American Battery Technology Company: Soon To Be Public Leader In Battery Recycling

Summary

- There is a very rapidly growing need for US lithium-ion battery (Li-ion or LIB) recycling.

- Attainable recycling capacity goals and an eco-friendly proprietary recycling process sets up American Battery Technology Company (ABML) to be the only publicly traded leader in US battery recycling by 2025.

- ABML’s current recycling facilities in Nevada are positioned for long-term success.

Just_Super

Introduction

American Battery Technology Company (OTCQX:ABML) is one of the companies looking to ride the wave of Electric Vehicle (EV) transition and is building the infrastructure necessary to support the EV fleet. Their battery recycling plants in Nevada will retain more than 95% of the valuable metal inputs, closing the supply chain loop by decreasing the global reliance on virgin metal extraction from mining. While battery recycling may not be the most eye-popping or sexy industry, it is a necessary and lucrative aspect of electrification and transition to EVs.

There is already substantial demand for the battery recycling industry in the form of manufacturing scrap, a catch all term for the waste associated with the manufacturing of batteries. This scrap is often hazardous and useless to manufacturers, coming in a variety of forms: raw materials that do not meet purity standards, scraps from cathode or anode sheets as components are trimmed down to appropriate size, products that don't pass quality assurance screenings, etc. With many auto makers scrambling to set up their own domestic battery manufacturing plants, there is currently a significant surplus of recyclable scrap compared to projected domestic plant capacity for the next few years.

ABML has moderately ambitious goals for their recycling capacity, but CEO Ryan Melsert, with his background as the former TSLA R&D Manager, is most certainly accustomed to setting and achieving lofty goals. In fact, their goals for capacity are in line with the goals set by private competitors (Ascend Elements and Redwood Materials), bolstering the validity of ABML's timeline. Additionally, even if ABML produce just half their 2025 capacity goals, they will be the leading public company in recycling capacity and market share.

There is, however, a short-term uphill battle for ABML to attain these capacity goals. With cash reserves running low and high potential for other negative impacts on share price, we believe it ill advised to enter a full position at current levels. Continue reading for our three-tiered leg into a long stock position. This approach favorably reduces cost basis by capitalizing on a high probability of share price weakness over the next 6 months that is expected to have minimal hinderance on ABML's long-term growth potential.

Rapidly Increasing Battery Demand

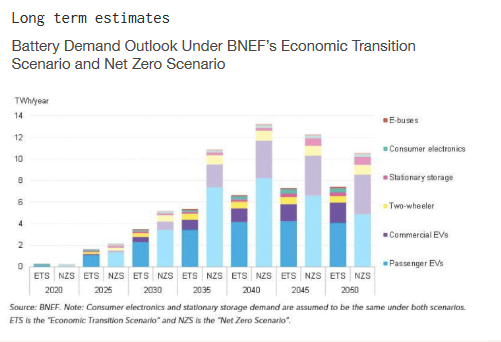

To be perfectly blunt, a chart should not be necessary to demonstrate that demand for li-ion batteries is huge. Consumer electronics are held in hand, strapped to wrists, and plugged into ears, while every mundane home appliance comes equipped with Bluetooth, but, somehow, batteries are still sold separately.

Data from Bloomberg New Energy Finance (BNEF) EV Outlook Report shows steady growth in consumer electronics and rapid EV growth causing a skyrocketing of demand for Li-ion batteries. Assuming the globe is on path to meet their Net Zero Scenarios (NZS), demand is projected to continue ramping up, potentially tapering after 2040 sees peak battery demand at more than 13 TWh/year. Alternatively, following a less aggressive projection under the Economic Transition Scenario (ETS), battery demand will grow steadily until leveling off around 2045.

2022 BNEF EVO Report

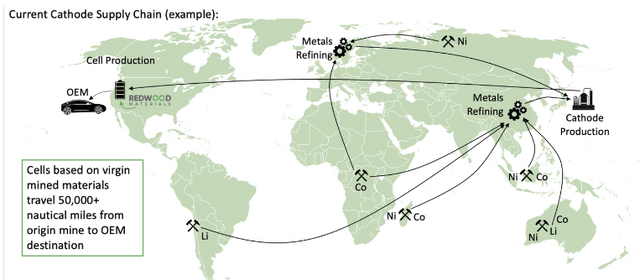

The global battery supply chain is expected to be able to handle this demand, but existing methods will certainly not do so in an eco-friendly manner. The production process of virgin, or non-recycled, batteries represents a significant detriment to eco-footprints, with raw materials being transported more than 50,000 miles before reaching a battery cell factory.

Written Testimony of JB Straubel, CEO of Redwood Materials

For example, raw cobalt, lithium, and nickel - key raw metals for production of cathode material in Li-ion batteries - could be extracted from mines in Australia, Chile, and Democratic Republic of Congo, shipped to China for refinement, then to Japan for cathode manufacturing, then to the US for battery manufacturing and EV assembly. All that for a "no emissions" EV.

