Petco Health and Wellness: High Leverage Is A Drag On Valuation

Summary

- I maintain a hold rating for WOOF due to the uncertain macroeconomic environment and the company's high leverage risk.

- Despite facing headwinds from macro trends and a shift in the pet life cycle, WOOF shows potential for growth in the long-term pet care market, especially in premium products.

- I see potential growth in EPS once the economic environment improves, but the leverage ratio needs to be addressed to remove the discount in comparison to peers.

Drazen_/E+ via Getty Images

Recommendation

Readers may find my previous coverage via this link. My previous rating was a hold as I believed Petco Health and Wellness Company (NASDAQ:WOOF) valuation was not cheap enough to go long.

I am reiterating my hold rating as the macro situation remains uncertain and is still weighing on WOOF’s potential to recover its growth. Moreover, the high leverage remains a risk that I am not comfortable with.

Business overview

WOOF is a company that specializes in pet health and wellness. The company offers a variety of pet care services, including veterinary care, grooming, and training, in addition to pet food and other pet supplies.

Industry landscape

Graphical Research estimates that the North American Pet Care Market will be worth upwards of $132 billion by 2027, up from a projected $110 billion in 2020. This outlook is consistent with research from Morgan Stanley, which projects an annual growth of 8% in the pet industry by 2030.

In my opinion, the future of this industry has the backing of the younger generation of Americans. I anticipate that Millennials will spend more on their pets than previous generations of pet owners, especially on high-end pet food and services, as they become homeowners, delay having children, and have smaller families. Thus, I think Wellness for pets, despite being in its infancy, will continue to grow. Given the time and effort required to establish preventative care protocols, vet training, and pet owner education on the significance of preventative pet care, I believe this is a long-term growth opportunity.

Comments

Despite the long-term tailwind I've identified, WOOF currently faces headwinds from broader macro trends and the expected slowdown due to the shift in the pet life cycle, which are weighing on demand for the company's higher-margin supplies and companion animals. The situation appears to have worsened as well, with management reporting that consumers became more cautious about making discretionary purchases in the second half of the first quarter. While I understand that this is a result of broader macro headwinds, the persistent nature of these headwinds has me worried about the near-term performance.

While demand for supplies and pets remains weak, I found that WOOF's consumables and services and other categories both saw year-over-year growth of 11.2% and 25.4%, respectively.

The company's consumables division, in particular, saw an increase in both volume and price as a result of the ongoing trend of offering premium products. This bodes well for future growth, as it indicates that pet owners have a preference for high-quality products. But there is also a short-term worry. The management team has recognized a change in consumer behavior toward value seeking, which I interpret as the initial stages of the "trading down" trend. However, thanks to their own product lines, WOOF was able to satisfy at least some of this demand.

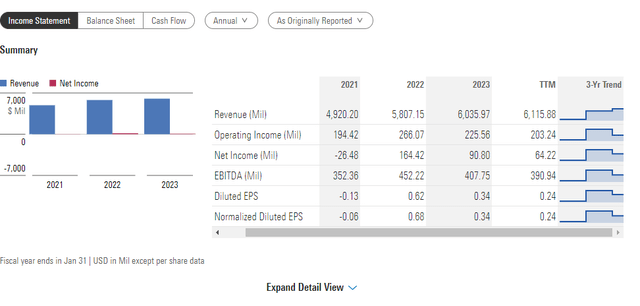

Financials

Given the pullback in discretionary spending, which affects WOOF, I expect overall industry growth to slow. In the coming quarters, I expect revenue to remain in the low to mid-single digits until there is evidence that consumer confidence has returned. When that occurs, I anticipate a surge in growth as WOOF benefits from the premiumization trend while also recovering in base level demand.

I do not see a path to gross/EBITDA margin recovery as revenue is expected to be muted in the near term. However, if we are looking at the long term, I would not be too disappointed. The fact that pet owners are willing to pay a premium for higher quality goods bodes well for increased gross margins. It is also not difficult to believe that WOOF can return to low 40s gross margins and 10% EBITDA margins because this is where it was operating in FY19 (pre-covid).

