Rollins: A Good Business Priced For Perfection

Summary

- Rollins, a global pest control service, operates in a market expected to grow by 5.7% through 2032 to $39 billion. The company currently holds a 12% market share.

- Rollins operates in 70 countries with over 800 company-owned and franchised locations, competing with over 20,000 companies in the US alone.

- The company is actively consolidating the fragmented market through frequent small and infrequent large acquisitions, with around 80% of its revenue being recurring.

Kittisak Kaewchalun /iStock via Getty Images

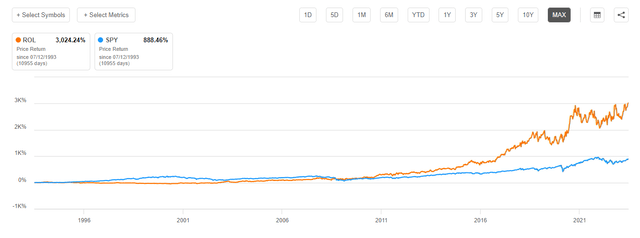

Rollins (NYSE:ROL) has been a compounding machine over the last decades, delivering total shareholder returns of 19% annually over 20 years. The company is family-owned and is a leader in the global pest control market. Over the years, Rollins has been a consolidator in the industry, one of my preferred strategies and with a strong focus on Free Cash Flow. Let's see if the stock could continue its outperformance over the next decade.

Rollins past outperformance (Seeking Alpha)

The pest control industry

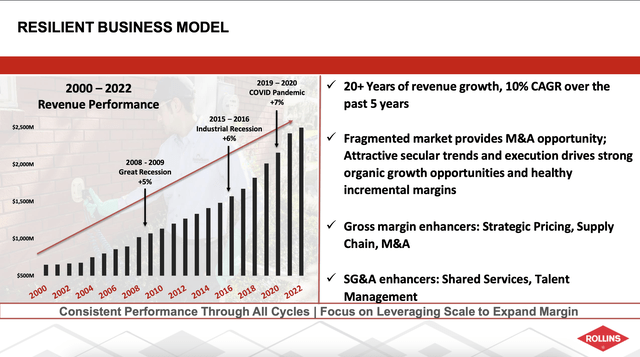

Rollins operates in the global pest control service market, estimated to grow by 5.7% through 2032 to a size of $39 billion. The market was $22.6 billion in 2022, giving Rollins a 12% market share ($2.7 billion in revenues). Rollins operates in 70 countries (but 93% of sales are from the US market) with over 800 company-owned and franchised locations. The company states that they have over 20,000 competitors just in the US market, showing how fragmented the market is. Fragmented markets are a great hunting ground for consolidators to take market share and Rollins is doing just that. Below you can see its revenue growth history and its resilience during the last three recessions. Pest control is not cyclical; around 80% of Rollins's revenue is recurring.

Rollins history of resilient revenue growth (Rollins investor presentation)

Consolidating the market

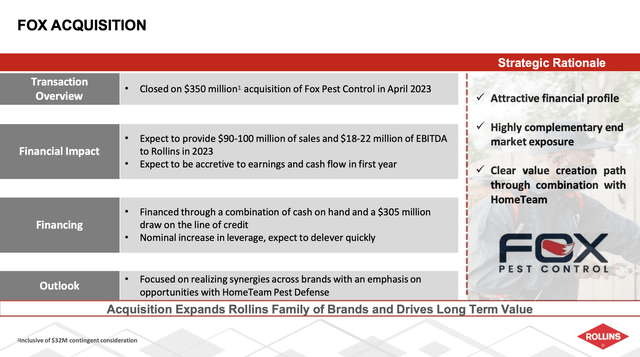

The company is actively rolling up the industry with many small but also infrequent large acquisitions. Over the last decade, the company spent $1.2 billion on bolt-on acquisitions. So the Fox acquisition is considerable compared to its prior M&A activity. At $350 million, the deal is valued between 16 and 19 times EBITDA. Rollins, on the other hand, is currently valued at 36 times trailing EBITDA. This makes deals very accretive with a huge valuation multiple arbitrage. On top of the multiple arbitrage, Rollins also expects to achieve synergies from closer proximity between branches and operational improvements. Rollins will take on $305 million of additional debt to fund the acquisition. Fortunately, the company has a strong balance sheet and net debt will increase to around $500 million, around one times EBITDA. This leaves options open for more M&A, even though historically, Rollins prefers to do smaller deals. Over the last five years, the company deployed 50% of cash to M&A, 45% to dividends and 5% to CapEx.