There are large quantities of Li-ion batteries in consumer electronics, EVs, and other sources being decommissioned each year. IHS Markit (subsidiary of S&P Global (SPGI)) published global estimations in 2020 that predicted 500,000 tons of Li-ion batteries would reach end-of-life in 2020, increasing to 1.2 million tons per year by 2025. The existing demand for LIB recycling is not being met, resulting in toxic production waste and end-of-life Li-ion batteries piling up globally.

Push for US Energy Independence

Just as the US is looking to counter China's dominance in microchips through the CHIPS and Science Act, due to China's strength in technology and manufacturing, there is also a sense of urgency among law makers regarding the battery industry. China currently produces three-quarters of all Li-ion batteries and is projected to retain 70% of all cathode production through 2030. Simply put, "no advanced nation can afford to be so reliant on another nation for critical resources."

As part of the US plan for independence, there are substantial government grants and awards available for companies in this space. The most recent Bipartisan Infrastructure Law (BIL) is just the first step in the US achieving energy independence, providing $126M for America's clean energy future.

ABML has already received numerous awards, totaling more than $70M, for their dual-faceted business model, and they are positioned for continued success in earning government support. ABML stands to gain should tensions between US and China continue to rise, as US lawmakers may continue to prioritize energy independence.

ABML and Competitors: Projected Recycling Capacity

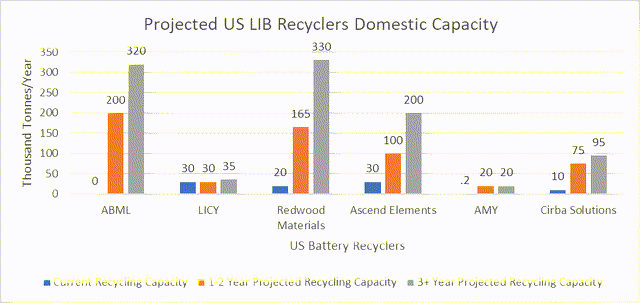

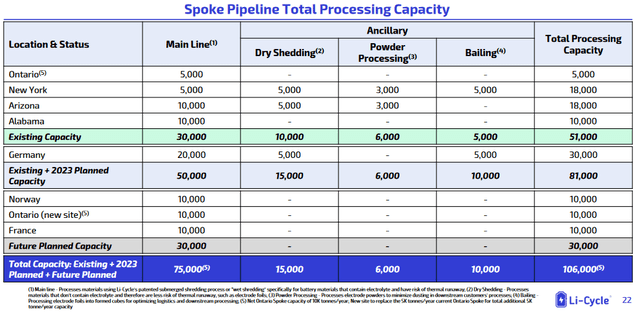

Li-Cycle Holdings Corp (LICY) has the existing infrastructure to process 30,000 tonnes/year of Li-ion batteries, with longer-term goals of 75,000 tonnes/year over seven Spoke plants (with additional, ancillary recycling shown below). While LICY has global plans for increased recycling capacity into 2025 and 2030 in their projections above, this article is specifically focused on US recycling capacity.

Li-Cycle Investor Presentation

Redwood Materials (private company), a primary competitor to ABML along with LICY, has recycling capacity (as of April 2022) of "approximately 6 GWh end-of-life lithium-ion batteries annually, which equates to about 60,000-80,000 EVs or 20,000 metric tons of material every year." This conversion is important as Redwood Materials' metrics are all in terms of GWh end-of-life Li-ion batteries and not the more widely used metric ton units. This is because Redwood Materials plans to take recyclable inputs and produce cathode and anode materials, of which the tonnes unit is a much less useful measurement than electrical capability. As part of their cathode and anode manufacturing, Redwood Materials will use both recycled and virgin raw materials with recycled percentages around 50%.

Applying the conversion, this means that Redwood Materials' production plan for their Nevada plant at 100 GWh/year of cathode and anode materials, with an average recycled percentage of 50%, is equivalent to more than 165,000 tonnes/year of recycling capacity. The Nevada plant is currently operational, though it is not yet fully scaled. Redwood Materials plans to open another plant in South Carolina, with a similar production plan targeting 100 GWh/year, before expanding internationally.

Ascend Elements (private company) operates a LIB recycling facility in Covington, Georgia processing 30,000 tonnes/year of Li-ion batteries and recyclable manufacturing waste. Construction is also underway for Apex 1 in Hopkinsville, KY, a battery recycling and materials facility, that is expected to produce the equivalent of 250,000 EVs per year, which is a recycling capacity of about 70,000 tonnes/year.

