AMC Networks: Undervalued With The Walking Dead's New Series

Summary

- AMC Networks has announced new productions, including a new series in The Walking Dead Universe, which I expect to boost future net sales growth.

- The company's use of artificial intelligence to monetize multi-platform content and further streaming strategies could significantly increase free cash flow growth.

- Despite potential risks from recent restructuring initiatives, high debt levels, and changing consumer or distribution formats, AMC Networks could be undervalued.

Tom Cooper

AMC Networks Inc. (NASDAQ:AMCX) recently announced a long list of new productions including the new The Walking Dead Universe series, which will most likely enhance future net sales growth. I also believe that further development of good quality content, the use of artificial intelligence to monetize multi-platform content, and further streaming strategies could bring significant free cash flow growth. I do see certain risks from the recent restructuring initiatives, the total amount of debt, or changing consumer or distribution formats. However, I believe that AMC could have more market valuation.

AMC Networks

AMC Networks is a company established in the United States with international operations and a long history of offering subscription contracts, streaming platforms, and entire franchises of international relevance. To understand the framework of operations and the size of this company, in my view, it is enough to say that it has a commercial agreement with the British agency BBC for the transmission of content within the United States.

Its production model includes ownership of the scripts and ideas developed in fictions and series as well as distribution for global audiences. In some cases, these contents are distributed by third parties in national or regional markets through paid licenses.

Currently, the company has a reach in more than 110 countries, and also has a film production company called IFC Films, which owns some winning productions at the most prestigious international festivals in the world such as Cannes, Golden Globe, or the awards of the Academy.

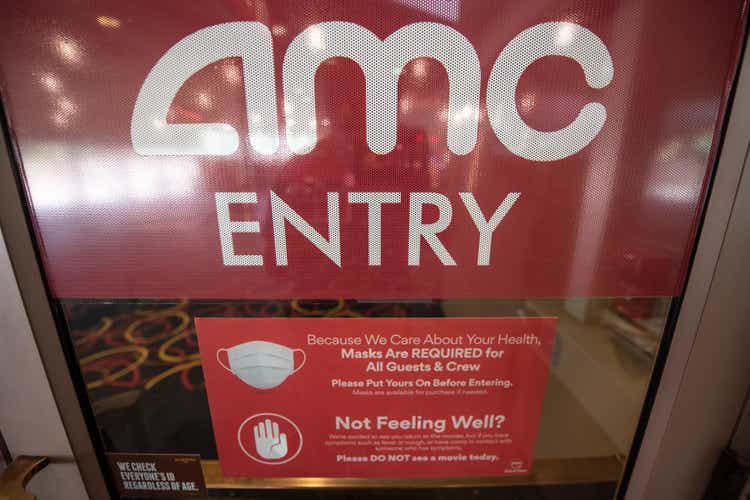

AMC's activities are divided into two segments that correspond to national and international operations respectively. Domestic operations are vastly superior, in infrastructure, to international operations, since AMC has domestically a larger share of the market, with some of the most watched channels locally in the United States. In any case, the largest sources of revenue come from the distribution of its programming as well as the advertising spaces.

