Boyd Gaming: A Prudent Choice For Growth Investors

Summary

- Boyd Gaming Corporation's stock has seen an increase of 83.01% over the past five years, with a 33.06% increase in the past year, outperforming the S&P 500.

- The company's Q1'23 profits were $199.7 million, a 12% increase from the previous year, and it exceeded expectations with an EPS of 1.71, higher than the projected 1.54.

- Despite risks such as a significant debt burden and vulnerability to cyber security threats, BYD's strong growth potential and undervaluation make it a buy.

andresr

Investment Thesis

Boyd Gaming Corporation (NYSE:BYD) is a gaming company that runs 28 gaming and entertainment facilities in 10 states. Over the past five years, shareholders of the company's stock have seen an increase of 83.01% in their investment. Its stock price increased by 33.06% in the past year, suggesting that this trend is picking up steam. Strong momentum in the last year and the last six months confirms the company's growing trend. The firm's momentum of 33.06% over the past year and 20.70% over the past six months is higher than the S&P 500's momentum of 12.72% and 12.94%, respectively, indicating that it has stronger momentum than the industry.

In the MRQ, the company outperformed expectations, and its profitability is quite appealing. I credit these positive results to the expanding game industry. Given the rising market and good growth levers, I expect the company's solid growth will continue in the long run. Given its financial leverage, I believe the corporation can capitalize on the expanding market. As a result, I am bullish on this stock.

BYD's Shining Moment

Aside from the share price appreciation and strong momentum, BYD has attractive profitability, which exceeded expectations in the MRQ, presenting a very appealing face of the company to investors. In Q1'23, they had a profit of $199.7 million, or $1.93 per share. As a point of reference, the same period last year generated $162.9 million, or $1.45 per share. Quarterly revenue for the company increased by 12.0%, from $860.7 million to $964.0 million. In terms of exceeding expectations, the company reported an EPS of 1.71, which was higher than the projected 1.54. Furthermore, its sales of $964 outperformed the projected value of $889 million by 8.8%.

Total Adjusted EBITDA was $367.1 million, up 8.4% from $338.8 million in the same period the previous year. In terms of quarterly dividends, the company increased its quarterly cash dividend from $0.15 per share to $0.16 per share. Another positive note is its share buyback program. In the first quarter of 2023, the company bought back about $106 million worth of shares as part of its ongoing scheme to buy back shares. As of March 31, 2023, the company still had about $133 million left in buy authorizations.

These statistics show that this company currently has very solid fundamentals, which I believe will fuel its short-term share growth. For long-term growth, I base my bullish argument on the expanding market, which I will discuss in the subsequent sections of this article.

The Market Trends: Long-term Growth Lever

Given the worldwide and domestic expansion of the sports betting business, the company's long-term prospects look promising.

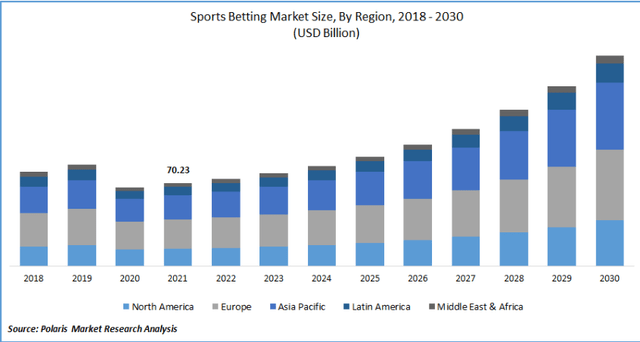

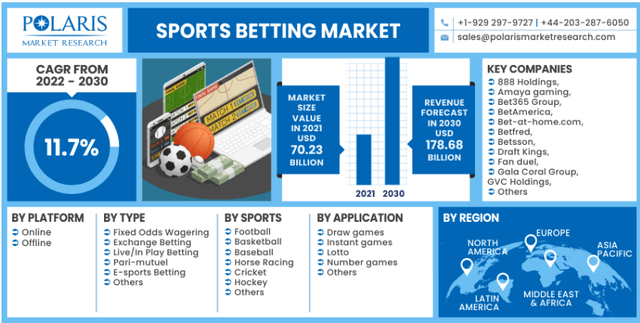

1. Global Growth

The global sports betting industry is projected to expand at a CAGR of 11.7% from its 2021 valuation of $70.23 billion. Increased smartphone penetration, developments in the digital landscape of South Asian nations, and the introduction of online gambling as a popular pastime among young people are all factors driving the expansion of this sector.

The proliferation of smartphones and the expansion of the digital infrastructure are propelling the sports betting industry forward. The proliferation of cell phones has altered consumer behavior across the board, and sports betting is no exception. About 6.3 billion people already use smartphones, and that figure rises each year. As the number of sports competitions and leagues expands, so does the interest in sports betting.

