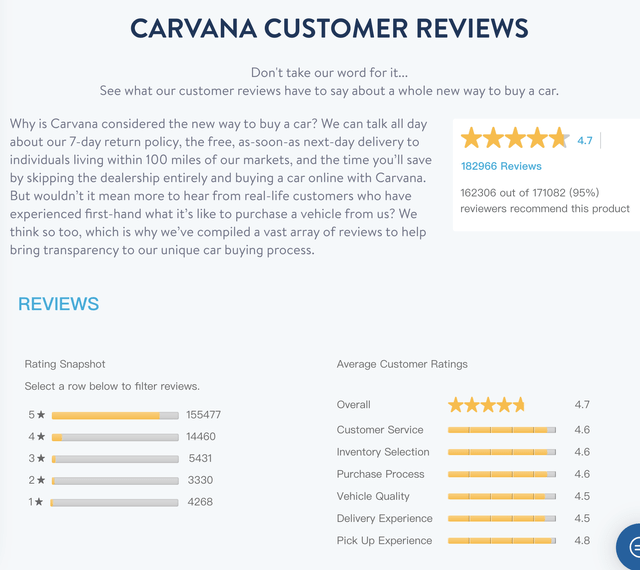

But let's not gloss over the bumps in the road. The customer reviews on Carvana's website paint a picture that isn't all rosy. Complaints about the delivery process and the condition of the cars not matching the advertisements are not uncommon. Yet, it's crucial to remember that every coin has two sides. Indeed, there are grievances. But there's also a chorus of satisfied customers who are thrilled with their purchases. Based on 182966 reviews, the consumer gave it an overall rating of 4.7.

In our opinion, the 7-day free return policy is a safety net, a reassurance that the customer's satisfaction is paramount. It's a reminder that they're buying used cars, not new ones. The option to discontinue the purchase within this period is a fair practice that balances the scales.

So, while the negative reviews about delivery and car conditions are not to be dismissed, they don't overshadow the positive experiences. The chorus of happy customers is louder, and that's what we're tuning into. The consumer feedback, the pulse we've been monitoring, tells us that Carvana is popular. Hence, we're not particularly worried.

What's the driving force behind the recent surge in stock prices?

In a recent update, Carvana shared its Q2 financial metrics, revealing a remarkable milestone. The GPU sales soared to an all-time high of $6000 during the second quarter, leading to a surge in the company's stock value.

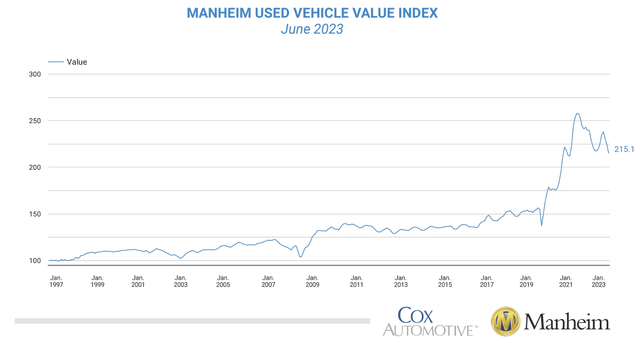

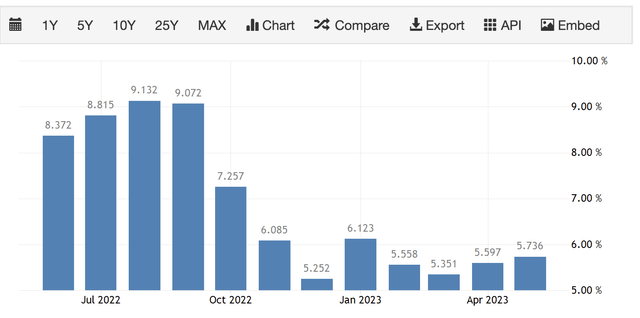

The news triggered a 20% surge in stock prices on the day of the announcement. Since July 6, the stock has continued its upward trajectory, skyrocketing by an additional 62%. While some media outlets attribute this surge to a short squeeze, we believe there are other significant factors at play. The primary driver behind the stock's upward movement is the substantial drop in used car prices in June.

According to Manheim, wholesale used-vehicle prices experienced a significant decline in June. On a mix, mileage, and seasonally adjusted basis, prices dropped by 4.2% compared to May. This decline is one of the largest in the history of the Manheim Used Vehicle Value Index (MUVVI) and the most significant drop since the beginning of the pandemic in April 2020 when the index plunged by 11.4%. Cox Automotive's Senior Manager of Economic and Industry Insights, Chris Frey, commented on the situation, highlighting the magnitude of the decrease.

Despite predicting a decline in used car sales during Q2 in its previous earnings call, Carvana acknowledged that the current high prices of used cars have been affecting demand. The drop in Manheim's index serves as a catalyst for the stock surge, indicating a potential resurgence in demand as a result of the decline in used car prices. Although used car prices remain elevated, recent wage growth data of 5.7% suggests an increase in used car affordability.

The investor has to understand how the stock performs during a turnaround:

Increased profitability will help the business first avoid bankruptcy value. As it returns to a growth-oriented stage, the stock price will increase even more.

What investor should do?

Here's what investors should do when a share approaches the target price:

Investors should revisit two key aspects: the company's competitive advantage and its moat. If the answers to these two questions are yes, then it's important to evaluate whether there is evidence to support the stock's potential to achieve the next price target.

It's important to note that our initial target price was based on a 5% market penetration assumption of the 40 million U.S. used car market using a DCF model. To trigger the stock to go higher, the company needs to demonstrate its capability to increase its market penetration above 5%.

