FXI: Making The Bullish Case For China

Summary

- China, the world's second-largest economy, has, for lack of a better way of saying it, been a terrible place to invest in.

- With inflation falling off a cliff, I suspect the PBoC will take actions to try to spur consumer spending.

- Investing in China with iShares China Large-Cap ETF comes with its unique set of geopolitical risks, particularly with the country's growing influence on the global stage.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Learn More »

da-kuk

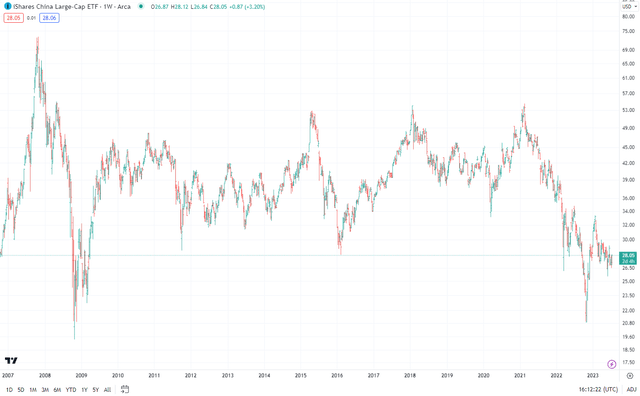

China, the world's second-largest economy, has, for lack of a better way of saying it, been a terrible place to invest in. When looking at the iShares China Large-Cap ETF (NYSEARCA:FXI), it's worse than a lost decade. The exchange-traded fund ("ETF") is trading back to levels not seen since March 2009. We all know there are legitimate concerns around the government and regulation, but is there a bullish case to consider finally buying FXI?

Overview of FXI

The FXI ETF tracks the FTSE China 50 Index, composed of the 50 largest and most liquid Chinese stocks listed on the Hong Kong Stock Exchange. This ETF is a reasonable choice for investors who wish to gain exposure to China's growth without the need to invest in individual Chinese stocks.

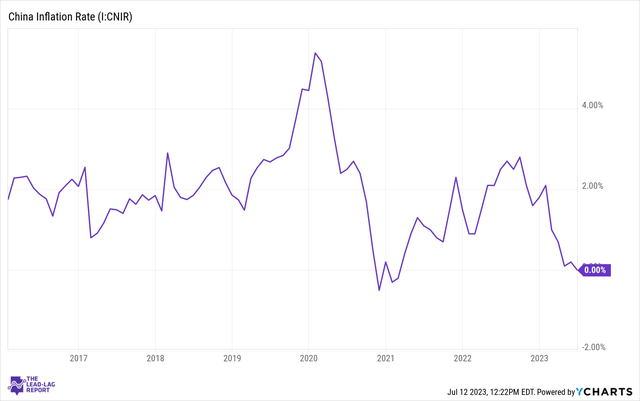

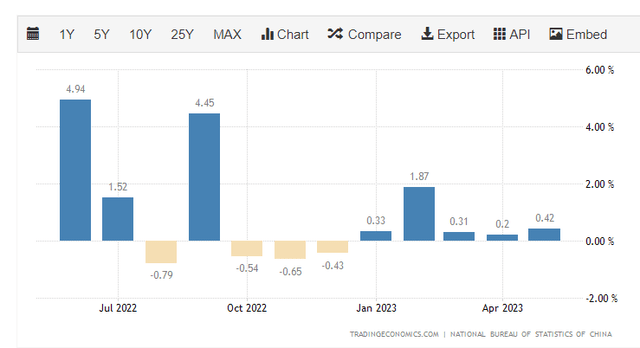

Despite all of the arguments for a surge in economic activity post re-opening, China's economy and markets have performed completely opposite of what Wall Street was expecting. Inflation? What inflation?

China Easing Incoming?

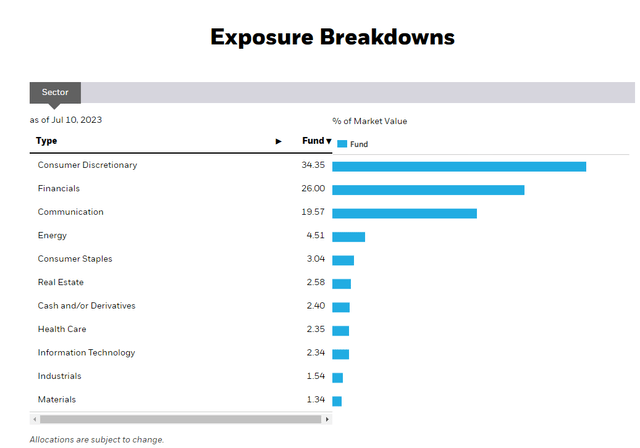

With inflation falling off a cliff, I suspect the PBoC will take actions to try to spur consumer spending. If that happens, this would be particularly relevant for FXI as the fund's largest sector allocation is to Consumer Discretionary stocks. The recent uptick in retail sales figures provides a positive outlook for this sector, which in turn is expected to support FXI's performance.

Geopolitical Risks and Opportunities

Investing in China comes with its unique set of geopolitical risks, particularly with the country's growing influence on the global stage. Recent partnerships between China and Russia, tensions with Taiwan, and issues surrounding technology and intellectual property rights are a few examples. However, these risks could also present investment opportunities, especially for contrarian investors who believe that these challenges are already factored into the current share prices.

The improving state of the Chinese consumer, in terms of spending, is vital for the performance of FXI. Recent retail sales figures out of China show an expansion of year-over-year percentage gains across the retail sector, which should help support FXI in the coming months. But growth is still anemic, which is the exact opportunity for investors.

Risks and Rewards

While there are several compelling reasons to invest in FXI, it's essential to take into account the heightened risks associated with it. The geopolitical tensions and the varying paths the U.S. and China are taking with respect to the Russia-Ukraine conflict add to this risk. However, given the ETF's current valuation and China's economic resilience, some investors may find the potential rewards worth the risks.

Conclusion

Despite recent deflationary trends observed in the Chinese economy, investors should not overlook the growth potential that the country still holds and resolve of the PBoC. With the right fiscal and monetary measures, China can steer its economy towards a path of sustained growth, making investments in funds like iShares China Large-Cap ETF more rewarding in the long run.

While the geopolitical risks cannot be ignored, they should be seen in the context of the broader economic trends that underline China's undiminished role as a global economic powerhouse. Investors need to be mindful of the risks associated with investing in China, but with a careful and balanced approach, the potential rewards can be significant.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)