Rollins acquisition of Fox Pest Control (Rollins Investor Presentation)

Focus on what matters - Free Cash Flow

Rollins is focused on driving cash generation. Over the last six years, the company has always generated excess FCF over its net income. FCF compounded at 15.5% since 2001. This has fueled the company's acquisition activity and growing dividend.

Rollins Free Cash Flow track record (Rollins Investor Presentation)

Compensation analysis

Show me the incentive and I'll show you the outcome.

Charlie Munger

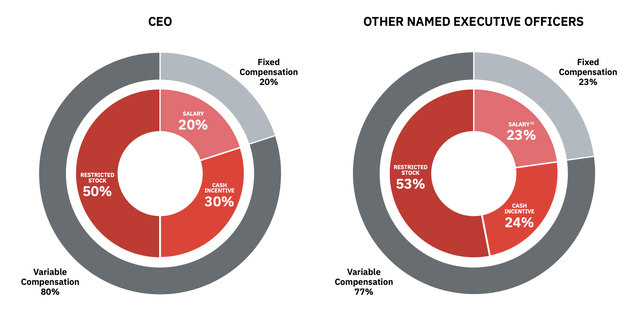

Understanding a company's compensation structure is vital to understand its goals better. Below you can see the distribution of executive compensation. We want to see high variable compensation bound to metrics aligning with shareholders. The CEO has 80% fixed compensation, while NEOs have 77%. This is a good mix and combines the stability of a fixed income with the upside of variable compensation.

NEO Pay mix (Rollins Proxy Statement )

The 30% cash incentive is tied to a revenue goal, a pre-tax profit goal and personal KPIs for each NEO. The 50% restricted stock options, on the other hand, are vesting based on time. There is no long-term incentive plan. I'm not too fond of this compensation structure, as it focuses solely on the current year and not on a longer time frame. Especially given the company's focus on Free Cash Flow, it is surprising that it isn't tied to the compensation. Furthermore, I prefer performance-based compensation over time-vested compensation.

The Rollins family owns over 50% of voting shares, so we have a strong alignment based on insider ownership. The majority of the shares are held in several trusts.

Valuation

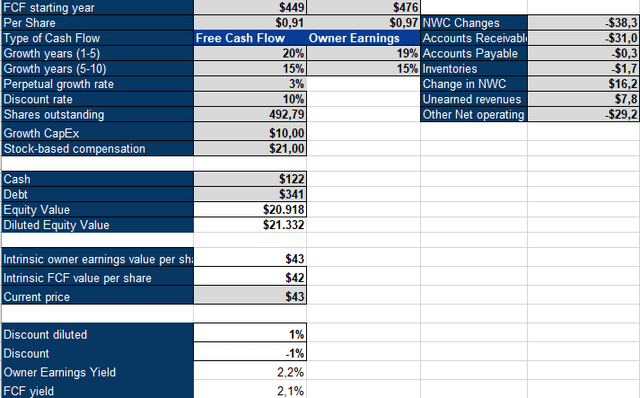

To value Rollins, I'm using an inverse DCF model. I use a 10% discount rate and a 3% perpetual growth rate; I also calculate Owner Earnings besides normal Free cash flows. I believe that Owner Earnings are a better representation of the cash flows to owners than normal free cash flow, which several factors can easily distort:

- Stock-based compensation is paid out in shares and replaces cash expenses, but it is a cost to shareholders.

- Often not all of the CapEx spend is going towards maintaining the business, but rather to grow it. These investments could be cut, returned to owners and thus added back to Owner Earnings.

- Changes in Net working capital can distort cash flows, so I adjust them out.

Owner Earnings = FCF - SBC + Growth Capex +/- NWC changes

Based on the model below, Rollins would need to grow Owner earnings by 19% over the next five years, followed by five years of 15% growth. This is above its long-term FCF growth rate and looks optimistic to me. At its current price, Rollins seems expensive.

Rollins Inverse DCF (Authors Model)

Risks

The main risk I see with Rollins is its valuation. The risk-reward ratio doesn't look appealing and multiple contraction is a serious risk. Fundamentally, the business is resistant on has highly recurring revenues in a mandatory sector. The company is not levered and doesn't do risky acquisitions just for the sake of growth. Based on the valuation, I assign Rollins a hold rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not financial advise.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.