Lose Money Slowly With SCHD ETF

Summary

- Dividend Growth investing made sense for retirees when short-duration bonds yielded next to nothing and valuations were reasonable.

- SCHD does a good job selecting higher-quality, higher-yielding businesses in which to invest, but the entire universe of these stocks is now overvalued.

- SCHD's current yield is considerably lower than U.S. Treasuries, it has very slow growth prospects and considerable price risk in the event of a recession.

- Retirees can now get safe 5% yields in short-term U.S. Treasuries, and that appears to be a much better alternative, given the high prices of SCHD's universe of stocks.

- Looking for a helping hand in the market? Members of The Cyclical Investor’s Club get exclusive ideas and guidance to navigate any climate. Learn More »

shellhawker/iStock via Getty Images

Introduction

I spend quite a lot of time in my articles pointing out areas of danger in the stock market, particularly for retail investors. Sometimes it can be difficult to tell investors what they prefer not to hear. I've written several articles over the years explaining why I'm not a dividend or a dividend growth investor. The primary reason is that I believe earnings (and cash flows) take primacy over dividends, and over time the market almost always rewards earnings growth with corresponding stock price growth. So, for me, dividends are mostly a byproduct investors get as a company's earnings growth prospects slow, and a form of insurance that investors will ultimately have their money returned to them before a company's life-cycle is over. I don't usually care too much about dividends themselves.

I've been writing for Seeking Alpha for nearly eight years now. Most of that time dividend growth and high-yield investing were the most popular investing strategies on the site. Articles about these styles of investing consistently got more views and followers than any other strategy. So, I'm proud of myself for always sticking to the ideas and strategies I thought would make investors the most money over the medium term of 3-5 years and not the ones I thought would garner the most popular support among readers. It has been very interesting to watch firsthand the emergence and development of modern dividend investing over the past decade, and I believe it follows a pattern similar to most other historical investing cycles (which is what I specialize in my Investing Group, The Cyclical Investor's Club).

The first thing investors need to understand is that the stock market is a parimutuel system, which is similar to betting on a horse race. Investors are rewarded by being both correct and contrarian. If everyone bets on the most popular horse in a race, even if they are correct, they would simply be returned their money (minus any fees or house take). In order to make the most money, you need to be correct about the winner and also have some other people choose a different horse. The less popular your horse is when they win, the more money you make.

The stock market works the same way. The more popular a business is, even if it is indeed going to be a big winner, the lower the returns of the investment will be because the purchase price of the stock relative to future earnings will be higher. When it comes to dividend investing, this can all be reduced down to the dividend yield at the time of purchase, along with the dividend growth during the holding period. For now, let's just focus on the dividend yield itself. The higher the yield when purchased, the less popular the investment was at the time, and the lower the dividend yield, the more popular it was. Very simple.

The Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) is designed to take advantage of this system by buying good quality, higher-yielding stocks. Buying when the yields are higher, in theory, means buying when the stocks are less popular. And by constantly doing this and reconstituting, the strategy works pretty well most of the time, buying at lower prices and selling at higher prices, collecting the dividend along the way. The same can be said for dividend investing in general.

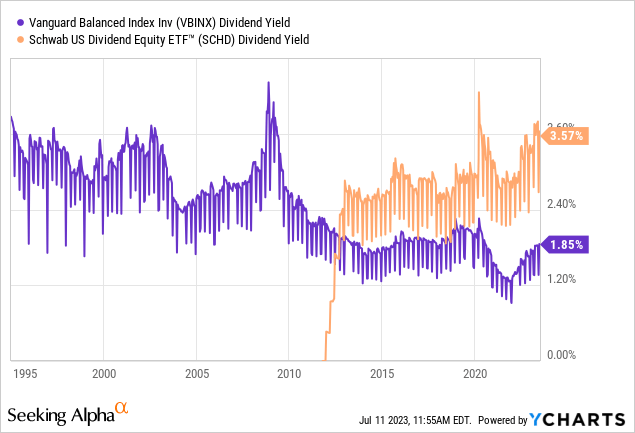

The chart below I think tells the story of dividend and dividend growth investing, and why it started taking off after 2010.

The Vanguard Balanced Index (VBINX) is a fund I use as a proxy for the standard 60/40 portfolio, which is often suggested as a good allocation for those approaching and in retirement. From the 1990s until about 2003, it yielded about 3.5%, give or take. Under these conditions, a retiree could collect about 3.5% in yield, add in a little Social Security or pension income, and sustainably fund their retirement with few worries at a 4% or 5% withdrawal rate. But after 2010, the yield of the 60/40 consistently fell, ultimately down to under 2%. About the time this was happening, there started a huge influx of Baby Boomer retirees, the US's wealthiest generation, and that trend of increased retirees continues to this day. These are the very people who are usually attracted to a 60/40-like portfolio, where they can comfortably live on the dividend yields, and life is simple. But when yields fell to half what they had been historically, that means investors wishing to live off yields needed twice as much money to do so. After the dot.com bust and Great Recession, not many people had earned twice what they needed for retirement.

