Hibbett: A Bargain If Risks Don't Implode

Summary

- Hibbett, a retail chain selling athletic apparel, footwear, and accessories, has a steady growth history and is expected to continue growing with new stores and an expanding ecommerce channel.

- Despite a turbulent earnings history due to Covid-related stimulus checks, Hibbett's current valuation suggests it could be a fruitful investment, with a potential upside of 86% from its current price.

- Risks include a prolonged period of weak consumer sentiment, changing fashion trends, and the possibility of EBIT margins falling to pre-Covid levels, which would make the company less attractive as an investment.

EXTREME-PHOTOGRAPHER

Hibbett (NASDAQ:HIBB) has had a turbulent price history as the industry benefited from Covid-related stimulus checks, and later fell back from the inflated consumer sentiment. Although Hibbetts’ earnings have deteriorated from FY2022 highs, I believe Hibbett could be a very fruitful investment considering the company’s current valuation. That’s why I hold a buy-rating on the stock.

The company

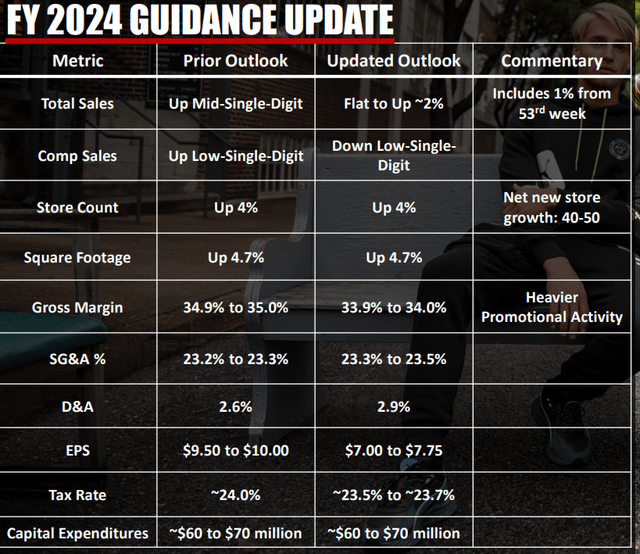

Founded in 1945, Hibbett is a retail chain that sells footwear, clothing, and accessories with a focus on athletic apparel. The company operates under brands Hibbett and City Gear, operating in the United States. Hibbett has a history of steady growth, as the company’s CAGR has been 8.2% from FY2009 to FY2023. This growth should be continuing into the near future, as the company’s store count is expected to grow four percent in FY2024:

Hibbett's Guidance (Hibbett Q1/2024 Investor Presentation)

The company's offering centers on trendy, athletic wear. A risk that I would associate with Hibbett is Nike's shoes' popularity - the company seems to draw lots of its attention from the mentioned product, and I would believe they contribute a notable amount of Hibbett's revenue. For example, taking a look at Hibbett's Instagram page, three of Hibbett's latest posts have Nike's shoes on them:

Hibbett's Latest Instagram Posts (Instagram (@hibbettsports))

Competition & Industry

Hibbett has established competition, as their competitors include for example Big 5 Sporting Goods, Dick’s Sporting Goods and Foot Locker. Even though there’s a lot of competition, Hibbett seems to be trying to gain market share with new stores and an expanding ecommerce channel. The company has a solid track record of modest growth, and I don't believe there's reason to believe it's going to stop for now.

The industry seems to be quite stagnant, as there are lots of established companies fighting for market share. That's why I believe that Hibbett's growth plans for the longer terms aren't to be taken for granted - growth in real terms would need to mostly come from competitors through fierce competition.

An important way to gain market share would be by building a better brand compared to competitors. Although the company is founded in 1945 and has a deep-rooted place in the country, I do not believe Hibbett has a significant edge over competitors in terms of branding; they could even lose the branding competition to Foot Locker; Hibbett has an Instagram following of 258 thousand, compared to Foot Locker's staggering 12.2 million.

