Duckhorn Portfolio: Upside Is Attractive, But Near-Term Demand Uncertainty Still Risky

Summary

- I recommend a hold rating for NAPA despite potential upside, due to near-term demand uncertainty and potential challenges in sustaining market share gains.

- NAPA has consistently exceeded revenue expectations, with strong gross margin performance and a well-managed balance sheet, showing resilience in the face of potential headwinds.

- The wine market is booming, driven by the status symbol of wine consumption, especially among the younger generation, and NAPA's commitment to innovation, portfolio diversification, and distribution victories bodes well for its future.

Klaus Vedfelt/DigitalVision via Getty Images

Investment action

I recommended a hold rating for Duckhorn Portfolio (NYSE:NAPA) when I wrote about it the last time as I saw little upside in the stock. Furthermore, I was concerned about volume being impacted by the price increases.

Based on my current outlook and analysis on NAPA, I continue to recommend a hold rating even though I see positive upside to the stock. I believe the right time to invest is when the macro economy turns for the better, at which, the growth visibility and stability will be a lot better.

Business

NAPA is a winery in North America that mass-produces high-end vintages. Duckhorn Vineyards, Decoy, Kosta, Paraduxx, Browne, Goldeneye, Migration, Calera, Canvasback, Greenwing, and Postmark are just some of NAPA's world-class luxury brands. More than 50 countries and all 50 U.S. states carry them. The suggested retail price for a bottle of NAPA wine is anywhere from $20 to $200.

Industry & Peers

The U.S. wine market was worth $63.69 billion in 2021, and Grand View Research predicts it will grow at a CAGR of 6.8% between 2022 and 2030. In my opinion, the wine market is booming because drinking wine is a status symbol, especially among the younger generation.

Companies like Pernod Ricard (OTCPK:PRNDY), Constellation Brands (STZ), Diageo (DEO), E & J Gallo Winery, etc. operate both internationally and domestically in this market.

Qualitative review

For the ninth quarter in a row, NAPA has reported revenue and gross profit that exceeded expectations. NAPA can only win over so many customers, so I'm worried that the company's rate of market share gain will slow down from here on out. I would like to remind investors that consumer tastes evolve over time, so this is not a winners take all market. Despite the fact that future share gains for NAPA may be more gradual, I remain optimistic about the company's prospects because of its commitment to product innovation, portfolio diversification, and distribution victories. The stock's near-term performance is threatened by this and the inflationary environment because investors may be anticipating another beat on consensus numbers, which, if it does not occur, will put pressure on the stock price.

Quantitative review

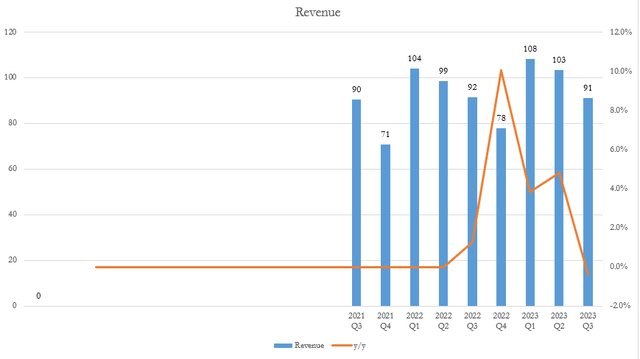

Despite my prediction of a slowdown in consumer demand, NAPA revenue performance exceeded my expectations. An interesting point to note is that despite poor weather in the quarter, NAPA saw positive net sales growth in tasting rooms in California, average spend per customer is up, and summer bookings appear strong. The fact that demand remained strong despite the appalling conditions gives me hope that NAPA can continue to grow in this macroenvironment. I believe revenue can continue to grow in the high single digits in the near term, albeit slightly lower than the historical low-teens range, as I anticipate some form of demand deterioration due to high inflation. However, there is a significant risk of a major recession, which could significantly slow growth.

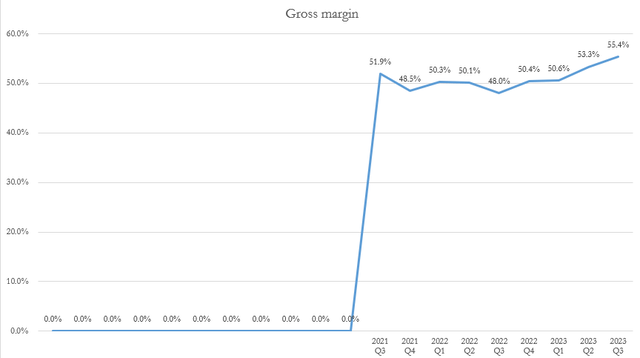

NAPA's gross margin is still performing well, increasing sequentially, which I attribute to price increases and management's focus on cost efficiency. Notably, given the unfavorable mix shift of higher margin direct to consumer, the gross margin expansion is impressive. While DTC has higher operating expenses because NAPA must handle the entire distribution cost, it has higher GM because it captures the entire margin (no need to give wholesalers a cut). As a result, as NAPA continues to go direct to consumer, I anticipate a further increase in gross margin.

