Rotation Preparation: Why QQQ Outshines SCHG

Summary

- I believe a rotation from growth to value stocks is imminent due to factors like sticky inflation and valuations, prompting me to consider potential assets for future investment.

- When comparing SCHG and QQQ, I find QQQ to be a better investment choice due to its higher technology exposure, consistent outperformance, and superior risk-adjusted return.

- I will likely be a buyer of QQQ after the next rotation, as it offers reliable tech exposure without the need to pick a specific sub-industry.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

-Antonio-

Introduction

Wayne Gretzky once said I skate to where the puck is going to be, not where it has been. I try to apply this to every major financial decision I make - especially when it comes to big-picture stuff like picking between growth and value stocks.

Since the start of this year, we've witnessed a massive rally in tech stocks. It was the best half for the Nasdaq ever, which tells us a lot about this market.

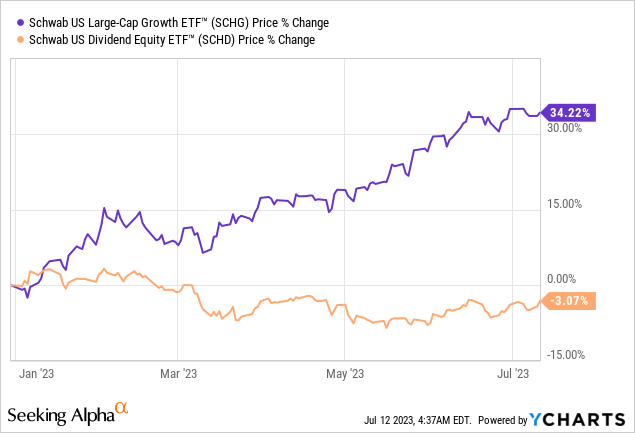

Year-to-date, the Schwab U.S. Large-Cap Growth ETF (NYSEARCA:SCHG) has returned 34%. The Schwab U.S. Dividend Equity ETF (SCHD) has lost 3%, excluding dividends.

Needless to say, this gap has an enormous impact on portfolios. Even a $10,000 investment in either tech or growth would have seen a difference of more than $3,000.

Having said that, I believe in a return from growth to value caused by sticky inflation, valuations, and related factors.

Hence, while I'm buying value and value/growth hybrids, I'm already thinking about assets to buy once we get the rotation from value back to growth.

That's why I'm writing this article.

As much as I respect the SCHG ETF as a terrific investment, I do believe that the bigger Invesco QQQ Trust (NASDAQ:QQQ) - the Qs - is a better investment.

The Growth Party May Be Over

So far, I've only discussed SCHG's brother, the high-yield ETF SCHD.

SCHD is a terrific investment, and I would make the case that it's the best high-yield dividend ETF on the market.

However, the same cannot be said about SCHG.

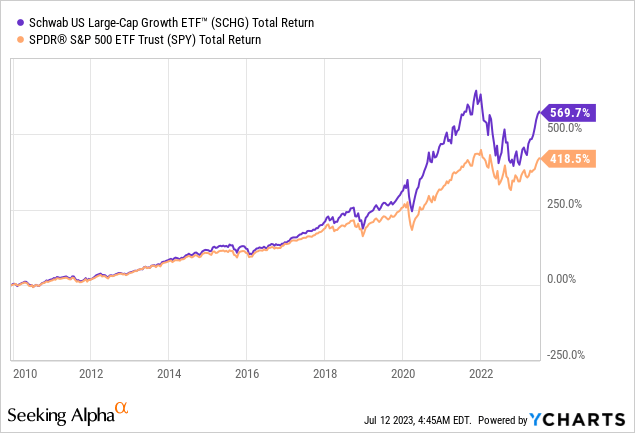

So far, SCHG has done tremendously well. Since its inception, the ETF has returned 570%, including dividends. This has beaten the already stellar return of roughly 420% of the S&P 500 by a wide margin.

While both SCHG and the S&P 500 struggled after peaking in late 2021, they got a renewed boost at the end of 2022.

This is what JPMorgan (JPM) said in February (via Bloomberg) when it made the case for a switch from value to growth stocks (emphasis added).

Value stocks have started to stall against growth peers recently, after outperforming them last year by the most since the dotcom bubble of 2000. While the cheaper shares got a boost from rising bond yields and inflation, investors are starting to price in more hawkish policy, which may reduce support for the trade as yields peak.

