Why I Believe Microsoft Might Close Activision Deal Despite U.K. Objections

Summary

- The UK's Competition and Markets Authority might need to initiate a fresh probe into Microsoft Corporation's proposed merger with Activision Blizzard, Inc.

- Microsoft could push to complete the merger before the July 18 walk date, potentially disregarding the CMA's block, despite the risk of future fines or investigations.

- The deadline coincides with a period of strong business performance for Activision, potentially strengthening their bargaining position in the merger negotiations and increasing the pressure on Microsoft.

- Despite the recent appreciation of Activision's stock, the spread remains attractive, as the likelihood of the merger making it through have never seemed higher.

- This idea was discussed in more depth with members of my private investing community, Special Situation Report. Learn More »

Loren Elliott/Getty Images News

Things are moving fast in the Microsoft Corporation (NASDAQ:MSFT) acquisition deal for Activision Blizzard, Inc. (NASDAQ:ATVI) saga. The latest news that I'm aware of is that the UK's Competition and Markets Authority ("CMA") may need to do a new probe into the deal if Microsoft wants it to work. That sounds a lot to me like the standard CMA process for if a company successfully appeals a block (which is quite rare). It very much looks to me like Microsoft is currently in a strong position in the U.K. (given its merger is actually blocked), and it clearly is in the U.S. with the judge coming out on its side vs. the FTC.

I wouldn't be surprised if Microsoft pushes hard to close this deal ahead of the July 18 walk date. I understand that the company could ignore the CMA's block while doing so. In most circumstances, this isn't very wise because it opens up an acquirer to fines or investigations at a later date, while a lot of expenses associated with a merger have been incurred.

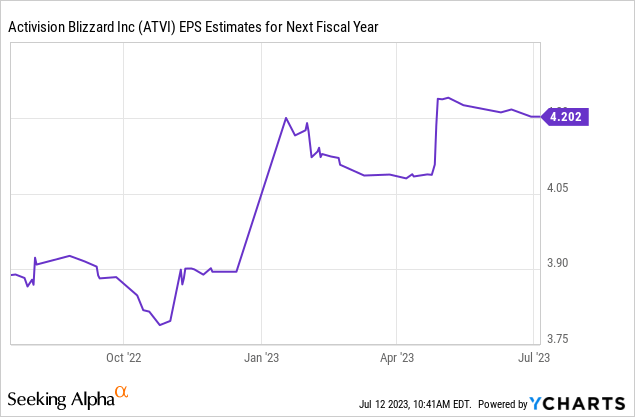

However, Activision can officially walk away from the deal on July 18. The timing of this deadline is a bit awkward for Microsoft. Activision is doing quite well business-wise; as I've argued in several articles on this deal, Microsoft picked it up on the cheap, the market is very strong, and sentiment is starting to be much more bullish.

Sentiment may be a contraindicator for the market in the medium term, but with short-term merger negotiations going on it strengthens Activision's position to ask for more. It doesn't have to fear as large a drop if the acquirer balks at its demands. Meanwhile, Microsoft has spent incredible effort to try and close this deals and has invested a lot of time and money into it. It has also been clear throughout the process its rival Sony (SONY) doesn't want the deal to happen, and last but not least, Microsoft likely desires to demonstrate not every tech deal can or will be blocked.

This is as I've argued since being interested in this merger. Here's an example from the fall of 22':

To look at competition through the lens of console makers seems very narrow to me. Being a leader for 20 years in consoles is great and all, but there's a lot of gaming going on outside of consoles (PCs, tablets, smartphones). There are even board games and trading card games that increasingly compete for attention with console games. I'm skeptical that Microsoft is interested in limiting rivals' access to top Blizzard titles. That would bring down the profits of the acquired company. There's tremendous value in having a console platform with a wide-ranging supply of titles available (why competition doesn't take hold in consoles or Mobile OS), but I doubt there's as much value in restricting content to Microsoft devices. High-end gaming revolves around building enormous and enduring franchises with loyal fan bases. Making titles less available breaks trust and franchises start to deteriorate. It also seems to me that regulators should be able to be appeased by certain promises not to ring-fence assets.

The question is what to do now with Activision stock having appreciated meaningfully. I think ATVI stock is actually still quite attractive. Over the last week, things hardly could have gone better for the merging parties, and yet the target is still trading at ~$90 with the possibility the acquirer is going to bump the bid if the July 18 deadline is exceeded. If the deadline isn't exceeded, this looks like a 5.5% return but within a matter of weeks. The annualized return is quite ridiculous, although somewhat balanced out by the likely significant short-term downside if the deal is broken off(think $60-$70). If it goes longer, there is a good chance the deal gets a bump. The annualized return is probably a bit lower, but in absolute terms, it could be very attractive.

The odds for this deal to close have never before looked this good to me. The price may have gone up, but the odds have improved as well. It is nerve-wracking to buy in here or hold a position here, but I think it is still one of the attractive mergers to hold. I like a vanilla long position as well but for subscribers of The Special Situations Report I've included a short-term higher-risk/higher-reward alternative.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

I gravitate towards special-situations. That means situations around companies or the market where the price can move in a certain direction based on a specific event or ongoing event. This eclectic and creative style of investing seems to suit my personality and interests most closely.

Since 2020 I host a podcast/videocast where I discuss (special-situation/event-driven) market events and investment ideas with top analysts, portfolio managers, hedge fund managers, experts, and other investment professionals. I highly recommend it (pick episodes around topics that interest you) for the amazing guests that come on with regularity.

I've been writing for Seeking Alpha since 2013 after playing p0ker professionally. In 2018 I founded Starshot Capital B.V. A Dutch AIF manager. Follow me on Twitter @Bramdehaas or email me Dehaas.Bram at Gmail

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ATVI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)