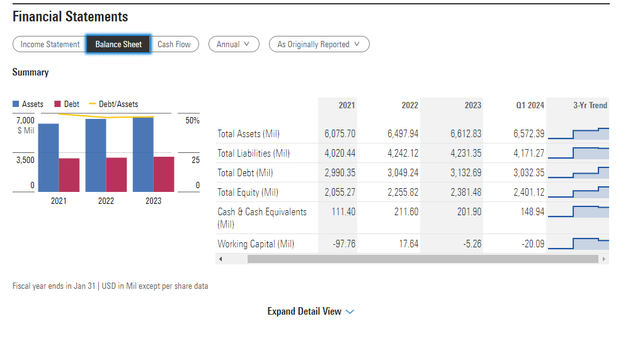

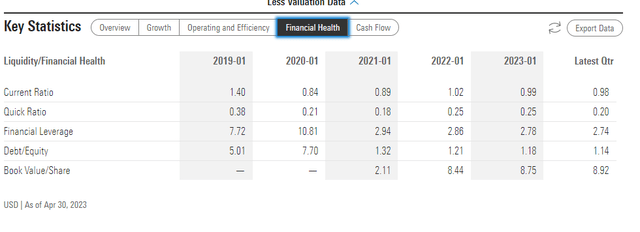

With $3 billion in debt and $150 million in cash, WOOF's balance sheet is quite leveraged, with a net-debt to LTM EBITDA ratio of 7x. This is excessive and poses a significant risk to the business if interest rates are raised further. Having said that, WOOF has begun to pay down some of the debt principal, which I see as a positive step.

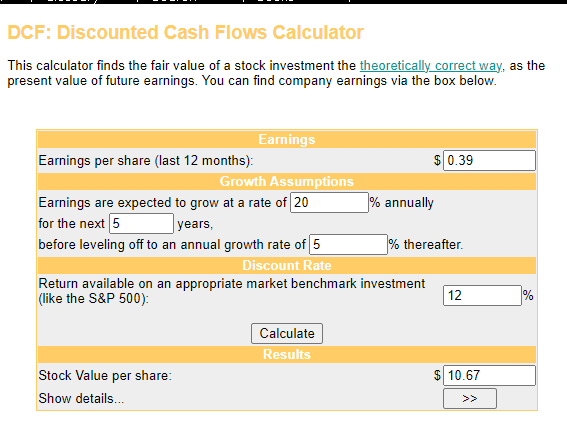

Valuation

Based on my analysis of the business, WOOF should be able to grow EPS much faster than its topline once the macroeconomic environment improves. However, growth should be concentrated in the later years (after FY25), as I am not confident that the economy will improve in the near future. My DCF model assumes a five-year elevated growth rate of 20% (topline growth + margin expansion), with growth tapering to 5% in the terminal year (5% because there is still a long-term secular trend and I expect this to grow faster than the overall economy). Finally, I used a 12% discount rate because this is a rather discretionary business, as evidenced by its recent performance. As a result, in order to compensate for the risk, I demand a higher return.

Moneychimp

WOOF trades at 7x forward EBITDA (I used EBITDA due to its debt level), which is lower than peers such as Rover Group (ROVR), Wag! (PET), and Chewy (CHWY), all of which are well known players in the Pets-related industry, and they average around 26x EV/ forward EBITDA. I believe the discount will remain until WOOF can reduce its leverage ratio (note that Rover Group and peers have no net debt) and the economy improves, boosting growth prospects (note that Rover Group is also expected to grow much faster than WOOF over the next two years).

Risk

WOOF's financials are highly leveraged (net debt/EBITDA of 7x). Investors should be aware that while there has been no current sign of liquidity problems, this is a potentially serious situation that could develop rapidly.

Conclusion

My recommendation for WOOF remains a hold due to the uncertain macroeconomic environment and the potential impact on WOOF's growth recovery. The high leverage of the company is a risk that I am not comfortable with. While the pet care market shows long-term potential, WOOF is currently facing headwinds from macro trends and a shift in the pet life cycle, impacting demand for higher-margin supplies and pets. I see potential growth in EPS once the economic environment improves, but the leverage ratio needs to be addressed to remove the discount in comparison to peer.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.