Source: 10-Q

Balance Sheet

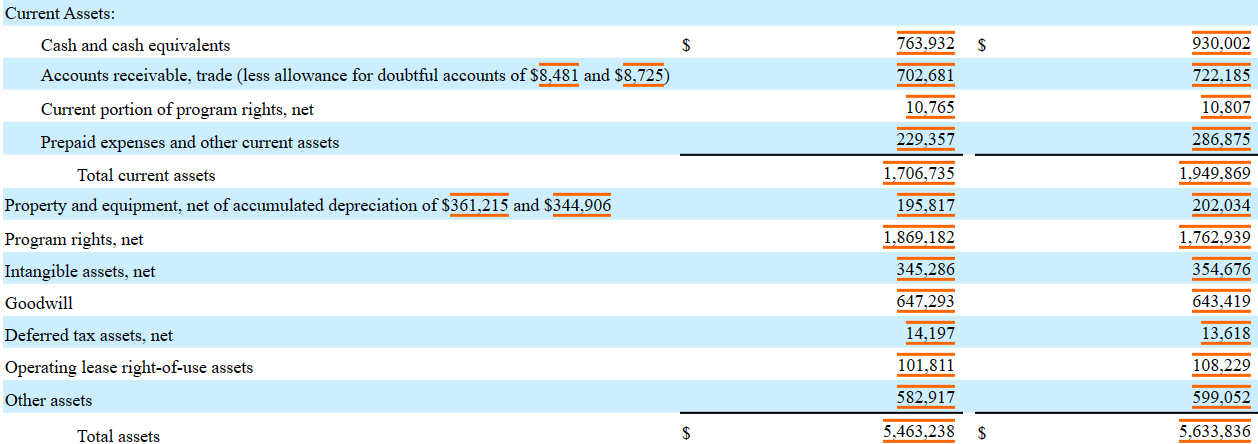

The last balance sheet included cash and cash equivalents worth $763 million, accounts receivable of about $702 million, current portion of program rights worth $10 million, prepaid expenses and other current assets close to $229 million, and total current assets of about $1.706 billion. The total amount of current liabilities is significantly below the total amount of current assets, so I believe that liquidity does not seem an issue for AMC. I believe that banks would provide necessary financing if necessary.

Long term assets include property and equipment, net of accumulated depreciation of $195 million, program rights of close to $1.869 billion, intangible assets worth $345 million, and goodwill of about $647 million. Finally, total assets stood at $5463 million, which implied an asset/liability ratio of more than 1x. Yes, the balance sheet appears solid, however investors need to carefully monitor the total amount of debt.

Source: 10-Q

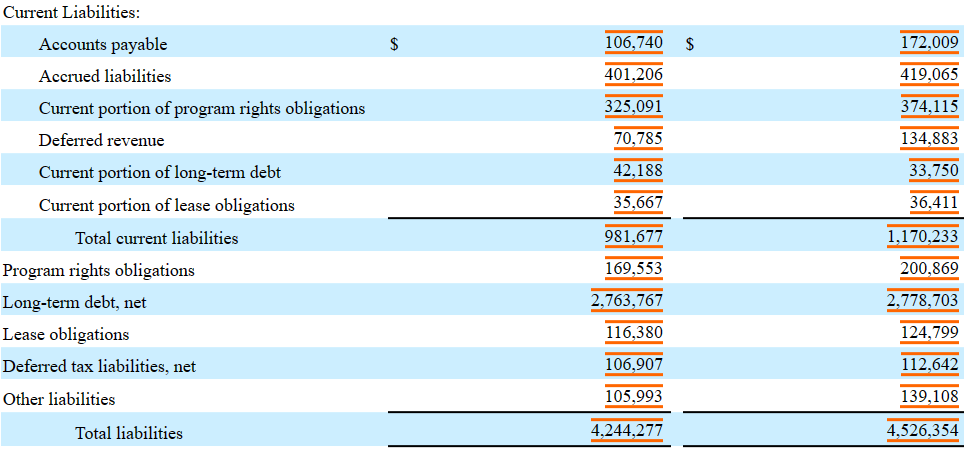

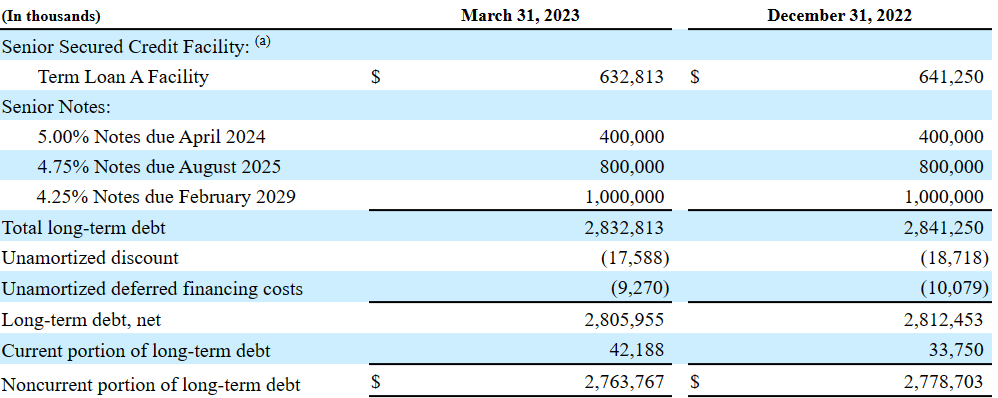

Liabilities include accounts payable worth $106 million, accrued liabilities of about $401 million, and current portion of program rights obligations worth $325 million. Additionally, with a current portion of long-term debt of close to $42 million, total current liabilities were equal to $981 million. Besides, with long-term debt of about $2.763 billion, total liabilities stood at $4.244 billion.

