AMD: Most Of Upside Has Been Realized

Summary

- Tech valuations are high, but that doesn't necessarily mean that tech will fall.

- I debunk two bearish arguments that suggest we're in a tech bubble.

- I also present the case for Advanced Micro Devices, Inc. as a core position in my portfolio and guide readers towards a reasonable price target.

- Looking for a helping hand in the market? Members of High Yield Landlord get exclusive ideas and guidance to navigate any climate. Learn More »

zirconicusso

Dear readers/followers,

I'm not just a REIT (real estate investment trust) guy. In fact my portfolio is spread between Real Estate, Financials (primarily Asset Managers), and Technology.

Note that I plan to reveal the exact weights and positions in my portfolio as I reach a certain threshold in the number of follower, so if you're interested in my allocation, make sure to follow my research. The plan is to share my REIT allocations first, when I reach 2,500 followers, followed by Financials at 5,0000 followers.

Because I primarily have positions in these three sectors, I spend a lot of time trying to determine their outlook so that I can rebalance my exposure accordingly. While I never exit any one of these sector completely, I do alter my exposure to a given sector by +/- 10% based on my expectations.

Currently, there's no doubt that tech (especially big tech) has decoupled from the market, with the top 7 tech stocks returning 60% YTD, while the remaining 493 stocks in the S&P 500 (SP500) have traded sideways on average. The question is whether that outperformance is justified or if it's likely to revert, in which case one would be better off rotating out of tech and into other sectors.

In this article, I want to have a look at two arguments that the bears have and evaluate their validity. Afterwards, I want to present my analysis of Advanced Micro Devices, Inc. (NASDAQ:AMD), which is one of my tech positions.

Bearish argument #1 - tech bubble

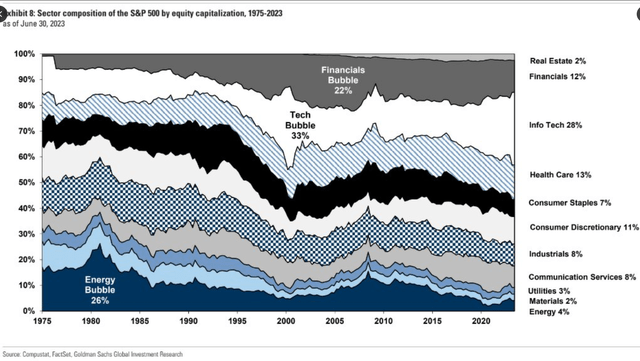

The first bearish argument is based on the fact that technology now accounts for 28% of the S&P 500, which is amongst the highest ever, and second to only the tech bubble in early 2000s.

The chart below reveals that almost every time a sector has grown to account for an overly large portion of the index, it has reverted and the bubble has popped. We've seen this three times already - in the 80s with the Energy bubble, in the early 2000s with the Technology bubble and in 2008 with the Financials bubble.

One thing missing from the chart, however, is the fact that technology has actually become a much larger part of our lives. This is not something that was true about energy in the 80s or banks in 2008, and in the early 2000s the stock market got ahead of itself.

Of course, one should never assume that this time is going to be different. That's a very dangerous way to invest, but I can't help but notice that nowadays, technology is everywhere I look. Nowhere is this more evident than in public transport, where 99% of people are "glued" to their phones.

This is why I think that an increase in the portion of the index that accounts for technology doesn't necessarily mean that it's a bubble. It simply accounts for a higher presence of tech in our daily lives.

Goldman Sachs Global Investment Research

Bearish argument #2 - high valuations

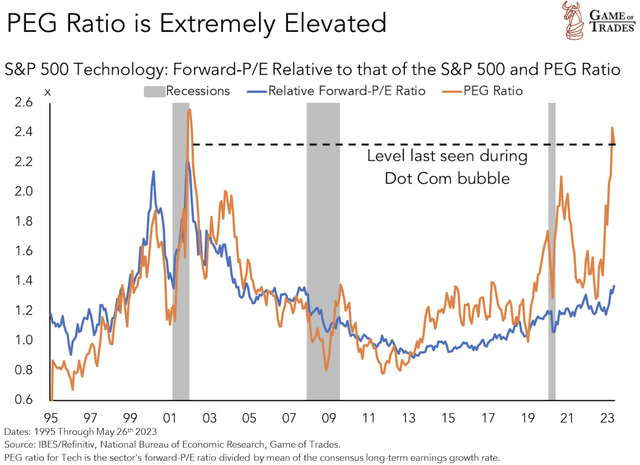

The second frequent bearish argument is high prices and especially high P/E and PEG ratios. A quick remainder, a PEG ratio is the P/E divided by earnings growth. It's essentially how much we're paying for each percentage of earnings growth. It's in many ways a superior measure to P/E, because while it might be OK to pay 30x earning for a company growing at 20-30% per year, it's certainly not OK for a company growing by just 5% and the PEG ratio takes into account both.