Financials

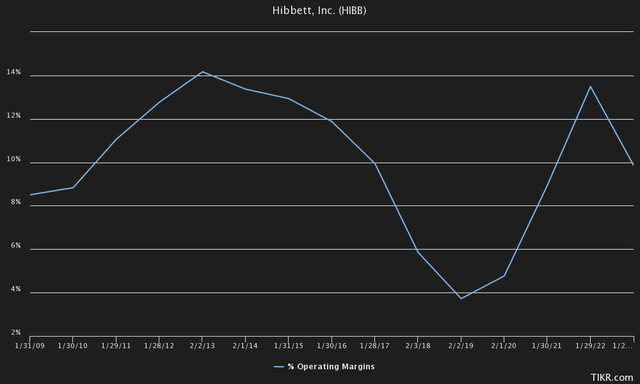

Modest growth in Hibbett's revenue has happened with a somewhat fluctuating EBIT-margin:

The company has mostly maintained an EBIT-margin above 10 percent excluding a FY18-started slump, that lasted all the way into the start of Covid. This represents a risk, as margins could fall into the prior territory. I do not believe it is likely, though, as the consumer sentiment is already bad with Hibbett still guiding an EPS of $7-7.75 for the year.

Hibbett’s balance sheet is relatively healthy in my opinion. The company shows around $27 million in cash, and $104 in debt. This debt could pose a small threat, though, as it is entirely in short-term borrowings and needs to be paid relatively soon. If capital leases are to be included in debt, the company has over $400 million in total debt. In my opinion, capital leases shouldn’t be considered as interest-bearing debt, as the debt’s nature is purely operational and not a source of financing.

Covid Effects

When Covid started, Hibbett experienced a surge in demand as outdoor activities became more popular overnight. Also, the US government issued stimulus checks, which largely benefited Hibbett as consumers suddenly had good buying power. The effect of stimulus checks can be seen in two of Hibbett’s quarters, as Q2 of FY20 and Q1 of FY21 had impressive growth numbers of 75% and 88% respectively.

At a larger scale, Hibbett hasn’t yet seen large revenue downturns from the prior unhealthy levels. It seems that these downturns are not going to happen either, as the company's CEO states on Q1 Earnings Call:

In summary, we believe Hibbett is well positioned for the short and long term to continue to grow and increase market share.

As Covid subsided a long while ago already, I believe the management's words at least concerning the short term - the company seems to have stabilized its place in consumers' wallets in the span of the pandemic.

Valuation

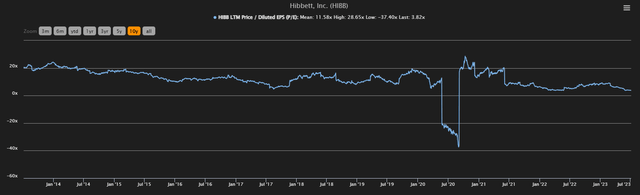

At a trailing P/E-ratio of 3.8, Hibbett’s stock seems to me to be a bargain. Although earnings are expected to drop, FY2024’s guidance middle point would correlate to a P/E of 4.9 with the stock standing at $36.11 at the time of writing. These prices are very low compared to Hibbett’s 10-year P/E figures:

Hibbett's Historical P/E (Tikr)

With the mean figure being at around 11.6, the stock would have a huge upside of 203% to its mean valuation. Even with FY2024’s expected results, the stock would have an upside of 136%.

Comparing the company's valuation to its peers, the company's undervalued nature is underlined - according to Tikr, for example, Dick's Sporting Goods trades at a trailing P/E of 11.5, Big 5 Sporting Goods at a P/E of 12.2 and Foot Locker at a P/E of 10.0.

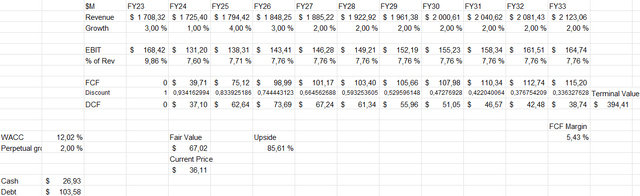

Going deeper into the company’s valuation, I constructed a Discounted Cash Flow model:

For expectations, I expect the company to hit the middle point of its current guidance, corresponding to a revenue of $1725 million in revenue and around $131 million in EBIT. The new store openings should correspond into a bit of growth in FY25, as customers find new opened stores and as stores are open for the full year. After FY26, I expect growth to stabilize into two percent, as the company would continue to grow at the scale of the economy, with basically no growth in real terms.

