The Children's Place: Pressure On Revenue And Margin Remains

Summary

- The company's revenue and operating margin continue to be under pressure due to macro headwinds and declining economies of scale.

- In addition, the company's plans to close 80-100 stores during 2023 may be an additional factor in reducing revenue.

- At the moment, I stick to the HOLD recommendation, as I see no catalysts for the growth of the stock.

Richard Drury/DigitalVision via Getty Images

Introduction

Shares of The Children's Place (NASDAQ:PLCE) have fallen 26% YoY. I believe that pressure on top line growth and operating margins may persist over the next quarters, so now is not the best time to go long.

Investment Thesis

First, I don't expect discretionary consumer spending to recover in proportion to decelerating inflation, as consumers continue to face higher spending on interest, rent and food, which is negative for business revenue. This factor, in my opinion, is common to the sector, which has a negative impact on the company's competitors, for example, Carter's (CRI), which I wrote about earlier. In addition, the company plans to close about 80-100 stores in 2023, which could have an additional negative impact on revenue growth in the coming quarters. Secondly, continued growth in sales in the online segment, which is less profitable, as well as reduced economies of scale and the effect of deleverage, may lead to pressure on the operating profitability of the business. In addition, the company's management provided weak guidance for the next quarter and 2023.

Company Overview

The Children's Place sells clothes, shoes and accessories for children and newborns. The main sales channels are offline (54% of revenue) and online (46% of revenue) formats. According to the results of the 1st quarter of 2023, the company has 599 stores. The company operates in the US and Canadian markets.

1Q 2023 Earnings Review

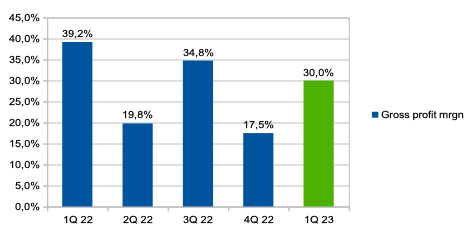

The company reported worse than investors expected. The company's revenue decreased by 11.2% YoY due to a decrease in real incomes of consumers. The share of online revenue increased from 45% in Q1 2022 to 46% in Q1 2023. Gross margin decreased from 39.2% in 1Q 2022 to 30% in 1Q 2023 due to increased operating and supply chain costs. You can see the details in the chart below.

Margin trends (Company's information)

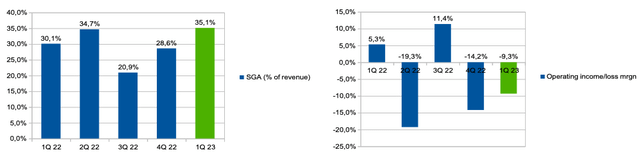

SGA (% of revenue) increased from 30.1% in 1Q 2022 to 35.1% in 1Q 2023 due to the deleverage effect, because some of the company's expenses for logistics, store rent and salaries are fixed. Thus, the company showed an operating loss (% of revenue) at the level of 9.3%, while in Q1 2022 we saw a positive operating margin of 5.3%. You can see the details in the chart below.

Margin trends (Company's information)

In addition, the company provided disappointing guidance for the next quarter and 2023. Thus, in accordance with the guidance of the company, in the next quarter we will see a decrease in revenue by about 10% YoY, while operating margin will continue to be in the negative zone of about 8%.

My Expectations

In line with company announcements, macro data and my own expectations, I expect the company's top line to continue to be under pressure. Even if we see a decline in inflation in the second half of 2023, consumer spending in the discretionary segment, I believe, will recover with a delay, as consumers continue to face increased spending on food and rent.

In addition, I would like to point out the fact that the company plans to close about 80-100 stores in 2023, while only 14 stores were closed in Q1 2023, which means that we will see about 66-86 more closures in the next quarters, which is about 11% -14% of the total number of stores. On the one hand, I fully support the company's initiative to reduce less profitable stores, however, on the other hand, I believe that such a rapid pace of closures could have a serious negative impact on the company's revenue in the coming quarters.

The company plans to increase the share of revenue in the e-commerce segment to 60% of total revenue by 2025. On the one hand, I like that the company is adapting to current realities and changing its strategy in accordance with consumer preferences. On the other hand, as an investor, I understand that an increase in the share of sales in the e-commerce segment (the company sells on Amazon) can lead to a decrease in operating profitability due to Amazon commissions and additional marketing investments. The company does not disclose the exact level of profitability by sales channel, but management comments confirm that online is second only to offline.

Amazon is our second highest operating margin channel, a significant contributor to our top and bottom lines and an important customer acquisition vehicle with many of these customers having higher income levels than our core customers.

Thus, in the coming quarters, I expect pressure on both revenue growth and operating margins to continue. At the same time, I do not see positive growth catalysts in the short term.

Risks

Margin: an increase in the share of business in the e-commerce segment, as well as a decrease in economies of scale and the effect of deleverage due to a decrease in the number of stores, can lead to pressure on operating profitability.

Competition: competition with both traditional and online players can lead to both a decrease in a company's market share and a decrease in profitability due to increased marketing costs and investment in prices

Macro (general risk): a decrease in consumers' real disposable income due to inflation may lead to a reduction in consumer spending in the discretionary segment, which may have a negative impact on business growth rates. In addition, store closures or reduced traffic can also put pressure on business growth.

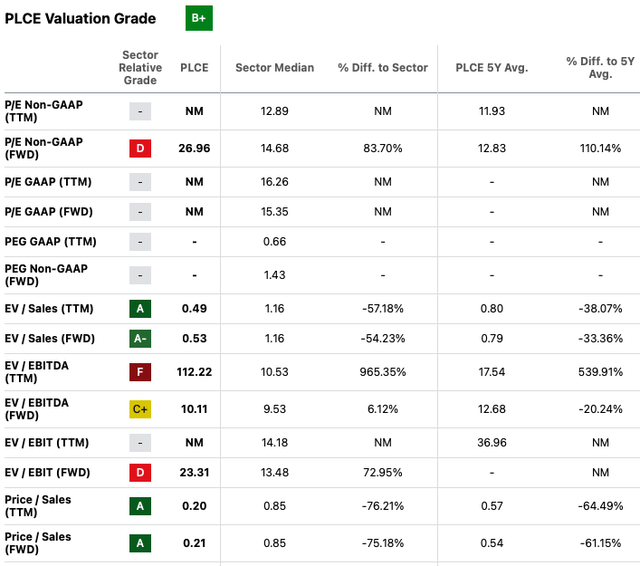

Valuation

In my personal opinion, at the moment, the company's shares are valued not expensive. I prefer to use P/S and EV/S multiples because it is difficult to use P/E and EV/EBITDA multiples because the company's earnings are extremely low, resulting in abnormally high P/E and EV/EBITDA multiples. Under P/S ('FWD') and EV/EBITDA ('FWD') multiples, the company trades 75% and 54% cheaper than the sector median, respectively. However, I believe that it is not worth making an investment decision based solely on multiples, the discount to the average values in the sector can remain for a long time until investors see positive changes in the company's financial statements.

Conclusion

As such, I don't see any catalysts for stock growth in the coming quarters. However, according to P/S ('FWD') & EV/S ('FWD') multiples, the company trades at a high discount to both the sector median and its own 5-year averages, so I'm sticking with HOLD rather than SELL recommendation for company shares. I believe pressure from macro headwinds will continue to weigh on the company's top line in the coming quarters, while operating margins may be driven by increased marketing spending due to continued e-commerce growth and reduced economies of scale.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)