In comes the promise of dividend growth investing. I think, especially in the early stages of its development, dividend growth investors were really smart, especially if they were using DGI as a replacement for bonds, which were extremely overvalued by 2015. In comes SCHD (and the individual strategies based on the same premise) and it provided at least some of the missing yield of the 60/40, with the promise of more growth. Investors who got into DGI in 2014 or earlier did extremely well.

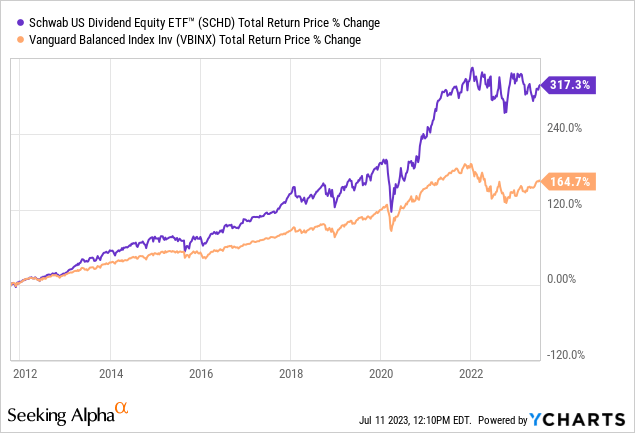

Really good DGI strategies, like the one SCHD uses, literally doubled the returns of a 60/40. That's great for early adopters.

However, now pretty much every stock that meets these general dividend and quality parameters is overvalued or has cyclical risk that isn't priced into the stock. There is simply too much demand, and too many people betting on the horses that have been winning for retirees the past 10 years.

I see two big risks going forward for SCHD. The first is there isn't going to be much revenue growth or earnings growth. The second is cyclicality is not accounted for in the strategy because it looks at data from the past 10 years and we haven't had a real recession in 14 years.

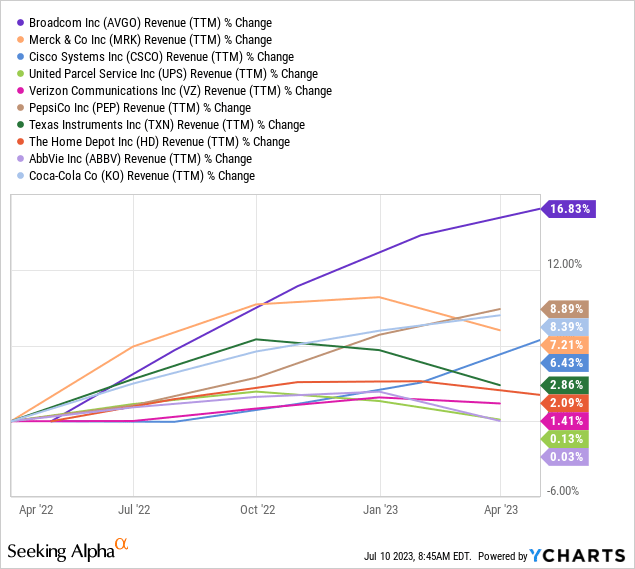

Below are the revenue trends of SCHD's current top 10 holdings, which represent about 40% of the portfolio weighting.

They have averaged +5.43% revenue growth over the past 12 months.

Above is the core inflation rate over the past 12 months. It is about the same as these businesses' revenue growth. So no real revenue growth over the past year, and we haven't had a recession, yet. When growth is flat, that means the dividend yield you see is probably what you are going to get in real terms going forward, which is +3.59%.

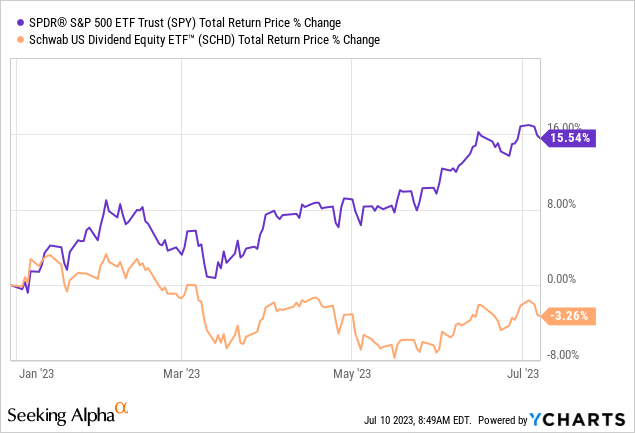

This lack of growth is reflected in SCHD's stock performance this year, which is significantly underperforming SPY.