I’m expecting EBIT-margins to stabilize at 7.76 percent, which is lower than the company’s long-term average. This gives safety margin for the model. Finally, for free cash flow, I’m expecting the company’s capital expenditures to continue into FY25 weakening the years’ cash flows, after which the company would focus on maintaining current stores making the company a real cash cow:

DCF Model of Hibbett (Author's Calculation)

The model has Hibbett’s fair value at $67 dollars, meaning an upside of almost 86% from its current price. At these prices, the company is very cheap in my opinion.

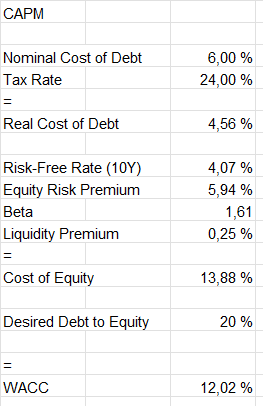

The used cost of capital is 12.02 percent. This is calculated with a Capital Asset Pricing model with the following inputs:

CAPM of Hibbett (Author's Calculation)

The cost of debt is an expectation for a company such as Hibbett with steady cash flows in the current environment.

For the risk-free rate on the Cost of Equity side, I believe 10-year government bonds represent the figure best, with US10Y being at 4.07%. Equity Risk Premium is Professor Aswath Damodaran’s latest estimate for the United States. For the company’s beta, I’m using Tikr’s figure of 1.61, with the figure being a monthly beta from a period of five years. The stock is quite liquid with around 320 thousand shares being traded on average per trading day in the last three months; a liquidity premium of 0.25 percent is sufficient in my opinion.

From historical figures, Hibbett doesn’t seem to leverage its balance sheet with lots of debt. I’m expecting the company to have around 20 percent of its capital from debt, with the rest being from equity. These expectations put Hibbett’s WACC at 12.02 percent.

Risks

Hibbett could experience a hiccup in its earnings from a prolonged period of weak consumer sentiment. This would hinder cash flows, as retailing is dependent on store volumes to stay profitable. With a historical beta of 1.61, the stock market considers Hibbett to be extraordinarily exposed to macroeconomic risks. Highlighting this risk is CFO Robert Volke's comments on the Q1 Earnings Call:

The business outlook for the remainder of fiscal '24 continues to be complex and difficult to forecast. There are several significant headwinds to consider as we proceed through the year. Inflation has a broad impact not only on consumer sentiment and spending patterns, but also contributes to operating cost increases in the form of wages and prices paid for goods and services. Higher interest rates have driven up the cost of borrowing for us that may also be affecting discretionary purchase decisions for those consumers with variable rate loans and credit card debt. We also expect the heavier promotional environment we have seen over the last 2 quarters to continue for the near term.

As a clothing retailer, Hibbett could always face challenges with a changing fashion trends. As Hibbett’s brand is associated with athletic brands, a downturn in athletic wear could deteriorate Hibbett’s margins; a turnover in inventory would be costly, and Hibbett and City Gear are already associated with a certain style.

Hibbett’s margins were significantly lower than currently before the start of Covid. Although the pandemic has been considered ended for a while, the consumer sentiment around athletic wear could still be inflated by it. If Hibbett’s EBIT margins fall severely into around 5 percent that they were prior to Covid, the company would not be nearly as cheap as it now seems.

Closing remarks

At $36.11 I think Hibbett is severely underpriced. The company’s earnings are dropping from Covid-related highs, but even with falling earnings, the company seems very cheap to me. Although the company is highly exposed to risks in the economy, currently earnings are not forecasted to drop too significantly even with a currently bad consumer sentiment.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.