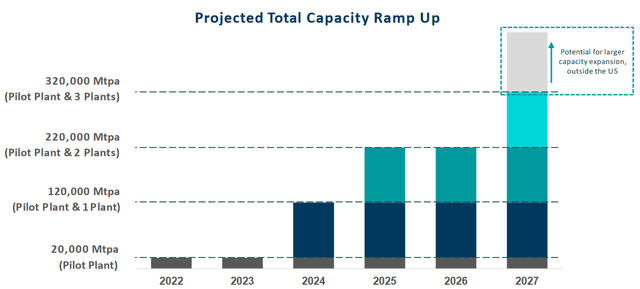

ABML is targeting 20,000 tonnes/year of Li-ion batteries at their pilot plant in Fernley, NV, with scaling potential up to 100,000 tonnes/year. More recently, ABML acquired a "move-in-ready 137,000 ft2 commercial-scale battery recycling facility" that would be similarly projected to handle 100,000 tonnes/year of Li-ion batteries. Thus, ABML's expected recycling capacity is about 200,000 tonnes/year over the next two years. Capitalizing on economies of scale principles, ABML can replicate existing plants in more locations, targeting 100,000 tonnes/year on each of the "second, third, fourth, and fifth facilities."

Note: this graphic does not include the pilot plant's ramp to 100,000 tonnes/year

Cirba Solutions (private company), with over 30 years of recycling batteries, "is the most experienced lithium-ion battery recycler in North America, with more than 50 million pounds of EV batteries recycled." 50M pounds of Li-ion batteries is about 22,000 tonnes, or the equivalent of about one year of operation of ABML's pilot facility. Considering Cirba Solutions has six operational facilities, their existing facilities are rather obsolete in terms of capacity (more on this topic is available in the second page of the linked Excel file). Growth for Cirba Solutions, though, is relevant, with ramp up of an existing facility in Lancaster, Ohio to 200,000 EVs/year, or about 65,000 tonnes/year of recycling capacity. Construction is also ongoing at Eloy, Arizona with expected recycling capacity of about 20,000 tonnes/year. Any plans to expand existing facilities in the longer term are currently private.

RecycLiCo (AMY) has an operational facility in Vancouver, Canada with a recycling capacity of more than 500 kg/day. That's less than 200 tonnes/year. AMY is currently in a due diligence phase, looking for partners in the battery manufacturing space, with expectations of constructing a plant with capacity up to 20,000 tonnes/year. CEO Zarko Meseldzija is emphasizing improvements to recycling technology rather than recycling capacity.

Umicore (OTCPK:UMICF) is currently recycling batteries overseas. They currently have about 7,000 tonnes/year of recycling capacity in Hoboken, Belgium. UMICF is partnered with Automotive Cells Company (private company) to provide battery recycling technology to a pilot plant in Nersac, France that has about 10,000 tonnes/year of recycling capacity. Umicore also has plans to construct a facility in Europe with capacity of 150,000 tonnes/year by 2026. All of these facilities are overseas, though the company has intentions of rolling out similar facilities in North America. UMICF will "prepare entry in North America" starting in 2026.

Even if ABML's recycling capacity falls behind, there are not the same risks related to competition as there are in other sectors and industries. JB Straubel, CEO of Redwood Materials, has stated that, in order to recycle all the end-of-life Li-ion batteries, there will need to be as many as four battery recycling companies, with Redwood Materials as just one piece of the puzzle. The flock of automakers transitioning to battery manufacturing and the rapid scale up of EVs will necessitate the existence of multiple battery recyclers to meet the supply of both the manufacturing waste and the end-of-life Li-ion batteries.

ABML and Competitors: Recycling Processes

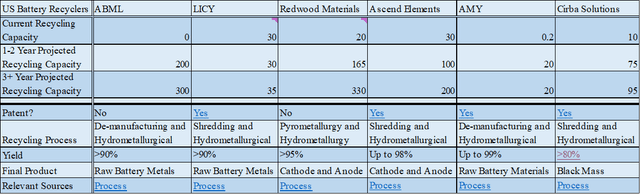

The recycling process used by ABML is both environmentally friendly and cost efficient. They turn recyclable inputs into black mass that gets refined into raw battery metals (nickel sulphate, cobalt sulphate, etc.). It is worth noting that black mass and raw metal output from all facilities are essentially identical, regardless of company specific recycling processes. All companies also have some degree of flexibility in the exact purity a facility can produce to meet client needs.

ABML's first $20M pre-purchase agreement of raw materials has already been completed, demonstrating the demand that exists due to recycled output being cheaper than virgin counterparts. In mining, large quantities of rock contain trace amounts of the desired metal, so eliminating the rock impurities requires elaborate and environmentally wasteful processes. However, in battery recycling, the input to the process is a conglomerate of highly concentrated and desirable metals that just need to be effectively separated.

LICY ends up with the same raw battery metal output as ABML, though it separates the process between two different facilities, the spoke and the hub. The spokes create black mass from recyclable materials and ship it to the hub for refinement into raw battery materials that get sold directly to cathode manufacturers.

Redwood Materials partially relies on pyrometallurgy, a potentially undesirable process from an environmental standpoint. Both Redwood Materials and Ascend Elements aim to fully close the loop by themselves, taking recyclable inputs and converting them all the way back to cathode and anode materials to be sold to battery manufacturers. Redwood Materials will have on-site manufacturing, where Ascend Elements will ship black mass to their facilities in Worcester, MA and Novi, MI for refinement and manufacturing of cathode and anode materials.