There are now safer alternatives

Above are the returns of iShares Treasury Floating Rate Bond ETF (TFLO) over the past year compared to SCHD. TFLO's current 30-day SEC yield is about +5.20%, significantly higher than SCHD's yield of +3.59%. In the event of a recession, TFLO's price is unlikely to fall much, while SCHD, because of the high price and low growth of the stocks, could fall a lot.

Below is a table where I share the PEG ratios of SCHD's current top ten holdings. Usually, a PEG of 1 is attractive, a PEG of 2 is unattractive, and a PEG of 3 often warrants selling a stock because its future returns are likely to be low.

| Ticker | P/E | Earnings Growth | PEG Ratio |

| AVGO | 20.86 | 13.17% (But Cyclical) | 1.58 |

| MRK | 15.75 | 7.45% | 2.11 |

| CSCO | 13.71 | 3.64% | 3.76 |

| UPS | 16.00 | 3.34% (adjusted for COVID) | 4.79 |

| VZ | 7.51 | 3.70% | 2.02 |

| PEP | 26.68 | 4.29% | 6.22 |

| TXN | 23.54 | 5.64% | 4.17 |

| HD | 20.60 | 11.30% | 1.82 |

| ABBV | 12.29 | 13.58% (Earnings downcycle starting) | 0.91 |

| KO | 22.19 | 2.60% | 8.53 |

The average PEG ratio is 3.59, which is extremely overvalued. Additionally, semiconductors can be deeply cyclical in a downturn, and drug companies can have earnings downcycles related to patent cliffs, so there can be good reasons that they trade at low prices. The earnings growth of most of these businesses is extremely low, and for most of these, I started the measurement for earnings growth in 2015 and didn't even include the effects of a potential recession. I've written individual articles on all of these stocks except ABBV, VZ, and AVGO, and I'm currently long Merck (MRK), and consider it a "Hold" at this time. But there is either cyclical risk or valuation risk for all of these stocks. In short, they are risky and should not be considered "safe". The overall dividend yield might be somewhat safe, but it's only 3.59%. TFLO has no price risk and will probably yield 5% or more for the next year or two unless there is a recession.

Conclusion

Dividend and DGI investors have done really well over the past decade if they chose a dividend growth strategy over a 60/40 strategy. But too many investors have been chasing these stocks lately. Where previously there was no alternative for yield, now TFLO yields 5.2% and CDs and money markets are competitive. In short, things have changed. The biggest danger for SCHD and strategies like it is that investors slowly lose money each year, especially in real terms, and they don't realize it. Like the frog sitting in a pot of water with the temperature slowly rising. That is exactly what SCHD has done this past year. The price would need to be about -30% lower to be attractive as a medium-term investment. Since we now have safer alternatives, I'm rating SCHD a "Sell".

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor's Club. It's only $30/month, and it's where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.

This article was written by

My analysis focuses on the cyclical nature of individual companies and of markets in general. I've developed a unique approach to estimating the fair value of cyclical stocks, and that approach allows me to more accurately buy near the bottom of the cycle.

My academic background is in political science and I hold a Bachelor's Degree and a Master's Degree in political theory from Iowa State University. I was awarded a Graduate Research Excellence Award in 2015 for my research on conservatism.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MRK, TFLO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (23)

Add in rising interest rates on short-term debt, and some are starting to see the appeal of the safer (and higher) yield. But I think this will be an ongoing process.

Thanks for the article.

In the end, the main reason SCHD currently had a much higher yield than SPY is most of the higher yielding businesses have no growth. the PEG helps show that.

I actually feel the same about some of mega tech, too. Once debt is taken into account, they are actually cheaper than the staples, so I view their recent run-up at least partially as investors getting defensive.

It's very interesting to watch.

I'm about 45% TFLO right now, but I am picking up a stock here or there if they look attractive.

Having that optionality I think is going to be really important. I view our current state as a sort of "fragile stagflation". We might very well muddle along, giving businesses some time to adjust to a tighter labor market and less globalization, and in that case, the market will do okay. But I think we are going to be in a fragile state as higher interest rates, student loan repayments, no government stimulus, and tricky geopolitics continues. So, really at any time the economy could crack, and the bear market could resume. I am more than happy to collect 5% on part of my portfolio while getting more aggressive with the rest and aiming for long-term growth.