Royal Caribbean: Sailing Far From Its Fundamentals

Summary

- Royal Caribbean Cruises' stock is overvalued and ripe for a bearish bet due to a potential market downturn, worsening fundamentals, or a possible valuation reset in a recession.

- Despite the company's revenue growth, its profitability remains weak and its debt-to-equity ratio is high at 7.3. The company has a long way to go in terms of returning value to shareholders.

- Investors should exercise caution with this stock; buying far out-of-the-money put options could pay off if the market or the company's valuation declines.

courtneyk/E+ via Getty Images

Thesis

It's not often an opportunity presents itself where a stock is not only trading far from its fundamentals but also provides an opportunity for an asymmetrical bet to profit from its fall. I have been eyeing Royal Caribbean Cruises (NYSE:RCL) since the beginning of the year and I believe that the time is ripe for a bearish bet mainly due to -

- Macro-economic outlook that would punish stocks such as Royal Caribbean if the markets were to turn

- Fundamentals that look worse now compared to its pre-pandemic high

- Valuation that can potentially undergo a reset during a recessionary period

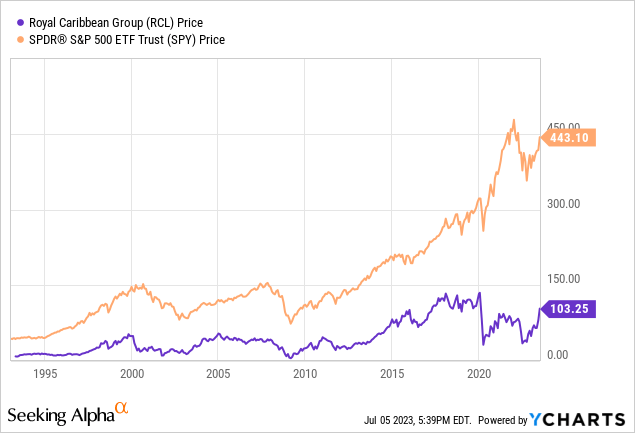

Price Performance and Market Exposure

Royal Caribbean operates in a cyclical industry and looking at its price chart its biggest drawdowns are in lockstep with the market. While most industries are attuned to the pulse of the economy and the stock performance closely correlated to the market, the effect is even more magnified when it comes to cruise industry stocks. Quantitatively, looking at its beta which is a measure of correlation against the index, the 24M beta stands at 1.8 which means the stock price movement is magnified by the same amount (Beta of 1 signifies that the stock moves as much as the index). If the forecasts for recession turn out to be correct, then RCL stock faces an additional risk in the face of a market meltdown.

Financial Performance

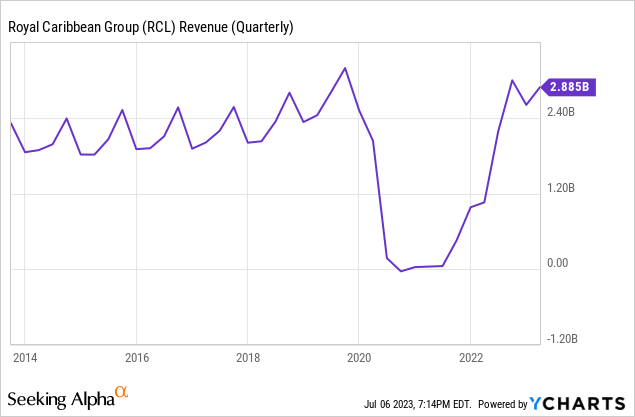

Even as the stock is marching towards its previous peak levels, the company is marching towards its peak revenues.

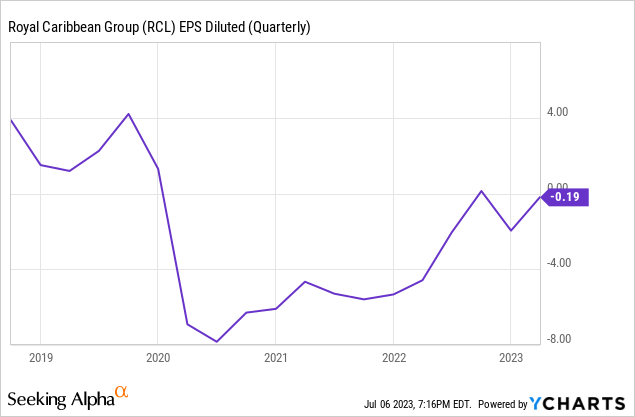

But profitability, while improving has still remained weak and is far from justifying the elevated levels in the stock price.