The CEO of AMY argues that "even if you build a 50,000 ton/year plant, [it] doesn't mean you are going to get 50,000 tonnes/year of batteries," demonstrating their emphasis on patents and technology improvements. This inherently makes investment in AMY a licensing/acquisition play. AMY does not have the recycling capacity to command market share, but they have patented technology that may be desirable to other companies. However, many of the companies detailed in this report, as well as many international LIB recyclers, already have their own proprietary recycling processes. AMY is neither revolutionizing the industry with brand-new methodology nor significantly outperforming competitors on percentage yield. Further negative developments surrounding the environmental concerns of LIB recyclers' processes, such as Redwood Materials' process, could stand to improve AMY's prospects, as the industry may look for more eco-friendly alternatives. Their current patents, however, do not appear to bring much to the table.

Umicore's patented recycling process yields >95% of recycled materials using a shredding and hydrometallurgical process. Resulting black mass will be sold back into the existing battery supply chain. Battery recycling is a rather small subset of Umicore's business model that includes automotive catalysts, jewelry, precious metals recycling, and more.

Glencore (LSE: GLEN) (OTCPK:GLCNF, OTCPK:GLNCY) and other competitors like Ecobat (a subsidiary of Schneider Electric SE (OTCPK:SBGSF, OTCPK:SBGSY)), rely entirely on pyrometallurgical and smelting processes that are neither eco-friendly nor capable of retaining high percentages of valuable metals from Li-ion batteries. General estimates suggest >80% yield of valuable metals from Li-ion battery inputs. These methods can, however, effectively retain copper, gold, silver, and other metals from certain electronic scrap, copper concentrates, and precious metal bearing recyclable materials. These companies are not currently major competitors with ABML, as their business models do not focus on Li-ion batteries, and their high temperature smelting methods are comparatively less efficient at handling LIB inputs while posing a larger environmental risk.

ABML, though they lack patent protection, has a proprietary recycling process with performance metrics in line with both their public and private competitors. Their projected recycling capacity is moderately ambitious, though not unreasonable compared to competitors, and would solidify ABML as a dominant US battery recycler around 2025.

Unique Virgin Metal Manufacturing

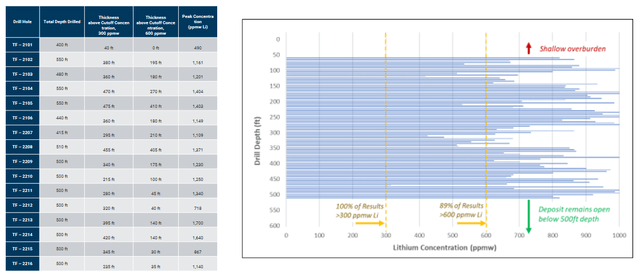

ABML is a dual-facet company with a primary focus on battery recycling and a secondary focus on lithium carbonate mining to fill the void of raw materials for battery manufacturing. Partnering with DuPont de Nemours (DD), ABML has received a $4.5M grant from the DOE for construction and operation of a multi-ton per day field demonstration to address the shortage of domestic lithium.

This extraction of raw lithium from their fields in Nevada is accompanied by the ~$60M award from the DOE to construct a lithium hydroxide (LiOH) refinery. Raw lithium harvested from the field demonstration will be turned into LiOH at the refinery. In fact, the LiOH produced at this refinery is "identical in specifications and chemically indistinguishable" from ABML's recycling facilities, streamlining sales and potential scaling.

"At present, there is only one active lithium mine in the country. Silver Peak, owned by Albemarle, produces about 5,000 tonnes of lithium carbonate equivalent (LCE) per year. This is only around two-thirds of the amount needed to power the EVs currently sold in the US" (emphasis added).

In the worst-case scenario, ABML's claims to more than 10,000 acres of lithium deposits are a capital safety net, substantially reducing the risk of investment by bolstering tangible assets and liquidation value. In the best case, however, it represents a lucrative foothold for ABML in domestic markets.

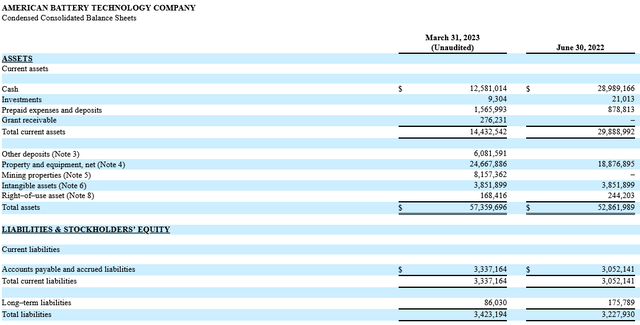

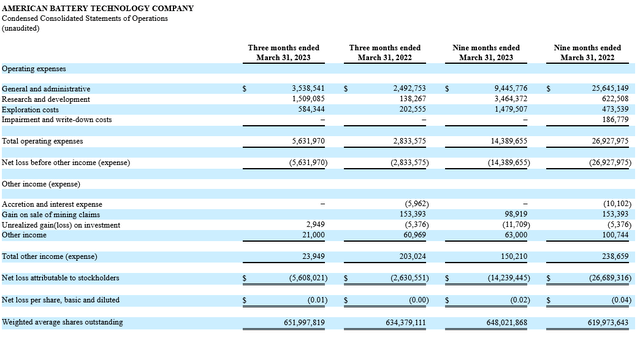

Uninspiring 6 Month Outlook

ABML has a high probability of share price deterioration over the next 6 months due to two primary factors: financial statements suggesting short cash runway and possible delays for factory completion.

