Trimble Has Substantial Upside Potential Despite Flat Growth

Summary

- Trimble is transitioning from a hardware/software solution to a subscription-based software platform, which is expected to widen margins and boost bottom-line growth.

- The recent acquisition of Transporeon is anticipated to add value to Trimble's software vertical for transportation services, contributing $135mm in incremental revenue over the next three quarters.

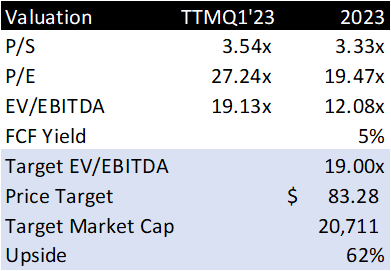

- Using historical multiples, I expect TRMB's shares to trade at $83.28/share for a market cap of $20,000mm, leading to a buy rating for the company.

JamesBrey

Trimble (NASDAQ:TRMB) is a multifaceted technology solutions provider with vertical software stacks across multiple industries, including construction, agriculture, and civil engineering. Sales are aligned through 4 reporting segments: building and infrastructure, geospatial, resources and utilities, and transportation, each with software solutions that connect field work to back office workflows to create a more efficient workplace.

Trimble is in the process of transforming their business from a hardware/software solution to a subscription-based software platform that can integrate across other vendors' platforms. As management has outlined in their guidance, this transformation should allow Trimble to widen margins and experience strong bottom-line growth while maintaining flat-slow topline growth in the coming fiscal year. Using management's 30% target EBITDA margin and their 5% topline growth projections as well has a historical 19x EV/EBITDA multiple, we can expect TRMB shares to trade at $83.28/share for a market cap of $20,000mm. With this, I give TRMB a buy rating.

Operations

Trimble's recently completed acquisition of Transporeon should add significant value to their software vertical for transportation services. Transporeon's services cover all aspects of the supply chain for freight shipment while providing more visibility in the transportation marketplace to optimize truck utilization while reducing downtime. Management clarified Transporeon's contribution of $135mm in incremental revenue over the coming three quarters which will improve transportation revenue by ~20%; however, in total, Transporeon is a drop in the bucket and will account for roughly 4% of total revenue and may not be much of a needle mover until the freight industry picks up again. To elaborate further, I believe this acquisition may be coming at an opportune time throughout a downcycle as the Cass Freight Index suggests a -5.6% y/y decline in shipments.

One interesting note Cass makes in their May report is that the expenditures component's drastic increases in both 2021 and 2022, growing 38% and 23%, respectively; however, their expectation for 2023 is for a pullback of roughly -16 - 20% throughout the year given the downward pressure from both volumes and rates in the present downcycle. Given this, Transporeon may be a slow burn before shipments pick up again in the retail space.

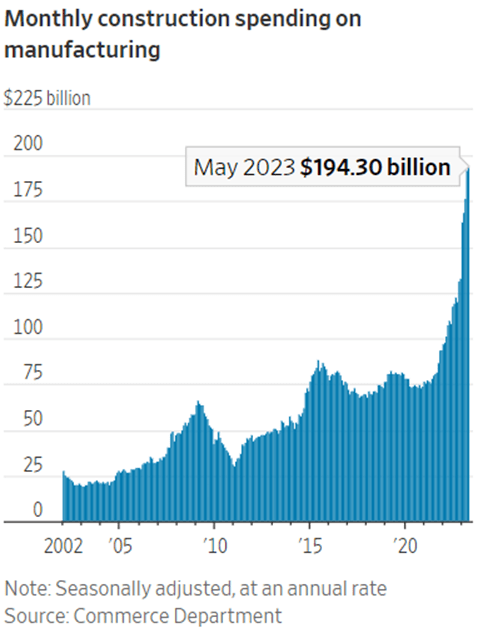

The majority of their sales contribution comes from buildings & infrastructure, which should have substantial growth with the accompaniment of the Inflation Reduction Act (IRA) and CHIPS Act. According to an article in the Wall Street Journal, construction spending for manufacturing facilities has experienced a huge increase in May, up 76.3% SAAR.

WSJ

In conjunction with their construction segment, utilities & resources should perform well as the grid is modernized to take loads from renewable sources. Given the heightened focus on renewable capacity as coal-fired power plants are phased out, more sophisticated power management systems will be required to ensure a stable load between intermittent power sources and more reliable sources like natural gas and nuclear. Please read my articles on power transmission for a further elaboration: AGX here and PWR here. Trimble's geospatial should perform well in this respect given the necessity to better plan wind turbine spacing for optimal power generation and the need for access roads for remote power generation.

Financials

Trimble's growth was relatively mixed across their segments, with building & infrastructure and resources & utilities showing growth over the last three years while geospatial and transportation remained relatively flat or pulled back between 2020 and 2022 figures. This progression also provided mixed results on their operating margins with a slight compression for building & infrastructure and resources & utilities while both transportation and geospatial showed margin expansion. Management did discern that margins should improve throughout FY23 as much of the investment has been spent in FY22 and should ride the wave throughout the next year with an aggregate operating margin improvement from 14% in FY22 to 23% in FY23 and achieve an EBITDA margin of roughly 30%. Though guidance suggests a flat 5% aggregate revenue growth, margin expansion will flow throughout the income statement down to free cash flow for a 17% flow-through. This will provide a FCF yield of 5% for FY23 figures, a significant improvement when comparing to the last two years.

Valuation

TRMB shares trade at 27.25x earnings with an enterprise value of 19.15x EBITDA. Looking forward using management's guidance, these multiples will significantly compress with the drastically improved margins. Given that TRMB has historically traded in the mid-20x EV/EBITDA range, it can be safe to assume that the shares will remain at a relatively expensive price going forward.

Using the lower end of the range at 19x EV/EBITDA and management's estimates, we can come up with a price target for FY23 of $83.28/share. The midpoint of 25x will provide a price of $111/share, or an upside of 117% from today's current price. Given that I'm more of a value investor and that this stock trades at a premium to my typical universe, I'll take the more conservative multiple for my price target to add shares to a portfolio with the higher end being a good selling point. Given their historical range and their expected margin expansion, I give TRMB a buy rating.

SeekingAlpha

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.