Blue-Chip, High-Yield Dividend Growers: Enterprise Products Partners And Brookfield Infrastructure

Summary

- Infrastructure is a great place to find high quality, high yield, dividend growers.

- EPD and BIP are among the very best high-quality, high-yield distribution growth stocks in the market today.

- We look at them side by side and share which one is the better buy at the moment.

- Looking for a portfolio of ideas like this one? Members of High Yield Investor get exclusive access to our subscriber-only portfolios. Learn More »

MarsBars

Infrastructure is a great place to invest when looking for growing, reliable, and attractive income, because:

- It generally benefits from a natural moat due to high replacement cost - especially in a high cost of capital environment - and difficulty of replicating an advantageous location enjoyed by existing assets.

- The cash flows are generally very predictable and defensive due to the long-term fixed-fee contract nature of many infrastructure assets and the essential services that they tend to provide as the backbone of the economy.

- Many infrastructure businesses already have long-dated debt at fixed interest rates on their balance sheets, providing very attractively priced leverage on their assets, resulting in lucrative cash flow yields for investors.

In this article, we will look at two of the best infrastructure businesses available today - Enterprise Products Partners (NYSE:EPD) and Brookfield Infrastructure (NYSE:BIP)(NYSE:BIPC) - that offer investors a very attractive combination of current yield, strong payout growth, exceptional management, and fairly low balance sheet and business model risk.

Enterprise Products Partners Stock And Brookfield Infrastructure Stock: Business Models

EPD is a large and well-diversified midstream MLP with more than 50,000 miles of pipelines, 260 MMBls of liquids storage capacity, 29 natural gas processing plants, 25 fractionators, and 20 deepwater docks. It operates across a diversified set of geographies and energy commodities, combining with its long-term take-or-pay fee-based pipeline contracts to give it a very stable cash flow profile along with numerous opportunities for high-returning organic growth projects and bolt-on acquisitions. EPD is particularly strong in its NGL and petrochemicals business segments, and EPD anticipates enjoying a growth tailwind from growth in US NGL exports.

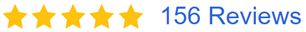

This business model results in a very attractive risk-reward profile for EPD as it enjoys relatively low commodity and macroeconomic risk, mitigates regulatory and project execution risk by focusing on projects in lower-risk jurisdictions and with fewer engineering challenges while still enjoying high returns on invested capital. When combined with management's prudent financial management, it should be little wonder that EPD has delivered market-crushing total returns over the long term while growing its distribution every year for about one-quarter of a century:

BIP is another high-quality infrastructure firm that's even more diversified than EPD is. While EPD is diversified within the midstream sector, BIP is diversified across the infrastructure sector, with midstream only making up about 28% of its total cash flow. Utilities make up an additional 32%, transportation makes up another 30%, and data transmission, distribution, and storage makes up the final 10% of its business.

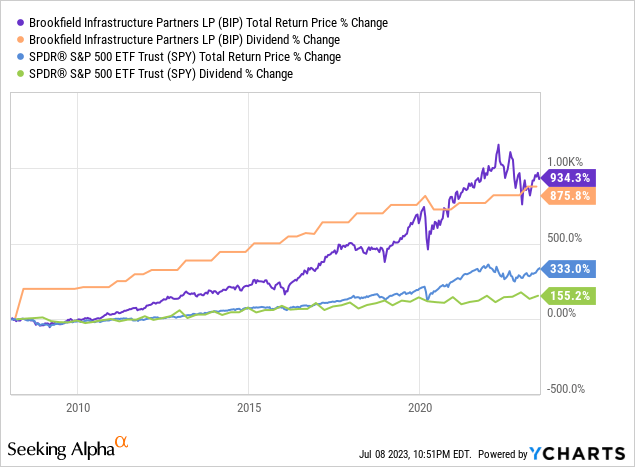

BIP management have proven to be shrewd capital allocators over the years, leveraging their access to proprietary deal flow, attractively priced capital, and operational expertise that they get from their parent and manager Brookfield (BN)(BAM), to buy assets on a value basis, leveraging them up with cheap debt, implementing improvements, and then recycle that capital into new opportunities. This has resulted in an accelerated compounding effect that has delivered exceptional long-term total returns and distribution growth for shareholders thanks in large part to an 11% FFO CAGR over the past decade:

On top of that, BIP boasts considerable defensive and inflation-resistant traits. Its cash flows are largely contracted (90% of FFO is either regulated or contracted) to defensive, mission-critical assets, leading to stable cash flows through all sorts of macroeconomic environments. Moreover, ~80% of its cash flow is protected from or indexed to inflation. This makes it a great business model for the current stagflationary environment.

Enterprise Products Partners Stock And Brookfield Infrastructure Stock: Balance Sheets

Perhaps EPD's greatest credential is its sector-leading A- credit rating, backed by a very low leverage ratio of ~3.0x, $4 billion in liquidity, and a 20-year weighted average debt term to maturity.