Cash burn, the per month measure of a company's consumption of their cash reserves, is currently $1.9M including operating expenses alone. However, ABML has consistently been posting an additional $1-2M per month in operating and investing activities that burn cash in excess of the pure operating expenses. That spending is likely to continue, making ABML's cash reserves of $12.5M look rather insufficient.

Thus, ABML has a cash runway of about 4.5 months as of their March 10-Q, which was about 4 months ago.

The most natural solution to this cash problem is share dilution. In fact, in the trailing 12 months, ABML has issued 36.3 million total shares, representing a 6% increase in shares outstanding and diluting the stock, further impacting values such as the already low tangible book value per share. It is worth noting that the company has other venues to generate cash, such as the aforementioned $20M prepurchase agreement with TechMet-Mercuria that has not yet hit the books. This, coupled with other, smaller injections of cash, could bolster ABML's cash runway to about 6 months from the time of writing, hence the 6-month target timeline for short-term weakness.

The other primary short-term risk to the share price is delays in factory construction. Without an operational factory, ABML is already lagging behind competitors and they have historically struggled to meet goals for factory completion. However, given the already long delays and the positive management restructuring (more information below), it is arguably unlikely for continued delays to significantly impact the share price, unless it is accompanied with negative company outlook/forward guidance.

Investment Strategy: Legging into a Long Position

6-Month Outlook | |||

Bear | Base | Bull | |

Target Share Price | 0.51 | 0.62 | 0.68 |

% vs. Current | (~30%) | (~15%) | (~7%) |

Our base case for the next 6 months is lower prices, largely due to noteworthy share dilution. We believe share dilution to be a highly probable event given our analysis, and all cases factor in varying magnitudes.

Our bull case expects either a more moderate share dilution or a base case share dilution that is accompanied by a relatively strong corporate outlook.

Our bear case prices in one of the three following substantial risks to share price:

- Larger, more significant share dilution,

- Large negative adjustment to factory construction timelines,

- And/or a negative revision of expected recycling capacity.

We believe a prudent entry strategy to capitalize on the longer-term potential of ABML involves a tiered approach to legging into a long stock position over the course of the next roughly 6 months.

Target Tier 1, enter 25% of desired position: $0.68-0.69

Target Tier 2, enter 35% of desired position: $0.61-0.63

Target Tier 3, enter remaining 40% of desired position: $0.55-0.56

Stop loss at $0.35.

This strategy allows custom tailored risk based on desired position sizing. However, we do not suggest tailoring risk by altering the stop loss level. The stop loss is strategically placed far enough to the downside that realization of two of the three circumstances cited in the bear case should not drive prices into the stop loss. We believe that two of the three circumstances can occur without drastically altering the longer-term potential that ABML has in the industry. However, all three of those circumstances occurring should, ideally, trip the stop loss, as our investment thesis would likely be invalidated, and investment would need to be reconsidered.

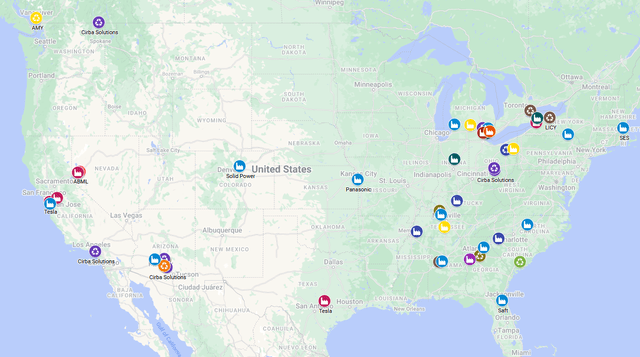

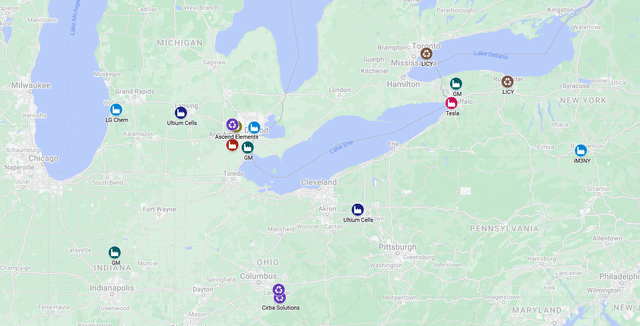

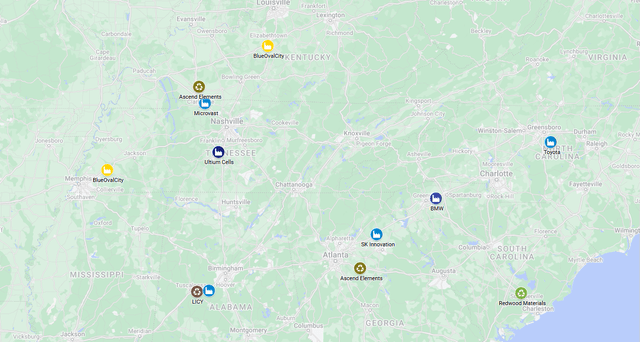

Comprehensive Map of the US Battery Supply Chain as it Specifically Relates to Battery Recycling