Source: 10-Q

Market Expectations

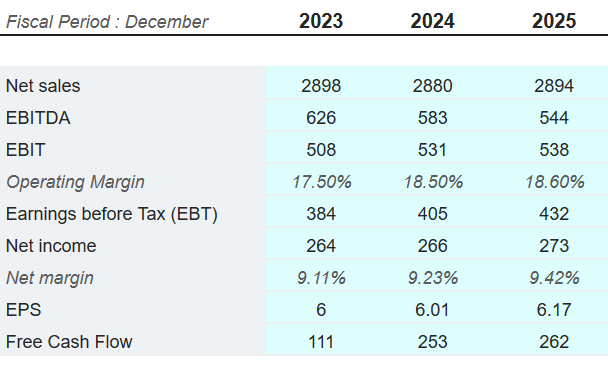

Market analysts expect 2025 net sales close to $2.894 million, 2025 EBITDA of $544 million, EBIT close to $538, and 2025 net income close to $273 million. It is also worth noting that the free cash flow is expected to be close to $262 million in 2025. In my view, as soon as investors have a look at the FCF growth expectations, demand for the stock will most likely increase.

Source: MarketScreener.com

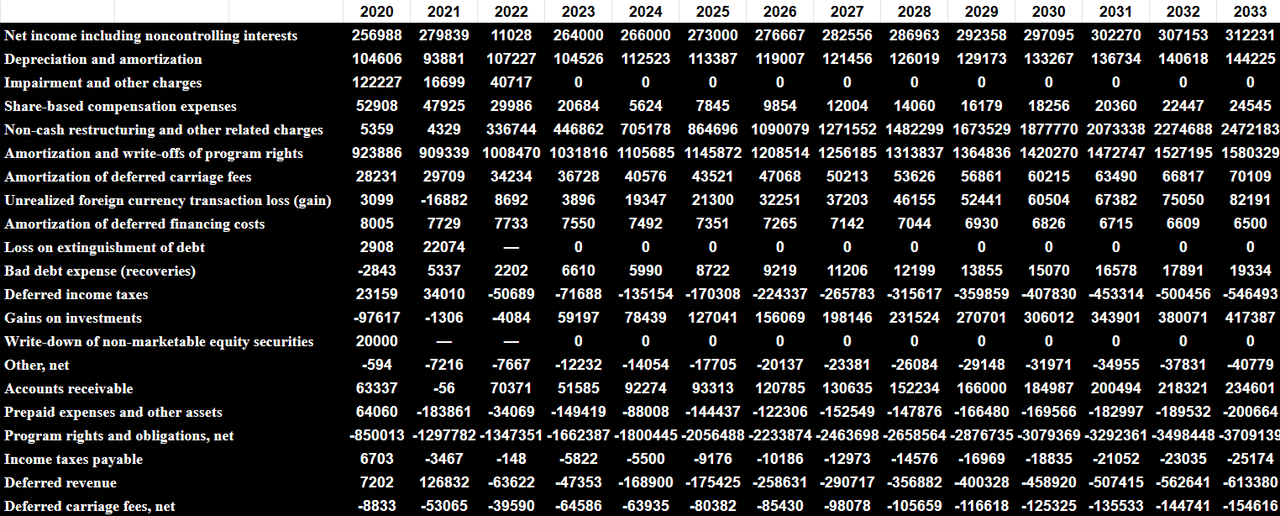

My Financial Model

Under my DCF model, I included some optimistic assumptions about future developments of AMC. First, I believe that the ad-supported version of AMC+, which is expected to be released soon, will serve as a revenue catalyst. Besides, I also assumed that second seasons of Mayfair Witches and Anne Rice's Interview with the Vampire, which are expected to be launched soon, will also be successful.