The bank made the case that economic growth had peaked, which would make falling inflation expectations more likely.

So far, both calls were right.

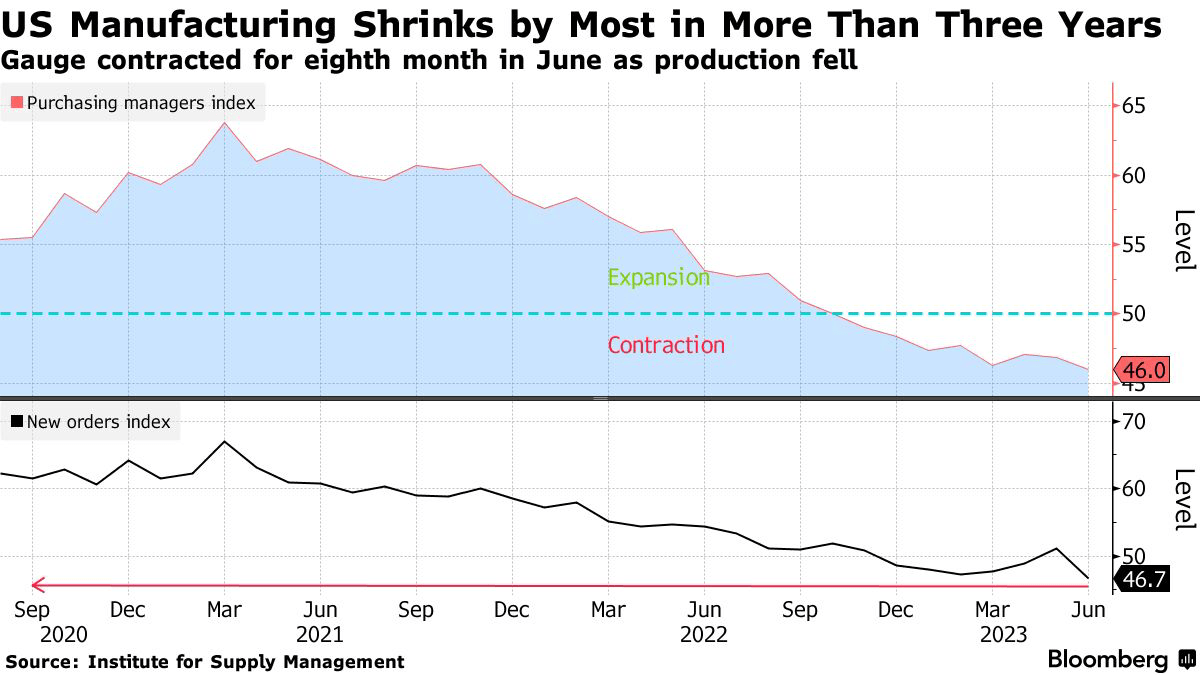

Economic growth has continued to lose momentum. The ISM Manufacturing Index is now in contraction territory, supported by a very weak outlook for new orders.

Bloomberg

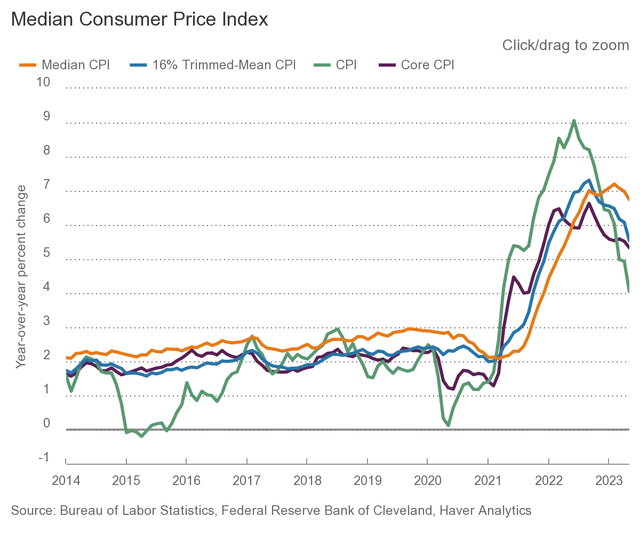

Inflation has also peaked. Looking at the numbers from the Federal Reserve Bank of Cleveland, we see that while inflation is sticky (median and core CPIs), momentum has shifted to the downside.