In an industry where proximity is crucial - as strict safety regulations apply to the transport of Li-ion batteries and potentially hazardous scrap - the lack of comprehensive maps showing both battery manufacturers' facilities and battery recyclers' facilities is disappointing. There are numerous maps detailing locations of US battery manufacturers, but the maps detailing locations of battery recyclers leaves a little to be desired. A core problem faced by map makers is the rapid changes that are occurring to company structure in this fast-growing industry.

Using the features of My Maps from Alphabet inc. (GOOG, GOOGL), we made a comprehensive map that attempts to include all battery manufacturers and battery recycling facilities in a living document that can be updated as the industry evolves.

Author's Interactive US Battery Recycling and Manufacturing Facilities

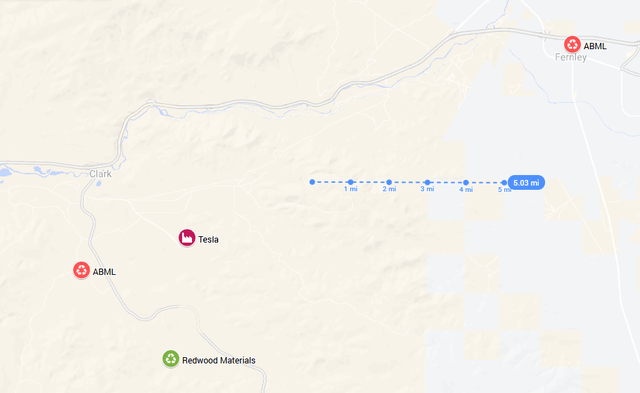

Zoom in on ABML in Nevada

One key concern is immediately apparent from this map. Redwood Materials' operational plant and both of ABML's prospective plants are clustered around one manufacturing facility: Tesla's Gigafactory Nevada. Between ABML's 20,000 tonnes/year capacity at the Fernley facility and Redwood Materials' current capacity of at least 20,000 tonnes/year this year, is Gigafactory Nevada outputting enough recycling manufacturing scrap? Additionally, as these two companies ramp up capacity, there will ultimately be about 365,000 tonnes/year of recycling capacity in this locality, with the second nearest battery manufacturer more than 200 miles away.

How much manufacturing scrap does Tesla's Giga Nevada output?

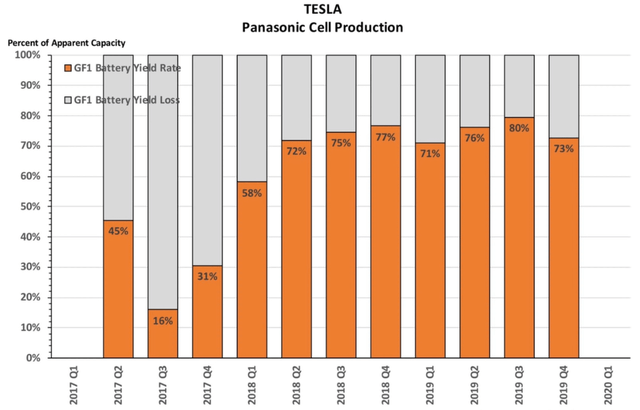

A battery manufacturer in early production may experience scrap rates upwards of 30%, which can improve to about 10% battery yield loss as the process is improved. Even the industry best can only reduce scrap rates to about 5%. Panasonic's early cell production with Tesla produced batteries at a ridiculously high scrap rate of ~70% in 2017, which was improved to ~28% through 2018 and 2019.

Panasonic Investor Presentation

Presently, Tesla's Giga Nevada is most certainly out of their early production phase, producing between 37 GWh/year and 38 GWh/year, with plans for an additional expansion to 100 GWh/year production of 4680 batteries. For the sake of argument, assume Giga Nevada is operating at an industry average scrap rate of 10%. Thus, to produce 37 GWh/year, apparent capacity is about 41 GWh/year, and manufacturing scrap is output at a rate of about 4 GWh/year. Redwood Materials is the only operational recycler in proximity to Giga Nevada and currently receives "all Panasonic's manufacturing scrap from the Tesla Gigafactory." Recall that Redwood Materials, as of April 2022, had a realized recycling capacity of 6 GWh/year. The remaining ~2 GWh/year difference was sourced from "end-of-life lithium-ion batteries, in the form of… consumer devices (phones, laptops, and electric vehicle packs)."