The chart below reveals that while P/E ratios are still significantly lower than during the early 2000s tech bubble, the PEG ratio is actually on par. This because of the simple fact that growth is forecasted at lower (perhaps more conservative) levels and it means that from a PEG ratio perspective tech is very expensive today at 2.4x.

But here's the thing. It doesn't necessarily mean that tech is going to fall. The market is a forward looking machine and we could very well be in a situation where the market is expecting that growth forecasts will increase in the future which could drive the PEG ratio lower while tech prices stay the same or move higher.

Notice that this is exactly what happened in early 2021, right after the pandemic. The PEG ratio was very high back than also, but tech continued to move higher and as growth forecasts increased, the PEG ratio gradually returned to a more healthy level of 1.5x.

So with these two bearish arguments somewhat debunked, let's have a look at AMD. It is a company which needs little introduction. A lot has been written on the stock here and elsewhere, so I will not spend time on the basics. My goal is to show the expected level of growth for the company and focus on valuation.

AMD Valuation

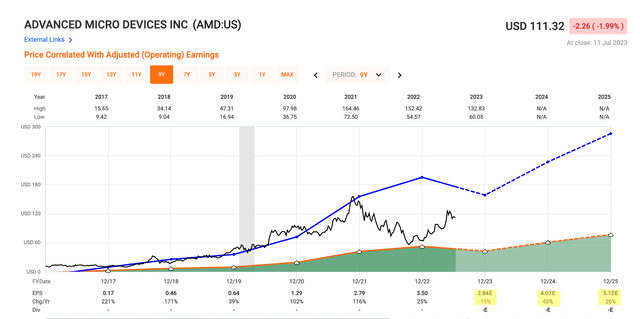

2022 and into Q1 2023 has been a tough period for most chip makers and will very likely turn out to be the period of trough earnings. AMD is no different, as their earnings this year are expected to decline by 19% compared to last year and come in at $2.84 per share.

On a positive note, the company has been able to maintain very healthy 50% gross margin, which is in line with the sector average, though below Nvidia Corporation's (NVDA) industry-leading margin of 67%.

In the following years, however, growth is expected to pick up significantly. Depending on where you look, the consensus ranges from 43% to 48% growth in 2024 and from 24% to 26% in 2025. Using midpoint estimates, that means average expected growth over the next two years of 35%.

Beyond 2025, it's nearly impossible to know what will happen to earnings, because amongst many other things, it will depend on how big AI gets. As showed in my article on Nvidia, analysts expect that this level growth could potentially be sustainable all the way to 2028. Personally I don't like such aggressive growth forecasts, which is why for my calculation I will assume that AMD grows their earnings by 15-20% beyond 2025.

Currently, the stock trades at a forward P/E of 39x, which is by no means low. But looking five years ahead, with average annual earnings growth forecasted just shy of 25%, it means a PEG ratio of 1.56x. That's quite healthy, especially when compared to the current sector-wide PEG ratio of 2.4x which leads me to believe that AMD is not overpriced relative to the sector in the current market environment.

Assuming that management delivers on the 2025 forecast and earnings reach $5.12 per share, what is a reasonable price target? A lot will obviously depend on forecasted forward growth at that time, but if our conservative forecast holds and forward growth slows to 15-20% beyond 2025, the P/E multiple could re-rate lower. This is because if the market continues to value AMD at a PEG of 1.56x, with lower expected growth the P/E has to decrease to about 27x (all else being equal). That means a share price of $140 per share, up 26% from today.

So even under relatively conservative assumptions, AMD stock should produce nice double-digit annual returns over the next two years. This is why I continue to HOLD the stock here at $111 (though I have trimmed a bit), but admittedly most of the upside has already materialized as the stock nearly doubled from a low of about $60 per share.

This is exactly why I think it makes sense to balance the portfolio between stocks like AMD and stocks that are currently under-appreciated and undervalued.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

![]()

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

This article was written by

Disclaimer: I am not a financial advisor and none of the content I provide on this website is financial advice. Content is provided for illustrative and educational purposes only. Always do your own research before investing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.