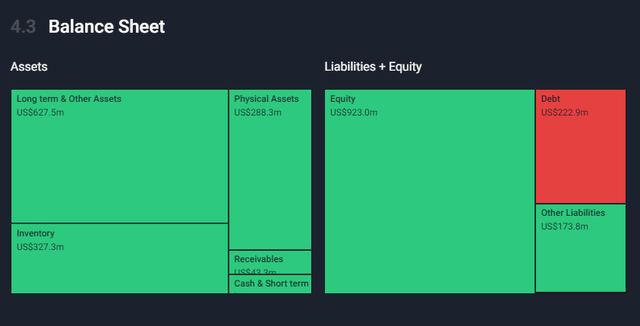

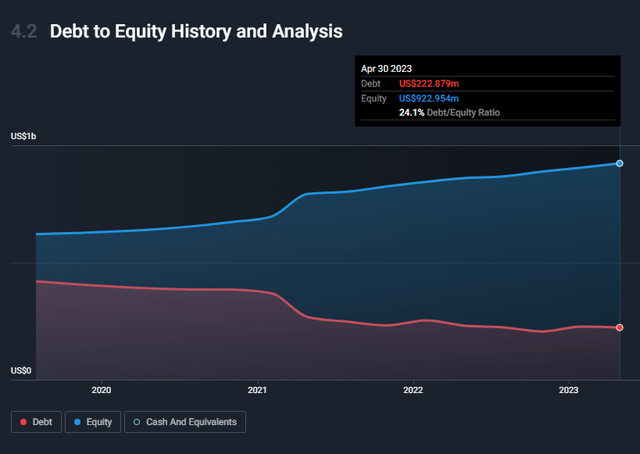

NAPA has a little net debt of only $210 million, which is just slightly lower than 2x net debt/EBITDA. This is a great improvement from historical levels, which means management is managing the balance sheet risk well. There should be no need for additional capital raising as the business is growing. Also, NAPA debt is well covered by its operating cash flow and interest is well covered by EBIT at 7x.

Valuation

I believe a forward PE multiple is the right way to value the business as it is profitable. NAPA current trades at 19x forward PE which is lower than peers.

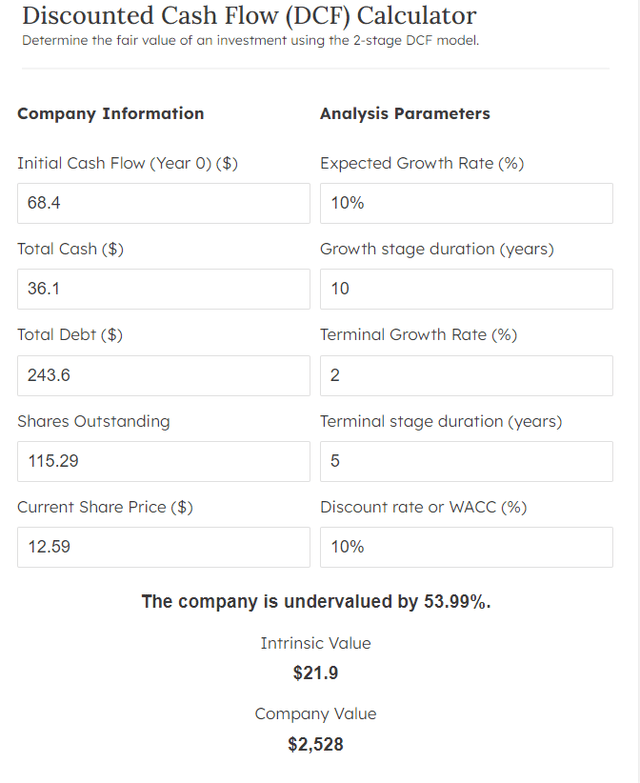

I believe NAPA can grow earnings at a 10% annual rate in the medium term as it continues to gain market share (albeit at a slower rate) and margins improve from increased DTC mix (which has a higher gross margin). Following the growth stage, the business should eventually grow in the low-single digits, owing primarily to pricing as volume becomes more or less saturated. My DCF model suggests a price target of $22 based on these assumptions.

Risk

Most NAPA wineries' labels and brands are consistently praised by the most prominent critics and publications in the wine business, and many have been named among the best luxury wine brands in the United States. NAPA's continued success as a top-tier winery is largely due to the consistently high marks they receive from critics outside the company. Neither the ratings themselves nor the criteria used to assign them are under NAPA's purview in any way. NAPA's bottom line will take a hit if they suddenly switch to sending only negative feedback.

Conclusion

I recommend a hold rating for NAPA despite the attractive upside potential due to near-term demand uncertainty. The wine market is booming, driven by the status symbol of wine consumption, especially among the younger generation. NAPA has consistently exceeded revenue expectations but may face challenges in sustaining market share gains and navigating the inflationary environment. Despite potential headwinds, the company's commitment to innovation, portfolio diversification, and distribution victories bodes well for its future. Financially, NAPA has shown resilience with strong gross margin performance and a well-managed balance sheet.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.