Federal Reserve Bank of Cleveland

Essentially, this was the perfect environment to buy growth stocks.

After all, the market was betting on a return to lower rates and lower inflation. The market believed we would go back to the scenario we enjoyed between 2008 and 2021 when inflation was very subdued and central banks supported the market with close to zero % interest rates.

Again, it was the perfect scenario for growth stocks.

Now, that is changing.

While I do not disagree with the outperformance of growth stocks so far this year - the market had valid reasons - I do not believe we go back to the environment we enjoyed prior to the pandemic.

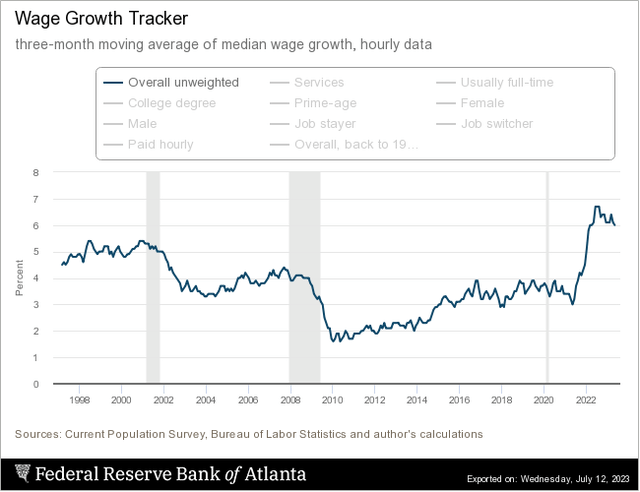

For starters, inflation is extremely sticky. It has enjoyed the benefit from a steep decline in energy costs, which is now wearing out. It also does not take into account that wage inflation is still high.

Federal Reserve Bank of Atlanta

We're now at a point where inflation has worked its way through the economy.

It's a feared chain reaction the Fed needs to battle by doing damage. Hence, the risk at this point is that the Fed might have to do so much damage that we will end up in a recession. Manufacturing surveys already confirm that.

In such a scenario, I believe that the Fed will be forced to cut rates, which will fuel inflation. It could cause us to return to a 2021-like scenario. Back then, tech stocks were flying to celebrate low rates and QE. However, they forgot that this would lead to inflation, which caused a massive rotation.

I might be wrong, but this is the scenario I'm incorporating into my financial decisions, especially because I believe that energy and commodities in general, are dealing with supply issues that could quickly result in higher inflation.

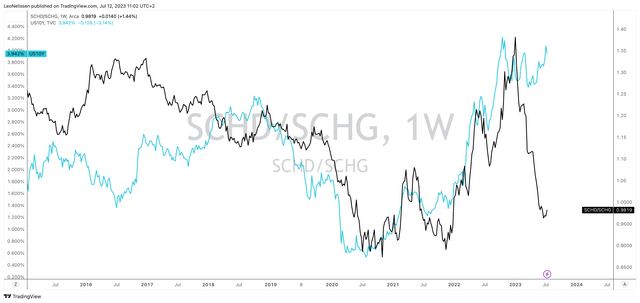

Also, looking at a comparison between the ratio between SCHD and SCHG and the 10-year government bond yield, we see that rates aren't buying the rotation from value to growth.

TradingView (SCHD/SCHG Ratio, 10Y Yield)

I believe the ongoing value-to-growth rotation is on thin ice, and any signs of persistent inflation or a scenario where the Fed pumps more money into the system could lead to a move back to value assets.

Value stocks tend to do well when inflation is sticky, forcing rates to stay elevated - that's my higher-for-longer thesis.

Why I'm Watching The Qs, Not SCHG

As I'm Europe-based, it tends to be hard to buy ETFs that are listed in the US. However, I found a (legal) way, which now paves the road for ETF investments.

In general, I don't like ETFs, as I prefer to do the work myself.

However, when it comes to investing in certain themes or trends, ETFs make sense.

Right now, I'm preparing for an investment in the future in tech stocks, as I want to be a buyer when my growth-to-value thesis pans out. That could offer attractive buying opportunities in tech.

After all, in such a scenario, growth stocks could see attractive valuations again.