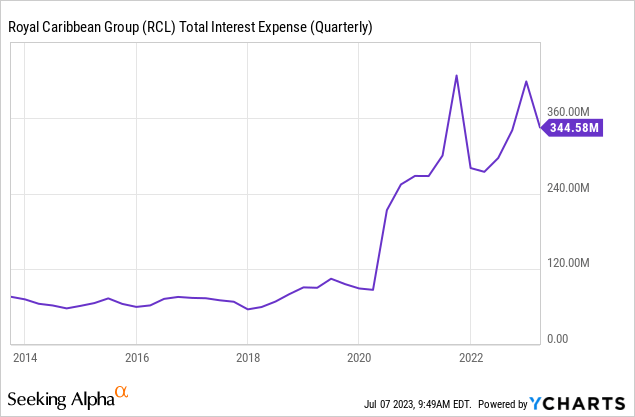

Most of the bullishness in the stock can be attributed to the investors anticipating the summer travel. In their most recent earnings release, the company sounded quite upbeat and even raised their full-year 2023 guidance. While they are able to push revenues, the company needs to also be able to swing back to profitability. In the short to medium term, this may not be possible as the company had to take on a lot of debt during the pandemic, and the interest expense is currently weighing on its earnings.

Looking further into its debt, the company carries a total debt of $22B against a total equity of $3B. This puts its debt-to-equity ratio at 7.3, which suggests that the management has a lot of work to do to bring its debt back down to healthy levels. This makes the next few years crucial for the company. The enthusiasm for travel needs to continue for several more years and the economy needs to stay on track during this entire time frame for them to spring back a healthy balance sheet.

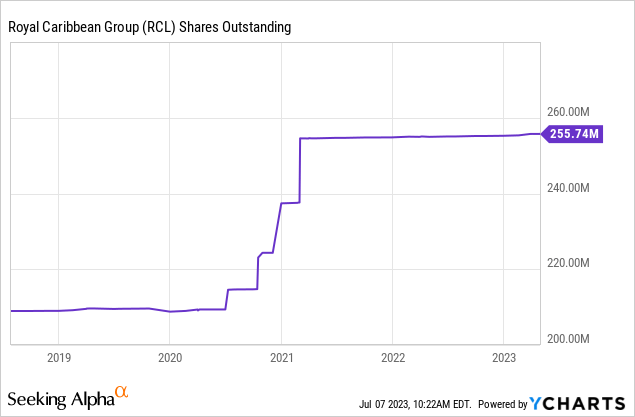

Share Dilution and dividends

This is another area the company had to tap into to survive the pandemic years but the effects of this move will stay on for several years.

The company had to also suspend its dividend in early 2020 in order to survive. These moves are completely justified in terms of survivability. But for the retail shareholder, this means that it's hard to expect any meaningful return from the business in the near future as the company's immediate priority and efforts will be directed to manage its balance sheet.

Valuation

The run-up in the stock while understandable in terms of revenue rebound, it is not at all justified in terms of its valuation. Considering the company's equity and debt, its EV/Sales is quite elevated at 4.4x, and Price to Book value is at 9x. This shows that a lot of enthusiasm has already been baked into the stock.

Undoubtedly, the forward ratios exhibit a notable decline, tied to an increased sense of optimism regarding its future prospects. But the fact that the stock has run so far ahead of itself means any missed expectations are likely to weigh on its valuation. Valuation resets can be brutal and as we have seen in the past two years, the momentum and narrative can easily turn further weighing down the price of the stock.

Risks to this thesis

If the economy continues to grind higher and the cruise industry outperforms in the near to medium term it would invalidate this thesis. Most near-term indicators show that the cruise industry is doing very well. Royal Caribbean announced that the load factor, indicating the percentage of occupied seats on its cruise ships, surged to an average of 102% during the first quarter of 2023. Similarly, Norwegian Cruise Line recorded an average occupancy rate of 101% in the first quarter. A consistent outperformance of this nature for the next several years would invalidate this thesis. That is why it is important to get the positioning right. Exercising caution in either direction of this stock would help an investor manage their risk well.

Positioning

For the holders in this stock, especially those who got in at its lows betting on the eventual return of the cruise industry, this would be a good time to take some chips off the table. This is neither a growth nor a value stock and the continued risks of holding on to this stock far outweigh the benefits. The cruise industry is dominated by only a few players so it is hard to see any kind of existential risk for this company but at the same time, the run-up in the stock has made it less rewarding to continue to hold at these levels.

For a more sophisticated investor, I believe the options market for this stock is beginning to look attractive. Buying far OTM puts with expiry at least a couple of months in the future would pay off well should any of the scenarios we discussed occur (Market gyrations, recession, valuation reset). Depending on the positioning this could also potentially serve as a hedge in a portfolio especially if there is a big concentration of cruise industry stocks. It is important to note that sophistication is key when taking a position in options. It is more than likely that the entire investment in put options expires worthless.

This article was written by

Analyst’s Disclosure: I/we have a beneficial short position in the shares of RCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.