Analysis of Future Supply of Recyclable Materials for ABML

~1 Year Projection

ABML's pilot plant in Fernley should be operational with a recycling capacity of 6 GWh/year. Given that there was no timeline associated with Tesla's 100 GWh/year expansion plan, there are three scenarios possible in the next year:

- 4680 production is not online,

- 4680 production is fully operational, or

- 4680 production is in the process of ramping up production.

The first scenario has Giga Nevada continuing to output 4 GWh/year of production scrap into a locality that has a total recycling capacity of 12 GWh/year (assuming Redwood Materials does not increase capacity). Additionally, as Redwood Materials would likely continue to receive all of Giga Nevada's scrap, ABML would have to look for alternative sources of recyclable feed for their factory to operate.

This crisis is averted in the second scenario. Standard manufacturing expectations say the early production of 4680 batteries would likely operate with a battery yield loss of around 30%. Thus, to hit the 100 GWh/year target, apparent capacity would be around 143 GWh/year, outputting 43 GWh/year of production scrap. Factor in the existing output rate of 4 GWh/year, and there is 47 GWh/year of manufacturing scrap available to a combined recycling capacity of 12 GWh/year.

For the third scenario, assume 4680 battery production is beginning to ramp up, producing a fifth of target capacity, or about 20 GWh/year. These operations would output about 8.5 GWh/year of manufacturing scrap (at 30% battery yield loss), and fully satiate local recycling capacity without any need for sourcing end-of-life Li-ion batteries.

2-3 Year Projection

Both of ABML's facilities are online and they have a recycling capacity of 36 GWh/year (if not more as Fernley scales up capacity to 100,000 tonnes/year). Giga Nevada is presumably still in an early production phase of 4680 batteries, so scrap rates are 30%, and the gigafactory will output 47 GWh/year of scrap. In this timeline, it would also be reasonable to assume that end-of-life Li-ion batteries from EVs will be more available for recycling. In line with the historically >150% EV demand growth YoY from the BNEF EVO Report cited earlier, the combined availability of these materials could realistically increase from about 2 GWh/year to about 7 GWh/year.

Thus, Redwood Materials can expand the recycling capacity of their Nevada facility threefold to about 18 GWh/year without impeding ABML's supply.

However, assuming Redwood Materials continues to produce cathode and anode materials with a 50% recycled percentage, this threefold growth would only represent about 35% of targeted 100 GWh/year production. Given the private company's aggressive ambitions, it is unlikely they will settle for being out scaled by ABML, a late competitor for Giga Nevada's production scrap. Should both companies reach their target capacity in similar timeframes, Redwood Materials' 50 GWh/year recycling capacity would be able to consume nearly all the recyclable materials available in the locality.

Additionally, the assumed 30% battery yield loss is an optimistic estimate of manufacturing scrap. As Tesla ramps up their production, their margins become a larger priority and a 30% scrap rate is low hanging fruit for improved margins. Even at the optimistic scrap rate, projection had only about 4 GWh/year of easily attainable end-of-life Li-ion batteries left for ABML in the locality. At a more plausible <25% scrap rate, ABML is certainly not getting any Giga Nevada manufacturing scrap, assuming Redwood Materials continues receiving as much as they can process.

Projection Key Takeaways

Naturally, these projections are riddled with uncertainty (i.e., scrap rate percentages and recycling facility expansion timelines), but the consistent theme throughout is that ABML will find themselves competing with an established player over the relatively scarce production scrap generated by Giga Nevada. This may ultimately force ABML into sourcing production scrap from long distance suppliers such as Giga Lathrop (215 miles), Giga Fremont (260 miles), etc.

While this analysis seems daunting to ABML, remember that the most crucial benchmark for battery recyclers is their performance relative to mining. There is ample space in the battery recycling market to be beaten out in a locality and still operate profitably. An additional 200-mile scrap haul from California still wildly outperforms the more than 50,000-mile voyage of virgin metals and materials across the globe that forms the existing battery supply chain.

Additionally, as Tesla further expands Giga Nevada to 500 GWh/year of 4680 battery production many years in the future, ABML's potentially rocky start in Nevada will be perfectly positioned to take advantage of the surplus of recyclable manufacturing scrap. The other crucial piece of the puzzle to consider is where additional battery recycling facilities are going to pop up. No competitor will make a significant capital investment in an oversaturated locality. We believe this will preserve ABML's (albeit competitive) market share in Nevada in the long run.

Battery Belt: The Attractive Location for New Recycling Facilities

Whether it is further expansion from US battery recyclers, or international LIB recyclers looking to the US for expansion opportunities, there are certainly going to be new facilities popping up to capitalize on the growing recycling industry. Ideal locations have proximity to both the battery manufacturers for consistent supply of scrap and the population centers where there is going to be the largest supply of end-of-life consumer electronics and EV battery packs.