While I believe that both SCHG and QQQ offer tremendous opportunities, QQQ seems to be the better play. It's also one of the most straightforward investments, as it's one of the big ETFs next to the S&P 500 (SPY) ETF and the Dow Jones Industrial (DIA) ETF.

Furthermore, both ETFs enjoy a five-star rating from Morningstar, which is a major stamp of approval.

Morningstar

In other words, we're comparing two top-tier assets to each other. This is more challenging than comparing two ETFs where one has an obvious edge.

I also believe that it adds more value.

Before we dive into the details, let me show you some factors that explain what these ETFs are all about.

QQQ

- Incepted in 1999, QQQ is one of the oldest tech-focused ETFs on the market.

- QQQ is the second-most traded ETF in the United States, with more than $200 billion in assets under management.

- The ETF tracks the Nasdaq-100. It has 101 holdings.

- The expense ratio is 0.2%, which I believe is a bit elevated, but OK, given the performance (more on that later).

- Its dividend yield is 0.6%.

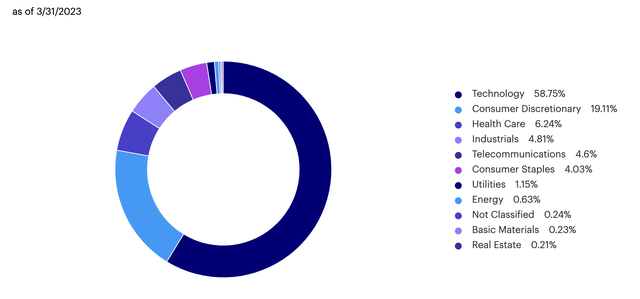

As of March 21, close to 60% of this ETF is invested in the technology sector, followed by consumer discretionary with 19%. Value sectors like real estate, basic materials, energy, and utilities are neglectable.

Invesco

SCHG

- This ETF was incepted in December 2009.

- SCHG does not track the Nasdaq. Its goal is to track the Dow Jones US Large-Cap Growth Total Stock Market Index.

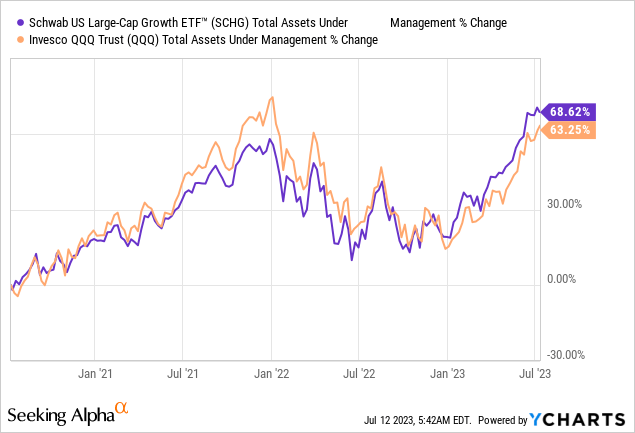

- The ETF has close to $20 billion in assets under management. Over the past five years, SCHG's assets have grown in lockstep with QQQ's assets.

- The ETF has an expense ratio of just 0.04%, which is very low.

- This ETF has 245 holdings.

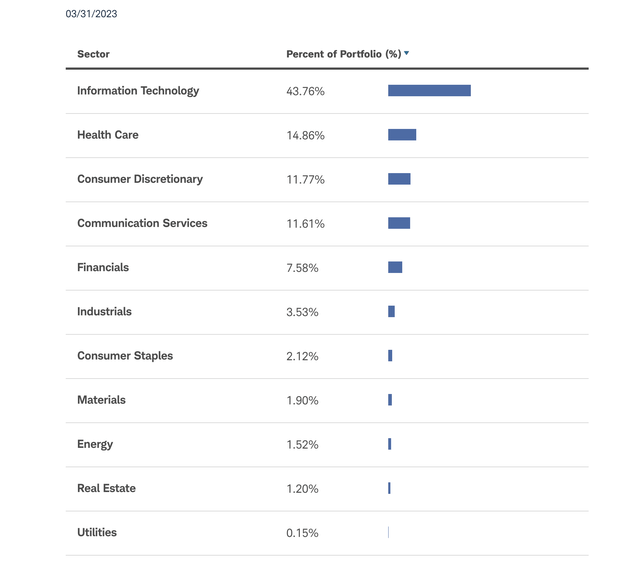

- The main difference versus QQQ is that technology exposure is a bit lower, yet still elevated at 44%. In this case, health care is the second-largest sector with 15% exposure. Also, value sectors have slightly higher exposure.

