More Questions Than Answers At Peloton

Summary

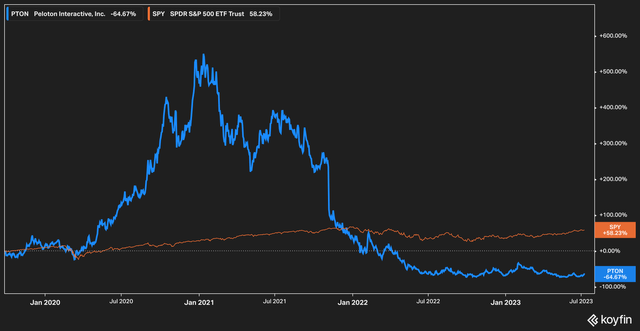

- Peloton Interactive, the maker of home fitness equipment, has seen its stock value fall 64% below pre-pandemic levels.

- The company recently announced a recall of 2.2 million bike units for safety issues with the seat.

- The company has done much to cut costs, but is still in the middle of a turnaround effort.

kali9

The Good Old Days

The Coronavirus pandemic was a lot of things: terrible, painful, and unique. It ushered in a wave of trends that, at the time, seemed destined to remain part of our collective norm. Remote work, teleconference meetings, and building out home gyms all experienced an explosion in popularity perhaps never again to be repeated.

Of course, many of these trends, if they haven't faded completely, are shells of their former selves, and none of these more so than working out from home. Among the casualties of this trend reversal is Peloton Interactive (NASDAQ:PTON), the maker of the eponymous stationary bike, treadmill, and rower. Post-pandemic life has not been kind to the company or the stock.

From its pre-pandemic levels, the stock surged by more than 500%, only to see a steady grind downward. Today, the stock is trading 64% below its pre-pandemic levels. In this article, we'll assess what we think the future holds for the company. Let's dive in.

Unhealthy Financials?

In early 2022, Barry McCarthy joined Peloton as the company's new CEO and replaced the company's founder, John Foley, whose management of the company had drawn the ire of at least some investors. Thus far, however, it does not appear that new leadership has been able to right the ship in our view.

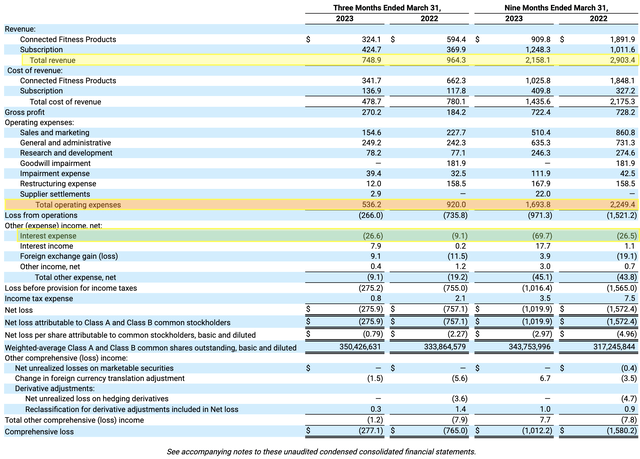

Company Filings, Author's Highlights

Above is Peloton's profit and loss statement from their 10Q for the quarter ending March 31st, 2023. Within it are some figures we found distressing. To start, total revenue for the three months ending March 31st was down 22% (highlighted in yellow).

In the 'other' operating section, interest expense came up dramatically, from $9.1 million in 2022 to $26.6 million in 2023 (highlighted in green). This is likely due to the company's term loan, against which the company pays a premium to the SOFR rate.

The company's bump in subscription revenue was positive, but it comes with a bit of an asterisk. The line item was actually up 14% year over year to $424 million, largely owing to the company's push to bring in consumers through the standalone app who may not yet own a piece of Peloton hardware, but the corresponding cost of said revenue jumped 16% to $139 million.

One brighter spot in the P&L is that McCarthy's mission to cut costs is plainly evident by the large reduction in Sales and Marketing for both the three and nine month periods covered.

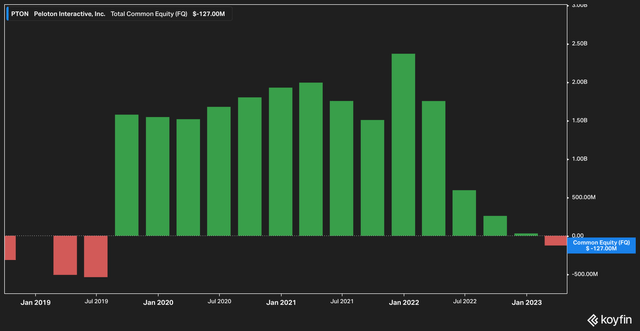

Turning to the balance sheet, the quarter ending March 31st had an ignominious return - the company turned shareholder equity-negative.

Of course, this is not perhaps surprising - as a company utilizes cash for its operations in an attempt to turn profitable, this unfortunate change can happen.

On the front of operating cash flow, the company has actually done what appears to be solid work - operating cash flow losses for the nine months ending March 31st narrowed from a staggering $1.6 billion to just $339 million.

Reaching operational cash flow, however, requires the adding back non-cash expenses, which is where stock-based compensation raises its ugly head. According to the latest 10Q, stock-based compensation for the nine months ending March 31st amounted to $333 million, or roughly 15% of the $2.1 billion of total revenue generated in the same time frame.

Product Recall

Investors were also greeted on May 11th with the ugly news that 2.2 million Peloton bikes were being recalled due to safety concerns with the seat. The news of the recall caused the stock to drop 8.9% on the day of the announcement.

To fix the issue, Peloton has offered to send consumers a replacement seat free of charge. Investors, however, are likely to wonder what the cost will be to the company and will be expecting further details on the recall and its financial implications during the company's next conference call.

The Bottom Line

No one is disputing that Peloton is a company in turnaround - after all, that's why a new CEO was brought on board. These situations are often attractive for investors who seek out companies who appear down and out and that the rest of the market has seemingly given up on.

Whether or not Peloton can turn its fortunes around is something that only time will tell. However, we do not think at this time that the turnaround effort has yielded enough in the way of positive results for us to jump in.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.