Most wagers are placed on American and European football, basketball, baseball, hockey, cricket, boxing, and auto racing. Bets can be placed on a wide variety of activities, not only traditional sports like football and basketball. Statista estimates that there are 30,861 companies contributing to the sports betting industry's annual revenue of $218 billion. Despite the fact that most gamblers now do their business online, online gambling is a booming industry. Sports betting in 2021 is up 206% from 2019 in some categories.

Increased investment in online platforms has also contributed to the expansion of the sports betting business as internet usage rises. The number of people who use the internet regularly is now over 4.8 billion. Gamblers can monitor their progress in real-time on online platforms using any device with an internet connection.

2. Domestic Growth

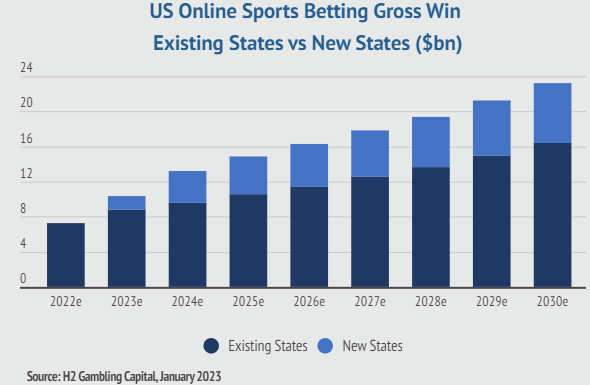

The total winnings from sports betting in the US are expected to reach $23.2 billion by the year 2030, according to H2. Sports betting accounts for 57% of the expansion in areas where it is currently allowed, while in places where it is not yet legal but is likely to be within the next few years, it accounts for 43%.

H2 Gambling Capital

California is the most important possible new state, but the latest vote result means H2 does not anticipate anything to pass in the state for at least four years. Ohio and Massachusetts legalized sports betting on January 1 and 31, 2023, respectively, representing approximately 20% of new state launch projections.

One of the primary drivers of future growth is likely to be the increased adoption of in-play wagering, which presently contributes for approximately 50% of US sports betting handles and approximately 44% of sports betting gross wins. This contrasts with about 57% for Europe and about 64% for European sports. Given the strong market growth, I believe BYD is striving to leverage this opportunity. A good example of its commitment to exploiting this growing market is its big investment in gaming software purchases and digital transformation initiatives.

Balance Sheet Analysis

When reviewing the opportunity presented by the expanding market, I believe that evaluating the balance sheet strength to capitalize on that opportunity is vital. With a total debt of $3.80B vs. a market cap of $6.86, I believe BYD is fairly leveraged to capitalize on the market opportunity. Debt finance can be a valuable source of capital investment if the company can readily repay it. This is due to the fact that debt funding, among other benefits, does not result in share dilution.

Therefore, let's assess the firm's capacity for debt repayment. The ratio of EBIT to interest expense is 6.7X, meaning the company can easily cover its interest expenses with a TTM interest expense of $157.5 million. In addition, the company's operating cash flow of $1.02B is sufficient to cover its debt by around 27%. Based on these indicators, I believe the company's choice to use debt financing is appropriate. I believe that if properly employed, the company will seize the market's opportunities and expand exponentially.

Valuation

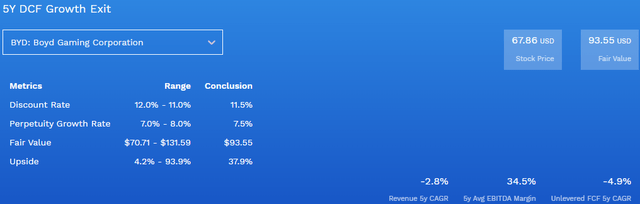

Based on relative valuation metrics, BYD appears to be a bargain stock. The company is trading at a PE ratio of 10.71, which is lower than the industry median of 16.26 by about 34%. This signifies that the company is undervalued and therefore trading at a discount. To confirm this assertion is a DCF model from finbox, which estimates a fair value of $93.55, leaving the company with an upside potential of about 38%. Given the growing industry and the investment in technology the company is making, I believe it can exploit its potential.

Risks

Investing in BYD, like any other investment, has a certain risk. Some of the major risks are presented below.

Debt burden: BYD carries significant debt on its balance sheet. High debt levels make the company more vulnerable to changes in interest rates and can restrict its ability to invest in growth opportunities or withstand periods of economic stress.

Vulnerability to cyber security threats: As a gaming company, the company stores and manages many customer data and financial information. Any cyber security breach or data theft could harm the company's reputation, lead to legal liabilities, and adversely affect its business operations.

Conclusion

In conclusion, BYD is a good investment for growth-oriented investors, given its strong growth potential backed by the growing industry. Given that the stock is undervalued, I recommend the stock to potential investors to diversify in this industry at a discount.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article was researched and written by January Mbuvi of Fade The Market.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.