Northern Battery Belt

The northern part of the battery belt - roughly consisting of Michigan, western New York, Indiana, and Ohio - has a high density of recyclers and manufacturers. There are currently plans for more than 175 GWh/year of battery cell manufacturing in this region. This output is primarily from the Stellantis (STLA) and Samsung (KRX: 005930) gigafactory in Kokomo, Indiana, the Stellantis and LG Energy Solutions (KRX: 373220) gigafactory in Windsor, Ontario and two Ultium Cells facilities, which is a joint venture between LG Energy Solutions and General Motors (GM).

Southern Battery Belt

The southern part of the battery belt - roughly consisting of Kentucky, Tennessee, Alabama, Georgia, and the Carolinas - has an even higher density of recyclers and manufacturers. There are currently plans for more than 260 GWh/year of battery cell manufacturing in this region. Output in this region is from multiple massive gigafactories: Giga America by Freyr (FREY) and Koch (private company), Ultium Cells' third facility in Tennessee, SK Innovation's (KRX: 096770) Georgia facilities, and Blue Oval City, which is a complex jointly operated by Ford (F) and SK Innovation.

This brings the total LIB production in the whole battery belt to more than 435 GWh/year. Assuming a conservative average 20% battery yield loss, as many of these facilities are new and just ramping up production, this region is expected to generate about 110 GWh/year, or about 365,000 tonnes/year, of recyclable manufacturing scrap. There is expected to be only ~355,000 tonnes/year of recycling capacity in this region across facilities operated by Redwood Materials, Ascend Elements, Cirba Solutions, and LICY.

Factor in the end-of-life Li-ion batteries that will find their way back to the battery belt, and this is a significantly more attractive location for prospective recycling facilities than the Nevada locality. Thus, ABML will be largely shielded from additional competition, strengthening their moat in the industry.

Invest in the People

ABML CEO, Ryan Melsert, joined ABML in 2019, bringing a unique wealth of knowledge and experience to the company. Melsert was the R&D Manager of TSLA's Gigafactory Nevada Battery Materials Processing Group, founding and leading a team to develop "first-of-kind systems for the extraction, purification, and synthesis of precursor and active battery materials." He also worked as the senior mechanical design engineer for waste solvent refining, leading a team tasked with developing a closed-loop water system to minimize the environmental impacts of TSLA's battery production. Melsert's previous work at TSLA demonstrates that he is used to aiming high for ambitious goals and, more importantly, has experience meeting those timelines.

Prior to his roles at TSLA, Melsert worked for Southern Research on a variety of projects including the development of "first-of-kind systems for the extraction of aqueous lithium and generation of electricity from geothermal brines." Thus, Melsert has a thorough understanding of both facets of business operations from hands-on work experience, which grants ABML an additional competitive edge in the industry.

Risks

There are many companies currently in the US with recycling facilities specialized for lead batteries, steel, gold, and other metals that use relatively non-eco-friendly, pyrometallurgical recycling processes. These plants were excluded from this article due to their substantially poorer yield for the recycling of Li-ion batteries, though they do have the capability to compete with ABML for recyclable materials. In a perfectly efficient market, ABML's superior cost margins due to their higher yield should trump this competition, though investors should certainly be mindful of competitors' possible transition into comparable hydrometallurgical processes.

Price predictions in this article are based on valuations and fundamentals in varying future projections, which are often inaccurate methods of capturing investor sentiment. Fear, greed, hype, and other emotions can drive stock prices irrationally away from even the most perfect valuations.

Our Investment Strategy for ABML involves potentially purchasing stock ahead of expected share dilution. Adequate position sizing is strongly encouraged to ensure appropriate risk tolerances are adhered to. Additionally, the strategy relies on short-term deterioration to enter any position, potentially missing out completely.

ABML is both a penny stock, currently trading for less than a dollar, and a security that trades OTC, not on a major US exchange. Investment into stocks of these categories have certain risks associated with them that investors should be aware of before putting money at risk. Additionally, given the large share price fluctuations that can occur based on the pre-revenue company's news releases, the price predictions presented that are based on currently available data may rapidly become obsolete.

It is also worth noting that significant advancement in battery technology could displace existing companies focused on LIB recycling. Research into alternatives to Li-ion batteries and new material makeups, such as graphene batteries or solid-state batteries, is currently underway and may use substantially different inputs than Li-ion batteries. A broad transition to a new type of battery will have serious repercussions to LIB recyclers, as it will decrease available recyclable material and decrease the value of recycled output.

Conclusion

We believe there is strong reason to believe that ABML will be the only public company with a significant market share in the LIB recycling industry by 2025. ABML's growth projections are nearly identical to private competitors' plans, suggesting their reasonably ambitious 1-2-year goals are attainable, though not without some short-term turbulence. A high rate of cash burn and limited cash reserves means share dilution, and other short-term risks to the share price, should present ideal buying opportunities to invest in ABML.

Analysis of the availability of recyclable materials for the two Nevada facilities suggests that they will have a consistent supply and that they are well located to avoid mid-to-long-term competition. CEO Ryan Melsert is an expert in both facets of ABML's business model, bringing a strong leadership to a company that is already poised for success.

We would like to thank Andrew Guaragno for his research for this piece.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.