Impinj: Strong Buy On Recent Growth Fears

Summary

- Impinj, a pioneer in RAIN RFID technology, has seen a recent selloff in stock after Q1 results revealed order delays.

- Despite disappointing Q2 guidance, the company's management remains confident in its long-term profitability and growth, citing a backlog of non-refundable, non-cancelable orders.

- Short-term inventory issues have hampered revenue growth, but the company is working to alleviate these issues and is a leader in its markets.

Jeevan GB/iStock via Getty Images

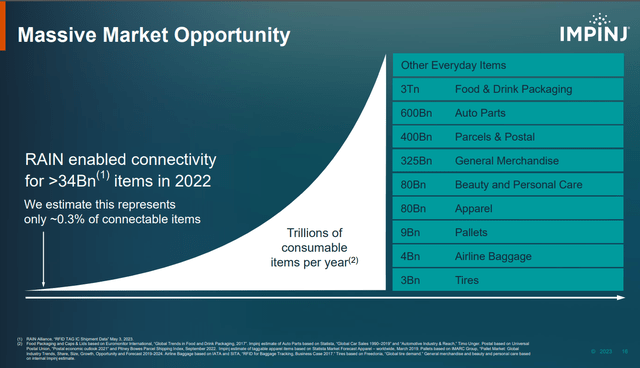

Impinj (NASDAQ:PI) is a pioneer in RAIN RFID technology - tag devices using radio frequency technology to track the trillions of items that exist in the business world today. The industry is growing quickly, with both endpoint chip sales and reader sales growing at a 30% pace in the past several years. While growth has ramped up over the past few years, as still just 0.3% of all items are utilizing RFID allowing PI to drastically grow volumes and revenue of late. The technology is helping to remove manual scans and drastically increase productivity across enterprises. Recently after Q1 results some delays on orders caused a severe selloff in the stock creating a very intriguing buying opportunity for investors. This is even as the company has had record revenues for 7 consecutive quarters. Margin concerns also weighed on the stock from the recent investor day where margin forecasts lagged expectations for long term. However, despite these factors PI is still a solid buy right now as the valuation has reset. The company is a great play on the ongoing digitization of the modern world, as enterprises look to connect and have visibility in all parts of their business. Things like tracking food to optimize freshness and reducing waste or losses to theft make the RFID technology essential to business in the future.

Investor Day Presentation (PI Investor Relations)

Q2 guidance disappointed Wall Street

The main reason for the huge selloff post Q1 earnings for Impinj was the Q2 revenue guidance. Consensus was for $88.3m in revenue but the company guided for $84 to 87 million. The guidance weakness is from the systems area, as a few components are stubbornly hard to come by and will cause shrinkage over Q1. Integrated circuit endpoint sales (IC) will still grow in Q2, with more upside for Q3. Putting the selloff into perspective the stock was down from $135 prior to the earnings release to under $86 today or a drop of 37% where the stock has found some support recently. To me this screams drastically overdone selloff, with many momentum investors deciding to get out of the name rather than wait for more clarity. Q1 revenue was up 62% y/y to $85.9 million with the top end of Q2 guidance at $87 million still representing 45% y/y growth. Expense growth is going to slow into the second half of the year, allowing for improved EBITDA margins. Management also noted that backlog was significantly more than the $85 million in inventory on hand at the end of Q1. This likely means an additional $100 million in orders that are delayed as the company brings on additional supply to prevent issues supplying large clients after they roll out projects. PI made it clear that these are non-refundable, non-cancelable orders - timing of revenue is the only question for these. Other companies in the software space have called out phase ramps for projects in recent quarters as well, as enterprises look to nail down costs and keep rigorous focus on profitability. The recent investor day added its own worries, as the long term margin target put forward by management was 56-57%. The market was hoping for something above 60%, as this isn't a large expansion from the current margin of 52.4% from Q1 2023. This does mean scale will increase margins over time, but additional products of readers will add cost as well and prevent margins from hitting as high as other technology manufacturers. This makes a steady ramping of revenue even more important for profitability, as PI is still striving for GAAP profitability with a $4.4 million loss in Q1.

Small cap technology is notorious for big moves on small misses like this, and they can be incredible opportunities for investors. PI has had a volatile stock in the past, with significant selloffs and recoveries before. It has had 4 different 50% selloffs prior, but has made new all-time highs in 2017, 2021, 2022 and now 2023. This stock volatility is very common for PI, making it a great stock for active swing traders. Management called out that pushing out of large enterprise deployments was more of months than of quarters, commentary that should make investors bullish for a second half rebound. That gives me some confidence management is working through transitory issues and will be able to continue to lead its underlying markets. PI management also noted that short term inventory issues were hampering revenue growth, but that backlogs for endpoint IC's were very strong still. Shortfalls of wafers have been an issue for some time for PI, with 2021 and 2022 also having issues with inventory availability. However, they have been working with foundry partners and improving post processing investments to alleviate these issues. Management also had a shortage in components for readers, which help drive IC sales due to the requirement of having both for optimal usage. Reader business will grow in the second half over the first half, but the level of growth remains to be seen.

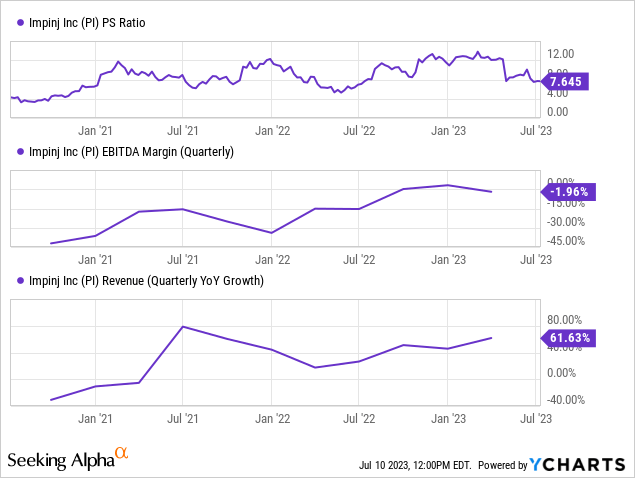

In the below chart you can see that valuation is on the lower end of the past 3 years, but revenue growth is still high and EBITDA margins are nearing break even. The stock is a strong buy trading down to just 7.6x Sales while continuing its strong growth north of 35% this year. Earnings are expected to grow at a 40% pace through 2025 when factoring in stock based compensation with solid GAAP earnings in 2024. Combine that with continued market leadership and large customer deployments and the future is bright for Impinj.

Buy into upcoming results

Impinj is a solid long term play albeit one that trades at a high valuation. Right now the stock is in a place where you can buy as a trade or a long-term investment. While Q2 results will show a slowing in revenue growth, management has made it clear Q3 should be a return to growth. Strong Q3 guidance should send the stock back to the $100+ range as the market digests the lumpiness of revenues and the fact large deployments are still coming in 2023. Margins will improve over the next few years with scale and new programs rolling out. Longer term RFID technology provides more data for businesses and Impinj provides the best overall platforms for large enterprises to scale with. While the selloff was justified based on the current market environment, it's a buying opportunity for those willing to take medium risk for a potentially large reward in the next 6 months.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.