(1) Competitive advantage

In our analysis, we believe the company possesses a competitive advantage due to its transparent pricing. Following the acquisition of ADESA, the company has significantly enhanced its ability to liquidate outdated inventory through ADESA's wholesale marketplace. This further strengthens its competitive advantage in terms of transparent pricing.

The viability of its business model is another factor to consider when assessing its competitive advantage.

Due to its low 1% penetration, the company is now operating at a loss. For the company to become more profitable, each market penetration needs to grow.

Cohort data provided by the company, cited from our original analysis, showed a reduction in advertising expenses from $3,749 per unit in newer cohorts to as low as $440 per unit in older cohorts. This suggests that the older and newer cohorts exhibit distinct profitability profiles and that Carvana is still in the early stages of its growth, with 2021 marking just the beginning.

(2) Moat

In our assessment, the company has established a moat through its online marketplace, which eliminates the need for salespersons and reduces occupancy costs, securing a cost leadership position to fend off competition.

Moreover, given the company's strong online presence, it enjoys a consumer traffic advantage compared to traditional used car dealerships like AutoNation.

While the company's online traffic may be lower than that of CarMax (NYSE:KMX), we believe it poses no significant threat at this stage for two reasons: first, the company only has a 1% market penetration, and the used car market remains fragmented; second, CarMax still relies on physical presence, incurring additional costs compared to Carvana. In the long run, we envision Carvana's ideal business model as selling cars to retail consumers at highly competitive prices to expand its addressable market, increase consumer traffic, and generate profits through loans and the wholesale market. By doing so, the company will have the opportunity to challenge CarMax in terms of unit sales and solidify its position as a scale leader, further strengthening its moat.

Improving consumer traffics

In fact, the company has demonstrated continuous growth in website traffic over the past three months, with a growth rate surpassing that of CarMax. These positive trends are promising indicators.

Stabilizing industry conditions

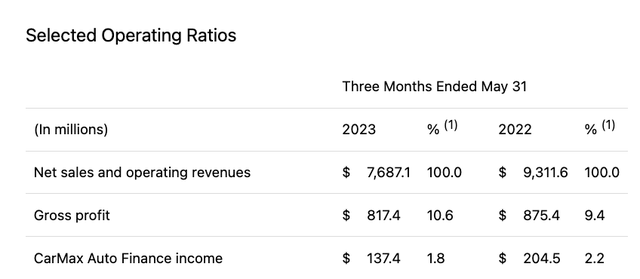

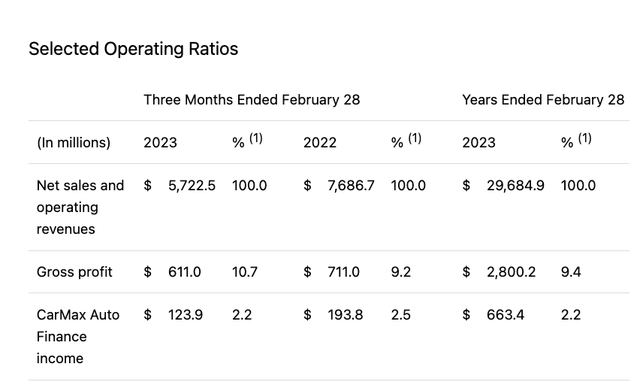

CarMax announced its Q1 2024 (March-May) results on June 28, 2023. By looking at CarMax's earnings report, we may get a head start on the industry conditions.

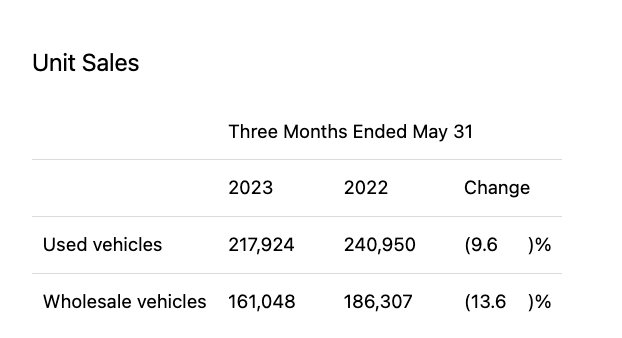

CarMax once again enhanced its use of car unit sale growth in its Q1 2024 earnings release. Retail used car unit sales at CarMax are down 9.6%, which is an improvement from the Q4 2023 decline of 12.6%.

Q1 2024 (CarMax)

In the first quarter of 2024, its gross profit per unit rose 1% over the prior year. Additionally, its financial income dropped 33% in the quarter, a better result than the 37% drop in Q4 2023. As a result, we think that the used automobile market in the United States is actually running better and stabilizing, which is good for Carvana. However, we think there is space for improvement if the cost of used cars in July 2023 falls even lower.

We believe that the financial situation of Carvana was likely to improve in Q2 and Q3 2023 based on the analysis above. For the stock to move higher from its current level, we believe the company must return to unit growth.

Summary

Once more, before purchasing this stock, investors should take their risk tolerance into account.

As a result of the stock's impressive run and the fact that it is now close to our initial price target, we urge investors to simply trim their positions until there is more proof that it can achieve penetration rates greater than 5%.

We think trimming to a smaller position exposure rather than liquidating them is the best strategy to invest in this stock because we feel that if the firm restarts growing, there will be an opportunity for profit. The company still receives great consumer feedback, a strong competitive edge, and a moat. We have a "buy" recommendation for the stock.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVNA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.