QQQ: The Historic Magnificent Seven Rebalance

Summary

- The Invesco QQQ Trust ETF, which tracks the NASDAQ 100, has rallied almost 40% in 2023, largely due to the performance of seven major companies.

- These seven companies, including Microsoft, Apple, Nvidia, Amazon, Tesla, Meta, and Alphabet, now represent over 55% of the QQQ's weight.

- A historic rebalance of the NASDAQ 100 will occur on July 24, reducing the collective weight of the top five companies to 38.5%.

ArtistGNDphotography

As US indexes attempt to rally to new all-time highs, there has been one part of the market doing extremely well. The Invesco QQQ Trust ETF (NASDAQ:QQQ), which tracks the NASDAQ 100, has rallied almost 40% so far in 2023. The surge we've seen is primarily due to just a small handful of companies, which is going to result in a historic rebalance of the index later this month.

The NASDAQ 100 index is generally weighted based on market capitalization, but there are some modifications made to limit over concentration. In recent weeks, there's been a lot of talk about the "Magnificent Seven" - the seven largest names in the index, that have all rallied tremendously so far this year. These names are Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), Amazon (AMZN), Tesla (TSLA), Meta (META), and Alphabet (GOOG) (GOOGL).

There were some rough patches for these names in the last couple of years, especially as we worked through the coronavirus and its resulting impacts. Google parent Alphabet is up almost 32% this year, which seems great, but that actually makes it the worst performing name of the group. Nvidia, Tesla, and Meta have all more than doubled in 2023, but not every one of these names is back to an all-time just yet.

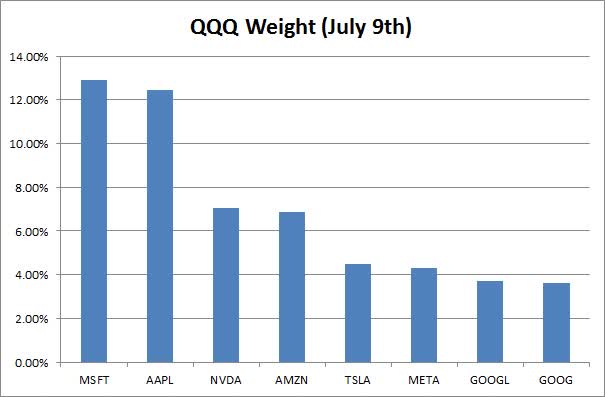

As a result of these major rallies, their market caps have obviously surged, but the rest of the NASDAQ 100 index hasn't done as well as whole. As a result, these seven names (eight tickers using Alphabet's dual-class trading structure) now represent more than 55% of the QQQ's weight. You can see in the chart below the respective weights of these tickers based on last week's finish.

QQQ Top Holdings (ETF Website)

This historic Nasdaq 100 special rebalance will take place before the market open on Monday, July 24. The weighting changes will be announced on Friday, July 14. Unlike when the index is periodically rebalanced, due to mergers and acquisitions, IPOs, or market cap changes, no stocks will be added or removed to the NASDAQ 100 index.

As the article above details, the five companies with the largest weights will have their collective position reduced to 38.5%. Because this is company based, Alphabet counts as one of the top five, as its two ticker weights are added together. At the end of last week, these five companies represented about 46.6% of the index, meaning they would lose eight percentage points of weight in total. While not a top five name at the moment, Tesla and perhaps even Meta could potentially see their weights come down slightly because they went into Monday with a 4.49% and 4.30% weight respectively. Their fate is based on the following rule:

Meanwhile, no component outside the top-five market cap companies can have a Nasdaq 100 exceeding the lesser of 4.4% or the weight of the stock with the fifth-largest market valuation.

So who will be some of the names that benefit the most? Well, that will depend a bit on how some of these names trade the next few days. The outside the top five rule has to be examined in the case of Meta and Tesla. After these names, the next five largest names in the NASDAQ 100 are Broadcom (AVGO), PepsiCo (PEP), Costco (COST), Adobe (ADBE), and Cisco Systems (CSCO).

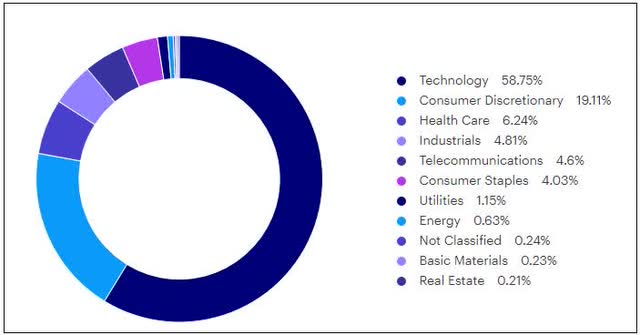

In terms of sectors, consumer discretionary will benefit the most. There are 22 names in that space that are in the NASDAQ 100, although they only had a 19.11% weight at the end of Q1 per the QQQ website. With the continued rally in big tech since then, that weight has likely decreased a bit since. No other sector had a weight in the double digits, percentage wise, at the end of March as the graphic below shows.

QQQ Sector Weights (ETF Website)

With the historic rebalance being announced, the market helped the process a little way along on Monday. While the QQQ was up just a small fraction on the day, Meta was the only one of the Magnificent Seven to finish the day in the green. The others all declined anywhere from roughly 75 basis points to nearly 2.75% on the day. This won't make a tremendous dent in the weights of these names, but if we see some more weakness during the rest of the week, perhaps they won't see their weights cut as much as previously thought.

In the end, the NASDAQ 100 is about to undergo a historic rebalance. With the huge rally in large cap tech so far this year, the seven largest names finished last week representing more than 55% of the index. The top five companies will see their collective weight come down to 38.5%, while the other two are waiting to see if they need to be trimmed as well. As a results, all other names in the index should see a boost in their weights, and thus the QQQ ETF will have some buying and selling to do to meet these adjustments.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.