Announced plans to launch an ad-supported version of AMC+ later this year. Source: Quarterly Release

Premiered second series in an expanding Anne Rice Immortal Universe, Anne Rice’s Mayfair Witches, which became the #1 freshman basic cable drama for the 22/23 season, the most successful premiere in the history of AMC+ and the most watched single season of any show on the platform. With second seasons of Mayfair Witches and Anne Rice's Interview with the Vampire on the way, announced development of a third series set in the world of the Talamasca. Source: Quarterly Release

Additionally, I believe that investors will most likely be holding the shares of AMC as soon as they notice the incoming production of the new The Walking Dead Universe series. The format with well-known stars may be even more popular than previous productions.

Completed production of the first season of TWD: Daryl Dixon and are finishing production on a new The Walking Dead Universe series, which reunites stars Andrew Lincoln and Danai Gurira in an epic story of faith, struggle, love, and reunion. Source: Quarterly Release

Moreover, I believe that in the long term, further increase in ownership and control over valuable content streaming strategies as well as more brand expansion will bring revenue growth and FCF margin expansion. In addition, I expect successful monetization of the multi-platform content as well as innovating and generating growth in the area of advertising, particularly technology tools with artificial intelligence in its processes and automation of distribution channels.

Considering the talks about a potential recession, I would also expect a certain decrease in advertising revenue in the short term. However, I think that we could expect further increases in revenue in the long term. In line with this comment, the recent decrease in advertising revenue in the last quarter is worth noting.

Net revenues increased 1% from the prior year to $717 million, largely driven by increased distribution and other revenues partly offset by lower advertising revenues. Source: Quarterly Release

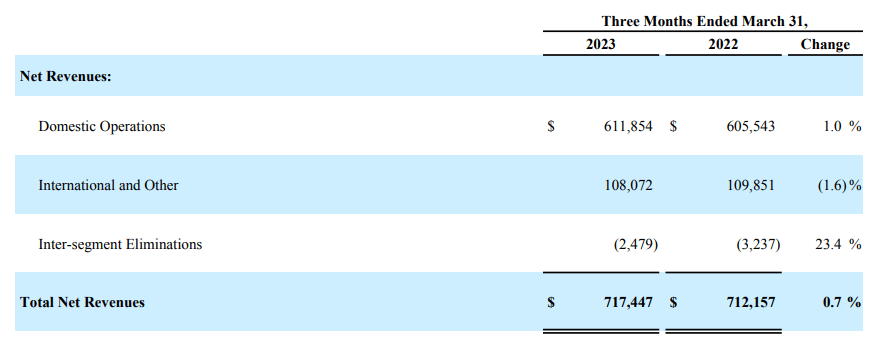

My financial model included 2033 net income including noncontrolling interests worth $312 million, depreciation and amortization close to $144 million, non-cash restructuring and other related charges of about $2.472 billion, amortization and write-offs of program rights close to $1.580 billion, and deferred income taxes of about -$547 million.

Besides, with changes in accounts receivable close to $234 million, prepaid expenses and other assets worth -$201 million, program rights and obligations close to $-3.710 billion, and changes in deferred revenue of -$614 million, I also assumed changes in accounts payable, accrued liabilities, and other liabilities worth $217 million. Finally, net cash provided by operating activities would be about $290 million, which, with capex of close to $-37 million, implied 2033 FCF of $253 million.

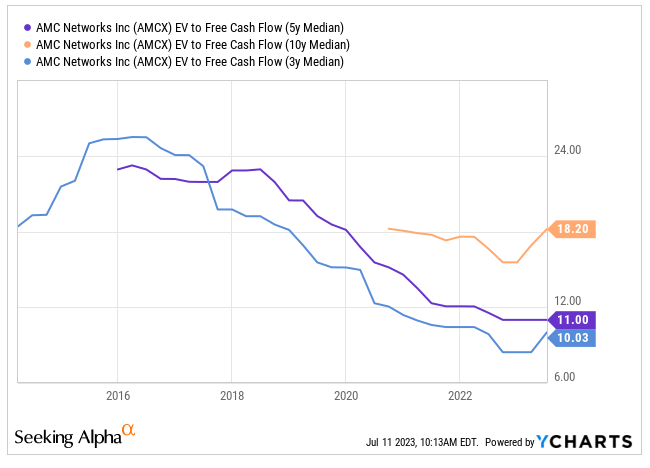

The EV/FCF 5 years median, 10 years median, and 3 years median stand at close to 10x-18x, so I believe that assuming a terminal multiple of 14x makes sense.