Furthermore, EPD's debt is 96.9% fixed rate and only 11% of its debt matures in the next three years (with non-maturing this year) and only 18% of it matures in the next five years, mitigating much of its interest rate risk. A whopping 51% of its debt does not expire for 30-plus years, giving it a very lengthy timeline of enjoying very low-interest rates on its debt (its current weighted average interest rate is 4.6%).

EPD Debt Maturity Schedule (Investor Presentation)

Meanwhile, ~85% of BIP's debt is non-recourse and 90% of its debt is fixed rate with an average term to maturity of seven years, with an 11-year average term to maturity at the corporate level. When combined with its quality and well-diversified asset portfolio and backing from its parent, BIP earns a strong BBB+ credit rating from S&P and Fitch.

BIP also has ~$4.2 billion in total liquidity, giving it substantial capacity to not only support its balance sheet and current businesses, but also invest opportunistically and aggressively to fuel continued growth. Only 3% of its debt matures this year and 51% of its debt matures after 2027, giving it a well-laddered debt maturity profile.

BIP Debt Maturity Schedule (Investor Presentation)

Enterprise Products Partners Stock And Brookfield Infrastructure Stock: Distribution Outlook

Despite paying out a hefty distribution with a current yield of 7.42%, EPD still covers it 1.76x with distributable cash flow based on 2023 analyst forecasts. With a ~5% per unit CAGR anticipated for the distribution in the coming years based on recent management commentary and actions, the yield plus growth profile for EPD appears quite attractive and likely to deliver double-digit annualized total returns for years to come.

In addition to growing its distribution, EPD also is buying back units. As management stated on its latest earnings call:

We declared a distribution of $0.49 per common unit for the first quarter of 2023, which is 5.4% higher than the distribution declared for the first quarter of the prior year...As we mentioned on our February earnings call, we will evaluate another increase midyear...For the 12 months ending March 31, 2023, Enterprise paid out approximately $4.2 billion of distributions to limited partners. In addition, we also repurchased $267 million of common units off the open market. As a result, our payout ratio of adjusted cash flow from operations was 55% for this period and our payout ratio of adjusted free cash flow was 75% for this 12-month period.

They later elaborated further on this, stating:

Over the last couple of years, we have grown more in the range of, call it, 4% to 6%...And again, we've demonstrated good EBITDA growth. Jim mentioned $3.8 billion worth of projects going into service for the remainder of the year. That gives us good cash flow growth that will support distribution growth down the road...I think we'll look to continue to come in and provide distribution growth and buybacks, for that matter, as far as getting capital back to investors.

True to form, EPD just hiked its distribution for the second time this year.

Meanwhile, BIP is projected to cover its distribution with AFFO by 1.67x and 1.77x with FFO this year. Given its stable cash flows from diversified sources and strong balance sheet, the payout looks very safe for the foreseeable future. Moreover, moving forward BIP is forecasting a ~10% FFO per unit CAGR and is expected to generate a near 7% distribution per unit CAGR through 2027, which combines with its 4.4% NTM distribution yield to provide a very attractive total return profile.

Enterprise Products Partners Stock And Brookfield Infrastructure Stock: Valuation

On top of the distribution growth and current yield along with buybacks, the expansion of EPD's valuation multiple could contribute further to total returns in the coming years. Take for instance the EV/EBITDA multiple of 9.24x that stands at a meaningful discount to its five-year average of 10.13x. If the valuation multiple expands back closer to where it was previously, EPD could see substantial capital appreciation on top of its growth.

Overall, we rate EPD as an attractive buy with a high degree of likelihood that it will generate double-digit total returns for years to come.

Meanwhile, BIP's sum-of-the-parts valuation implies that it's trading at a substantial premium to NAV:

| Business Segment | Exposure | Fair Value Multiple | Peer Comparison |

| Midstream | 28% | 11.5x | ENB |

| Utilities | 32% | 12.8x | FTS |

| Transportation | 30% | 13.1x | CNI |

| Data | 10% | 20.0x | DLR |

| BIP | 13.2x |

When we compare its rough estimate fair value EV/EBITDA multiple of 13.2x to its current EV/EBITDA multiple of 20.9x, the valuation appears to be way out of whack.

However, BIP's past track record of successfully leveraging its unique advantages that come from its Brookfield management earns this valuation premium in our view. In fact, it trades at discounts to its three-year and five-year EV/EBITDA averages as its growth has outstripped its stock price performance over that period of time. As a result, we think it's back in "Buy" territory given the attractive growth plus yield profile.

Investor Takeaway

Infrastructure is currently the largest sector in our portfolio at High Yield Investor, and for good reason. At the moment, we're finding plenty of high-quality businesses for the portfolio across the infrastructure space that offer well-covered high yields, strong growth, defensive characteristics, and rock-solid balance sheets at attractive valuations.

EPD and BIP are two of a plethora of opportunities right now that retirees can acquire to set their portfolio up for lucrative income and strong growth for years to come without taking on too much risk.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Investor for a 2-week free trial

We are the #1-rated high-yield investor community on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EPD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (7)

And yesterday EPD increased its quarterly distribution to $0.50, thereby enhancing its annual distribution to $2.00 from $1.96. And don't forget the SPOT project.

Elliot Miller