Schwab Asset Management

- The ETF has a 0.5% yield, which is ten basis points below the yield of QQQ (which somewhat makes up for the slightly lower expense ratio).

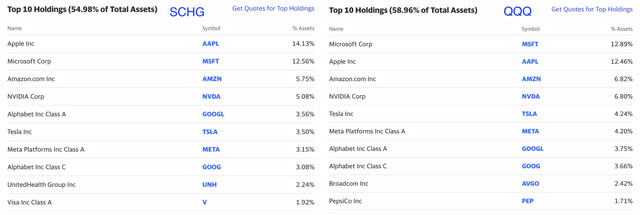

When comparing the top 10 holdings of the two ETFs, we see that both have more than half of their assets in their top 10 holdings. Moreover, both have invested roughly a quarter of their assets in Apple (AAPL) and Microsoft (MSFT).

Yahoo Finance (Author Annotations)

So, essentially, the major difference is that SCHD has a tiny bit more value exposure, which is reflected in its performance.

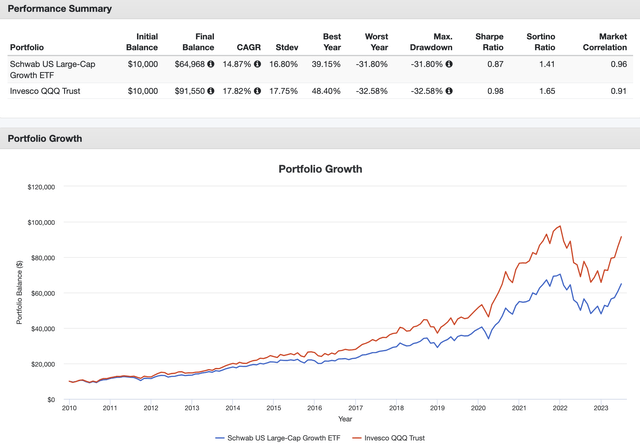

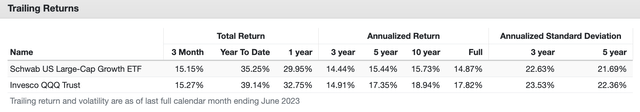

Since its inception, SCHG has returned 14.9% per year. That's a fantastic return, yet less than the 17.8% annual compounding return of QQQ. Moreover, the slightly lower standard deviation (volatility) of SCHG did not result in a better risk/adjusted return (0.87 Sharpe Ratio versus 0.98).

Portfolio Visualizer

Furthermore, SCHG has a higher market correlation, which can be explained by its slightly higher exposure to value sectors.

It also needs to be said that QQQ's outperformance has been consistent. The only recent time interval where SCHG comes close is on a three-year basis. Over the past three years, QQQ has outperformed by less than 50 basis points per year, which is due to the strong performance of value stocks during this period. Unfortunately, it was not enough for SCHG to outperform.

Portfolio Visualizer

Having said all of this, I will likely be a buyer of QQQ after the next rotation.

I put the ETF on my watchlist instead of SCHG, as I believe that QQQ offers no-nonsense tech exposure without having to pick a certain sub-industry.

So, essentially, I have two takeaways today.

Takeaway(s)

1. I believe in a new rotation from growth to value stocks. This is likely to be triggered by sticky inflation and elevated interest rates. Even if the Fed is forced to cut, it could trigger a second wave of inflation, triggering a rotation to value stocks, similar to what we witnessed in 2021. My goal is to use potential weaknesses in growth stocks to build a position. I didn't buy growth stocks when they were cheap last year. I will not make that mistake again, which is why I'm now putting growth stocks on my watchlist.

2. When it comes to investing in tech stocks, I have my eyes set on the Invesco QQQ Trust as a better ETF choice compared to the Schwab US Large-Cap Growth ETF.

While both ETFs have their merits, QQQ stands out as a straightforward investment with significant exposure to the technology sector. In terms of performance, QQQ has consistently outperformed SCHG over the years, offering a better risk-adjusted return.

As I prepare for future rotations, QQQ remains on my watchlist as a preferred investment option.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)