Source: YCharts

The company reported 5% notes, 4.75% notes, and 4.25% notes, so in my view, a discount of 6.5% appears conservative. With the previous assumptions, I obtained an implied enterprise value of $3.331 billion.

Source: 10-Q

If we also add cash and cash equivalents of about $763 million, and subtract current portion of program rights obligations of $325 million, current portion of long-term debt worth $42 million, program rights obligations of about $169 million, and long-term debt close to $2.763 billion, the implied equity would be $794 million. Finally, the fair price would be about $18.27 per share, and the IRR would be 2.93%.

Competitors

The competition regarding AMC's activities is driven by three key factors: the competition of its programming against others to obtain distribution on channels and platforms, the reach over audiences, and the competition for the audience's attention with other products that are not of the same nature, among which we find radio or news media.

AMC competes in any of these circuits with public companies of considerably larger size and greater access to resources. ABC, CBS (CBSR), Fox (FOX), and NBC are some of the competing chains in the first and second of the named cases, directly competing for the place in the programming and distribution of the platforms. Even with the high levels of fragmentation and competition in these markets, the possibility of developing specific products for certain audiences and the reading of consumer trends in this regard are equally relevant factors such as the scope of distribution in the order of quantity and quality of the content offered by the company.

Risks

In this market competition environment, even though AMC is an international reference company in the production and distribution of content, in my view, the ability to retain audiences and increase subscribers to its platforms is a determining factor in the business development of the company. An inability in this sense, added to the increase in operating costs or the ability to adapt its contents to the new forms of consumption and distribution, can play a negative role towards the future of the company.

Specifically, in addition to the natural exposure to international markets, fluctuations, or variations in the US and global economies, ACM faces a lack of diversification in the contracts with its distributors, which in most cases have scope until 2028, and there are no renewal obligations. Although it does not imply an immediate risk, it must be taken into account that business development in this decade is a determining factor for the possible renewal of these contracts or the obligation for the company to seek new distribution channels for its products.

I could also expect negotiations with shareholders to define the future strategy with regards to the total amount of debt, which in extreme cases could affect the operations of the company.

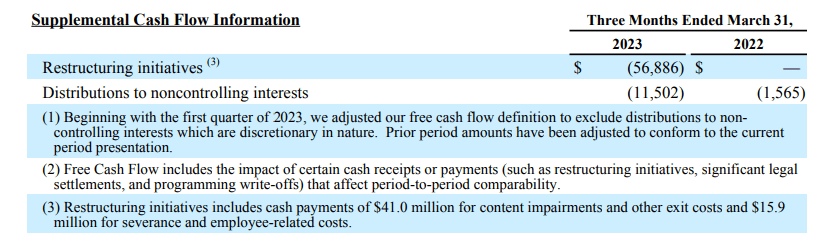

Finally, among one of the largest risks that I consider today, there is the fact that incoming restructuring efforts could fail. If AMC loses key personnel, and know-how is lost, or competitors obtain human talent from the company, in my view, future net revenue expectations would most likely decline. In this regard, I would mention that the company noted restructuring initiatives in the last quarter.

Source: 10-Q

Conclusion

AMC Networks recently announced a significant number of new productions such as Mayfair Witches, Anne Rice's Interview with the Vampire, and the new The Walking Dead Universe series. Such new developments could serve as revenue catalysts for the upcoming years. Besides, successful monetization of the multi-platform content, innovation in the area of advertising, and the use of artificial intelligence could bring significant FCF margin growth. Even considering risks from failed restructuring, the total amount of debt, or new forms of consumption and distribution, I think that AMC appears undervalued.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

Even if they now change the stategy, it will take years to consolidate their finances. Income / EV is around 12 and revenues are expected to decline 10% within the next 3 years. Those are not numbers that usually lead to an outperformance.