Bank Of Canada Hikes Again As Inflation Fears Linger

Summary

- The BoC hiked rates to 5% as broadly expected with the tone of the statement suggesting we will need to see significant softening in activity and inflation to deter it from hiking again in September.

- Markets are pricing a 75% chance of a move and that looks about right. USD/CAD could now break below 1.3000 quite soon.

- The market reaction to the BoC hike was – as we had expected – positive for the loonie.

joshlaverty

By Francesco Pesole, FX Strategist and James Knightley, Chief International Economist

The BoC hiked rates to 5% as broadly expected with the tone of the statement suggesting we will need to see significant softening in activity and inflation to deter it from hiking again in September. Markets are pricing a 75% chance of a move and that looks about right. USD/CAD could now break below 1.3000 quite soon

Second hike in a row after a long pause

The Bank of Canada has raised rates a further 25 basis points today, leaving it at 5%. This follows a five-month pause between the January hike and the restart of policy tightening in June, triggered by concerns that demand was proving to be more resilient and inflation more persistent than the BoC had expected.

This argument was used again today with the BoC stating that “three-month rates of core inflation running around 3½-4% since last September, underlying price pressures appear to be more persistent than anticipated. This is reinforced by the Bank’s business surveys, which find businesses are still increasing their prices more frequently than normal”.

The BoC also places a heavy emphasis on the strength in consumer demand and the tightness in the labour market, which is keeping wage pressures elevated. It sees inflation staying around 3% for the next year before only returning to target in 2025.

The BoC offers little in the way of forward guidance, merely stating that the “Governing Council will continue to assess the dynamics of core inflation and the outlook for CPI inflation. In particular, we will be evaluating whether the evolution of excess demand, inflation expectations, wage growth and corporate pricing behaviour are consistent with achieving the 2% inflation target”.

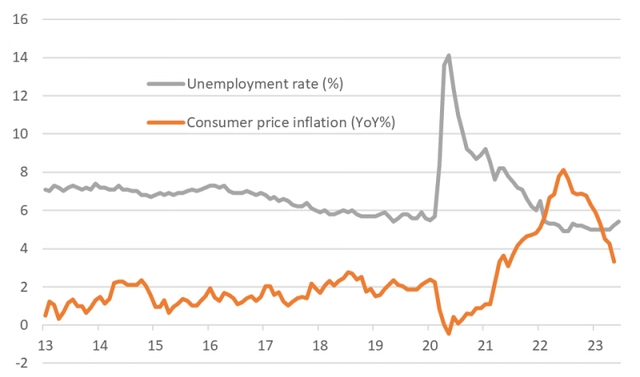

The chart below shows that inflation and the unemployment rate are moving in the direction the BoC would like to see, but clearly it isn’t happening quickly enough and may not be sustainable enough for the BoC to keep rates at 5%.

The market is currently pricing around a 75% chance of another hike at the September meeting, and we feel this is about right. The tone of the statement suggests the BoC is not convinced it has done enough yet, so we will need to see significant softness in activity, labour and inflation numbers to prevent another move.

Canada's CPI and unemployment

CAD: On track to hit sub-1.30 levels

The market reaction to the BoC hike was – as we had expected – positive for the loonie, although the proximity to the surprisingly soft CPI print in the US meant that CAD lagged other pro-cyclical currencies on the day. That, once again, boils down to the rather tight correlation of the loonie with incoming data from the US.

Looking beyond the very short-term impact, the extra hike by the BoC and no pushback against further moves in the future means that CAD can keep benefitting from an attractive carry.

It’s worth remembering that the loonie has the best volatility-adjusted carry in the G10 space. We don’t necessarily see this as the inception of a broader USD downtrend, but the close USD-CAD correlation also means that CAD is more shielded in the event of a USD rebound than other pro-cyclical currencies.

A move below 1.3000 is surely possible in the coming weeks, although we may need to wait for the fourth quarter of this year to see the USD/CAD sustainably trade around 1.27/1.28.

Content Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by