United Homes Group: A Housing Market Slowdown Can Weaken Performance Further

Summary

- United Homes Group's stock price has halved since its successful SPAC listing earlier this year, prompting questions about its future growth.

- Despite robust growth in previous years, the company's latest financials show a slowdown in the housing market, with a 12.5% decline in revenue and a decrease in net new orders.

- While the company expects improved margins based on recent sales figures and controlled lumber prices, the overall weakness in the housing market suggests caution is needed before investing in the stock.

- Looking for more investing ideas like this one? Get them exclusively at Green Growth Giants. Learn More »

Kirk Fisher

House builder United Homes Group (NASDAQ:UHG) had a good debut as a SPAC listing earlier this year. By the close of its first trading day, it was up by 64% from the previous close. Things haven’t been that good since. At the last close, it was down to half the initial closing price. Here I look at whether this is an indicator of a rise ahead or if it's better to stay away from UHG stock for now.

The company

But first, a bit of background on the company. Started in 2004 as Great Southern Homes, the company which subsequently changed its name to United Homes Group at the time of listing, focuses on first time home buyers in of South Carolina and Georgia. It has been ranked as the 25th biggest single-family homebuilder by Pro Builder magazine in 2022 and has delivered 11,000 homes to date. The uniqueness of its business model lies in that it enters into purchase agreements with third parties that do the actual development.

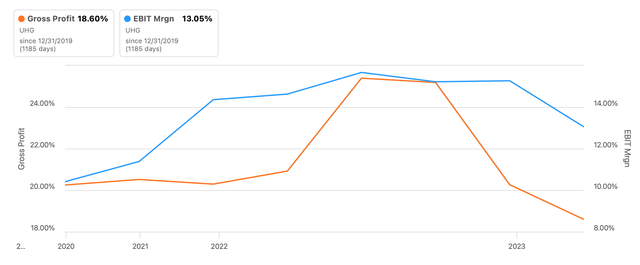

The financials available on the company reflect its robust growth. For the three years ending December 2022, it showed a compounded annual growth rate [CAGR] of 20.6% in revenues, while its net income grew by 34.9%. Its margins weren’t as impressive, but even then, its gross margin remained consistently above 20% through the years and its operating margin has ranged between 11-15%.

Margins (Source: Seeking Alpha)

However, the housing market is going through changes, which of course impacts a house builder like UHG. So it cannot be assumed that the company will continue to grow at the same pace it has over the past years. In fact, the latest trends already suggest otherwise.

The housing market is slowing down

On the positive side, in its latest result update for the first quarter of 2023 (Q1 2023), the company points to a recovery in sales from the “rate-induced slowdown” in the second half of last year. For context, in December 2022, new home sales fell by 26.6% year-on-year (YoY) but fluctuated in the first quarter of 2023 (Q1 2023). Specifically, it mentions that net new orders grew significantly sequentially.

But the new orders growth is an exception rather than the rule. Largely, a trend of slowing down in growth is seen in its latest numbers. Net new orders are actually down by 18% YoY, even if they have risen from the previous quarter. Further home closings have fallen by almost 21% during Q1 2023.

This, as would be expected, shows up in a 12.5% decline in revenue numbers as well. Even though the company reports a 15.5% increase in prices of houses sold at this time, that alone has not been able to stave off the drag from the weakness in demand.

I wouldn’t chalk it up to just a weakness in a single company’s numbers either. Even D.R. Horton (DHI), the biggest house builder in the US, reported flat revenues and a generally sluggish trend in the quarter, indicating that the housing market is indeed being impacted. And this is showing up in house builders’ financials.

The cost effect on margins

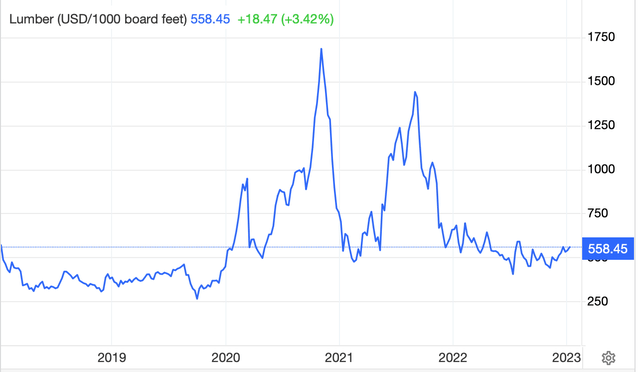

Hearteningly though, UHG’s cost of revenues has actually declined by almost 4% YoY in Q1 2023, which is indicative of a softening in price pressures. At the same time, the drag on revenues reflects on its gross margin which was down to 17.7% in the latest quarter, a sharp correction from 25.2% in Q1 2022. The company attributes this to sales incentives and “selling inventory with higher lumber costs”. While lumber futures data shows that they have cooled down considerably since the time they skyrocketed in 2021, the prices have however fluctuated in a range in 2023.

Lumber Futures (Source: Trading Economics)

The gross margin fall is hardly all. The decline in operating margin was even more dramatic to just 4.7%, down from 15.5% in Q1 2022. With a softening in the gross margin, this was to be expected. But operating costs have risen too, and by 18.3%. Also, UHG fell into a net loss as there was an increase in the fair value of earn out considerations, as its stock price increased after listing. In sum, the company’s earnings have been impacted by weakness in demand, cost pressures and technical factors. I am hopeful of its net earnings turning positive next quarter, though, going by the very specific reasons for the latest loss.

The outlook

Further, UHG is optimistic about its future margins as well. It expects adjusted gross margins to rise to 23%, from 20.2% in Q1 2023. This could also reflect well on the reported gross margin discussed above. At the same time, it’s worth noting that it will still be below 26% in Q1 2022. In other words, some improvements are expected, but earnings are unlikely to go back to their early 2022 levels.

The company’s expectations of improved margins are based on its recent sales figures. Incidentally, the latest macro data gives some room for optimism too. In May 2023, US-wide new single-family home sales grew by 20% YoY and saw a 12.2% sequential rise. Lumber futures have also been relatively controlled, which can bode well for the short-term earnings prospects too.

In fact, lumber prices are expected to continue to remain soft compared to last year in the near future. And the reason behind this is the expected softening in the US housing market, which is expected to slow down later in the year. Goldman Sachs predicts a 22% decline in new home sales in 2023 as the various macro factors currently at play finally impact housing demand.

What next?

So in sum, we are looking at some short-term improvements, but over the course of the year, and spilling over into next year, there will likely be weakness in the housing market. While this can be positive for UHG’s margins as cost pressures reduce, a demand decline isn’t good news for its top line.

The net impact on earnings will be a function of the extent of the decline in both costs and demand. In any case, the company doesn’t expect margins to go back to where they were last year. I think it is better to wait for a more optimistic time for the housing market before buying the stock. I’m going with a Hold on UHG.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

--

This article was written by

Manika is an investment researcher and writer as well as a macroeconomist, with a focus on converting big-picture trends into actionable investment ideas. She has worked in investment management, stock broking and investment banking. As an entrepreneur, running her own research firm, she received the Goldman Sachs 10,000 Women scholarship for certification in business. She is also a public speaker, having shared her views at multiple international forums and has been quoted in leading international media.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.